The Resilient Investor (2015)

CHAPTER 5

Find Yourself on the Map

What You Are Already Doing: Self-Assessment

NOW THAT YOU HAVE A FULL PICTURE OF THE RESILIENT INVESTING framework, it’s time to learn how to put these concepts to work in your life. In this chapter you’ll be assessing where your current actions fit on the Resilient Investing Map and begin thinking about how your own priorities and life situation can find expression within our expanded view of investing. While the RIM may seem fundamentally new, you have undoubtedly been making investments for many years that can be plugged right into your personal map.

For example, we are guessing that you already devote time each week to your familial, social, and community relationships. Great! You’re investing in zone 1. Do you periodically plug in to online social networks or take personal or professional training courses? Check, zone 3. We know you buy stuff, from cereal to cell phones: zone 5. Gardening? Zone 4. Have you supported an interesting new project on Kickstarter or Kiva? Hip hip, you’re at work in zone 9! If you chose your job or career in part because it makes a positive contribution to the world, then zone 2 is in play, too.

Of course, simply having some activity in many different zones is not what this is all about; resilient investing is a dynamic process of making clear, conscious choices about how much time and money to spend in your activities across the entire RIM. The next two chapters will help you think more deeply about these choices, and chapter 8 will take you through the process of designing your resilient investing plan.

For now we will guide you through the first step: putting your existing investments onto a blank RIM. We prefer to do our brainstorming old-school style, with pen and paper, but you might be the type to crank out a spreadsheet or fill out a document online; the book’s website provides a variety of free downloadable resources to assist you in your planning, including a customizable Excel spreadsheet and Word document and the Resilient Investing Map as a PDF or JPG file. But we prefer the tangibility of paper. Give it a try: take out a piece of paper and divide it into a 3 × 3 grid—or, even better, spread out on a big table and use nine sheets, one for each zone on the RIM.

You will be working your way around the map, jotting down anything you are already doing in your life that seems related to each of the nine zones. Simply capture the first few things that come to mind in each zone; there will be plenty of time to add more later. If you don’t have anything significant in some of the zones, that’s fine too; this might be a clue about areas to focus on later.

To jump-start your inventory, let’s consider a few of the things you may put in each zone. Bear in mind that these are just representative examples of the kinds of things you may ask yourself and are far from comprehensive; it may help to refer back to chapter 4 for reminders about each zone. You will likely notice that some things do not fit neatly into a single zone; set the ambiguity aside for now and feel free to list these things in more than one zone or to just make one choice for starters.

Listing Your Assets by Zone

Let’s begin with your personal assets. List the things that belong in zone 1, personal assets/close to home. What investments are you currently making locally to build your personal/social assets? How is your health? Your community engagement? Your connection with family, biological or chosen?

In zone 2, personal assets/global economy, how would you characterize your career? Is it a key piece of your life path that is really humming along? If it is dominating your time but sapping your energy, note that here. Perhaps you are in transition and looking to pick up some new skills.

Next consider your personal and spiritual growth. How would you rate them for zone 3, personal assets/evolutionary?

Now repeat this process with the ways you engage with your tangible assets across the three columns, starting with zone 4, tangible assets/close to home. Do you own a home? Have you made investments into the house or landscape? If you are not a homeowner, what about other close-to-home and tangible assets you have invested in, such as being part of community projects that provide tangible benefit for many?

For zone 5, tangible assets/global economy, what about your stuff, cars, and equipment? Most of us have significant spending in the global economy; are you happy with your spending patterns and how conscious your choices have been?

For zone 6, tangible assets/evolutionary, have you made any investments in sustainable agriculture or conservation finance? Perhaps you’re a member of a local collaborative technology center. Don’t worry if you have little to report here; this is a very new investment category.

Your financial assets start with zone 7, financial assets/close to home. Do you have any accounts in local credit unions, banks, or direct investments in other community projects?

You may already have statements from an accountant or financial planner or records of your own; most of these investments go in zone 8, financial assets/global economy. If you don’t know where you stand with your financial assets, that’s okay, too, but note that you will want to look at this area later. There’s no need to list all of your market investments right now; just note whether you have some and whether they are managed using sustainability criteria.

