Tax Insight: For Tax Year 2014 and Beyond, 3rd ed. Edition (2015)

Part IV. Business Income and Deductions

Chapter 18. Travel Expenses

How to Get the IRS to Buy You a Car, and Other Great Tidbits

Business travel expenses can add up to a significant amount of money. They can prove to be a great deduction when used correctly. In fact, there are even opportunities to deduct a larger amount than you actually spend. These deductions are very popular among businesses, and are often abused. The IRS is aware of this abuse and has put very strict rules and guidelines in place that govern which expenses are deductible, to what extent, and what records need to be kept. They are also very inclined to audit travel expenses that have an appearance of abuse. Even so, certain businesses will gain a lot from understanding how these deductions work and taking advantage of them on their returns.

This chapter focuses on two types of travel expenses: First, mileage and vehicle expenses for business driving and, second, expenses such as airfare, hotels, and other incidental items that are incurred for travel away from home. While meals and entertainment expenses can also be associated with travel, they are given a chapter of their own, Chapter 20.

Mileage and Vehicle Expenses

Early in my career as a tax preparer, I was discussing with a client the standard mileage rate deduction for business use of a vehicle. He was considering the purchase of a fuel-efficient vehicle for his business driving and wanted to know the after-tax costs of the vehicle. As we spoke I ran some quick calculations and excitedly told him it looked like the government would be paying him to buy the vehicle! It turned out that with his high tax bracket, the low price he was going to pay for the car, and the great gas mileage that it got, he would actually come out with more cash in his pocket from claiming the standard mileage deduction than he would spend on the purchase of the vehicle and fuel.

This amazing scenario is not very common, but it is common for business owners (as well as some employees) to obtain significant after-tax savings from the mileage deduction. In fact, the right combination of a high tax bracket and a cheaper vehicle with great gas mileage can make it so that the after-tax cost of operating the vehicle is minimal.

![]() Example On January 2, 2014, Jasper bought a five-year old Volkswagen Jetta in great condition and with average miles for $9000. He expects the vehicle to last for 4 years, after which he will dispose of it. Jasper drives around 1,000 miles per month, mostly on the highway. Based on customer ratings and his driving habits, he estimates that he will average about 25 miles per gallon (mpg). At $4 per gallon that would translate to $160 in gas per month (1,000 miles ÷ 25 mpg × $4 per gallon = $160). The monthly car payment and gas costs combine for a total operational expense of $348 per month.

Example On January 2, 2014, Jasper bought a five-year old Volkswagen Jetta in great condition and with average miles for $9000. He expects the vehicle to last for 4 years, after which he will dispose of it. Jasper drives around 1,000 miles per month, mostly on the highway. Based on customer ratings and his driving habits, he estimates that he will average about 25 miles per gallon (mpg). At $4 per gallon that would translate to $160 in gas per month (1,000 miles ÷ 25 mpg × $4 per gallon = $160). The monthly car payment and gas costs combine for a total operational expense of $348 per month.

Jasper is in the 35% marginal federal tax bracket, 5% state bracket. and, as a business owner, he also pays 15.3% in self-employment taxes—for a total combined tax bracket of 55.3%. The standard mileage rate for 2014 is $0.565 per mile. Driving 1,000 business miles per month brings him a $565 mileage deduction ($0.565 × 1,000 miles = $560). This deduction results in a tax savings of $310 (55.3% × $560 deduction = $310 tax savings).

With a tax savings of $37, Jasper’s true out-of-pocket, after-tax cost for purchasing the vehicle and driving it 1,000 miles each month is $38 ($348 monthly costs – $310 tax savings = $38 net cost). If Jasper had found a better deal on the car, purchased a car with even better mileage, or driven more business miles than planned, his net cost would be even closer to $0.

For many small business owners, vehicle mileage is one of their biggest deductions—especially for those whose business requires a lot of travel. If you are willing to keep good records, this deduction could prove to be a real money saver.

The tax code provides two options for deducting business-use vehicle expenses. You can either use a standard mileage rate for the deduction or you can deduct your actual expenses. At times the actual-expense method can result in a larger deduction—but not always. If you didn’t pay very much for the vehicle, have a fuel-efficient vehicle, or drive a lot of miles each year, the standard mileage rate may prove to be more valuable. The actual-expense method requires significantly more recordkeeping than the standard mileage method as well. For some people the recordkeeping requirement alone makes the standard mileage method more appealing than deducting actual expenses, even if it doesn’t save you as much money—especially since the difference in tax savings between the two methods is sometimes insignificant.

