Learning Bitcoin (2015)

Chapter 2. Buying and Selling Bitcoins

|

"I really like Bitcoin. I own Bitcoins. It's a store of value, a distributed ledger. It's a great place to put assets, especially in places like Argentina with 40 percent inflation, where $1 today is worth 60 cents in a year, and a government's currency does not hold value. It's also a good investment vehicle if you have an appetite for risk. But it won't be a currency until volatility slows down." |

||

|

--David Marcus, CEO of Paypal |

||

Building on the basics that were introduced in Chapter 1, Setting up a Wallet we're going to set up a trading account with an online Bitcoin exchange. In this chapter, we're going to cover the following topics:

· Understanding Bitcoin's price volatility

· Following exchange rates and news

· Comparing Bitcoin exchanges

· Trading Bitcoins on an exchange

· Physical Bitcoins

Understanding Bitcoin's price volatility

In May of 2010, the first significant Bitcoin transaction was exchanged. A pizza worth roughly $25 was purchased for 10,000 bitcoin. At today's pricing, where a single bitcoin is worth about $250, the same amount of bitcoin would be worth approximately $2,500,00. In retrospect, it was a "worthy" pizza!

Since then, Bitcoin's volatile price movements took the exchange rate, in US dollars, up to $1200 in 2013 and back down to $180 in 2015. It's quite an impressive history for a currency that's only six years old.

Before investing your own money in Bitcoin, it's advisable to become familiar with the reputable services available, as well as its price history. Linking significant events and stories to the price is a fundamental approach to trading bitcoin.

Compared to most other global markets, Bitcoin has an overall low volume. Thus, a large move by a big player can alter the price very quickly. Make sure to assess your personal financial risk level before investing any large amount of money in Bitcoin.

Exchange rates

The first exchange rates for Bitcoin were calculated and published in October of 2009. It was a simple calculation that divided one US dollar by the average cost needed to mine a single bitcoin. The first rate published was approximately 1,300BTC for 1USD.

Note

The first Bitcoin exchange rate was published on the "New Liberty Standard":

"During 2009 my exchange rate was calculated by dividing $1.00 by the average amount of electricity required to run a computer with high CPU for a year, 1331.5 kWh, multiplied by the average residential cost of electricity in the United States for the previous year, $0.1136, divided by 12 months, divided by the number of bitcoins generated by my computer over the past 30 days." http://newlibertystandard.wikifoundry.com/page/2009+Exchange+Rate ."

Today the free market determines the price of Bitcoin. Factored into the price by the market are many elements that include government reactions to Bitcoin, price rallies, adoption announcements, and investor speculation. Occasionally, the exchange rates have experienced sharp gains followed by steep losses, sometimes prompting the news media to make extreme or exaggerated claims, such as "Bitcoin is dead".

Yet, despite all the excitement from the ups and downs of trading, the Bitcoin network continues to operate independently of its trading price. We're truly seeing the digital version of gold standing on its own.

Similar to most commodities, Bitcoin's exchange rate can be listed in many different currencies, such as US dollar and Euro, as well as in its price against some commodities such as gold and silver.

To get a better feel for its current exchange rate, let's quickly highlight the major pricing events in its six years of history.

Bitcoin's price history

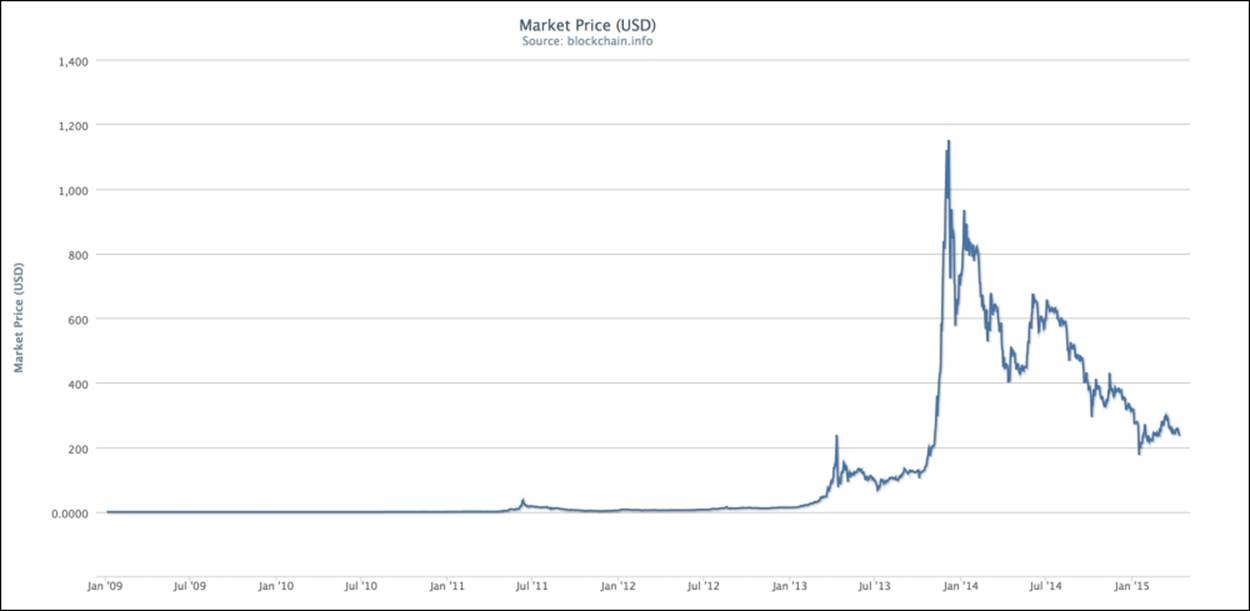

Available on many exchanges, we can find a price chart showing Bitcoin's exchange rate since its beginning. The following chart, available at https://blockchain.info/charts, shows Bitcoin's price history in US dollars since 2009:

Figure 2.1 - Bitcoin's price history (source Blockchain.info)

For the first two and half years of Bitcoin's existence, its price remained less than one US dollar. The new digital currency was being mined quite easily at the time. With little mining competition, it was common for miners to earn 50 BTC a day.

Once parity with the dollar was reached, early in the year 2011, the mainstream news outlets started covering Bitcoin. Rapid growth and adoption soon followed, leading to much more competition for mining Bitcoin. The result was a quick boom in price.