As for zone 9, financial assets/evolutionary, this is where you place any impact investments that aim to foster real breakthroughs.

Okay, now that you have completed your first pass, keep it handy, as we will be working through the map again at the end of the chapter.

From here on out, we will be sprinkling in examples of completed RIMs to illustrate how to fill them out. All of them are necessarily abridged, featuring just a highlight or two in each zone.

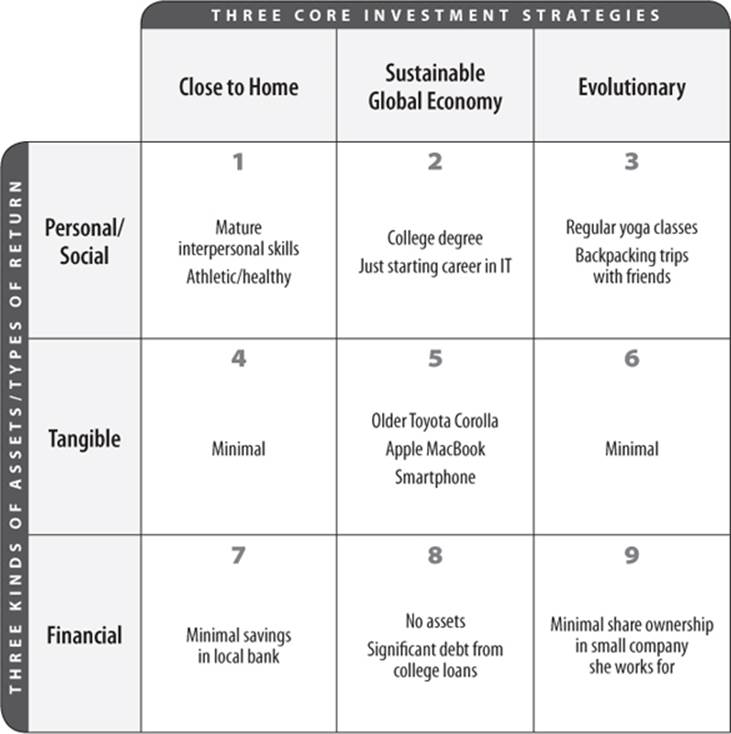

Case Study: Dahlia the Driver

Dahlia is a recent college graduate who is just starting out. Her father died when she was little, and although her mother was very loving and worked hard, financial strain in the home was high. Dahlia has always been driven to build a better life for herself, deciding early on that she would go to college. She did get some scholarships and graduated from a solid university, but like many students today she ended up with substantial loan debt. SEE FIGURE 3 She has few financial assets and not many tangible assets either. Her zone 1 is pretty substantial, with inspiring and supportive friends both near and far and healthy relationships with her mother and siblings. She is just getting started in her career, so she has not yet built up much of an asset base in zone 2, though her college education in a dynamic field is an advance payment on that zone.

Figure 3 Dahlia’s Inventory RIM

Going Deeper: Readying for Resiliency

Let’s set the map aside for a moment and add a couple of bigger-picture perspectives to your toolkit. They both address some of the new types of thinking that our system asks of you and will help you engage with more clarity as you go forward.

Your Assets and Personal Predilections

To make the map your own, you will need to consider some deeper questions about who you are and what you have been doing. Your focus here will be on the rows of the RIM—the three asset classes defined in chapter 2. You will be assessing your life situation, along with your personality and goals. The new directions you choose for your path forward will be shaped by your available assets and overall life priorities, so it is crucial to get a clear and realistic picture of what you have to work with. You might want to make some notes as you think through the questions that follow. If any new investment ideas come to mind along the way, start a separate list of these; they will be a starting point in chapter 8 as you compile a comprehensive set of new options for your resilient investing plan.

Personal Assets

![]() Do you enjoy social engagement, or are you more of a private person?

Do you enjoy social engagement, or are you more of a private person?

![]() Is your time largely accounted for by family or work obligations, or do you have discretionary time that you could devote to new things?

Is your time largely accounted for by family or work obligations, or do you have discretionary time that you could devote to new things?

![]() As you have learned about resilient investing, have you thought about things into which you would like to put more time?

