Fail Fast or Win Big: The Start-Up Plan for Starting Now (2015)

CHAPTER THREE

Ideas Are Great but Business Models Rule

For the majority of entrepreneurs, coming up with an idea or a solution to a problem is what they focus on—to the point of ignoring whether or not there is a solid business model that can be created to support a potential company. This is critical moment for a young start-up. Realizing exactly what is working and what is not working in the context of a business model could likely be the most strategic decisions an entrepreneur can make. Let me give you an example.

Imagine Jeff Bezos looking to create a company called Amazon in the early ’90s. He sees book sales on the rise, and the Borders and Barnes & Noble bookseller chains are growing rapidly. He notes that these two big booksellers are talking about creating another “place” where customers can hang out in their larger, 25,000+-square-foot stores. From a business model perspective, it does not look very attractive. You have deeply entrenched competitors who are well funded to expand their brick-and-mortar environment. To enter the marketplace without a unique advantage would be difficult at best.

Add to that, there’s the capital needed to get started in the bookselling business—capital for store expansion, inventory, employees. And so on. But if you create a business model that looks at book purchasing and delivery differently—say, by offering wider availability and a simpler ordering process through the Internet, as well as to-your-doorstep delivery by UPS/Fedex, then the whole business model shifts.

“The only thing worse than starting something

and failing … is not starting something.”

—Seth Godin, author and marketer

By shifting the manner in which people find out about and obtain their books, Jeff Bezos created a new kind of e-commerce platform. In time, he leveraged that access to customers to distribute multiple other products, not just books. In the process, he created something that traditional bookstores did not have: a strong database of customers who can then be cross-marketed and sold those other products. All with less overhead.

The only things that were initially different in Amazon.com’s company design were its purchase and delivery strategy. Same books. Same customers. Same basic pricing. Different delivery. Purchases on the Internet can be made 24 hours a day, and subject-matter searches reveal all available books on a topic. Delivery follows rapidly upon order. Along with marketplace timing, reading trends, and listening to customers, Bezos created that powerful business model we know today as Amazon.com. Pretty good business model, great execution.

It seems simple. But remember that a great idea with a weak business model will ultimately fail. You need to refine and mold your business model so that it becomes a strategic weapon. Can your business model be as great as or better than your idea?

A great idea with a weak business

model to sustain it will ultimately fail.

But, getting back to the Osterwalder and Pigneur “canvas” mentioned in Chapter Two, one of the reasons it is so powerful is that it is so simple. The entire business model can be seen on a single sheet of paper and then modified on that same sheet of paper. (See the next section for more on the “canvas.”) The other thing the business model canvas does is that it forces you to focus on the critical elements of your business model. Even if you are not a marketing expert, you need to see your business’s “value proposition” from the customer’s point of view, not your point of view. In other words, what makes your product or service unique so that a customer will care about it?

Many entrepreneurs are so “in love” with their idea that they don’t see its potential flaws, whether those flaws are in their product, their strategy, or their business model. Yet, once I start walking them through the elements of the business model and I question their strategy, only then can they see the flaws. These are flaws, by the way, that can be corrected. It just takes more focus, more customer insight, perhaps investigating a distribution channel a little bit better, maybe developing a key partner relationship with a manufacturer. But it is at this point of realization that you really start to think in terms of developing a business, rather than starting a company. Big difference.

BUILD A REAL BUSINESS MODEL

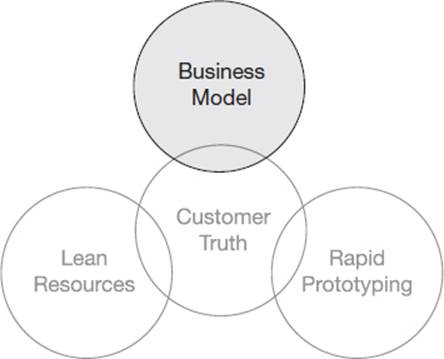

A critical element of the LeanModel Framework is the early identification, iteration, and evolution of a start-up business model. It’s the one question I ask almost anyone who approaches me with an idea for a new business opportunity. Rather than asking a general question about the business idea, I ask specific questions related to the business model. How is your product unique? Who is your target customer segment? What is your distribution strategy? Do you have multiple revenue streams? Quite a few entrepreneurs are not able to answer these critical questions in a detailed and confident manner.