Referring to the preceding market chart, let's review some key drivers that influenced significant changes in the Bitcoin price.

Price bubbles

In market economics, a bubble is a cycle characterized by a rapid expansion or rise in price followed by a sharp correction. The changes in the market prices during a bubble are often unsupported by the underlining fundamentals, thus leading to the "post bubble crash". Over speculation is often the primary driver of bubbles.

In Figure 2.1, we can identify three significant price bubbles, with each having the characteristic rapid rise and fall in price.

The first bubble occurred circa July 2011. This is when the news media first picked up on Bitcoin. At the time, the USD/BTC exchange rate was around $2-3. Soon after, the price surpassed $30 in only a few weeks. Before the end of the year, the exchange rate fell back down to $2.

The next major bubble happened around April 2013. At that time, Bitcoin adoption was increasing and more people were familiar with it. At the same time, the government of Cyprus announced an unprecedented bailout of its banks. These were the conditions for a bubble that took the Bitcoin price to over $260. After the bubble, the price settled back down to around $140.

The largest bubble shown in the preceding price chart happened in late 2013 when the Chinese market exploded. With a large surge in interest in Bitcoin by the Chinese investors, the price surged past $1100 in a short period of time. The government officials responded by banning its banks from handling bitcoin transaction. Its citizens were not restricted from buying/selling Bitcoin, but without a legal framework for exchanges, fear dominated the markets. Less than 12 hours after the news was published, the exchange rate fell below $600. Uncertainty of government acceptance and restricted access to capital quickly cooled the surge in price.

Instability with government currencies may be one of the most significant drivers of Bitcoin price movements. As we've seen in the two largest bubbles, investors are looking for an alternative market, outside the restrictions imposed by the financial system. As governments' acceptance of Bitcoin can be quite uncertain, trading on these conditions can be quite risky.

Over time, as the Bitcoin market matures, we may eventually see price stability, but it's evident that it may take some time to get there. Until then, we can continue to see the price volatility tied with major global events and government acceptance.

Theft

In the first few years of existence, many homebuilt websites were being used to provide Bitcoin services to the public. Bitcoin wallets and exchanges were being built quickly by enthusiasts. Yet, without experience in security, there were many thefts resulting in thousands of lost bitcoins.

In most of the cases, the Bitcoin theft was due to systems built with weak protection from invasion and/or exploitation in the software. Additionally, some services stored their full Bitcoin balance on public-facing servers. Best practices for storing customers' Bitcoin mandate that only a small portion of the full balance should be stored in an online hot wallet, with the remainder backed up on an offline cold storage wallet.

As the price started to increase over time, the public's reaction to theft became more sensitive. Many were still questioning Bitcoin's resilience to hacking with a component of confusion around what was actually getting hacked. The public was uncertain as to how safe it was to hold bitcoin. This uncertainty led to questioning Bitcoin's viability as a mainstream currency, leading to a decline in price. Eventually, as the public's understanding of Bitcoin was corrected, the price stabilized.

Seizure

The Silk Road online drug market bust was the largest seizure of Bitcoin to date by government officials. Silk Road operated as a marketplace for illegal items such as drugs and weapons. At its height, more than 10,000 items, ranging from cannabis to heroin and from knives to pistols, were listed for sale, all priced in bitcoin.

Using an open sourced service called Tor, users were able to log in to the site anonymously and purchase items using Bitcoin. Using Tor with Bitcoin makes it very difficult to trace the connection between buyers and sellers. Thus, illegal sales flourished. It is estimated that, in 2013, Silk Road grossed $1.2 billion in revenue and earned $80 million in commissions.

Dead Pirate Roberts was the operator of Silk Road. Working anonymously, he inadvertently leaked enough traces of his identity that the DEA and the Secret Service were able to make an arrest. In October of 2013, Ross Ulbricht was arrested on charges of drug trafficking and money laundering.

Seizure of Bitcoin by law enforcement agencies resulted in some significant price movements. With the seizure of 144,000 bitcoin from the Silk Road bust, the traders were uncertain of Bitcoin's ability to sustain its price. This news resulted in a drop from $123 to $75. Two days later, the price recovered to around $118.

Following exchange rates and news

To help track what's going on in the Bitcoin space, we'll look at some products and services to track exchange rates and related news events.

Price tickers

There are many services that track and display Bitcoin exchange rates. One of the easiest apps to use is btcReport (available for iOS on the App Store):

Figure 2.2 - btcReport, a Bitcoin price ticker for the iPhone

The main display of btcReport, as shown in Figure 2.2, shows the latest trading price and news. Daily metrics are shown as changes in today's price (shown on the top), a ticker chart, and the trailing 3-day average (shown under the chart). Displayed along the bottom is a selection of currencies, and on the top right there is an option to change the exchange. btcReport functions nicely as an app in your pocket for a quick glance at the exchange price and recent movements.

For most users who wish to casually buy and sell bitcoin, btcReport offers a clean and uncluttered view into the markets.

The following table lists some other popular ticker apps suitable for the mainstream audience:

|

Service |

Platform |

Description |

|

btcReport btcreport.com |

iOS, Web |

Clean and simple design. Supports price alerts and the largest list of currencies and markets. |

|

Coin Desk coindesk.com |

Web, iOS, Android |

Daily news articles and well organized price data for USD, EUR, GBP, and CNY. |

|

XBT Apps xbtapps.com |

Android, iOS, Web |

Works on Android. Supports price alerts and 29 exchanges. |

|

Bitcoin Wisdom bitcoinwisdom.com |

Web |

Candlestick charts and detailed pricing information. Great for advanced traders. |

|

Preev preev.com |

Web |

Very simple Bitcoin price converter. |

Table 1 - Bitcoin ticker apps

Bitcoin prices are also available from Google. Google stores and tracks historical Bitcoin price information and makes it available through their search engine. The following search terms are examples of how to access Google's pricing information from the search box:

btc to usd

Bitcoin price in dollars

As shown next in figure 2.3, Google offers a quick way to find the latest Bitcoin price. It displays a quick chart and offers a quick currency converter.

Figure 2.3 - Google's Bitcoin price chart

Detailed price tracking

For those trading bitcoin on a more frequent basis, a more advanced and detailed view of the Bitcoin price is necessary. Many applications and services, which provide detailed price charts and analysis, are available to help the traders.

