Hacking Happiness: Why Your Personal Data Counts and How Tracking It Can Change the World (2015)

[PART]

2

Be a Provider

10

VIRTUAL CURRENCY

All the artifacts of a human being belong to physical and logical governments, and not to social networks. But the ability to move any form of asset between the virtual world and the physical world needs a commonality of understanding of identity.1

J. P. RANGASWAMI

SOCIAL CURRENCY is an idea you’re already used to. In a particular clique of friends or at your local church or synagogue, you’ve earned a reputation. Perhaps it’s based on your words and personality—you’re outgoing and funny. Or perhaps your reputation is based on action—you volunteer to help a lot. Wherever you fall into that spectrum, you’ve earned a social currency based on your identity that is made up of a combination of your words and deeds.

You’re also aware of how you can redeem currency in these types of real-life social networks. For instance, say you helped someone from your synagogue carry a heavy box from inside the building to their car after a service. If you asked them to help you move a box of the same size the following week, you’d expect them to help you. If you asked them to help you move out of your house, however, you’d be straining that relationship because it’s not perceived as a fair exchange of value.

A big part of Hacking H(app)iness is understanding how the worlds of digital technology, economics, and happiness intersect. Economics in the digital realm is something we’ve already touched on—you may earn a high enough Klout score, for instance, to get a Klout Perk. A brand offers you something based on your influence and the value exchange is understood. You get a coupon or a product of some kind, and the brand gets the benefit of the marketing you generate when you talk about your perk to your Twitter or Facebook audience. This is essentially paid advertising, where the brand reaches your audience in exchange for a product.

Economics and happiness in the digital realm intersect with regard to your data. As consumers and citizens we’re being measured in ways we don’t fully understand, but the portraits of who we are (our digital/virtual identities) are being projected in public and private realms. If we don’t understand or control our identities, how can we measure or even increase happiness? To fully leverage information about our happiness and well-being generated from quantified self devices or other inputs, we need to own our data.

But what if you could sell your data directly to brands at a profit? By eliminating data brokers, people could establish their own virtual storefronts for their own data to sell as they’d like. This would provide a form of virtual currency exchange, as the online market would determine what your data was worth.

Federico Zannier, a New York University graduate student, decided to pursue this idea by selling his data via a Kickstarter campaign called A Bite of Me. People who participated in his campaign bought increments of Zennier’s data beginning at two dollars a day. Zannier utilized a number of tools to gather data for the project while also educating users. Like marketers, Zannier used tools that tracked his Web traffic and activities, and software that tracked his GPS location. But as Sarah Kessler explains in her Fast Company article “What If We Thought More Often About Being Tracked Online? Man Stalks Himself to Find Out,” it was the act of selling his data via Kickstarter that made Zannier’s project truly unique. First of all, it made people realize how thoroughly our actions are being measured and evaluated via our online and mobile behavior. Second, as Kessler notes, the project poses a question: If data is valuable to companies, why shouldn’t the people who create that data be able to sell it?2