“What constitutes a business model?” I asked the crowd at a start-up weekend event about four years ago. Not one of the college students and would-be entrepreneurs in attendance could articulate what a business model was or what its key elements are. That was pretty amazing. Despite everyone’s talking about business models and acting like they know what it was, most people really haven’t a clue.

Most experts will define what a business model is with a few variations, and most will agree on the key elements of a business model. Here is a generic description: A business model is a design for the successful operation of a business, identifying revenue sources, customer base, products, and details of financing.

The Business Model Building Blocks

No matter how you define a business model, it’s the business model elements we are most interested in. These are the building blocks of the business, the essentials. Consider it a business blueprint. In their book Business Model Generation, Osterwalder and Pigneur devised a simple way for an entrepreneur to focus on and iterate his or her start-up business model. As I mentioned earlier, they created something they call the business model canvas. It’s a useful tool (see Figure 3.1) for any entrepreneur, at any level. I have been using it in my entrepreneurship courses since 2011.

Undergraduate students in my classes easily understand the canvas, and within six weeks, they are creating a business model built around an idea, talking to about 75 customers, iterating the business model with what they learned, talking to another 50 customers, evolving or pivoting the business, then beginning to complete other areas of the business model, such as obtaining key partners and setting distribution strategies. By constantly updating their model with customer feedback and input, at the end of 10 weeks they have a good idea of whether they are actually on to something or if they should abandon the idea.

Figure 3.1 Business Model Canvas

(From Business Model Generation, ©2010 by Osterwalder and Pigneur.

Used with permission; www.businessmodelgeneration.com)

You know what I like about seeing a group of students going through this process in a classroom? They rarely fall in love with an idea; instead, we vote on the best ideas in the class, then assign them randomly so their analysis and evolution of a business model is done somewhat objectively and honestly. They don’t “fudge” the results to please an ego or creatively avoid reality, as could be done in forming some business plans.

Furthermore, they are not so in love with the idea that they are blind to its critical flaws. Based on their research and discussions with customers, potential partners, and distributors, if they cannot design a solid business model around the idea, they recommend abandonment. As it happens, student grades in these classes are based not on whether the students can create a successful business model, but on their recommendations of the business worthiness of those potential ideas. Love it.

The Key Components

If you are an entrepreneur or aspire to be one, here are the key elements of a business model, using the business model canvas just presented. Remember, as you investigate and gather feedback on each element of your business model, you will be making changes to that business model canvas. Get used to making changes—you will make a lot of them as your business model gets refined. But let’s go into each element in detail and consider some starter questions. To review, here are the key elements of the business model.

• Unique Value Proposition

• Customer Relationship Feeling

• Customer Target Segments

• Distribution Channel Strategies

• Start-up Activities

• Start-up Resources

• Partners, Strategic and Tactical

• Product or Service Costs

• Selling/Revenue Sources

Now, let’s consider each of these in turn.

THE UNIQUE VALUE PROPOSITION

The very core of a product or service idea is that it, in a unique and demonstrable way, solves a customer problem or delivers a customer solution. Most entrepreneurs struggle with this concept in regard to their idea. Instead of truly solving a customer problem, entrepreneurs potentially design a solution in search of either customers or problems. In fact, quite a few entrepreneurs feel they have to have an “epiphany” to come up with something unique. In reality, you would be better served looking at large marketplaces, understanding trends, and looking for customer problems.

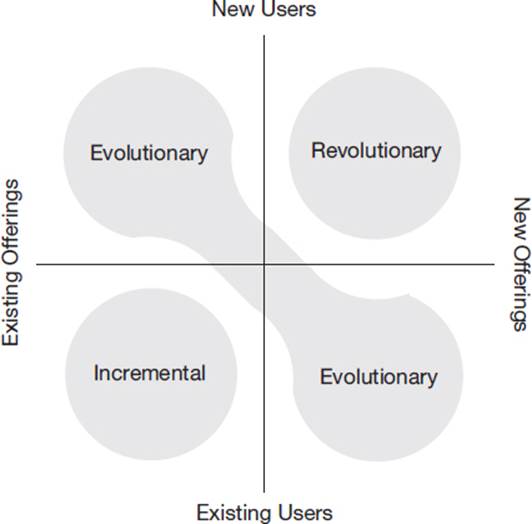

IDEO is an amazing company that solves problems and creates potential products for Fortune 500 firms and well-heeled start-ups. If you look at their chart on market opportunity (see Figure 3.2), you will see that most product or service innovation opportunities come from iterations or evolutions of current or past products or services. Very few things are revolutionary.