![]() Caution If you want to use the standard mileage method for a vehicle you must elect to do so the first year you use the vehicle for business. If you use the actual-expense method in the first year, you are stuck using that method for as long as you have the car.

Caution If you want to use the standard mileage method for a vehicle you must elect to do so the first year you use the vehicle for business. If you use the actual-expense method in the first year, you are stuck using that method for as long as you have the car.

![]() Tip If you use the standard mileage method in the first year, you are allowed to switch back and forth each year between actual costs and the standard rate. If you are not sure which method to choose, it may be advisable to choose the standard mileage method in the first year so you can decide each year which method is best, based on a comparison of the actual deductions available through each of the methods each year.

Tip If you use the standard mileage method in the first year, you are allowed to switch back and forth each year between actual costs and the standard rate. If you are not sure which method to choose, it may be advisable to choose the standard mileage method in the first year so you can decide each year which method is best, based on a comparison of the actual deductions available through each of the methods each year.

![]() Caution If you lease your vehicle, you may not switch back and forth between methods. Whichever method you choose in the first year is the one you have to use for the life of that vehicle.

Caution If you lease your vehicle, you may not switch back and forth between methods. Whichever method you choose in the first year is the one you have to use for the life of that vehicle.

If you plan to calculate each year which method brings the greatest deduction, keep a few things in mind. First, you must adjust the value of the vehicle for depreciation by the depreciation portion of the standard mileage rate that has been previously applied to the vehicle. Also, in the years when you claim actual expenses, you must calculate depreciation by using the straight-line method (which gives you an equal amount of depreciation each year) instead of the accelerated depreciation method (which gives you a much greater amount in the early years of the vehicle’s use). Finally, you cannot claim any bonus depreciation or a Section 179 deduction (which is another special kind of rapid depreciation) on the vehicle. Each of these factors must be weighed in determining the best method to choose for deducting your vehicle expenses.

When claiming the standard mileage deduction, you simply deduct a predetermined amount (set and adjusted by the IRS) for every business mile driven. The rate in 2014 is $0.56 per mile. This fixed deduction per mile is based on an average cost for fuel, repairs, maintenance, and depreciation of a vehicle. It does not matter what your actual expenses were, or what type of vehicle you drive; the standard deduction does not change. The portion of the standard rate that accounts for depreciation must be subtracted from the basis of the vehicle each year, which affects the amount of gain (or loss) on the vehicle when it is sold.

As you can see, most of the actual costs of owning and operating a vehicle are covered by the standard deduction. However, there are four vehicle-related expenses that you can deduct in addition to taking the standard mileage deduction. These are:

· Tolls

· Parking fees (but not those at your place of business)

· Interest on a loan to purchase the vehicle

· Any value-based tax paid when purchasing the vehicle

Of these additional deductible expenses, the most significant may be the interest on a loan, which can add up to a large amount of money, and which many people neglect to deduct. (It is important to note, though, that you can deduct only a portion of the interest based on the percentage of business versus personal use of the vehicle.)

It may seem obvious, but if you decide to claim actual expenses, rather than the standard deduction, you can deduct only the expenses that you actually incur (including depreciation). If you have a lot of repairs, low gas mileage, or can take a high depreciation deduction, the actual-expense method may bring greater dividends.

![]() Caution When I have illustrated the potential cost savings of the standard mileage deduction to clients, as in the example about Jasper, above, a couple quick-minded clients have asked me about the possibility of using scooters. Some scooters get 100+ miles to the gallon and are very inexpensive to buy. Driving a scooter for business purposes and deducting the standard mileage rate could actually result in a nice profit—a business itself!

Caution When I have illustrated the potential cost savings of the standard mileage deduction to clients, as in the example about Jasper, above, a couple quick-minded clients have asked me about the possibility of using scooters. Some scooters get 100+ miles to the gallon and are very inexpensive to buy. Driving a scooter for business purposes and deducting the standard mileage rate could actually result in a nice profit—a business itself!