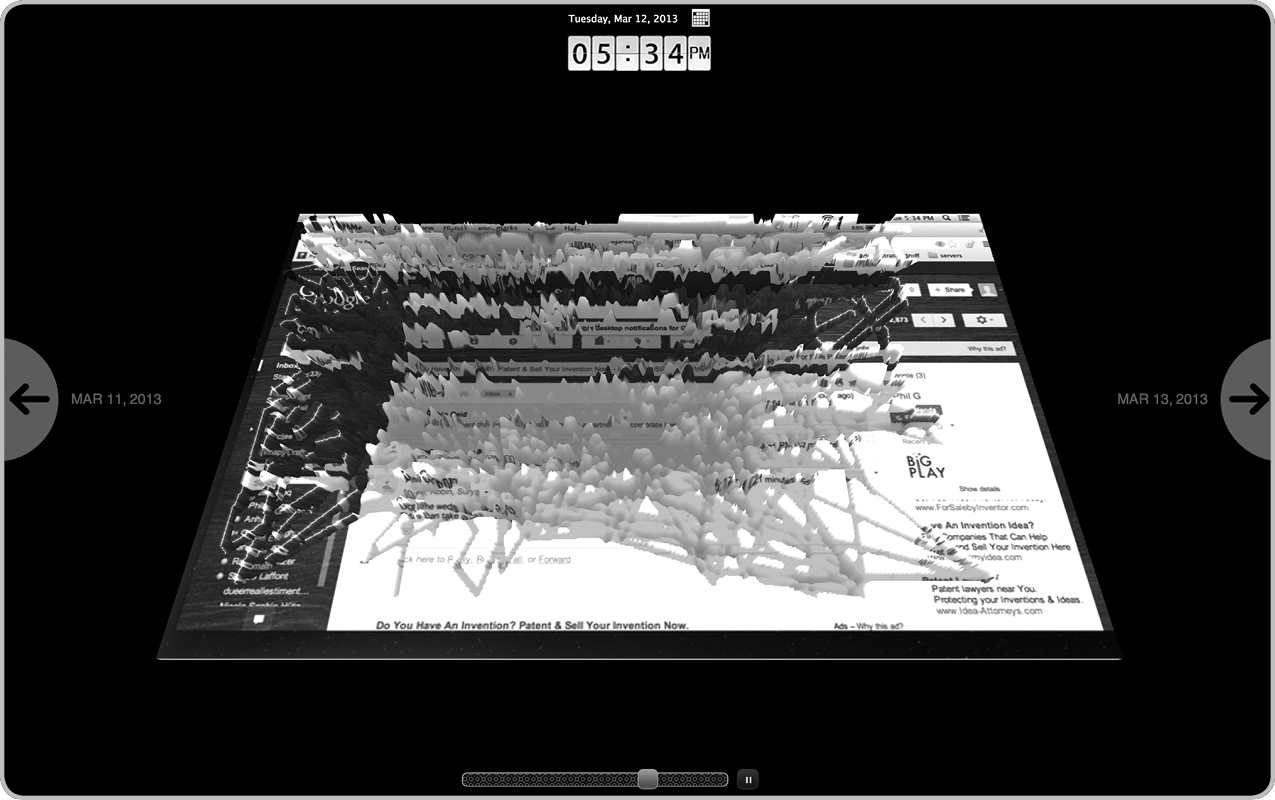

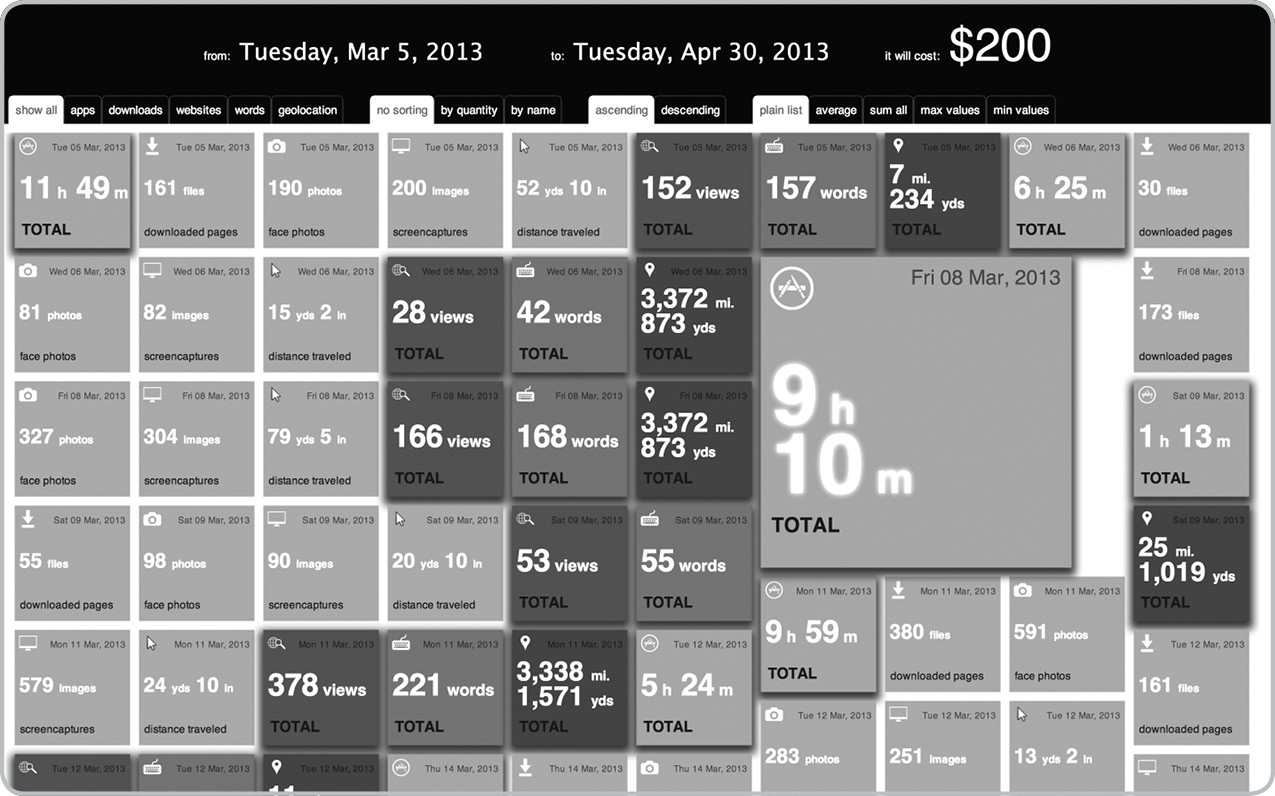

I bought a week’s worth of his data, paying five dollars, which included around five hundred websites Zannier visited, four thousand screenshots he took, four thousand webcam images, a recording of his mouse pointer movements, his GPS location, and an application log of 4,200 lines of text. Here are some visual samples of his data:

Do I know what an advertiser would pay for his data for this same time frame? Nope. I am fairly sure if I did the same thing, an advertiser would pay a lot less for my data, as I’m forty-four years old and have two kids and a mortgage. You don’t need a calculator to figure out that means I have less disposable income than a young, savvy New York graduate student.

The more relevant question is: Do I feel a week’s data is worth five dollars? Apparently so, because I bought it. For his effort alone the money was well spent, and I’m also paying to support his educational message. Plus the act of paying him made me happy. I genuinely got pleasure knowing that I was supporting his work versus giving money to a third-party data broker neither of us will ever meet.

I interviewed Eli Pariser, author of The Filter Bubble: How the New Personalized Web Is Changing What We Read and How We Think, about this issue. While he wasn’t sure that selling personal data will work at scale, he does see the value in trying.

It’s hard for me to envision a world where people could make a fair amount of money selling their personal data. However, I would love to move toward a world where people are able to leverage their data at least as well as big companies do. Apple knows more about my behavior from my iPhone than me.3