As you have learned about resilient investing, have you thought about things into which you would like to put more time?

![]() How important to you is growing your personal assets? This includes family time, deeper connections with friends and colleagues, and emotional/spiritual inquiry.

How important to you is growing your personal assets? This includes family time, deeper connections with friends and colleagues, and emotional/spiritual inquiry.

![]() What are your skills, talents, and capacities?

What are your skills, talents, and capacities?

Tangible Assets

![]() Do you already own a home? If so, does it fulfill your needs and desires?

Do you already own a home? If so, does it fulfill your needs and desires?

![]() Do you want to settle in one place, or do you envision moving periodically?

Do you want to settle in one place, or do you envision moving periodically?

![]() Do you enjoy expressing yourself through tangible stuff? This includes things like wardrobe, book/music collection, and gadgets.

Do you enjoy expressing yourself through tangible stuff? This includes things like wardrobe, book/music collection, and gadgets.

![]() Do you have hobbies that require tangible support? Examples include sewing, woodworking, biking, and restoring antique furniture or classic cars.

Do you have hobbies that require tangible support? Examples include sewing, woodworking, biking, and restoring antique furniture or classic cars.

![]() What tangible assets are you most interested in growing? This includes home/land/tools, becoming more conscious as you shop for food and other consumable products, and the physical landscape and the natural resources in your region.

What tangible assets are you most interested in growing? This includes home/land/tools, becoming more conscious as you shop for food and other consumable products, and the physical landscape and the natural resources in your region.

Financial Assets

![]() Do you have financial assets to invest?

Do you have financial assets to invest?

![]() Do you have income that does, or could, allow you to set aside money to invest?

Do you have income that does, or could, allow you to set aside money to invest?

![]() How important to you is increasing your income and growing your financial assets?

How important to you is increasing your income and growing your financial assets?

![]() Would you like to shift some of your existing financial assets or direct some of the money in your monthly budget toward strategically growing your personal or tangible assets?

Would you like to shift some of your existing financial assets or direct some of the money in your monthly budget toward strategically growing your personal or tangible assets?

Your self-assessment and your final resilient investing plan are both shaped in fundamental ways by the specifics of your life. Friends, loved ones, financial advisors, and spiritual or psychological counselors can be invaluable allies as you dig into this process of working with the entiremap. We encourage you to find some areas to explore that push you out of your comfort zone as you move ahead; taking risks is one of the first steps toward charting a new course for your life. And who knows, you might just find that resilient investing helps you to discover new passions, new ways to be of service, and new opportunities for cultivating love, knowledge, and deeper satisfaction in your life.

Evaluating Nonfinancial Returns

As you have evaluated your investments in each zone, you have likely noticed that there are different types of returns, depending on whether you are investing time, attention, or money in the activity. It is generally straightforward to track your returns on financial investments, but learning how to think about your returns on personal or tangible assets is a bit trickier.

Some tangible assets have concrete financial benefits, often with nonfinancial returns that add to their value: two obvious big-ticket examples are solar panels and a car that gets high gas mileage. Similarly, making a lifestyle choice that minimizes private automobile use in favor of public transit, walking, and biking offers a ripple effect of positive returns: quantifiable financial savings (on gas and car maintenance) as well as a smaller carbon footprint, better health, and more social interaction along the way.

Growing a garden offers a particularly rich opportunity to explore the mix of returns that often result from investment of time: you will save money at the store or farmers market, you will savor the pleasure of physical work and the beauty of mornings in the garden with family and friends, and you will gain the satisfaction of eating fresh, healthy food that you grew yourself. At the end of your second year, you’ll want to consider whether the time you devoted to the garden did in fact pay off in the ways you expected, or if there are other things calling for your time.

Similar reflection will be necessary as you look at any other investments related to your personal and tangible assets—and even some of the investments in the financial assets row that are designed to have social or environmental returns, such as involvement in local businesses in zone 7and impact investing in zone 9.

The returns from your nonfinancial investments are generally subjective; for example, exercise makes you stronger and more energetic; it may also make you feel more self-confident and outgoing. Despite this ambiguity, you can still make a habit of reviewing how well your nonfinancial investments perform compared with your expectations for them. If approached with honesty and care, these assessments provide an essential perspective that you can use to inform your allocations of personal and tangible assets over the years.

