QuickBooks 2014: The Missing Manual (2014)

Introduction

Thousands of small companies and nonprofit organizations turn to QuickBooks to keep their finances on track. And over the years, Intuit has introduced various editions of the program to satisfy the needs of different types of companies. Back when milk was simply milk, you either used QuickBooks or you didn’t. But now, when you can choose milk from soybeans and rice as well as cows—and with five different levels of fat—it’s no surprise that QuickBooks comes in a variety of editions (which, in some cases, are dramatically different from their siblings), as well as six industry-specific editions. From the smallest of sole proprietorships to burgeoning enterprises, one of these editions is likely to meet your organization’s needs and budget.

QuickBooks isn’t hard to learn. Many of the features that you’re familiar with from other programs work the same way in QuickBooks—windows, dialog boxes, drop-down lists, and keyboard shortcuts, to name a few. And with each new version, Intuit has added enhancements and features to make your workflow smoother and faster. The challenge is knowing what to do according to accounting rules, and how to do it in QuickBooks. This book teaches you how to use QuickBooks and explains the accounting concepts behind what you’re doing.

What’s New in QuickBooks 2014

Despite the fluctuating size of the tax code, accounting and bookkeeping practices don’t change much each year. The changes in QuickBooks 2014 are mostly small tweaks and subtle improvements, but some of them might be just what you’ve been waiting for:

§ Setting up bank feeds (the connections between your real-world bank accounts and the accounts in QuickBooks) is a simpler and shorter process these days, as you’ll learn on Activating Online Services for Your QuickBooks Account. In the Bank Feed Setup window, just fill in your bank’s name, your user ID, and your password. When the Bank Feed Setup window displays the accounts you have at that bank, simply match them up with the corresponding accounts in your QuickBooks company file, click Connect, and your QuickBooks accounts are ready to talk to the ones at your financial institution.

§ The Bank Feed Center (Banking Online Using Express Mode) makes it easy to compare your online bank account balances with the ones in your QuickBooks accounts. After you download transactions, a status area in the middle of the Bank Feed Center window shows how many transactions QuickBooks was able to match automatically and how many you have to match manually. Then, when you click the Transaction List button to open the Transactions List window, that same info appears at the top of the window.

Click one of the bars in the Transactions List window’s status area, such as the orange Need Your Review bar, and the program filters the transaction table to show only those transactions. And you can fill in the payee name, account, or class right in the transaction table. In addition, you can tell QuickBooks how to handle each transaction by choosing an option from the Action cell’s drop-down menu: add the transaction to your account register, add more details to it, match it to an existing transaction, or ignore it. You can also add, approve, or delete multiple transactions at once. As you process the downloaded transactions, QuickBooks updates the status area to reflect your progress.

§ Income Tracker (Receivables Aging) lets you see the big picture of your income at a glance, shows the transactions that contribute to those high-level numbers, and provides features that streamline collecting income from your customers. (This feature is available only if your company file uses just one currency.) The colored boxes at the top of the window represent four categories of income: the total value of estimates you’ve created, the total amount on your open invoices (that is, the invoiced income that isn’t due yet), the total overdue amount, and how much your customers paid you in the last 30 days.

The window’s transaction table lists the transactions that contribute to the totals at the top of the window. You can filter the table to peruse the details—for example, to see all the overdue invoices for the last quarter. Ready to take action, like receive a payment on an invoice? Click that invoice’s Action cell, click the down arrow that appears, and then choose Receive Payments from the drop-down list. Choose Print or Email from the drop-down list instead to print or email the invoice.

§ Each company file can have its own color scheme (Preferences for Saving the Desktop), so you can easily identify which company file you’re working on by the color of the QuickBooks title bar and the borders of its windows. You can choose from 15 different colors.

§ Handling bounced checks (Using the Record Bounced Check Feature) in QuickBooks 2014 is easier than it used to be. When a customer’s check bounces, the program can help you perform the steps required to deduct money from your account and re-invoice your customer.