Note

TRADING BITCOIN CAN BE RISKY. Market trading is well beyond the scope of this book. Learning Bitcoin's goal is to familiarize its readers with transacting in Bitcoin, including online trading.

If you're interested in learning more about trading for profit, please make sure you do proper research online, or through other sources of information on market trading and price chart analysis.

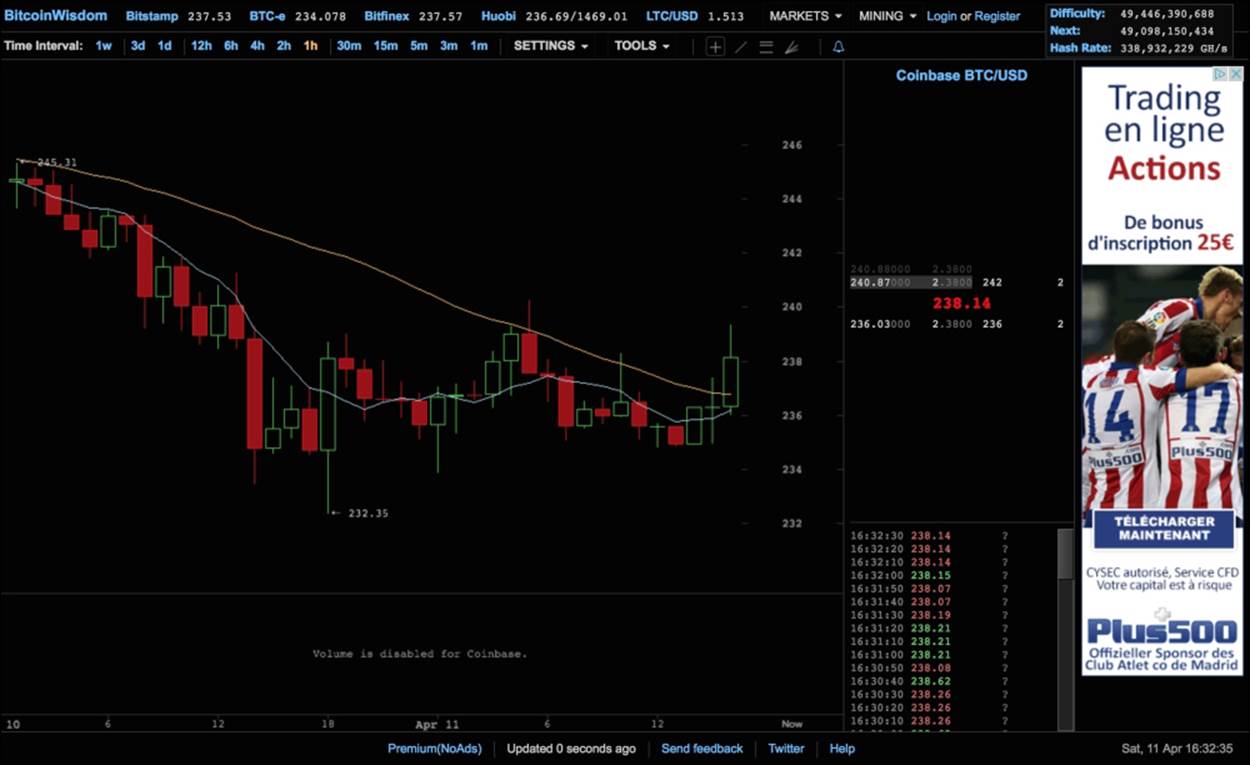

Shown in the following figure 2.3 is a service called BitcoinWisdom, available at https://bitcoinwisdom.com/:

Figure 2.4 - BitcoinWisdom market analysis

BitcoinWisdom offers a more detailed look and analysis of the moving market prices. Each section of the screen displays detailed:

· Candle stick chart, shown in the main section

· Open market orders, shown to the right of the candlestick chart

· Last orders traded, shown below the open market orders section

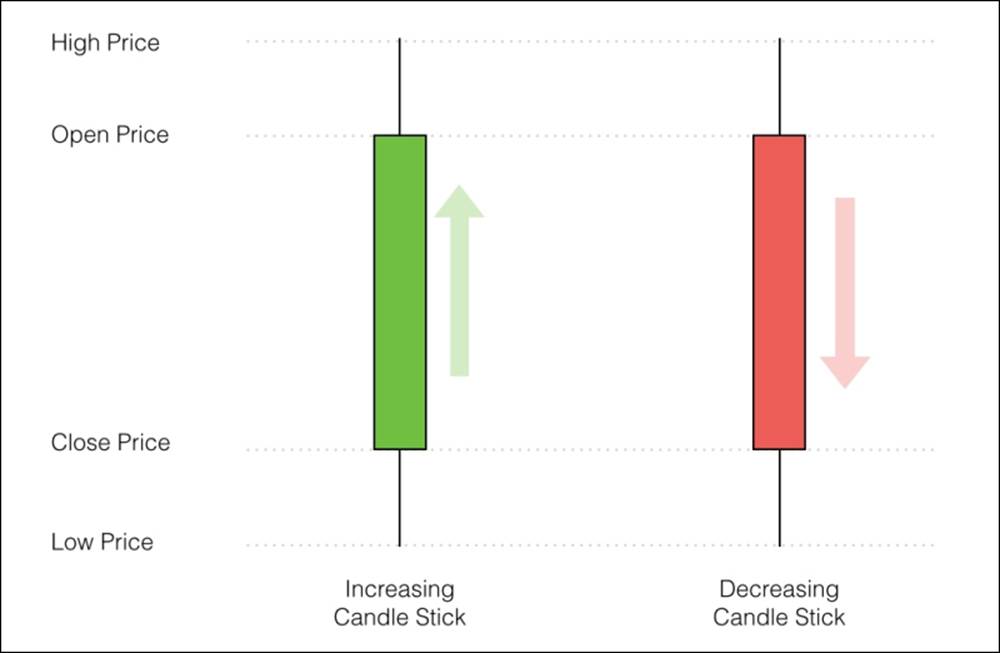

Candlestick charts

Market charts often display candlestick charts, which are dense with information. Each candlestick contains a bar, called the body, with a line both above and below, called the wick. The top of the body represents the open price, and the bottom, the close price. The wick extending above the body shows the high price and the one extending below shows the low price.

Each candle stick can represent an interval of time. The available intervals on BitcoinWisdom are shown along the top: 1w, 3d, 1d, 12h, 6h, and so on. The color, usually green or red, represents the movement of the price.

