Blockchain: Blueprint for a New Economy (2015)

Chapter 1. Blockchain 1.0: Currency

Technology Stack: Blockchain, Protocol, Currency

Bitcoin terminology can be confusing because the word Bitcoin is used to simultaneously denote three different things. First, Bitcoin refers to the underlying blockchain technology platform. Second, Bitcoin is used to mean the protocol that runs over the underlying blockchain technology to describe how assets are transferred on the blockchain. Third, Bitcoin denotes a digital currency, Bitcoin, the first and largest of the cryptocurrencies.

Table 1-1 demonstrates a helpful way to distinguish the different uses. The first layer is the underlying technology, the blockchain. The blockchain is the decentralized transparent ledger with the transaction records—the database that is shared by all network nodes, updated by miners, monitored by everyone, and owned and controlled by no one. It is like a giant interactive spreadsheet that everyone has access to and updates and confirms that the digital transactions transferring funds are unique.

The middle tier of the stack is the protocol—the software system that transfers the money over the blockchain ledger. Then, the top layer is the currency itself, Bitcoin, which is denoted as BTC or Btc when traded in transactions or exchanges. There are hundreds of cryptocurrencies, of which Bitcoin is the first and largest. Others include Litecoin, Dogecoin, Ripple, NXT, and Peercoin; the major alt-currencies can be tracked at http://coinmarketcap.com/.

|

Cryptocurrency: Bitcoin (BTC), Litecoin, Dogecoin |

|

Bitcoin protocol and client: Software programs that conduct transactions |

|

Bitcoin blockchain: Underlying decentralized ledger |

|

Table 1-1. Layers in the technology stack of the Bitcoin blockchain |

The key point is that these three layers are the general structure of any modern cryptocurrency: blockchain, protocol, and currency. Each coin is typically both a currency and a protocol, and it may have its own blockchain or may run on the Bitcoin blockchain. For example, the Litecoin currency runs on the Litecoin protocol, which runs on the Litecoin blockchain. (Litecoin is very slightly adapted from Bitcoin to improve on a few features.) A separate blockchain means that the coin has its own decentralized ledger (in the same structure and format as the Bitcoin blockchain ledger). Other protocols, such as Counterparty, have their own currency (XCP) and run on the Bitcoin blockchain (i.e., their transactions are registered in the Bitcoin blockchain ledger). A spreadsheet delineating some of the kinds of differences between Crypto 2.0 projects is maintained here: http://bit.ly/crypto_2_0_comp.

The Double-Spend and Byzantine Generals’ Computing Problems

Even without considering the many possible uses of Bitcoin and blockchain technology, Bitcoin, at its most fundamental level, is a core breakthrough in computer science, one that builds on 20 years of research into cryptographic currency, and 40 years of research in cryptography, by thousands of researchers around the world.13 Bitcoin is a solution to a long-standing issue with digital cash: the double-spend problem. Until blockchain cryptography, digital cash was, like any other digital asset, infinitely copiable (like our ability to save an email attachment any number of times), and there was no way to confirm that a certain batch of digital cash had not already been spent without a central intermediary. There had to be a trusted third party (whether a bank or a quasibank like PayPal) in transactions, which kept a ledger confirming that each portion of digital cash was spent only once; this is the double-spend problem. A related computing challenge is the Byzantine Generals’ Problem, connoting the difficulty of multiple parties (generals) on the battlefield not trusting each other but needing to have some sort of coordinated communication mechanism.14

The blockchain solves the double-spend problem by combining BitTorrent peer-to-peer file-sharing technology with public-key cryptography to make a new form of digital money. Coin ownership is recorded in the public ledger and confirmed by cryptographic protocols and the mining community. The blockchain is trustless in the sense that a user does not need to trust the other party in the transaction, or a central intermediary, but does need to trust the system: the blockchain protocol software system. The “blocks” in the chain are groups of transactions posted sequentially to the ledger—that is, added to the “chain.” Blockchain ledgers can be inspected publicly with block explorers, Internet sites (e.g., www.Blockchain.info for the Bitcoin blockchain) where you can see a transaction stream by entering a blockchain address (a user’s public-key address, like1DpZHXi5bEjNn6SriUKjh6wE4HwPFBPvfx).