§ The Reports tab within transaction windows contains icons for running reports related to that type of transaction. For example, the Create Invoices window’s Reports tab has icons for reports such as Transaction History, View Open Invoices, and Sales by Customer Detail.

§ You can tell QuickBooks how many pages wide or tall you want a report to be (Printing and Saving Reports).

§ As you type something in the Search box, QuickBooks displays a drop-down list with suggested search terms and recent search terms (Using QuickBooks Search). If you see the term you want, simply click it.

§ You can now copy a line in a transaction table and paste it into another line in the table. For example, if you add a line in the wrong place in the invoice, you can copy and paste it to another row.

§ Working with email in QuickBooks is easier and more powerful. If you use a Web-based email service like Gmail, you can set up multiple email templates (Setting Your Send Preferences) for each type of transaction you send out. If you attach files to transactions, you can also attach them to the email message (Emailing One Form). In addition, the Receive Payments window now includes a feature for emailing a payment receipt to a customer (in earlier editions of QuickBooks, you could only print a receipt).

When QuickBooks May Not Be the Answer

When you run a business (or a nonprofit), you track company finances for two reasons: to keep your business running smoothly and to generate the reports required by the IRS, SEC, and anyone else you have to answer to. QuickBooks helps you perform basic financial tasks, track your financial situation, and manage your business to make it even better. But before you read any further, here are a few things you shouldn’t try to do with QuickBooks:

§ Work with more than 14,500 unique inventory items or 14,500 contact names. QuickBooks Pro and Premier company files can hold up to 14,500 inventory items and a combined total of up to 14,500 customer, vendor, employee, and other (Other Names List) names. (In the QuickBooks Enterprise Solutions edition of the program, the number of names is virtually unlimited.)

§ Track personal finances. Even if you’re a company of one, keeping your personal finances separate from your business finances is a good move, particularly when it comes to tax reporting. In addition to opening a separate checking account for your business, track your personal finances somewhere else (like in Quicken). If you do decide to use QuickBooks, at least create a separate company file for your personal financial info.

§ Track the performance of stocks and bonds. QuickBooks isn’t meant to keep track of the capital gains and dividends you earn from investments such as stocks and bonds. Of course, companies have investments like machines, and you should track investments such as these in QuickBooks. However, in QuickBooks, they show up as assets of your company (Understanding the Balance Sheet).

§ Manage specialized details about customer relationships. Lots of information goes into keeping customers happy. With QuickBooks, you can stay on top of customer activities with features like to-dos, notes, reminders, and memorized transactions. You can also keep track of leads before they turn into customers. But if you need to track details for thousands of members or customers, items sold on consignment, project progress, or tasks related to managing projects, a customer-management program or a program like Microsoft Excel or Access might be a better solution.

NOTE

Some third-party customer-management programs integrate with QuickBooks (Working with Other Apps).

Choosing the Right Edition

QuickBooks comes in a gamut of editions, offering options for organizations at both ends of the small-business spectrum. QuickBooks Pro handles the basic needs of most businesses, whereas Enterprise Solutions (the most robust and powerful edition of QuickBooks) boasts enhanced features and speed for the biggest of small businesses. On the other hand, the online editions of QuickBooks offer features that are available any time you’re online.

WARNING

QuickBooks for Mac differs significantly from the Windows version, so this book isn’t meant to be a guide to the Mac version of the program. Likewise, features vary in the editions for different countries; this book focuses on the U.S. version.

This book focuses on QuickBooks Pro because its balance of features and price make it the most popular edition. Throughout this book, you’ll also find notes about features offered in the Premier edition, which is one step up from Pro. (Whether you’re willing to pay for these additional features is up to you.) Here’s an overview of what each edition can do:

§ QuickBooks Online Simple Start is a low-cost online option for small businesses with very simple accounting needs and only one person running QuickBooks at a time. It’s easy to set up and use, but it doesn’t offer features like entering bills, managing inventory, tracking time, or sharing your company file with your accountant, and you can download transactions from only one bank (or credit card) account.