The first time the idea came up in a conversation I thought it was brilliant. However, when I looked into it I found that other, more brilliant minds had already thought of it and shut it down. Unfortunately, the IRS and Congress were aware of this scenario and have made it so that the standard mileage rate is not available for motorcycles, scooters, or bicycles (bicycles being the most brilliant idea). It applies only to passenger vehicles.

The standard mileage rate is also not available if you use five or more vehicles for your business in one year (such as with a fleet). In this case you must use the actual-expense method for deducting your vehicle expenses.

It is important to note that travel from your home to your office is not considered business miles—it is considered personal commuting miles. The same goes for traveling from home to another business location within the area of your home if it is effectively your commute. Once you have made your commute, then other miles that you must travel for business purposes during the day are deductible.

I have an acquaintance who drives a mile or two to a coffee shop near his home and does some work on his phone or computer while there. Then he continues on to the office from there. Since he has begun to work at the shop he says that the distance to the shop is his commute and the remaining miles are then considered business miles. It’s a cute idea, but something tells me it won’t fly in an audit or in tax court.

![]() Tip If you have a home office that qualifies as your principal place of business, you can deduct any trips you make from your home to another location for business purposes. With careful planning of your trips from home, you can write off a significant number of miles each year. See Chapter 17 for details on what qualifies a home as a principal place of business.

Tip If you have a home office that qualifies as your principal place of business, you can deduct any trips you make from your home to another location for business purposes. With careful planning of your trips from home, you can write off a significant number of miles each year. See Chapter 17 for details on what qualifies a home as a principal place of business.

Employees can also claim the vehicle expense deductions. If they claim the deduction directly, it is done as a miscellaneous expense on Schedule A, subject to the 2%-of-AGI threshold. However, an alternative to claiming the deduction is to be reimbursed by the employer for the actual expenses, or a fixed rate per mile up to the standard mileage rate.

![]() Tip If your employer reimburses for mileage at a rate that is lower than the standard rate set by the IRS it is possible to receive the reimbursement and then claim a deduction for the difference.

Tip If your employer reimburses for mileage at a rate that is lower than the standard rate set by the IRS it is possible to receive the reimbursement and then claim a deduction for the difference.

If you are receive a temporary assignment that is distant from your home or office you can count that commute as business miles. It is considered temporary only if it is expected to last one year or less. As soon as it is reasonable to expect the assignment to last longer than one year the travel becomes a commute and not business miles.

If you have two jobs you can actually deduct the miles driven from the first job to the second one if you go straight from one to another. However, if you go to the first on one day and to the second on a separate day, both are considered to be commuting miles.

Record Keeping and Audit Risk

The key to maximizing either mileage deduction is keeping accurate records of every business trip. Each time you travel from one location to another, for business reasons, you should record the following information:

· Date

· Starting odometer reading

· Ending odometer reading

· Business reason for the trip

You must record this information for each individual trip. If you travel to five different locations during the day, each for a business purpose, don’t just write down the total mileage for the day. You need to break out the record keeping for each segment of the route and the purpose for each piece. Although this may seem cumbersome, it is what the IRS requires and what they will be looking for in an audit. This requirement is still easier than the actual-expense method, which requires all of that same detail plus individual records (receipts) for every expense incurred.

In addition to those daily records you should also obtain a third-party record of your vehicle’s mileage at the beginning of each year (such as the receipt from an oil change). This will substantiate your beginning and ending odometer reading for the year for the IRS.

Several products are available to help you track your mileage. Some people simply use a notebook in their car. You could also buy an inexpensive mileage log from any office-supply store. Mobile phone apps are available for this purpose as well. Whichever way you choose to track your mileage, just be sure to record all of the key information and to keep the records safe and accessible for three years after the year you file your tax return.

The deduction for vehicle mileage is one of the most heavily audited deductions by the IRS. Three factors lead to this heavy scrutiny:

· Notoriously bad record keeping by business owners

· The high dollar value of the deduction

· A history of abuse

The mere fact that you have claimed the deduction will increase the likelihood that your tax return will get a second look by the IRS. In addition, if your return is selected for an audit for any reason, you will almost certainly have to defend the mileage deduction as well. Good records will help you keep the deductions you have claimed. I have found that an IRS agent’s lenience with this deduction correlates closely to the level of detail and accuracy in the taxpayer’s records. The more detailed and complete your records are, the less scrutiny the IRS tends to give the deduction you claimed and the more likely that it will stand.