Figure 2.5 - Candle stick chart explanation

Market orders

Online exchanges match buy or sell orders with their respective parties. The traders submit an order, listed as buy or sell, with the quantity and price. The orders sit in a queue called the order book. The order book lists all the buy and sell orders by amount, and is updated in real time. Usually, there is a gap between the highest buy order and the lowest sell order. The difference is called the spread.

Once an order is matched, it is recorded and displayed below the order book (refer to figure 2.4). Each order matched is then summarized and plotted as a candlestick chart. Moving averages are calculated and overlaid as a blue and yellow line.

Trading techniques

There are primarily two ways to analyze market trading data: fundamental analysis and technical analysis.

Fundamental analysis is based on the underlying support of each market and stock or commodity. The company's assets, revenue, and profitability, as well as the associated economic environment, are all factored into the fundamental analysis. For example, Warren Buffet, one of the most famous investors, relies on the company's fundamentals before making an investment. These fundamentals are cited as his reasoning to invest in industries such as railroads and energy.

Technical analysis deals more with the day-to-day price movement. It factors in the psychological aspects of trading. Technical price analysis has the following guiding principles:

· The price reflects all known information

· Price action is more important than the news, earnings, and so on

· The market's price movement is based on emotions such as fear and greed

· Markets fluctuate and the actual price may not reflect its actual value

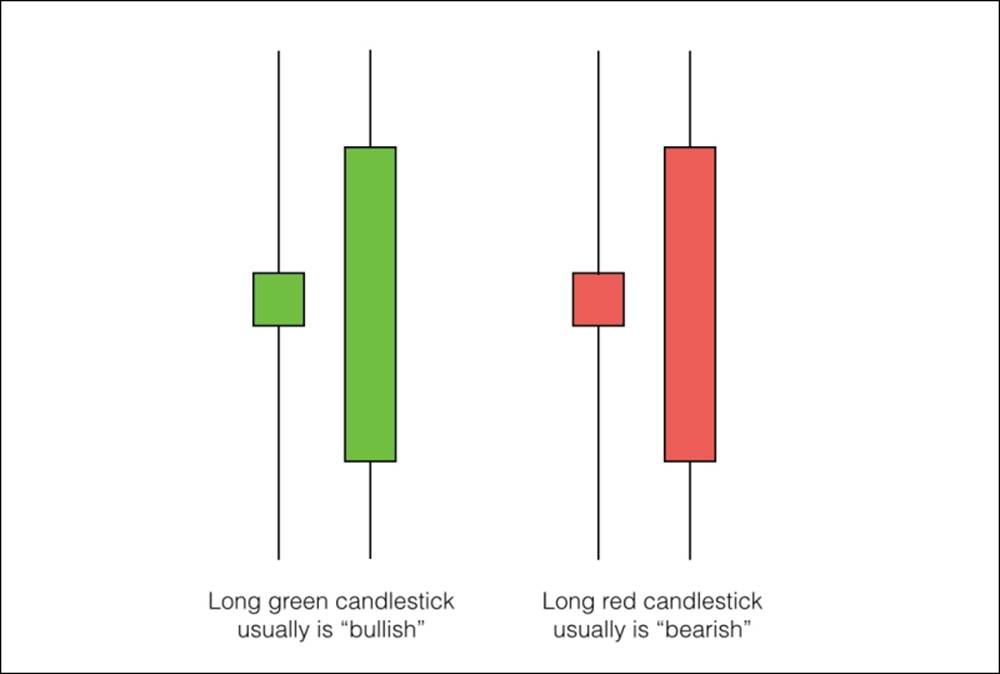

Candlestick charts are used extensively in technical analysis. The size of the body, the length of the wicks, and the movement of the price are all used to influence how to place trades.

Just to give an example of how to read candlestick charts, let's consider the body length given in a typical chart:

Figure 2.6 - Long green versus long red candlesticks

Long green candlesticks usually indicate strong buying pressure. The longer the wick, the further the close price is above the open price. Long green candlesticks can be found after an extended decline, marking a potential turning point or a resistance level.

Long red candlesticks usually indicate strong selling pressure. The longer the wick, the further the close price is below the open price. Long red candlesticks can be found after a long advance, indicating a turning point or a future resistance level.

In this chapter, we're providing a quick introduction to candlestick charts. In-depth coverage, with a broad range of examples of candlestick charts and technical analysis, can be found through online search.

Note

IMPORTANT

Before beginning to day trade, it is extremely important to understand each market's particular dynamics and have some understanding of technical analysis. Remember to only trade with money that is at your disposal.

News sources

Access to the latest news is very helpful for following trends and activity in the Bitcoin space. Quality news articles are available through several sources. Google provides a clean interface which combines historical price charts with the latest news.

Figure 2.7 - Google's finance page for Bitcoin

Google's finance page for Bitcoin displays price tracking alongside the latest news. You can easily access this information through Google's search bar, with the following terms:

CURRENCY: BTC

http://www.google.com/finance?q=CURRENCY:BTC

CoinDesk is a service focused on providing an in-depth look at the Bitcoin space. They publish daily news articles focusing on the latest developments, the exchange rate information, as well as a quarterly State of Bitcoin report.