§ QuickBooks Online Essentials allows up to three people to run QuickBooks at a time and lets you connect to as many bank or credit card accounts as you want. As its name suggests, it offers essential features like automated invoicing, creating estimates, and entering bills.

§ QuickBooks Online Plus has most of the features of QuickBooks Pro, but you access the program via the Web instead of running it on your PC.

NOTE

These online editions let you use QuickBooks anywhere, on any computer, tablet, or smartphone, so they’re ideal for someone who’s always on the go. The online editions are subscription-based, so you pay a monthly fee to use them. Although a year’s subscription adds up to more than what you’d typically pay to buy a license of QuickBooks Pro, with a subscription, your software is always up to date—you don’t have to upgrade it or convert your company files to the new versions you install.

§ QuickBooks Pro is the workhorse desktop edition. It lets up to three people work on a company file at a time and includes features for tasks such as invoicing; entering and paying bills; job costing; creating estimates; saving and distributing reports and forms as email attachments; creating budgets; projecting cash flow; tracking mileage; customizing forms; customizing prices with price levels; printing shipping labels; and integrating with Word, Excel, and hundreds of other programs. QuickBooks Pro’s name lists—customers, vendors, employees, and so on—can include up to a combined total of 14,500 entries. Other lists, like the Chart of Accounts, can have up to 10,000 entries each.

NOTE

QuickBooks Pro Plus is a subscription product that costs a little more than the one-time license fee you pay for QuickBooks Pro, but QuickBooks Pro Plus offers mobile access, unlimited phone support, online backups, and always-up-to-date software. Similarly, QuickBooks Premier Plus is the premier version of the subscription product.

§ QuickBooks Premier is another multiuser edition (up to five simultaneous users). It can handle inventory items assembled from other items and components, generate purchase orders from sales orders and estimates, apply price levels to individual items, export report templates, produce budgets and forecasts, and work with different units of measure for items. Plus, it offers enhanced invoicing for time and expenses. This edition also includes a few extra features like reversing journal entries. When you purchase QuickBooks Premier, you can choose from six different industry-specific flavors (see the next section). Like the Pro edition, Premier can handle a combined total of up to 14,500 name list entries.

§ Enterprise Solutions is the edition for midsized operations. It’s faster, bigger, and more robust than its siblings. Up to 30 people can access a company file at the same time, and this simultaneous access is at least twice as fast as in the Pro or Premier edition. The program’s database can handle lots more names in its Customer, Vendor, Employee, and Other Names lists (1 million versus 14,500 for Pro and Premier). It can track inventory in multiple warehouses or stores and produce combined reports for those companies and locations. And because more people can be in your company file, this edition has features such as an enhanced audit trail, more options for assigning or limiting user permissions, and the ability to delegate administrative functions to the other people using the program. And if you subscribe to Intuit’s Advanced Inventory service, you can value inventory by using first in/first out (FIFO) valuation.

TIP

You don’t have to pay list price for QuickBooks. Your local office supply store, Amazon, and any number of other retail outlets usually offer the program at a discount. (If you buy QuickBooks from Intuit, you pay full price, but you also have 60 days to return the program for a full refund.) In addition, accountants can resell QuickBooks to clients, so it’s worth asking yours about purchase and upgrade pricing. QuickBooks ProAdvisors (you can find a local one by going to http://proadvisor.intuit.com/find-a-proadvisor/search.jsp) can get you up to a 30 percent discount on QuickBooks Pro or Premier, and you’ll have 60 days to return the program for a refund.

The QuickBooks Premier Choices

If you work in one of the industries covered by QuickBooks Premier, you can get additional features unique to your industry. (When you install QuickBooks Premier, you choose the industry version you want to run. If your business is in an industry other than one of the five options, choose General Business.) Some people swear that these customizations are worth every extra penny, while others say the additional features don’t warrant the Premier price. On the QuickBooks website (http://quickbooks.intuit.com/premier), you can tour the Premier features to decide for yourself. Or you can purchase QuickBooks Accountant, which can run any QuickBooks edition, from QuickBooks Pro to the gamut of Premier’s industry-specific versions.