My transaction with Zannier demonstrates a form of virtual currency, one where I helped him leverage his data for fiscal gain. I trusted that his data was worth five dollars. And I won’t be upset if I find out it wasn’t worth five dollars. Our exchange was built on trust, even though I’ve never met him. Trust ranks high in importance for the happiness economy. That’s why your actions, as reflected in data, are such a big deal. Other people’s algorithms, like the ones being used for a dating service, will judge whether or not you’re worthy to meet based on your reputation. Learning about virtual currency will help you understand where the banks of the future will be tallying information relevant to you and your relationships.

Virtual Currency, Past and Present

I wrote about one of the most famous examples of virtual currency for my Mashable article “Why Social Accountability Will Be the New Currency of the Web”:

In 1932, a small town in Austria called Worgl created an economic experiment to counter the devastating effects of the Great Depression. The mayor issued a new currency and encouraged citizens to spend it quickly to put money back in the system. People were motivated to participate in an economy based on action. Within months, the town’s unemployment rate had dropped by over 30 percent. Dubbed “the Miracle of Worgl,” the experiment was eventually terminated by Austria’s Central Bank in 1933 for fear the nation’s existing currency would lose relevance. Unemployment immediately returned, and Austria’s economy collapsed further in the wake of Hitler’s rise to power.4

One wonders how Austria might have fared differently if the Worgl idea had spread through the country before Hitler came to power. Perhaps greater economic strength would have helped them avert the Anschluss.

This demonstrates how value exchange by consenting parties could work to everyone’s advantage. It is similar to an economic model known as “the commons,” in which citizens work together without needing oversight from government or other institutions to advance society.