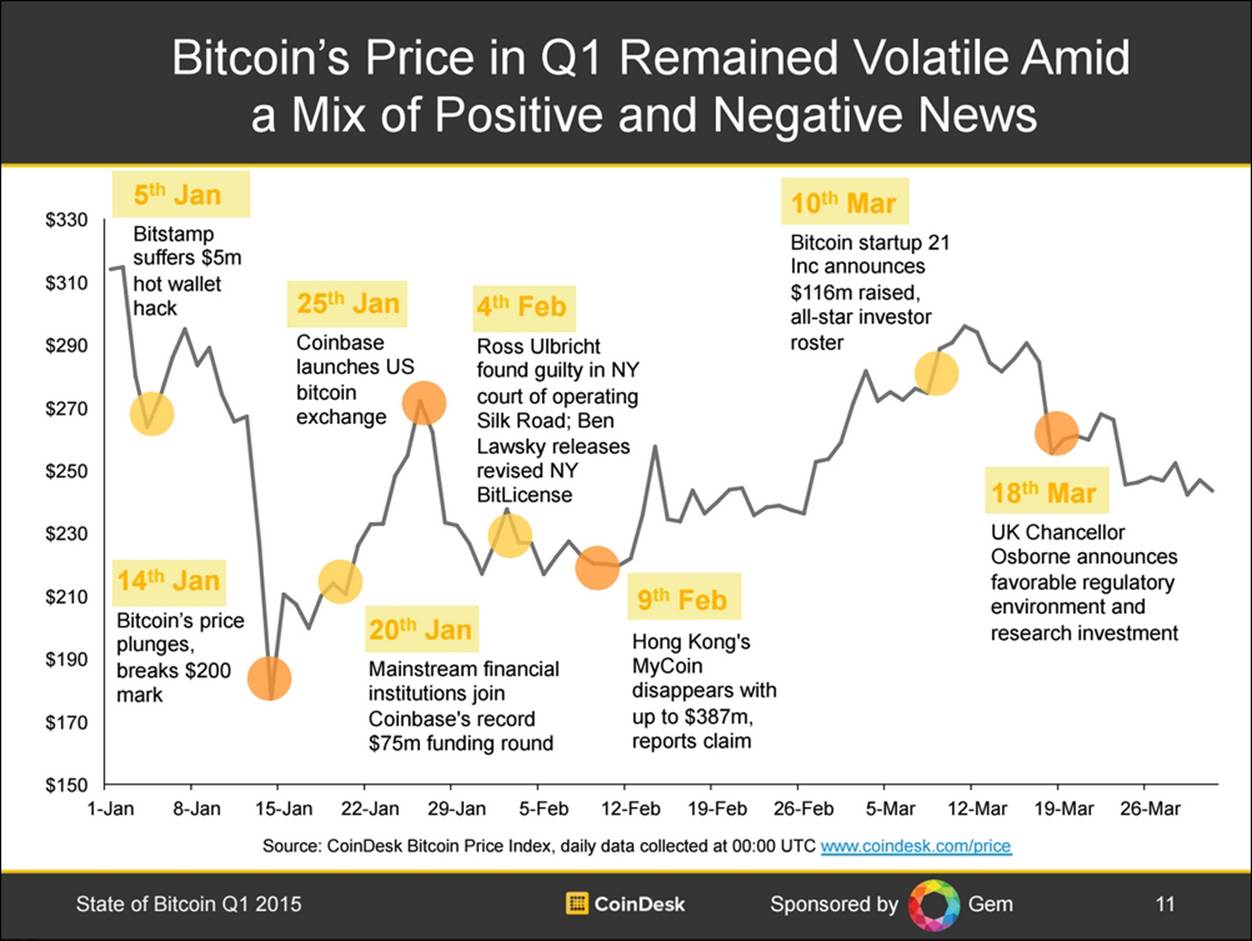

Figure 2.8 - Coindesk's State of Bitcoin report

The State of Bitcoin reports focus on the major events and drivers in the Bitcoin space. Researching these reports, on a quarterly basis, will help develop a better understanding of the fundamentals backing Bitcoin.

CoinDesk publishes several other periodicals related to Bitcoin. These reports can be found at http://www.coindesk.com/bitcoin-reports.

Listed in the following table are some of the sources of high-quality Bitcoin news and content:

|

Service |

Description |

|

CoinDesk coindesk.com |

Offers a quarterly State of Bitcoin report and a detailed price history for the major markets |

|

The Coin Telegraph cointelegraph.com |

Offers the latest news, prices, breakthroughs, and analysis with emphasis on expert opinion, and commentary from the digital currency community |

|

Bitcoin Magazine bitcoinmagazine.com |

Periodical magazine that covers current events in business, technology, politics, law, and society |

Table 2 - Services offering Bitcoin-related news

Comparing Bitcoin exchanges

Shortly after Bitcoin's beginning in 2009, online exchanges were created to facilitate buying and selling of Bitcoin. In 2010, MtGox was the first exchange to bring Bitcoin to the market. MtGox was originally a site for trading Magic the Gathering cards but was adapted for trading bitcoin. They grew quickly, both in user base and trade volume, and brought Bitcoin to many thousands of people. However, they were unable to sustain the pace of growth and met difficulty in meeting government compliance. Ultimately, they experienced a significant bitcoin theft that left them insolvent. In early 2014, they publicly announced their insolvency and filed bankruptcy.

Thus, when choosing a Bitcoin exchange, it's most important to do some research on the company and its operations. Let's cover some important aspects used to make a worthy comparison.

Volume and liquidity

Consider an exchange with a light trading volume. If a large order is placed that exceeds the order book's capacity, the price can significantly change. To absorb a large order, a marketplace must be able to cover the order without a major change in price.

A marketplace's ability to process such orders is dependent on its liquidity. Depending on your trading requirements, some exchanges may not suffice. You can check the exchange's 30 day volume to get a picture of its liquidity.

Fees and commissions

Most online Bitcoin exchanges charge a commission, both from the buyer and the seller, for each trade completed. The fees usually run between 0.1 percent and 0.5 percent, depending on the trading volume of the user. The rates are calculated on your total monthly volume and are often tiered to encourage volume trading.

For example, Bitstamp (www.bitstamp.net) charges fees based on your 30-day USD volume. To illustrate the fee structure, refer to the following table:

|

Fee % |

30-day USD volume |

|

0.25% |

< $20,000 |

|

0.24% |

< $100,000 |

|

0.22% |

< $200,000 |

|

0.20% |

< $400,000 |

|

0.15% |

< $600,000 |

|

0.14% |

< $1,000,000 |

|

0.13% |

< $2,000,000 |

|

0.12% |

< $4,000,000 |

|

0.11% |

< $20,000,000 |

|

0.10% |

> $20,000,000 |

Table 3 - Bitstamp's fees based on trading volume

Coinbase Exchange (https://exchange.coinbase.com/) offers a different model for commission. It's based on a taker/maker schema. Makers are the orders that add liquidity to the exchange and takers are the orders that remove the liquidity. For example, if you place an order on the order books, you're a maker. If you place an order to purchase an existing order, you're a taker. Coinbase simply charges a 0.25 percent fee to all the takers and a 0.0 percent fee to all the makers.

Transfer limits

Exchanges are subject to limits imposed by their banking partners and/or government regulations. For example, Coinbase has daily and monthly withdrawal limits based on your level of account verification. You may experience varying withdrawal limits, depending on the exchange policy.