NOTE

QuickBooks Accountant edition is designed to help professional accountants and bookkeepers deliver services to their clients. It lets you run any QuickBooks edition (Pro or any of the Premier versions). It also lets you review your clients’ data and easily correct mistakes you find, transfer an accountant’s copy to your client, design financial statements and other documents, process payroll for clients, reconcile clients’ bank accounts, calculate depreciation, prepare clients’ tax returns, and work on two company files at a time.

Here are the industries that have their own Premier editions:

§ The General Business edition has Premier goodies like per-item price levels, sales orders, and so on. It also has sales and expense forecasting, the Inventory Center, more built-in reports than QuickBooks Pro, and a business plan feature (although, if you’re using QuickBooks to keep your books, you may already have a business plan).

§ The Contractor edition includes special features near and dear to construction contractors’ hearts: job-cost and other contractor-specific reports, the ability to set different billing rates by employee, and tools for managing change orders.

§ Manufacturing & Wholesale is targeted at companies that manufacture products. Its chart of accounts and menus are customized for manufacturing and wholesale operations. You can use it to manage inventory assembled from components and to track customer return merchandise authorizations (RMAs) and damaged goods.

§ If you run a nonprofit organization, you know that several things work differently in the nonprofit world, as the box below details. The Nonprofit edition of QuickBooks includes features such as a chart of accounts customized for nonprofits, forms and letters targeted to donors and pledges, info about using the program for nonprofits, and the ability to generate Statement of Functional Expenses 990 forms.

FREQUENTLY ASKED QUESTION: NONPROFIT DILEMMA

I’m doing the books for a tiny nonprofit corporation. I’d really like to avoid spending any of our hard-raised funds on a special edition of QuickBooks. Can’t I just use QuickBooks Pro?

You may be tempted to save some money by using QuickBooks Pro instead of the more expensive QuickBooks Nonprofit edition, and you can—if you’re willing to live with some limitations. As long as funding comes primarily from unrestricted sources, the Pro edition will work reasonably well. You’ll have to accept using the term “customer” when you mean donor or member, or the term “job” for grants you receive. Throughout this book, you’ll find Notes and Tips about tracking nonprofit finances with QuickBooks Pro or QuickBooks Premier (the General Business edition—not the Nonprofit edition).

However, if you receive restricted funds or track funds by program, you’ll have to manually post them to equity accounts and allocate them to accounts in your chart of accounts, since QuickBooks Pro doesn’t automatically perform these staples of nonprofit accounting. Likewise, that version of the program doesn’t generate all the reports you need to satisfy your grant providers or the government, although you can export reports (Exporting Addresses) and then modify them as necessary in a spreadsheet program. In that case, QuickBooks Premier Nonprofit might be a real timesaver.

§ The Professional Services edition (not to be confused with QuickBooks Pro) is designed for companies that deliver services to their clients. Unique features include project-costing reports, templates for proposals and invoices, billing rates that you can customize by client or employee, and professional service–specific reports and help.

§ The Retail edition is customized for retail businesses. It includes specialized menus, reports, forms, and help, as well as a custom chart of accounts. Intuit offers companion products that you can integrate with this edition to support all aspects of your retail operation. For example, QuickBooks’ Point of Sale product tracks sales, customers, and inventory as you ring up sales, and it shoots that information over to your QuickBooks company file.

Accounting Basics: The Important Stuff

QuickBooks helps people who don’t have a degree in accounting handle most accounting tasks. However, you’ll be more productive and have more accurate books if you understand the following concepts and terms:

§ Double-entry accounting is the standard method for tracking where your money comes from and where it goes. Following the old saw that money doesn’t grow on trees, money always comes from somewhere when you use double-entry accounting. For example, as shown in Table 1, when you sell something to a customer, the money on your invoice comes in as income and goes into your Accounts Receivable account. Then, when you deposit the payment, the money comes out of the Accounts Receivable account and goes into your checking account. (See Chapter 16for more about double-entry accounting and journal entries.)