Travel Away from Home

When the reason for traveling is entirely for business purposes, all reasonable travel expenses will be deductible. However, if there is a combination of business and personal purposes for the travel (determined by what is done on the trip), then the deductibility of the expenses on the trip may be limited—sometimes severely. The rules for deducting travel expenses differ depending on what portion of the trip was for business, and whether the travel is within the United States or if it is in a foreign location. In addition, there are special rules for conventions and luxury water travel (i.e., cruises).

Travel within the United States

Travel within the United States that is entirely for business is fully deductible, including the costs of getting to and from the destination, as well as related expenses while you are there. If the trip is not entirely for business, it will fall into one of two other categories: primarily-for-business or primarily-for-personal reasons.

Primarily business . If your trip was primarily for business and, while there, you extended your stay for a vacation, make a personal side trip, or had other personal activities, you can deduct only your business-related travel expenses. In this case, the entire costs of traveling to and from the business location are deductible. The only items that cannot be deducted are those that you would not have incurred had you solely engaged in business while on the trip.

![]() Example Lance, who works in Los Angeles, takes a business trip to Omaha, NE to meet with an important client. He spends five days in business meetings and then drives two hours east to Des Moines, IA, to visit with his sister for a couple days before returning home to L.A. The cost of the entire trip was $2,800, $300 of which was for the rental car and some food during the visit to his sister. Because the trip was primarily for business purposes, Lance can deduct all of the expenses of the trip except the $300 associated with visiting his sister.

Example Lance, who works in Los Angeles, takes a business trip to Omaha, NE to meet with an important client. He spends five days in business meetings and then drives two hours east to Des Moines, IA, to visit with his sister for a couple days before returning home to L.A. The cost of the entire trip was $2,800, $300 of which was for the rental car and some food during the visit to his sister. Because the trip was primarily for business purposes, Lance can deduct all of the expenses of the trip except the $300 associated with visiting his sister.

Primarily personal . If the trip is primarily for personal reasons the entire cost of the trip is non-deductible, except for those items that are directly related to your business. The biggest loss in this treatment is that you cannot deduct the cost of traveling to and from the location. Scheduling incidental business activities (or even conducting business remotely) during the trip will not change it from personal to business. There must be a significant and primary business reason for making the trip.

![]() Example Lance and his sister enjoyed being together so much that they decided he would come back in November to spend Thanksgiving with her. Lance took the week of Thanksgiving off from work and spent it in Iowa. However, while he was there he decided to make a quick trip to Omaha for a follow up visit with his client—using a full day to do so. The entire week-long trip cost Lance $1,500, of which $200 was for a car rental and food on the day he visited his client. Lance can deduct only $200 as a business expense for this trip because that is the portion directly related to business, while the rest was primarily personal.

Example Lance and his sister enjoyed being together so much that they decided he would come back in November to spend Thanksgiving with her. Lance took the week of Thanksgiving off from work and spent it in Iowa. However, while he was there he decided to make a quick trip to Omaha for a follow up visit with his client—using a full day to do so. The entire week-long trip cost Lance $1,500, of which $200 was for a car rental and food on the day he visited his client. Lance can deduct only $200 as a business expense for this trip because that is the portion directly related to business, while the rest was primarily personal.

Travel Outside of the United States

The rules for deducting business travel expenses become more complicated when the travel is outside the 50 states and Washington, D.C. There are a lot more “if’s” and “or’s” to consider. With careful planning, some of these rules can definitely be taken advantage of and result in a larger deduction then you might otherwise “deserve.” On the other hand, they can quickly bite you and take away the deductions you would like to claim for your foreign travel expenses.

As was the case with travel within the United States, much of the determination comes down to whether the travel was entirely for business, primarily for business, or primarily for pleasure. In all cases, a pure, necessary and reasonable business expense is always deductible—regardless of the purpose of the travel. The greatest expense that is at stake when determining deductibility is the travel to and from the foreign location. In addition, some of the accommodations that you pay for during the travel may or may not be deductible.