For larger institutional investments, online Bitcoin exchanges may not carry sufficient liquidity. Currently emerging are privately managed Bitcoin funds and electronically traded funds (ETF's). A Bitcoin fund may purchase and securely hold a specified amount of Bitcoin. Shares representing a portion of the fund are then sold and traded. Privately managed Bitcoin funds may be more suitable for institutional investors to serve larger investments without exceeding the liquidity of an exchange's order book. Additionally, the bitcoins are securely held, relieving the investor of having to manage their storage.

Jurisdiction and regulations

Bitcoin exchanges that accept transfers between the banking systems must get registered and comply with their local laws and regulations. Governments' licensing requirements often vary between jurisdictions, depending on the financial services offered. Therefore, it is important that any exchange that you do business with meets these requirements.

Some governments are not certain on how to classify Bitcoin. In the United States, the IRS classifies Bitcoin as a commodity subject to capital gains tax, while FinCEN treats it as a currency. These classifications are subject to change in line with Bitcoin adoption within governments.

Note

Some banks are not able to accept the uncertainty of the ambiguity surrounding Bitcoin compliance. As a result, there have been several cases where an exchange's banking partner has discontinued business. This can often lead to slow withdrawal rates and service interruptions. Make sure to research the exchange's banking partnerships and their history of doing business together.

Any trader should consult with a tax professional to ensure they are in compliance with their local and state tax laws.

Service uptime

An exchange's service uptime and capacity to handle peak loads of traffic are an important aspect to consider when choosing a Bitcoin exchange. Heavy trading excitement can lead to a spike in traffic, resulting in a heavy load on the exchange's service. If capacity is exceeded, it may be difficult to place or change the orders.

Many exchanges claim to have high-performance servers and bandwidth. Yet, it's advisable to review their uptime statistics. Some exchanges offer a status page announcing down time or service interruptions.

To help you get started with researching an exchange to trade with, following is a list of some of the major exchanges by currency accepted and jurisdiction:

|

Exchange |

Currencies |

Jurisdiction |

|

Coinbase Exchange exchange.coinbase.com |

USD, EUR |

United States, European Union |

|

Bitstamp bitstamp.net |

USD, EUR |

European Union |

|

Kraken kraken.com |

USD,EUR,GBP |

United States |

|

BTC-E btc-e.com |

USD, RUR |

Bulgaria |

|

ANXPRO anxpro.com |

USD, EUR, GBP, CHF, CAD, JPY |

Hong Kong |

|

BTC China btcchina.com |

CNY |

China |

Table 4 - Exchanges that offer Bitcoin trading in various currencies

Trading Bitcoins on an exchange

Aside from the risks involved, trading Bitcoin can be rewarding. For our introduction into trading Bitcoins, we will setup an account with Coinbase Exchange. Coinbase is a Bitcoin wallet service. They offer the option to buy and sell bitcoin from your wallet similar to Circle. In addition, they offer a full service platform for trading Bitcoin in real time.

Coinbase, founded in 2012, is funded by top-tier investors, including the New York Stock Exchange. They have a license to operate as a money transmitter in more than 15 states in the United States. Users who are living in the US and Europe can fund their accounts with US dollars or Euros.

Setting up an account

To start trading on Coinbase Exchange, you will need to sign up with Coinbase for the wallet and verify your account. From your account you will be able to link your bank account to transfer funds. Similar to Circle's requirements, Coinbase will prompt you for a valid identification as well as a recent photo.

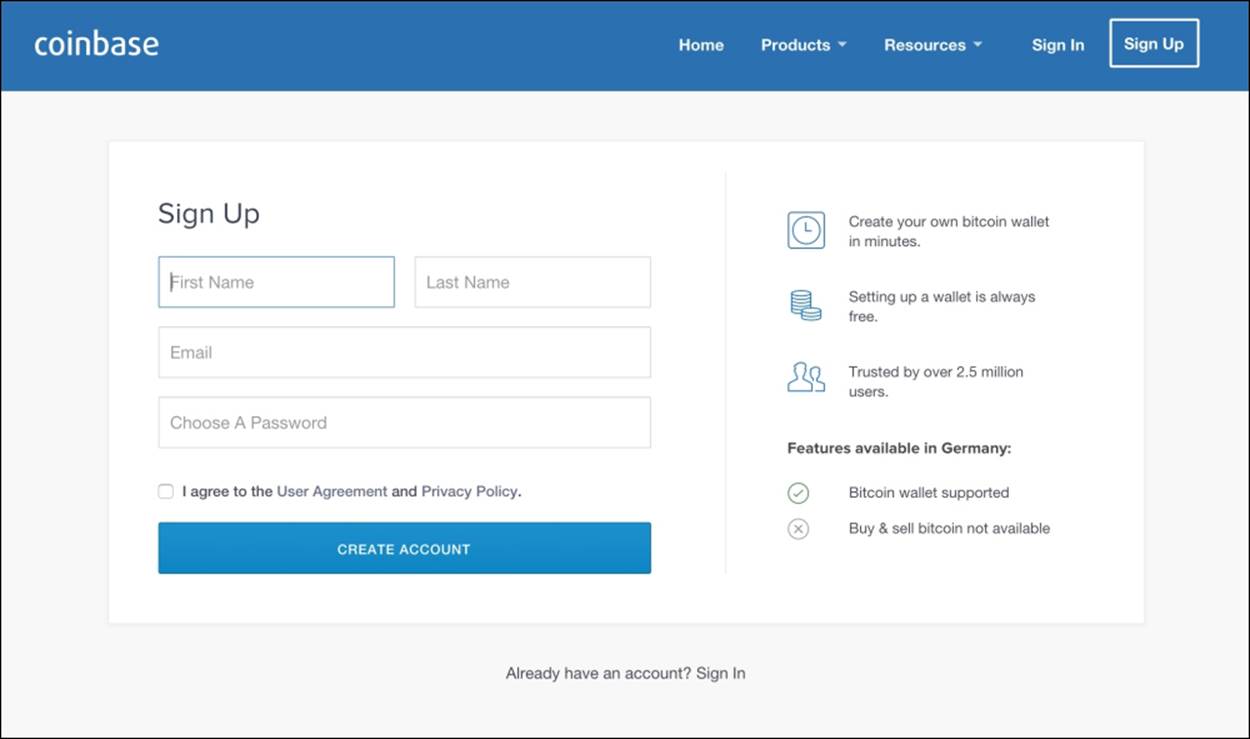

Open Coinbase (https://www.coinbase.com/) in your browser and follow the Sign up links (see Figure 2.9).