The cellphone was revolutionary. Perhaps also the microwave oven. And for sure, the refrigerator. Yet today’s household brands were not the revolutionaries. Google was not the first search engine. Facebook was not the first social media company. These companies offered incremental, or perhaps evolutionary, products. And there’s nothing wrong with that. You can create quite a valuable company by listening to the marketplace and doing something just a little bit better, in your own, unique way.

Figure 3.2 Startup Opporutunities for New Products or Services

(From IDEO.org, “Human-Centered Design Toolkit,” used with permission)

As an entrepreneur, you have a choice. You can wait for an epiphany, you can design something you like or believe in (not sure if customers need it), or you can study marketplaces so hard that you will eventually learn about a customer problem. You can study and intersect trends à la Steve Jobs, and try to predict what customers will need. In any event, you validate the problem or opportunity and test a potential solution with real customers. If they react positively, you rapidly improve the prototype and test it again.

For instance, you try to add a unique element to an existing product or service that customers need and you can defend offering. If you can’t deliver something unique, then get ready for the competitors. Books.com was the first bookseller on the Internet. That did not bother Amazon.com. The company proved their concept, focused on excellent customer service, accessed the largest number of books available through two distributors, and raised several million dollars to create a high level of brand awareness. They flew past the early entrants and quickly dominated the marketplace.

CUSTOMER RELATIONSHIP FEELING

There’s a reason I linked the word feeling with the words customer relationship. While you can create marketing messages, creative advertising, or unique events, your real goal is to consider this: How do I create my product or service so well that customers actually “feel” an emotion when using my product or service? You can’t make someone “feel” some way with your marketing. It has to come from within the customer. Really great companies and brands figure out a way to accomplish this goal. Let me give you an example.

Before 2008, Starbucks never advertised on television or print media, and then they began to do so only because of a weak stock price and some new competition from McDonald’s. Everything customers experienced from the brand came from within the stores themselves and the staff. Greeting customers, knowing their names after a while, the warm store décor, even the unique flavor combinations of coffee. Customers would hang out there with friends or even alone, using services such as the wireless network, listening to the soft music playing. Seriously, it’s just coffee. But they made most people feel something about being there. They even named it, calling it the “third place.” Starbucks is an amazing example of a company’s making people “feel” they deserved its product, that it was one of life’s little pleasures.

Customers are not always right but they are never wrong.

Apple is another company that employs simplicity, beautiful design, and a great user interface to give customers products that are similar and yet uniquely different from the competition. This approach allows them to delight customers while charging them premium prices for those products. Safe to say, I love my iPhone.

Will your new product or service create an emotional feeling that distinguishes it from the competition? Are you a social entrepreneur, bringing a cause to the public’s attention through sales? For example, Tom’s Shoes is a nonprofit company that sends money and shoes from its sales to people all over the world through their One for One program. Do you think Tom’s Shoes are unique? Or do you simply believe in their cause? It does not matter what you think, but it matters what Tom’s customers think. And more important, it matters what they feel when they purchase Tom’s products. It must be working because according to Fast Company magazine, Tom’s revenue was estimated at more than $250 million in 2013.

As you consider your product or service, examine the customer relationship you want to build: what you want your customers to “feel” as they consume or use your product. If you are not sure what that feeling is, spend some time with potential customers. Find out what frustrates them about the current product or service they are using. Do you see an opportunity to create a solution that delights them? If so, you could potentially win big.

CUSTOMER TARGET SEGMENTS

Often when I meet with entrepreneurs and we end up talking about customers, I ask this question: Who is your niche target customer segment? Let’s assume, for example, the product under consideration is intended for young women. So the entrepreneurs might reply, “It’s for women ages 18 to 40.” According to the U.S. Census of 2010, that would be approximately 90 million women. That’s an entire market, not a target segment, let alone a niche segment.