How a Cryptocurrency Works

Bitcoin is money, digital cash, a way of buying and selling things over the Internet. The Bitcoin value chain is composed of several different constituencies: software developers, miners, exchanges, merchant processing services, web wallet companies, and users/consumers. From an individual user’s perspective, the important elements in transacting coin (I’ll use “coin” in the generic sense here) are an address, a private key, and wallet software. The address is where others can send Bitcoin to you, and the private key is the cryptographic secret by which you can send Bitcoin to others. Wallet software is the software you run on your own computer to manage your Bitcoin (see Figure 1-1). There is no centralized “account” you need to register with another company; if you have the private key to an address, you can use that private key to access the coin associated with that address from any Internet-connected computer (including, of course, smartphones). Wallet software can also keep a copy of the blockchain—the record of all the transactions that have occurred in that currency—as part of the decentralized scheme by which coin transactions are verified. Appendix A covers the practicalities of maintaining an altcoin wallet in more detail.

Figure 1-1. Bitcoin ewallet app and transferring Bitcoin (image credits: Bitcoin ewallet developers and InterAksyon)

eWallet Services and Personal Cryptosecurity

As responsible consumers, we are not used to many of the new aspects of blockchain technology and personal cryptosecurity; for example, having to back up our money. Decentralized autonomy in the form of private keys stored securely in your ewallet means that there is no customer service number to call for password recovery or private key backup. If your private key is gone, your Bitcoin is gone. This could be an indication that blockchain technology is not yet mature enough for mainstream adoption; it’s the kind of problem that consumer-facing Bitcoin startups such as Circle Internet Financial and Xapo are trying to solve. There is opportunity for some sort of standardized app or service for ewallet backup (for example, for lost, stolen, bricked, or upgraded smartphones or laptop/tablet-based wallets), with which users can confirm exactly what is happening with their private keys in the backup service, whether they self-administer it or rely on external vendors. Personal cryptosecurity is a significant new area for consumer literacy, because the stakes are quite high to ensure that personal financial assets and transactions are protected in this new online venue of digital cash. Another element of personal cryptosecurity that many experts recommend is coin mixing, pooling your coins with other transactions so that they are more anonymous, using services like Dark Coin, Dark Wallet, and BitMixer.15 As the marketplace of alternative currencies grows, demand for a unified ewallet will likely rise, because installing a new and separate wallet is required for most blockchain-related services, and it is easy to have 20 different ewallets crowding your smartphone.

Despite their current clunkiness in implementation, cryptocurrencies offer many great benefits in personal cryptosecurity. One of the great advantages is that blockchain is a push technology (the user initiates and pushes relevant information to the network for this transaction only), not a pull technology (like a credit card or bank for which the user’s personal information is on file to be pulled any time it is authorized). Credit card technology was not developed to be secure on the Internet the way that blockchain models are developing now. Pull technology requires having datastores of customer personal information that are essentially centralized honey pots, increasingly vulnerable to hacker identity theft attacks (Target, Chase, and Dairy Queen are just a few recent examples of large-scale identity-theft vendor database raids). Paying with Bitcoin at any of the 30,000 vendors that accept it as of October 2014 (e.g., Overstock, New Egg, and Dell Computer; see https://bitpay.com/directory#/) means not having to entrust your personal financial information to centralized vendor databases. It might also possibly entail a lower transaction fee (Bitcoin transaction fees are much lower than merchant credit card processing fees).