Elinor Ostrom, the most famous proponent of the commons and the only woman to ever win the Nobel Memorial Prize in Economic Science (while not actually being an economist), demonstrated with her research that a number of communities flourished by exchanging virtual currencies rooted in social capital. Neighbors essentially decided among themselves how to pool and distribute resources, and monitors were set up to fine or eventually exclude anyone who broke communal rules.5 What’s apparent from these aspects of the commons is the inherent trust that pervaded the communities who set up these guidelines. Where rules were adhered to by individuals, positive reputation and trust in the communities increased. In our lives today, online etiquette has created a form of digital commons. There’s a reason the media is called social after all—how we relate to other people determines our currency or value.

Social Networks as Banks

It may surprise you to learn that some social networks operate as banks, as they’re the primary platforms for certain types of monetary exchanges beyond traditional online purchases. For millions of users, Facebook Credits operated for a number of years as the primary form of currency when purchasing in-game items, for example (the company stopped using Credits in 2013). One U.S. dollar equaled ten Facebook credits. In 2011, Facebook began requiring that game developers process payments only through their Credits platform. Facebook kept 30 percent of all revenue collected, and developers retained 70 percent. While Facebook’s gaming revenue declined in 2012, the company’s third-quarter profits that year were still a sizable $176 million (U.S.).6

Thirty percent is a hefty fee for developers to have to pay to Facebook. While the network is hugely popular, developers still have to pay to drive people to their Facebook pages while trying to make revenue from their games. Fair or not, the example points out how Facebook was acting as a financial institution by taking direct payments from gamers and charging a fee for developers while mandating they only take payments through their Credits platform.

The trend for digital and social networks to act as banks is growing, as reported by a press release from Gartner in October 2012. Noting the advantages networks have over banks, the release noted:

Digital mega-firms have many things in their favor. They are masters of data management and analytics. To all intents and purposes they define agility, both from a technology and a business model point of view. They are extremely adept at extending their value chain analysis beyond the core offering, with an eye to identifying new opportunities for business and highlighting specific customer needs that they might address. They have the ability to define—and then redefine—the business models that they deploy while their focus on what partners can bring to their propositions stands as an equally strong differentiator.7

There’s a concept in telecommunications known as Metcalfe’s Law. The technical definition is that the value of a network is proportional to the square of the number of connected users of a system. In plain terms, this means you need two devices speaking to each other to have any value—for example, owning a fax machine is useless if nobody else has one. The concept has now spread to users. You’ve already experienced Metcalfe’s Law in your own life, the first time you saw someone with a device you didn’t have. If you’re my age, you saw someone with a cell phone the size of a shoe box back in the day and mocked them for six months until you had to have one of your own. Perhaps you held out longer than I did, but by and large you got tired of people asking, “Why can’t I reach you on your cell?” So you caved and bought one because everyone else was benefiting from a device you didn’t have.

Virtual currency has this effect if you’ve ever wanted to make a purchase and had to use PayPal. You may want to pay with a credit card, but if the only way you’ll get a product is with PayPal and you really want it, you signed up and got an account. Metcalfe’s Law will also apply to things like Google Glass. While a recent study cited that only 10 percent of Americans say they would wear Google Glass, it didn’t take into account how the other 90 percent would react when seeing people wearing the device (outside of the fact that 10 percent of Americans adopting any new product is a staggeringly large number).8 By the time augmented reality glasses from any brand become cheap enough for the average consumer to buy, the early adopters will influence their friends who will in turn purchase devices, and we’ll see the Outernet get turned on at scale.

In May 2013, Amazon created its own form of virtual currency by giving a set of Amazon Coins to Kindle Fire users to buy apps and games.9 Like Facebook Credits, the plan was also geared to try to increase developers’ interest by making more money off apps when customers are incentivized to purchase more with the Coins. In response to this announcement, an article in the Economist10 summarized a key point of David Graeber’s book Debt: The First 5,000 Years, describing how the idea of cash money (versus trade) first developed. To help soldiers get food and provisions, a king created coins his subjects had to use to pay taxes. Then he gave these coins to his soldiers to buy provisions, while subjects got the coin of the realm needed to stay out of prison. Fast-forward a few thousand years and the origin of this process has been lost, but the metal or paper currency still holds sway over our collective imaginations when it comes to value creation.