Then, I ask the next question: Within that larger group, who are your early adopters or early influencers?” They might answer, “Oh, that would be women in college.” That number now drops to approximately 11 million in the United States. Then I ask another question about women in college. You get the picture.

By the time we are done, we have identified perhaps a target group of less than 1 million women between the ages of 18 and 24, and perhaps a niche segment of less than 250,000 in a given regional market. It’s not that you wouldn’t eventually be able to sell to all the women in the entire market. You just need to focus, focus, focus in order to get serious traction with your first niche group of target customers. Then, as you conquer that group, you expand to the next segment, then the next segment, and that’s how you move into the broader marketplace.

When we were working with Jeff Bezos of Amazon.com in those early days, we initially identified our first niche target customer among 1.3 million people living along the New York to Washington, D.C., corridor and in two cities in California—Los Angeles and San Francisco—who either read the major newspapers, bought a lot of books, or loved early technology. They were the influencers, the early adopters. So that’s who we targeted with our initial marketing efforts.

The message is this: Make sure you know everything about your target segment of potential customers. Obtain demographic information (facts like age, sex, residency, etc.) and the psychographic details (lifestyle, interests, etc.). If you believe you have more than one customer segment, then determine if you need to treat the segment groups differently. For instance, would a product attribute have to be changed to fit one or the other group? Do the groups require different distribution strategies? Should there be multiple price points on the product? Focus first on the most important segment, then work additional segments, one at a time. It’s too hard to handle multiple segments simultaneously and to juggle varying products or customer needs.

DISTRIBUTION CHANNEL STRATEGIES

Once you have a solid grasp of your unique value proposition and have identified your key target customer segments, you need to consider how you will get your product to the marketplace. If you consider entry into a marketplace from a number of “channels,” evaluate the workings of direct sales, wholesalers, retailers, distributors, and selling online; of the latter, consider either your website or online retailers like eBay or Amazon.com. Each distribution channel provides different options for dealing with customers and prospects. The key question should always be: What is the best way to reach my initial target segment of customers? Or, simply, where do they want to buy the product or service?

You initially choose the distribution strategy that’s best for your start-up based on whether you want to enter the marketplace quickly (more distribution, lower gross margin, higher potential sales) or slowly (direct sales, online sales, local retailers, higher gross margins). Your distribution strategy may also be determined by the availability of your product. If it’s a mobile application, there’s no problem. If it’s a physical product that needs to be manufactured, then you may be constrained by inventory or cash flow.

If your strategy is to grow your business regionally or nationally, you need to research geographical areas and the customers you want to reach through a distribution channel, then identify key distributors or retailers that provide coverage of those territories. If you are planning an export/import business, you focus on established distributors with demonstrated local market knowledge.

Consider also how you will market your products online so that you can extend coverage to customers where there is no suitable physical distribution network. In working with Dustin, a local entrepreneur who developed a healthy food product, we discovered that initially he thought about selling the product online and through local stores. But after just six months, Dustin’s product was in only 20 stores. Once he started to investigate distribution networks by region, he began concentrating on selling to key distributors and retailers (regional retail brands with more than 25 locations). In the next six months, Dustin added 500 store locations by closing deals with two key distributors and four regional brands. He gave up some product gross margin but got tremendous sales volume in exchange.

Would you rather make $15,000 on sales of $100,000 (15 percent profit) or $150,000 on sales of $1 million (also 15 percent profit) through distributors/retail chains? Product sales volume solves a lot of cash-flow problems. You will always need more cash to fund additional inventory. These are the considerations that determine the distribution decisions you make.

I mentor Adam, an entrepreneur who does about $3 million a year in revenue exclusively through Amazon.com. He sells more than 100 different products based on observing customer trends. He also gives up some fees (gross margin) selling on that online platform. I asked him why he doesn’t build his own website, search-engine optimize it, and sell directly to his customers. Adam responded, “Amazon.com has over 235 million customer credit cards on file… they are like a huge mall, and I want to be in that mall. Besides, at my volume, they also fulfill and ship all my products so I don’t need a warehouse.” Adam runs the entire business out of his condo. That’s a LeanModel Framework business.