UP TO SPEED: LEARNING MORE ABOUT ACCOUNTING

If you need to learn a lot about QuickBooks and a little something about accounting, you’re holding the right book. But if bookkeeping and accounting are unfamiliar territory, some background training may help you use QuickBooks better and more easily (without calling your accountant for help five times a day).

The Accounting and Business School of the Rockies offers an accounting and bookkeeping self-study course that you can play on a VCR or DVD player. The course presents real-life accounting situations, so you’ll learn to solve common small-business accounting problems, and it includes hands-on exercises to help you master the material. It doesn’t take long to complete, so you’ll be up and accounting in no time. To contact the school, visit www.absrschool.com or call 1-303-755-6885.

Real World Training offers “Mastering Accounting Basics for QuickBooks,” an Intuit-endorsed product that teaches basic accounting concepts using QuickBooks in its examples. It’s available online, on CD, and on DVD. Check it out at http://tinyurl.com/rwaccounting.

NOTE

Each side of a double-entry transaction is either a debit or a credit. As you can see in Table 1, when you sell products or services, you credit your income account (since your income increases when you sell something), but debit the Accounts Receivable account (because selling something also increases how much customers owe you). You’ll see examples throughout the book of how transactions translate to account debits and credits.

Table 1. Following the money through accounts

|

TRANSACTION |

ACCOUNT |

DEBIT |

CREDIT |

|

Sell products or services |

Accounts Receivable |

$1,000 |

|

|

Sell products or services |

Service Income |

$1,000 |

|

|

Receive payment |

Checking Account |

$1,000 |

|

|

Receive payment |

Accounts Receivable |

$1,000 |

|

|

Pay for expense |

Office Supplies |

$500 |

|

|

Pay for expense |

Checking Account |

$500 |

§ Chart of accounts. In bookkeeping, an account is a place to store money, just like your real-world checking account is a place to store your ready cash. The difference is that you need an account for each kind of income, expense, asset, and liability you have. (See Chapter 3 to learn about all the different types of accounts you might use.) The chart of accounts is simply a list of all the accounts you use to keep track of your company’s money.

§ Cash vs. accrual accounting. Cash and accrual are the two different ways companies can document how much they make and spend. Cash accounting is the choice of many small businesses because it’s easy: You don’t show income until you’ve received a payment (regardless of when that happens), and you don’t show expenses until you’ve paid your bills.

The accrual method, on the other hand, follows something known as the matching principle, which matches revenue with the corresponding expenses. This approach keeps income and expenses linked to the period in which they happened, no matter when cash comes in or goes out. The advantage of this method is that it provides a better picture of profitability because income and its corresponding expenses appear in the same period. With accrual accounting, you recognize income as soon as you record an invoice, even if you’ll receive payment during the next fiscal year. For example, if you pay employees in January for work they did in December, those wages are part of the previous fiscal year.

§ Financial reports. You need three reports to evaluate the health of your company (described in detail in Chapter 17):

§ — The income statement, which QuickBooks calls a Profit & Loss report (Generating Financial Reports), shows how much income you’ve brought in and how much you’ve spent over a period of time. This QuickBooks report gets its name from the difference between income and expenses, which results in your profit (or loss) for that period.

§ — The balance sheet (The Balance Sheet) is a snapshot of how much you own and how much you owe. Assets are things you own that have value, such as buildings, equipment, and brand names. Liabilities are the money you owe to others (like money you borrowed to buy one of your assets, say). The difference between your assets and liabilities is the equity in the company—like the equity you have in your house when the house is worth more than you owe on the mortgage.

§ — The statement of cash flows (The Statement of Cash Flows) tells you how much hard cash you have. You might think that a Profit & Loss report would tell you that, but noncash transactions—such as depreciation—prevent it from doing so. The statement of cash flows removes all noncash transactions and shows the money generated or spent operating the company, investing in the company, or financing.

About This Book

QuickBooks Help provides a healthy dose of accounting background and troubleshooting tips. If you don’t find the answer you need in the program’s “Have a Question?” window (QuickBooks Help), the Intuit Community—which lets you ask your peers and experts for answers (Intuit Community)—or by searching with keywords, where do you turn next?