It’s easy to dismiss virtual currency, thinking it’s only part of a social network so it’s not really money. But Graeber’s point about the army shows how cash money first came into being—by the leader of a sovereign network (or nation) declaring that a certain form of currency should be utilized. It’s the same process that happened in Worgl and Facebook, just enforced for a longer period of time.

Just because something is digital doesn’t mean it’s not worth dollars.

In my interview with J. P. Rangaswami of Salesforce.com about virtual currency, he pointed out another example of digital dollars many people didn’t consider: “[In 2011] Steve Jobs said something in relation to Apple most people didn’t report on. He pointed out that Apple had over two hundred million active iTunes accounts that were associated with e-mail addresses and credit cards—meaning Apple has the most accounts with cards anywhere on the Internet.”11

While purchasing movies or music from the iTunes Store is done with credit cards, Rangaswami’s point focuses on the same idea that Graeber noted about a sovereign creating currency: Once you’re part of any closed network, the people running the network control its economy. You may not think of a sale within iTunes as a form of virtual currency, but it is. Whether it’s positioned as an actual coupon or an incentive to buy, it’s simply a form of digital haggling; you can buy just one episode, but if you buy all ten you get a discount.

Programs offered by airlines to get free miles operate in the same way. You’re incentivized to make purchases to gain more travel. You’re agreeing to an exchange because you see a fair value for both sides. These programs are a type of virtual currency you’ve been used to for years.

From the Virtual to the Virtuous

It’s important to recognize that you’re used to virtual currency when you think about Hacking H(app)iness in the personal data economy. If your data is protected in a data vault, in essence you have become your own economy. In the same way Federico Zannier sold his data, you could, too. People may not buy it, but the point is you’re controlling the currency in your own economy. While your data may be virtual in one sense, the currency or money you’d make from selling it could be used to buy actual goods.

Now add to the idea that you’re your own economy and think about trust. If you’ve got a positive reputation from a certain community, online or off, this will help get you get more money when you want to make a transaction. For one thing, people probably like you if they trust you, so they want to help you out. They also feel you’ll probably help them in the future. So now the main issue you’ll need to solve is what you can sell that people will want to buy.

What if people paid you for kind deeds? When virtual currency takes off, this practice might be called “life-tipping.” Instead of tipping in a physical sense, like throwing money in a hat after hearing a band play, you’d assign someone virtual currency when they’ve done something positive. When augmented reality becomes pervasive, we’ll all be able to see digital data associated with someone’s identity. This means we’ll be able to tag other people in some way, a sort of virtual instant message framework where we can exchange digital information. One of the things we’ll exchange is payment. Right now, you can get a Starbucks card that pays rewards when you use it at any location. Life-tipping around coffee is an easy scenario to envision. Someone lets you cut them in line, you nod your head using the Starbucks app for Glass, and the person behind you gets their coffee for free.

Other examples of life-tipping with virtual currency could involve reducing guilt. You may feel remorse when you don’t recycle all your plastic bottles. How about life-tipping the homeless woman making three dollars a day pushing a broken shopping cart, recycling bottles from the trash? You don’t need to look the other way when she smiles at you now—she’s providing a service you don’t have time to do. Smile back and life-tip her.

At work, maybe you know someone who is struggling to afford college tuition for their kids. But their disposition is always positive, and any meeting they attend involves laughter. If you managed this person, you could life-tip them tuition vouchers or another form of payment. This form of life-tipping would also eventually be a write-off for your taxes.

Community life-tipping would take this idea to scale and already has a precedent in a “Peace Corps for Caregivers” model as reported on in the New York Times article “A Volunteer Army of Caregivers.”12 The article describes the efforts of Janice Lynch Schuster, a senior writer for the Altarum Institute, who created a petition for We the People, a site created by the Obama administration. If someone gets at least 150 signatures, they can post a petition that will be acted on if it reaches one hundred thousand signatures. Her idea for the petition: “Create a Caregiver Corps that would include debt forgiveness for college graduates to care for our elders.” The idea represents a simple value exchange—older adults get companionship and help with basic needs while high school students get tuition credits for college or recent grads get debt forgiveness. While the petition didn’t get the hundred thousand required signatures for action to be taken by the government, it did get a large amount of press that pointed out the significant burden boomers will have on our economy once they need assisted care. Schuster’s petition raises the question: If there will be more jobs than workers available in the future in these situations, why not alleviate student debt and help seniors at the same time? If kids could be properly trained, the virtual currency exchanged would solve a great deal of problems.