As you consider your options, your distribution strategy should take account of the potential revenue and gross margin contribution of each distribution channel. Good distributors also provide you with local market insight and other customer bases, enabling you to establish your business in new regions without incurring additional marketing and sales costs. Before you make any distribution decisions, though, talk to some local retailers who have distribution experience or consider meeting with the distributors to better understand their services and operations. Since this area is so critical to the business model, thorough research is required.

START-UP ACTIVITIES

This is an area that can simply be overwhelming to a beginning entrepreneur. It can seem like you have everything to do and not enough time to do it. Here is some advice. Let your current business model help you focus on what really needs to be done regarding the launch of the business.

I know entrepreneurs who agonize about the myriad things that have to be done, to the point they become overwhelmed or even paralyzed. Slow down. If you examine your business model carefully, you can prioritize based on what needs to be done to rapidly build a prototype of your product or service. Look at each of the business model segments and identify the critical elements that require research or a solution. For instance:

• Do I need to learn more about my target customer segments?

• Do I need to define a minimum viable product specification?

• Do I know enough to determine my distribution strategy?

• Have I found a manufacturer for my product?

• Do I need a business location or will I be a virtual business?

• Who else do I need to meet to refine my overall business strategy?

• Am I aware of key trends in my proposed marketplace?

• How can I quickly get a prototype of my product or service built?

Keep referring to your business model and look for the gaps or the unknowns that keep you from quickly building a prototype. That should drive your key activities.

START-UP RESOURCES

If you have done a reasonably good job of focusing on key start-up activities, that action will identify the resources you will need to launch your product. Foremost, of course, might be the need for capital. Okay, you will always need more money than you think you will need.

Review your proposed product or service for whether it is appropriate for crowdfunding or an equity project on a crowdfunding platform. Review other projects currently on KickStarter, IndieGogo, and other crowdfunding websites; determine your possibility of raising funds or distributing equity to raise the funds that will support your start-up business.

In terms of the product or service you are looking to rapidly prototype, determine what resources you will need to actually build it. Will you try to build it in-house or will you outsource the product development? Consider keeping your company as “virtual” as possible. Resist the urge to do things that accumulate additional expenses, like taking office space or acquiring the trappings of a traditional business.

I mentor an entrepreneur duo who launched their company with friends and family money of $30,000 (borrowed and paid back) to support one kiosk location in 2011 while they were still on campus as undergraduates. They now have six locations and will do more than $2 million in revenue in 2014. They still don’t have an office (they meet on campus, in our center or at Starbucks, with their key employees), they still drive older cars, and they still live in a house with three other people. I keep advising them to put every possible dollar back into the business to open more locations. They have followed a LeanModel Framework strategy and own 100 percent of their company’s equity.

The other key resource you will need is people. For example, do you need someone to program or build something? If so, refrain from giving people equity unless they are mission-critical. And if that’s the case, let them earn the equity over two to three years. If they aren’t critical to your success, work out a deferred compensation arrangement instead of equity.

Similarly, you can raise capital through friends and family or crowdfunding to pay for having your prototype developed. Don’t throw equity around in those early days. There are a couple of reasons. For one, you will need that equity down the road for attracting really critical partners or key hires. And, two, I have seen more entrepreneurs in court or arbitration hearings due to a break-up or difference in strategy. That usually occurs in the early stages of a company, and it’s often a fight over mythical equity value. That is, the equity really isn’t worth anything yet, as the start-up is either prerevenue or is operating at a loss. And these disputes usually happen when the parties don’t really know each other well, don’t trust each other, or don’t accept each other’s strengths and weaknesses. A sign of true equity partnership is when the parties share a passion to create the company—that outweighs everything else.

PARTNERS, STRATEGIC AND TACTICAL

As you refine your business model and evaluate how to produce your product or get your product into the marketplace, you begin to identify key partners who can help you accomplish your objectives.

Trust yourself. Trust your instinct. And if you are

going to build a company, learn how to trust others.

Partners, by the way, can be both tactical and strategic. You should treat both with the same amount of respect. Never make someone feel he or she is “just” a vendor to you; make everyone you deal with like you and like your start-up mission so much that they want to help you.

Although there are any number of partner types, let’s look at three key areas:

• Manufacturers: This could be an outsourced team of people, freelancers, or actual manufacturers who could design and produce your product prototype.

• Distributors: These would be key distribution channel partners who will help you take your product to various marketplaces.