Entirely for business . If the purpose of the travel is entirely for business, you may deduct the full amount of travel expenses to and from the location, plus any other travel-related expenses while there. “Entirely for business” generally means that you spend your entire time on the trip (during normal business hours) on business activities. With foreign travel, however, the rules that govern the definition of “entirely for business” are unique. It is possible for you to do things for pleasure while on the trip and have the purpose be “considered entirely for business” if you meet at least one of the following four exceptions:

1. You have no substantial control over the trip. This is the case if you are an employee and the employer pays for, or reimburses you for, the cost of the trip and you are not related to the employer or a managing executive or greater than 10% owner.

2. You are not outside the United States for more than one week, combining business and non-business activities. One week means seven consecutive days (not counting the day you leave the United States, but counting the day that you return). This is an intriguing exception. Could you go to Canada on a Monday, cross the border back into the United States on the following Monday, and then go back to Canada for another week beginning on Tuesday? It seems that the answer would be a technical “yes.” Combined with some additional rules that I write about later in the chapter, this scenario could make for some interestingly deductible business travel plans.

3. You are outside the United States for more than one week but spend less than 25% of the total time you are outside the United States on non-business activities. For this rule you must count the day your trip began and the day it ended (different than in exception 2 above).

4. You can establish that a personal vacation was not a major consideration, even if you have substantial control over arranging the trip (such as being the owner of the business).

If one of the exceptions listed above applies to your travel, the expenses to and from the location are deductible (in addition to any business-related travel expenses while you are on the trip). Of course, personal expenses while traveling are not deductible.

Primarily business. If your foreign business travel is not entirely for business (or considered entirely for business because of one of the four exceptions), but is primarily for business, you will be able to deduct only a portion of your expenses for traveling to and from your destination. In this case the cost of travel will have to be pro-rated between business and non-business travel. You must count each day as business or non-business and divide the total number of business days by the total number of days outside the United States to determine the percentage of the expenses that can be deducted. (In this case, both of the days traveling to and from the location are counted in the total.)

The following list outlines what days may be counted as a business day:

· Transportation days. Any day that you spend traveling to or from a business destination is counted as a business day. However, if you do not take a direct route to the business location because you are making side trips for personal reasons, you may count only the number of days it would have taken if you had chosen a direct route.

· Your presence is required. Any day in which your presence is required at a particular place for a specific business purpose can be counted as a business day. This is the case even if you spend most of the day in non-business activities.

· You spend the day on business. If your main activity during working hours is focused on business, then it is a business day, regardless of what you do during the remaining hours of the day.

· Weekends and holidays. You can count weekends, holidays, and other necessary stand-by days as business days if they fall between business days. It is important to understand that it must be between two business days, not counting the travel-home day. For example, if you have a business day Friday, stay the weekend, and then travel home Monday the weekend does not count as business days.