A First Look Ahead: Stop/Start/Sustain

Now that you have taken an initial pass through your map and considered some of the larger context of the resilient investing system, take another look at what you have written. What stands out? Highlight anything in your notes from the previous sections that you want to carry over into your final resilient investing plan in chapter 8.

One quick and easy method for completing this early thinking about your activities across the map is the stop/start/sustain technique. For the zones in which you have made investments, do you want to stop making those investments, perhaps start something new, or sustain your current investments? Artistic types might use different colors: black for the inventory, a red line to indicate stopping an investment, perhaps a purple star for investments you want to increase or start, and a green circle for those investments you want to continue. Of course, simple plusses or minuses work too. Don’t let a method, or a lack of one, slow you down.

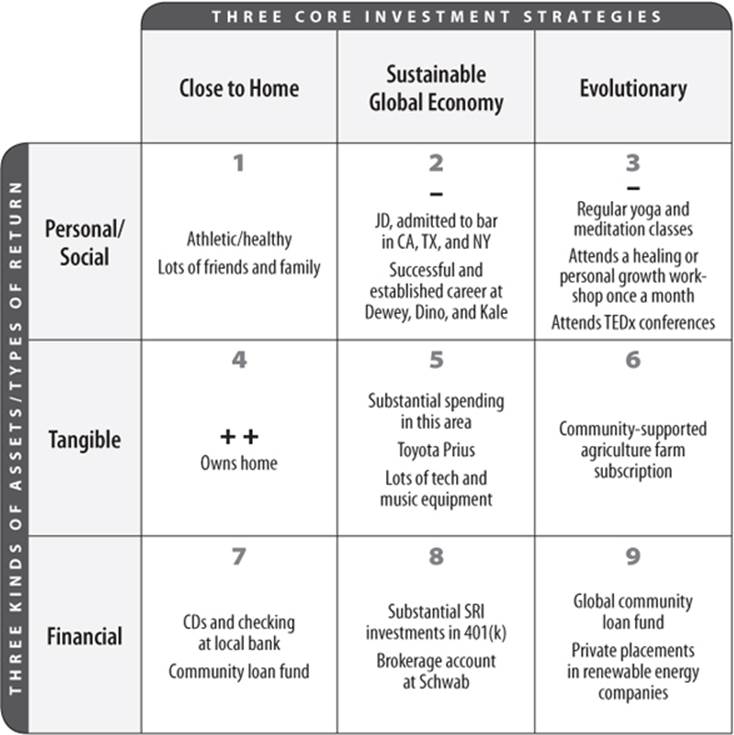

Let’s take a look at how another prospective resilient investor completed her map, including her stop/start/sustain intentions (remembering again that your full assessment will likely be more detailed). As you will see, she is using the +/- method to indicate zones in which she wants to increase or cut back her investment.

Case Study: Adele Adaptability

Adele has always dreamed of making the world a better place. For the past several years, she has spent thousands of dollars on workshops, retreats, and cutting-edge conferences. Established in her career as an environmental attorney, she admits that she’s finding the work a little boring these days (zone 2). SEE FIGURE 4 She is well invested in transformative education (zone 3) and is actively seeking opportunities in the most cutting-edge technologies and ideas (zone 9). She even subscribes to a CSA farm (zones 4 and 6). She has SRI mutual funds in her 401(k) (zone 8), while her commitment to social justice leads her to put a big chunk of her savings in local and global community loan funds (zones 7 and 9). She’s a diligent health food shopper and drives a hybrid car (zone 5). She owns her home, though she is so busy with work that she hasn’t put much energy into it.

Figure 4 Adele’s Stop/Start/Sustain RIM

![]()

In these initial passes through your map, you have likely found that you are already doing quite a lot. And we’re sure you are itching to get into the juicy task of actually making new plans and reshaping your map for the coming years. Not so fast! To build the personal and societal resilience we have been talking about, you will need to step back from your current patterns and activities and take a closer look at both yourself and our world. We will deepen our explorations in chapter 6, offering some tools and perspectives that are bound to broaden your horizons.