• Suppliers: These would be key suppliers or vendors who are supplying you with your product components necessary to produce your final product.

Before you choose any of these partners, talk to other entrepreneurs who have gone down a similar path. They have gained experience and knowledge that you need. They have also done some things right and have made some mistakes. You want to learn from them so that you don’t make the same mistakes.

Depending on the industry you are in, find out who the key manufacturers and suppliers are. If you have time, attend a trade show for manufacturers where you will learn even more.

When you do choose a key partner, move slowly, if you can. Get to know each other. If you are building a product, agree on the specifications of the product in writing. Don’t order a large quantity; order in small batches until you are satisfied the product is being built correctly.

In talking to quite a few entrepreneurs, I have heard the same story over and over again. We were moving too quick. We assumed they knew what they were doing. We ordered 3,000 instead of a first batch of 300 products. All agreed they had sacrificed quality for speed or cost savings. All agreed they made a mistake. It’s okay to move fast, but you cannot sacrifice product quality. No matter what your brand promise is, or how great everything looks, if the quality is not exceptional, you are in real trouble.

PRODUCT OR SERVICE COSTS

You will have some start-up costs as you conduct research and look to eventually build a prototype of your product or service. In terms of the business model, focus on the actual product or service ongoing costs, or the cost for each product at some level of volume.

You need to build your assumptions for your product costs, so set up a spreadsheet and identify all the costs related to the product itself. Let’s call these direct costs (like direct materials, direct labor, and manufacturing expenses). Then, let’s add all the indirect costs—those not related to the product itself (like marketing, travel expenses, rent, and labor other than direct labor).

Once you have a handle on estimating your expenses, move everything into a 12-month forecast sheet and estimate, conservatively, your projected revenues and expenses from month 1 through month 12. Based on this forecast sheet, you can tell if you are actually making money (are you profitable each month?). But, more importantly, you can tell how much money you need on hand before you start your company.

This before money is needed to fund the initial inventory and sales expenses. Plan on having enough money to fund the next inventory shipment, as you will still be receiving funds in staggering amounts from distributors or customers. If your product is online software, you may be cash-flow positive right from the start of the company.

But it’s not enough to fund just the next manufacturing order. You also have to determine how much money you need on hand, via yourself, friends, and family or perhaps by raising funds via a crowdfunding platform. Don’t be naïve about how much cash you need. Quite a few entrepreneurs have launched their companies without enough cash on hand to fund inventory replenishment or critical product refinement. As a consequence, the young businesses struggled or even failed. They failed not because the products were not good, but because the entrepreneurs simply ran out of cash. In the early days of a start-up, cash flow is king. Never forget that.

SELLING/REVENUE SOURCES

It’s important that you step back and identify all the potential revenue sources for your product or service. Initially, you may see only one or two potential revenue sources. But there are usually more.

While you don’t have to pursue these possibilities all at once, from a strategic perspective you do need to be aware of them and of their potential. To help you with this, here are two examples using real companies.

Manufactured Retail Fashion Product

Jenny wanted to create a company that would help others via an important social cause. She purposely wanted to create a triple-bottom company (people, profit, and planet). She selected a fashion product to launch her start-up for which a certain portion of the net profit would fund her cause. Jenny assumed she would be selling online using her own website and also in local retail stores. After being in business for one year, here are the potential revenue sources she has identified:

• Own Website

• Local Retail Stores

• Regional Brand Stores

• National Brand Stores

• Other Websites

• Private Label

• Licensing to Other Brands Overseas

Now that she has a bigger picture of potential revenue sources, she can make both tactical and strategic decisions that will grow her company.

Software Products

Dmitri noticed a popular e-commerce platform had achieved more than 20 million downloads. As he investigated the platform, he became frustrated by a few user-centric problems. So he created some simple software tools and widgets for the platform. He started by selling them on his website to developers and sophisticated customers. But as he investigated the marketplace for this platform, and the ecommerce marketplace in general, he discovered he had more options. So in year two, Dmitri began to utilize multiple revenue opportunities:

• Own Website

• E-Commerce Platform Website

• Several “Influencer” Developer Websites

• Portal Website for Developer Tools

• Key Product Partners via Bundling

Understanding the complete marketplace allowed him to utilize several revenue opportunities, which have resulted in a quintupling of his annual revenue.