These types of scenarios, on a personal and communal level, will become more prevalent as the personal data economy comes into full swing. When people control their own personal economies, they’ll get to decide who they want to share value with, in whatever form.

Sample Virtual Currency Models

For a comprehensive introduction to virtual currencies, an excellent resource is a paper created by the European Central Bank called Virtual Currency Schemes.13 Defining a virtual currency as “a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community,” it provides a detailed explanation of how these currencies relate to existing banks. It also provides a good synopsis for reasons to implement virtual currency schemes.

By implementing a virtual currency scheme focused on the online world (basically for virtual goods and services) a company can generate additional revenue. The use of virtual currencies can help motivate users by simplifying transactions and by preventing them from having to enter their personal payment details every time they want to make a purchase. It can also help lock users in if, for instance, it is possible to earn virtual money by logging in periodically. If users are asked to fill out a survey or to answer other questions in order to earn extra virtual money, users reveal their preferences, thereby providing valuable information for commercial use.14

In terms of how to introduce these ideas of virtual currency, an organization called Innotribe created the concept of something they call the Digital Asset Grid. The video documentary about the project15 was shown at an event called Sibos, which is an annual conference presented by SWIFT, the global provider of secure financial messaging services (you may be familiar with the term “SWIFT codes” referring to your credit card). Here’s a description of the Digital Asset Grid from the Digital Asset Grid Session at Sibos:

The idea is fairly simple: While many of us share digital assets every day and store them on various websites, these are, for the most part, assets of low value or low consequence. Few of us would feel safe conducting a complex banking transaction on Twitter or Facebook. In contrast, the Digital Asset Grid would provide a way of conducting transactions involving any high-consequence digital asset on the open Internet but with SWIFT-grade security and privacy. The Digital Asset Grid is conceived as a set of services built on top of the open, standards-based Internet. SWIFT is working on the Digital Asset Grid to position banks as platforms upon which online services can be built.16

A video showing examples of how the Digital Asset Grid could work provides the case study of a woman buying a motorcycle. After seeing an ad for a motorcycle she likes from a trusted seller, she asks for some further information (photos, maintenance reports) that are provided via a protected data exchange. Meaning only the data requested is provided between the buyer and seller. She likes what she sees, goes for a test drive, and buys the motorcycle on the spot using the Digital Asset Grid. All associated digital assets of the motorcycle also change ownership, including things like the insurance policy and maintenance history of the vehicle.

Ven is a virtual currency that’s growing in popularity. I interviewed Ven’s founder, Stan Stalnaker, for my Mashable article “Why Social Accountability Will Be the New Currency of the Web.” Stalnaker had a number of fascinating insights about the nature of evolving digital currency.

“Facebook will become the biggest bank in the world,” says Stan Stalnaker, the founding director of Hub Culture, a social network that revolves around a virtual currency called Ven. “This will happen the moment they allow for P2P exchange of Facebook Credit between users. If they can link that to Likes, and map the value of Likes and other activity on their imprint of the social graph, these values will begin to function like money.”17

But Stalnaker has already created this P2P exchange via Hub Culture where, like citizens of Worgl, members are expected to put Ven into virtual circulation as much as possible. Based on a portfolio of units that includes leading currencies, commodities, and carbon futures, the Ven is less volatile than other global currencies and is traded for everything from knowledge to travel discounts and even a Nissan Leaf.

Stalnaker recognizes that the notion of virtual currency is in its infancy. When the disparity of definitions surrounding currency and influence someday merge, a singular value will reflect a common exchange of goods. Until then, he notes that “what currency really is . . . is language. We all speak in English dollars, and some people speak in rubles. What the Internet needs is its own language for currency.”18

I Speak H(app)y

Accountability-based influence provides a language for currency that should be used in the Connected World. Once we build our own individual economies, our actions more than our words will build trust. Once augmented reality becomes pervasive, people will also digitally tag or life-tip us depending on their perception of our actions. Virtual currency will soon complement the paper in our pockets, and someday remove it for good.