This book provides lots of real-world examples, and you can search for topics in its index. In addition, with this book, you can mark your place, underline key points, jot notes in the margin, or read about QuickBooks while sitting in the sun—stuff that’s hard to do while reading on a screen.

This book applies to the U.S. Windows version of QuickBooks Pro and Premier. (Because the Mac version of the program differs significantly from the Windows one, this book won’t be of much help if you have QuickBooks for Mac. Versions for other countries differ from the U.S. version, too, primarily in how you work with payroll and taxes.)

In these pages, you’ll find step-by-step instructions for using every QuickBooks Pro feature, including those you might not quite understand: progress invoicing (Comparing Estimates to Actuals), making journal entries (Reclassifying Payroll Withholdings), writing off losses (Transferring Funds), handling customer refunds (Handling Customer Refunds and Credits), and so on. If you’re just starting out with QuickBooks, read the first few chapters as you set up your company file. After that, go ahead and jump from topic to topic depending on the bookkeeping task at hand. As mentioned earlier, you’ll learn about some of the extra bells and whistles in the QuickBooks Premier edition, as well. (All the features in QuickBooks Pro—and in this book—are also in Premier.) To keep you productive, this book also evaluates features to help you figure out which ones are most useful and when to use them.

NOTE

Although each version of QuickBooks introduces new features and enhancements, you can still use this book if you’re using an earlier version. Of course, the older your version of the program, the more discrepancies you’ll run across.

QuickBooks 2014: The Missing Manual is designed to accommodate readers at every technical level. The primary discussions are written for people with beginner or intermediate QuickBooks skills. If you’re using QuickBooks for the first time, read the boxes titled “Up to Speed,” which provide the introductory info you need to understand the current topic. On the other hand, people with advanced skills should watch for similar boxes labeled “Power Users’ Clinic,” which include tips, tricks, and shortcuts for more experienced QuickBooks wranglers.

About the Outline

This book is divided into five parts, each containing several chapters:

§ Part 1 explains how to set up QuickBooks based on your organization’s needs. These chapters cover creating a company file and setting up accounts, customers, jobs, invoice items, and other lists.

§ Part 2 follows the money from the moment you rack up time and expenses for your customers and add charges to a customer’s invoice to the tasks you have to perform at the end of the year to satisfy the IRS and other interested parties. These chapters describe how to track time and expenses, pay for things you buy, bill customers, manage the money that customers owe you, pay for expenses, run payroll, manage your bank accounts, and perform other bookkeeping tasks.

§ Part 3 delves into the features that can help you make your company a success—or even more successful than it already is. These chapters explain how to keep track of the financial tasks you need to perform, manage QuickBooks files, keep your inventory at just the right level, work with sales tax, build budgets, and use QuickBooks reports to evaluate every aspect of your enterprise.

§ Part 4 helps you take your copy of the program to the next level. You’ll learn how to save time and prevent errors by downloading transactions electronically; boost your productivity by setting the program’s preferences to match the way you like to work and integrating QuickBooks with other programs; customize the program’s components to look the way you want; and—most important—set up QuickBooks so your financial data is secure.

§ Part 5 provides a guide to installing and upgrading QuickBooks and a reference to helpful resources.

NOTE

You can find three bonus appendixes online at this book’s Missing CD page at www.missingmanuals.com/cds: Appendix C: Keyboard Shortcuts, Appendix D: Tracking Time with the Standalone Timer, and Appendix E: Advanced Form Customization.

The Very Basics

To use this book (and QuickBooks), you need to know a few basics. This book assumes that you’re familiar with the following terms and concepts:

§ Clicking. This book includes instructions that require you to use your computer’s mouse or trackpad. To click means to point your cursor (the arrow pointer) at something on the screen and then—without moving the cursor—press and release the left button on the mouse (or laptop trackpad). To right-click means the same thing, but you press the right mouse button instead. (Usually, clicking selects an onscreen element or presses an onscreen button, whereas right-clicking typically reveals a shortcut menu, which lists some common tasks specific to whatever you right-clicked.) To double-click means to click the left button twice in rapid succession, without moving the pointer at all. And to drag means to move the cursor while holding down the left mouse button the entire time.