* * *

The key is to examine the marketplace and understand how and where customers want to purchase your product or service. After reviewing every possible revenue opportunity, then you decide, perhaps in the order of priority, which revenue streams to initially pursue, knowing you can add others eventually.

Selling. There was a reason I titled this section “Selling/Revenue Sources.” You are not going to drive any revenue unless you know how to sell your product or service. If you have never had any experience selling, then talk with people who are comfortable selling, attend a seminar on selling, and take a part-time job selling something.

As an entrepreneur, you are either going

to sell something or not. It’s up to you.

You need to be comfortable with the job of selling; in fact, your sales skills are what will drive your company forward. Most entrepreneurs think they can just launch their company and the sales will magically appear. That won’t happen. So if you believe you will never be good at selling your company’s products or services, then find a partner or co-founder who thrives on selling. Also, read Spin Selling by Neil Rackham. It really helped me understand the complete sales process, the three key customer types, why people buy (want versus need), and how, if done right, they will actually buy from you as opposed to you constantly thinking you need to sell them something. And you can’t really sell something unless you have the answers to some important questions related to your business model.

A well-designed business model is a critical element of the LeanModel Framework. Instead of writing a “perfect” business plan, you develop, integrate, and evolve a solid business model. Here is the summary of questions you should know or be able to answer regarding your business model. They are listed by the various elements of the business model and are not intended to be a definitive list, just thought starters.

Unique Value Proposition

• What value will my product or service deliver to the customer?

• Which customer problem am I solving?

• Am I satisfying a customer need?

• What is the minimum viable product?

• Is my product offering unique and defensible?

Customer Relationship Feeling

• What kind of relationship do I want with my customers?

• What do I want them to say or feel about my product or service?

• How costly is it to build a relationship?

• Can I create the relationship I want in my business model?

Customer Target Segments

• What is the size of the marketplace?

• Is the marketplace growing or changing?

• Who is my initial target segment?

• Who is my secondary target segment?

• What are unique characteristics of each segment?

• Do I have to communicate or reach those segments in different ways?

Distribution Channel Strategies

• What distribution channels should I consider?

• Where are my customers?

• How do competitors reach their customers now?

• Are there new trends that will affect distribution channels?

• Which are different distribution channel pros and cons?

• Is this a new or growing customer segment?

Start-Up Activities

• What are key things I need to do now?

• Have I investigated various distribution strategies?

• Have I investigated various revenue streams?

• How could I create a minimum viable product?

• How and where should I incorporate?

Start-up Resources

• What key resources do I need to get started?

• What resources do I need for distribution, customer relationship, and to create revenue?

• What can I outsource?

• What do I need in-house?

• Do I have the talent I need?

• Should I create a crowdfunding campaign?

Partners, Strategic and Tactical

• Who are tactical partners/suppliers?

• Who are strategic partners?

• What key resources will I get from partners?

• What key activities do partners support?

• Who are my competitors working with?

Product or Service Costs

• What is the current cost of a product or service similar to mine?

• What will it cost me to produce the product or service?

• How can I outsource or cut my costs?

• At what point will product or service costs go down based on volume?

Selling/Revenue Sources

• What do current customers pay for a product or service like mine?

• What would I expect my customers to pay?

• What are the potential revenue streams (retail, online, licensing, etc.)?

• Will my revenue produce a gross margin or profit to sustain my business model?

ENTREPRENEUR INSIGHT

About three years ago, I was approached by an entrepreneur who had spotted an opportunity in the marketplace of social media tools. He had done a significant amount of research, had met with several technologists, even met with a few angel investors. At the time we had our conversation, I noted that he might only have a short “marketplace window” in which to launch his product and that he needed to get going. He indicated that, based on feedback from potential investors, he was going to take the time to craft a business plan. I told him to develop a prototype quickly and to move faster.

He spent six months developing a business plan and began to pitch investors. They told him they needed to see “traffic” and a proof of concept. He spent another nine months taking too much time to build the “perfect” prototype. He launched the prototype into the marketplace. Too late. Another company had already launched the same product.

KEY TAKEAWAY

The LeanModel Framework has four different and important interlinked components. But speed to market is critical. Build a solid business model. Use lean resources. Test your prototype. Get customer feedback. Move faster.