Figure 2.9 - Signing up with Coinbase

After signing up, Coinbase will ask you to verify your identity. You will be asked to verify your identity with an identification document and a recent photo.

Similar to Circle, mentioned in Chapter 1, Setting up a Wallet, Coinbase offers two-factor authentication. It is highly recommended to enable the two-factor authentication. If enabled, your account will be eligible for insurance in case of theft or loss.

Note

Trading Bitcoin on Coinbase Exchange is only available to customers located in US states where Coinbase is licensed to engage in money transmission. You can find this list at:

https://www.coinbase.com/legal/licenses.

There are other Bitcoin exchanges available where the other customers, outside of this list, can trade.

Depositing funds

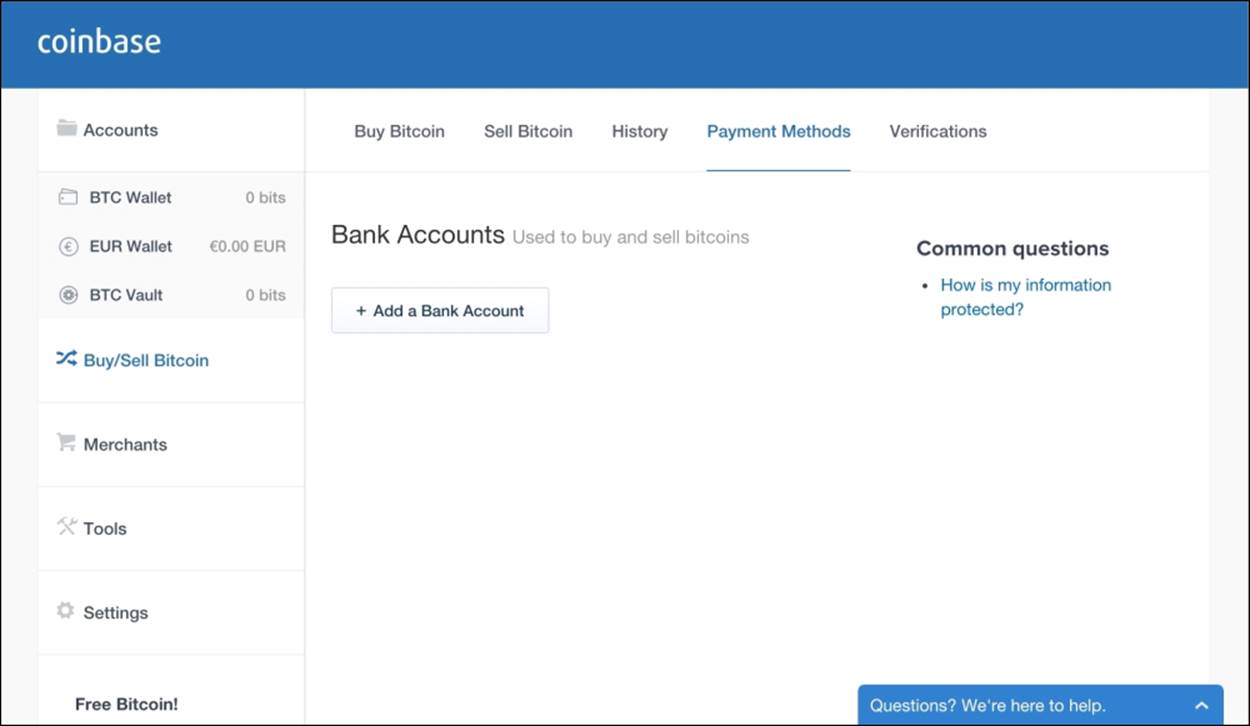

After setting up your account and verifying your identification, Coinbase will allow you to link your bank account. To add a bank account, start by logging in to your account and clicking on the Buy/Sell Bitcoin link on the left side navigation. From there, click on thePayment Methods from the links on the top navigation bar (see figure 2.10). Then click on the + Add a Bank Account button. You will be prompted for your account number and details.

Simply follow the instructions provided. Coinbase will verify your account by depositing two small amounts into your bank account. When they are received, you will be asked to enter the amounts back on your account page.

Figure 2.10 - Coinbase adds the bank account

Using your bank account, you can now deposit funds into your Coinbase USD or EUR wallet. Transfer times will vary, usually 2-5 days, depending on your bank.

Tip

You can use Coinbase to instantly buy or sell bitcoin with funds from your bank account. The exchange rate is determined by Coinbase's pool of available bitcoin. This is different than using Coinbase Exchange. On the exchange, you buy and sell from an order book of offers placed by the other traders. The rates could vary depending on liquidity.

Once your account is setup, your identity verified, and your bank account linked, you're ready to start trading using Coinbase Exchange.