Merchant Acceptance of Bitcoin

At the time of writing, the main Bitcoin merchant processing solutions for vendors to accept Bitcoin are BitPay and Coinbase in the United States, and Coinify in Europe.16 However, it is difficult for vendors, like the local café, to run two separate payment systems (traditional and Bitcoin), so a more expedient future solution would involve integrating Bitcoin payment into existing vendor payment networks. Mobile payment functionality is also needed for quick point-of-sale Bitcoin purchases (for example, a cup of coffee) via mobile phone. CoinBeyond and other companies focus on mobile Bitcoin payments specifically, and BitPay and CoinBase have solutions for mobile checkout. In one notable step forward, Intuit’s QuickBooks accounting software for small businesses makes it possible for vendors to accept incoming Bitcoin payments from CoinBase and BitPay with its PayByCoin module.17

Summary: Blockchain 1.0 in Practical Use

Blockchain is already cash for the Internet, a digital payment system, and it may become the “Internet of Money,” connecting finances in the way that the Internet of Things (IoT) connects machines. Currency and payments make up the first and most obvious application. Alternative currencies make sense based on an economic argument alone: reducing worldwide credit card merchant payment fees from as much as 3 percent to below 1 percent has obvious benefits for the economy, especially in the $514 billion international remittances market, where transaction fees can run from 7 to 30 percent.18 Furthermore, users can receive funds immediately in digital wallets instead of waiting days for transfers. Bitcoin and its imitators could pave the way for currency, trade, and commerce as we know it to be completely redefined. More broadly, Bitcoin is not just a better version of Visa—it could also allow us to do things we have not even thought of yet. Currency and payments is just the first application.19 The core functionality of blockchain currencies is that any transaction can be sourced and completed directly between two individuals over the Internet. With altcoins, you can allocate and trade resources between individuals in a completely decentralized, distributed, and global way. With that ability, a cryptocurrency can be a programmable open network for the decentralized trading of all resources, well beyond currency and payments. Thus, Blockchain 1.0 for currency and payments is already being extended into Blockchain 2.0 to take advantage of the more robust functionality of Bitcoin as programmable money.

Relation to Fiat Currency

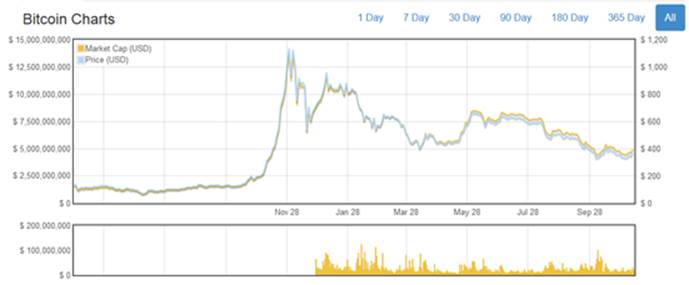

Considering Bitcoin as the paradigm and most widely adopted case, the price of Bitcoin is $399.40 as of November 12, 2014. The price has ranged considerably (as you can see in Figure 1-2), from $12 at the beginning of 2013 to a high of $1,242 per coin on November 29, 2013 (trading higher than gold—$1,240 per ounce—that day).20 That peak was the culmination of a few factors: the Cyprus banking crisis (March 2013) drove a great deal of demand, for example. The price was also driven up by heavy trading in China until December 5, 2013, when the Chinese government banned institutions (but not individuals) from handling Bitcoin, after which the price fell.21 In 2014, the price has declined gradually from $800 to its present value of approximately $350 in December 2014. An oft-reported though disputed metric is that 70 percent of Bitcoin trades are made up of Chinese Yuan.22 It is difficult to evaluate how much of that figure indicates meaningful economic activity because the Chinese exchanges do not charge trade fees, and therefore people can trade any amount of currency back and forth for free, creating fake volume. Further, much of the Yuan-denominated trade must be speculation (as is true for overall Bitcoin trade), as there are few physical-world vendors accepting Bitcoin and few consumers using the currency for the widespread consumption of goods and services.