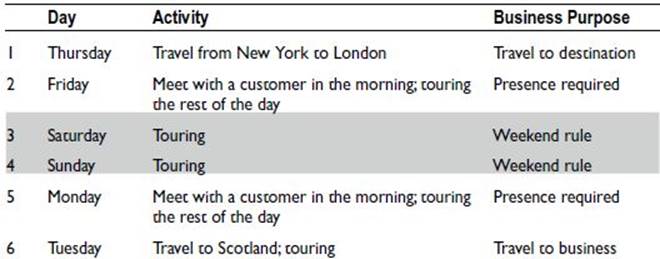

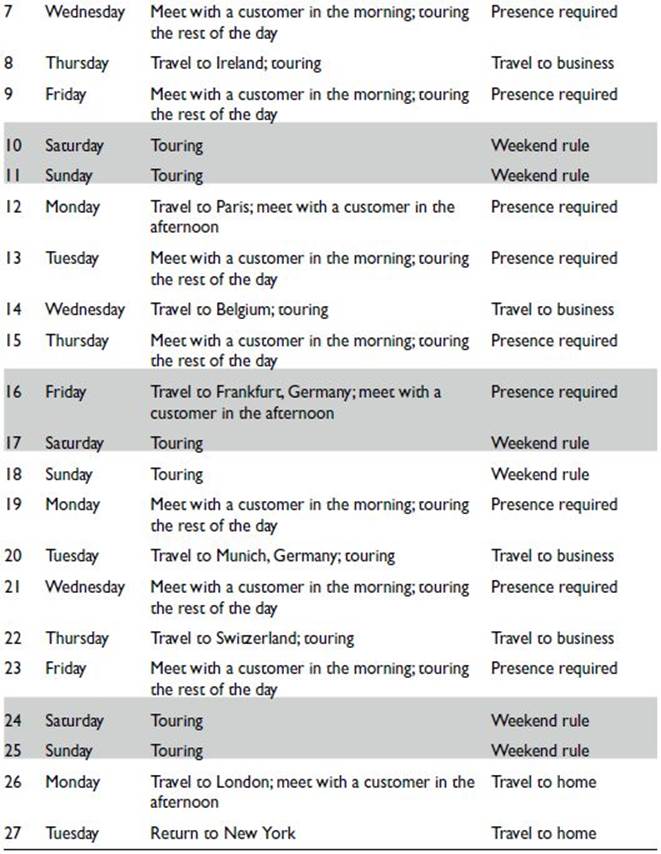

Perhaps you noticed that these rules open up a lot of wiggle room as long as you carefully plan your travel. The following example and Table 18-1 illustrate how a business trip can contain a lot of personal time and still be deducted as a business expense.

![]() Example Walter is an exporter of plastics. The majority of his customers are in Asia and Australia, but he wants to expand to Europe. His business model is to have one main distributer of his products in each country in which he sells his products and they, in turn, sell to others in their country. Walter has found the businesses in seven European countries that he thinks may be prime candidates to act as his distributors and is at the point where he needs to visit each one for final negotiations and inspection of their facilities.

Example Walter is an exporter of plastics. The majority of his customers are in Asia and Australia, but he wants to expand to Europe. His business model is to have one main distributer of his products in each country in which he sells his products and they, in turn, sell to others in their country. Walter has found the businesses in seven European countries that he thinks may be prime candidates to act as his distributors and is at the point where he needs to visit each one for final negotiations and inspection of their facilities.

Walter is also an avid traveler and well versed in the deductibility rules associated with foreign travel. With careful planning he has arranged for a four-week tour of Europe, where he will meet with 13 businesses. He expects each meeting to take an average of 4 hours, making his time spent in conducting business 52 hours. For Walter, 52 hours is a normal work week. However, he is able to spend four weeks in Europe and count the entire trip as a business expense. He does this by carefully placing his appointments with these businesses at just the right points in his schedule in order to count every day as a business day, per the IRS regulations. See Table 18-1 if you are interested in how he pulls this off.

Table 18-1. Walter’s Travel Schedule and Business Purpose of Each Day

In the example, is Walter’s approach to applying the rules a little extreme? Perhaps. Could it be questioned by the IRS? Of course. Would he win the argument? I think he might. He would be able to establish that the primary purpose of the trip is for business, that there was good reason for him to travel to each destination, and that each day meets the rules that are established in order to be counted as a business day.

If he wanted to he could have extended his stay even further by inserting days, here and there, where he spent most of the working day catching up on business via computer and phone. Six or seven hours of office work, catching up on things that are happening during his absence, would count as a business day as well—and then he could spend the rest of that day touring too.

Most trips, however, are not planned so perfectly, or with the tax consequences as the top priority. In those cases, the expense of travel to and from the destination must be pro-rated proportionate to the amount of time spent conducting business. In addition, expenses for those days that are not spent doing business (such as hotels, meals, and transportation) are not deductible.

![]() Example Walter’s friend, Andrew, thinks that Walter was brilliant for creating a month-long trip to Europe that was fully deductible. Andrew quickly threw together a 12-day business trip of his own, to Japan. Andrew flew to Japan one day, conducted business for four days, went on a tour of China for four days, conducted two more days of business, and then flew home.

Example Walter’s friend, Andrew, thinks that Walter was brilliant for creating a month-long trip to Europe that was fully deductible. Andrew quickly threw together a 12-day business trip of his own, to Japan. Andrew flew to Japan one day, conducted business for four days, went on a tour of China for four days, conducted two more days of business, and then flew home.

Unfortunately for Andrew, he didn’t pay as close attention to the tax rules as Walter did. The four-day tour did not meet any of the rules that would allow them to be counted as business days. Because of that, one third of the cost of the travel to and from Japan is considered personal (4 days personal ÷ 12 days total = 1/3 of the days) and is not deductible, as well as the lodging, food, and other expenses associated with those days.

Primarily personal. If the reason for the trip is primarily personal, then none of the expenses can be deducted except those that are directly related to doing business. All of the expenses of traveling to and from the destination would be non-deductible.