Using Coinbase Exchange

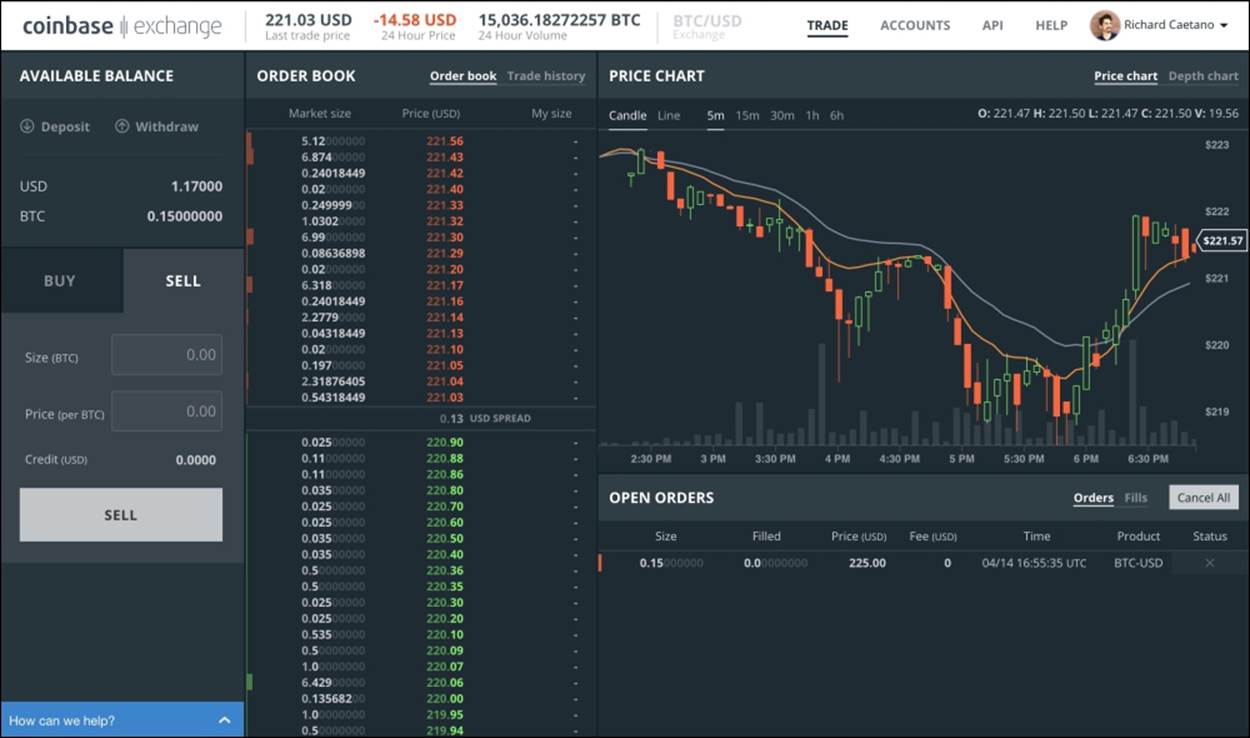

You can access the Coinbase Exchange platform by opening https://exchange.coinbase.com/ in your web browser. As shown next in figure 2.11, the platform offers the ability to deposit/withdraw the funds from your Coinbase wallet, has an order book for reviewing the available orders, and provides a real-time candlestick chart to support your trading activity. We will be exploring Bitcoin trading using these simple tools.

Figure 2.11 - Coinbase Exchange platform

Funding and orders

On the left side of the screen you can find your available balance. Initially it will be zero but you can easily transfer funds from your Coinbase wallets. Transfers can be made in US dollars or in Bitcoin and are available immediately.

Underneath your available balance, you can enter Buy or Sell orders that will be posted immediately to the order book. All the orders are listed, with their price and quantity, in BTC. Your open orders are listed under the Open Orders section found on the lower right. From there you can cancel the existing orders. Clicking on the Fills link will display your completed orders.

Order book and history

The section just to the right of your available balance is the order book. All the open orders are listed with the quantity and ordered by price. These are the orders that you can buy/sell immediately at the price listed.

In between the lowest priced sell order and the highest priced buy order is the spread. The spread price is an indicator of the liquidity of the market. The closer the spread price is to zero, the lower the transaction costs.

By clicking on the Trade history link, you can view all the orders completed from the order book.

Price charts

On the top right you can find the price chart displayed as a candlestick chart. Each candlestick represents a fixed unit of time that can be selected from the links along the top. Moving your mouse cursor over the chart will highlight a specific point on the chart, giving you the exact price for open/close/high/low and the number of bitcoin traded, or volume.

Overlaid onto the chart is the moving average, shown as a blue and orange line. Along the bottom of the chart, you can find a bar chart showing the total number of bitcoin exchanged.

By clicking on the Depth chart link, you can get a view of the order book, showing how all the orders stack up, and the total price you would have to pay to buy/sell a specific number of Bitcoin. You can move your mouse cursor over the chart to see a specific price point and quantity.

Figure 2.12 - The Depth chart

Physical Bitcoins

So far we've been discussing about buying and selling bitcoins that are stored electronically in your wallet. They are secured by a digital private key which is encrypted by wallet software. Being completely digital, these coins are only available and managed online.

Physical Bitcoins is a concept that allows us to hold a bitcoin in our hand by embedding the private key into a precious object. The objects openly display the public address that can be used to verify that the funds are in fact available. This makes it convenient to exchange Bitcoin, hand to hand, by not having to involve a software wallet. In addition, since the private key is never stored online, it makes hacking very difficult.

As a collector's item, physical Bitcoins often have a numismatic value placed above the actual value of the electronic Bitcoin. In addition, the physical object is often a precious metal, such as gold or silver. The combined values of all these aspects are used in estimating the full value of a physical Bitcoin. You can always check marketplaces, such as eBay, to help price this value.

Before buying any physical bitcoins, make sure to do some background checks on the seller and the manufacturer of the object. They often provide information on how to ensure the validity of the item. Because the private key is often hidden, it's important to be able to verify that it hasn't been compromised.

Manufacturers have used tamper-evident holograms to protect the key. The hologram can show if there was an attempt to uncover the key. The public key can be used to check if the bitcoin has been spent. Make sure to check these two components before buying a physical bitcoin.

The following table lists some of the popular manufacturers of physical bitcoins, and information about their products:

|

Manufacturer |

Description |

|

Casascius casascius.com |

One of the first manufacturers of physical bitcoin. Offers units consisting of solid brass coins, silver coins, and gold-plated bars. The private key is embedded under a card and protected by a tamper-evident hologram. |

|

Alitin Mint alitinmint.com |

Offers coins made of pure silver. The private key is engraved around the edge of the coin and is protected by a tamper-resistant case. |

|

Titan Bitcoin titanbtc.com |

Offers coins minted in gold and silver with the private key protected by tamper-evident hologram. |

Table 5 - Manufacturers of Physical bitcoins

Summary

In this chapter, we briefly discussed about Bitcoin trading. We covered what can move a Bitcoin's price and the various tools to follow the changes. Following that, we introduced Bitcoin exchanges, understood how to choose one, and looked into how they worked. Finally, we ended the chapter with getting to know another way to hold bitcoins, physically in our hands.

As we saw, there are various ways to buy and sell Bitcoin as a digital currency. In all cases, the bitcoins are controlled and owned through their private key.

In the next chapter, we're going to discuss how you can protect your bitcoins by learning how to safeguard the private keys.

All materials on the site are licensed Creative Commons Attribution-Sharealike 3.0 Unported CC BY-SA 3.0 & GNU Free Documentation License (GFDL)

If you are the copyright holder of any material contained on our site and intend to remove it, please contact our site administrator for approval.

© 2016-2026 All site design rights belong to S.Y.A.