When you’re told to Shift-click something, you click while pressing the Shift key. Related procedures, like Ctrl-clicking, work the same way—just click while pressing the corresponding key.

§ Menus. The menus are the words at the top of your screen: File, Edit, and so on. Click one to make a list of commands appear, as though they’re written on a window shade you’ve just pulled down. Some people click to open a menu and then release the mouse button; after reading the menu choices, they click the option they want. Other people like to press the mouse button continuously as they click the menu title and drag down the list to the desired command; only then do they release the mouse button. Both methods work, so use whichever one you prefer.

§ Keyboard shortcuts. Nothing is faster than keeping your fingers on your keyboard to enter data, choose names, trigger commands, and so on—without losing time by grabbing your mouse, carefully positioning it, and then choosing a command or list entry. That’s why many experienced QuickBooks fans use keyboard shortcuts to accomplish most tasks. In this book, when you read an instruction like “Press Ctrl+A to open the Chart of Accounts window,” start by pressing the Ctrl key; while it’s down, type the letter A; and then release both keys.

About→These→Arrows

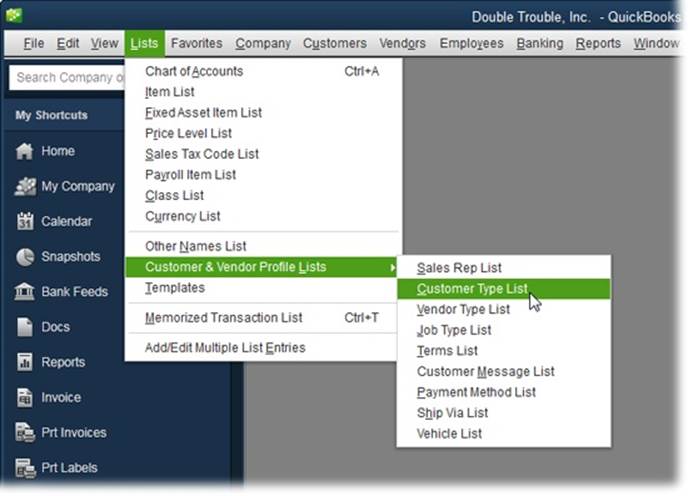

Throughout this book, and throughout the Missing Manual series, you’ll find sentences like this one: “Choose Lists→Customer & Vendor Profile Lists→Customer Type List.” That’s shorthand for a much longer instruction that directs you to navigate three nested menus in sequence, like this: “At the top of your screen, click the Lists menu. On the Lists menu, point to the Customer & Vendor Profile Lists menu item. On the submenu that appears, choose Customer Type List.” Figure 1 shows the menus this sequence opens.

Similarly, this arrow shorthand also simplifies the instructions for opening nested folders, such as Program Files→QuickBooks→Export Files.

About the Online Resources

As the owner of a Missing Manual, you’ve got more than just a book to read. Online, you’ll find example files so you can get some hands-on experience, as well as tips, articles, and maybe even a video or two. You can also communicate with the Missing Manual team and tell us what you love (or hate) about the book. Head over to www.missingmanuals.com, or go directly to one of the following sections.

Missing CD

This book doesn’t have a CD pasted inside the back cover, but you’re not missing out on anything. Go to www.missingmanuals.com/cds and click the “Missing CD-ROM” link for this book to download three additional appendixes. And so you don’t wear down your fingers typing long web addresses, the Missing CD page also offers a list of clickable links to the websites mentioned in this book.

Figure 1. Instead of filling pages with long and hard-to-follow instructions for navigating through nested menus and nested folders, the arrow notation is concise but just as informative. For example, choosing Lists→Customer & Vendor Profile Lists→Customer Type List takes you to the menu item shown here.