Luxury Water Travel

If you choose to travel to your foreign business destination by purchasing a ticket on a cruise ship, the cost of the travel that can be deducted is limited to twice the highest per-diem rate allowed for federal employee travel expenses. For example, if the highest per diem rate were $325 per day you could not deduct more than $650 per day ($325 highest per diem rate x 2 = $650 maximum deduction) as business travel expenses, even if it cost you significantly more. You can find the per-diem IRS Publication 1542 on the IRS website.

![]() Note The deduction is severely limited for conventions held on cruise ships. See the section on conventions, below, for more details.

Note The deduction is severely limited for conventions held on cruise ships. See the section on conventions, below, for more details.

If food and entertainment are separately itemized on your receipt for the cruise you may deduct only 50% of those costs. If they are not itemized you can deduct the entire amount, up to the daily limit.

![]() Example Paul lives in California and ships his business products around the world. His largest customers are in Panama. Paul travels to see these customers in person at least once per year in order to maintain relationships and negotiate new contracts. This year Paul decides to travel to Panama and back on a cruise ship.

Example Paul lives in California and ships his business products around the world. His largest customers are in Panama. Paul travels to see these customers in person at least once per year in order to maintain relationships and negotiate new contracts. This year Paul decides to travel to Panama and back on a cruise ship.

The cruise takes three days each way, and he stays in Panama for two days in the middle of the trip, which is plenty of time for Paul to conduct his business. The cruise costs $3,000 and includes all of his meals (which are not separately stated on his receipt.) The per-day cost of the cruise is $375 ($3,000 ÷ 8 days = $375), which is far below the limit of two times the per diem rate. Because of this, Paul’s entire $3,000 travel expense is deductible.

Conventions, Seminars, and Conferences

Travel expenses for attending a convention (or seminar or conference) are deductible only if the convention benefits your trade or business. The convention agenda is what determines whether it is beneficial to your business, and it is the proof that you will need in case of an audit. The topics presented in the agenda must relate to your duties and responsibilities in your business.

For conventions held outside the of the North America area, you must also be able to show that it is as reasonable for this convention to be held outside of North America as it would be to hold it within that area. Things that might make it reasonable to hold it outside North America might include the purpose of the meeting, the purpose and locations of the sponsoring groups, and whether there are similar opportunities to attend such an event within the North America area.

For the purposes of this rule, the North America area is pretty broadly defined—making North America much larger than you might otherwise think. Here are the locations that are included in the allowable area:

|

American Samoa |

Guam |

Netherlands Antilles |

|

Antigua and Barbuda |

Guyana |

Northern Mariana |

|

Aruba |

Honduras |

Islands |

|

Bahamas |

Howland Island |

Palau |

|

Baker Island |

Jamaica |

Palmyra Atoll |

|

Barbados |

Jarvis Island |

Puerto Rico |

|

Bermuda |

Johnston Island |

Trinidad and Tobago |

|

Canada |

Kingman Reef |

USA |

|

Costa Rica |

Marshall Islands |

U.S. Virgin Islands |

|

Dominica |

Mexico |

Wake Island |

|

Dominican Republic |

Micronesia |

|

|

Grenada |

Midway Islands |

If the convention is held on a cruise ship, you have additional limitations placed on your deductions. First, you may not deduct more than $2,000 per year for conventions held on cruise ships. In addition, the convention must meet the following conditions:

1. The convention, seminar, or meeting is directly related to your trade or business.

2. The cruise ship is a vessel registered in the United States.

3. All of the cruise ship’s ports of call are in the United States or in possessions of the United States.

4. You attach to your return a written statement signed by you that includes information about:

1. a. The total days of the trip (not including the days of transportation to and from the cruise ship port),

2. b. The number of hours each day that you devoted to scheduled business activities, and

3. c. A program of the scheduled business activities of the meeting.

5. You attach to your return a written statement signed by an officer of the organization or group sponsoring the meeting that includes:

1. a. A schedule of the business activities of each day of the meeting, and

2. b. The number of hours you attended the scheduled business activities.

In reading the list of requirements that are in place in order to deduct the costs of a convention on a cruise ship, you get the idea that this is an area that can be easily abused and that the IRS wants none of it. Just be sure to put all of your records in place as they have outlined, and you will be in good shape.