Figure 1-2. Bitcoin price 2009 through November 2014 (source: http://coinmarketcap.com/currencies/bitcoin/#charts)

Some argue that volatility and price shifts are a barrier to the widespread adoption of cryptocurrency, and some volatility-smoothing businesses have launched to address this: Bitreserve, which locks Bitcoin deposits at fixed exchange rates;23 Realcoin’s cryptocurrency, which is pegged to the US dollar (USD);24 and Coinapult’s LOCKS, which allow purchasers to peg Bitcoin to the price of gold, silver, the US dollar, the British pound, or the Euro.25 One of the first USD-pegged Bitcoin cryptocurrencies was Ripple’s XRP/USD BitStamp, and there is also BitShares’ BitUSD. Others point out that Bitcoin volatility is less than some fiat currency’s volatility and inflation (making Bitcoin a better relative value choice), and that many operations of Bitcoin are immediate transfers in and out of other currencies for which the volatility does not matter as much in these spot rate (i.e., immediate) transactions.

Bitcoin’s market capitalization as of November 2014 is $5.3 billion (see http://coinmarketcap.com/), calculated as the current price ($399.40) multiplied by the available supply (13,492,000 Bitcoin). This is already on the order of a small country’s GDP (Bitcoin would rank as the 150th largest world economy on a list of 200). Unlike fiat currencies for which governments can print more money, the money supply of Bitcoin grows at a predetermined (and capped) rate. New currency (in blocks) is being issued at a regular and known pace, with about 13.5 million units currently outstanding, growing to a capped amount of 21 million units in 2040. At a price of roughly $400 Bitcoin per dollar, Bitcoin is infeasible to use directly for daily purchases, and prices and exchanges for practical use are typically denominated in subunits of millibitcoins (a thousandth of a Bitcoin; 1 mBTC = ~$0.40) and Satoshis (a millionth of a Bitcoin; 1 Satoshi = ~$0.000004).

Regulatory Status

Government regulation is possibly one of the most significant factors as to whether the blockchain industry will develop into a full-fledged financial-services industry. As of October 2013, a handful of countries have completely banned Bitcoin: Bangladesh, Bolivia, Ecuador, Iceland (possibly related to using Auroracoin, instead), Kyrgyzstan, and Vietnam. China, as mentioned, banned financial institutions from dealing in the virtual currency as of December 2013, although trading volume in Chinese Yuan persists.26 Germany, France, Korea, and Thailand have all looked unfavorably on Bitcoin.27 The European Banking Authority, Switzerland, Poland, Canada, and the United States continue to deliberate about different Bitcoin-related issues.28 Countries try to match up Bitcoin (and the concept of digital currencies) to their existing regulatory structures, often finding that cryptocurrencies do not quite fit and ultimately concluding that cryptocurrencies are sufficiently different that new legislation might be required. At present, some countries, like the UK, have classified Bitcoin as a currency (and therefore not subject to VAT), whereas other countries, like Australia, were not able to classify Bitcoin as a currency due to laws about nationalized issuance (and Bitcoin therefore is subject to VAT or GST—the goods and services tax).29

In the United States, the Internal Revenue Service treats Bitcoin as property (like stock) and not as money, meaning that users of Bitcoin are liable for capital gains taxes on transactions.30 For taxation, virtual currencies are property, not currency. However, nearly every other US government agency—including FinCEN (financial crimes enforcement network), banking regulators, and the CFPB, SEC, CFTC, and DOJ—regulate Bitcoin as a currency.31

All materials on the site are licensed Creative Commons Attribution-Sharealike 3.0 Unported CC BY-SA 3.0 & GNU Free Documentation License (GFDL)

If you are the copyright holder of any material contained on our site and intend to remove it, please contact our site administrator for approval.

© 2016-2026 All site design rights belong to S.Y.A.