Bitcoin for the Befuddled (2015)

Chapter 4. BUYING BITCOINS

Buying bitcoins is essentially just like buying any other kind of currency. Think about the various ways in which you typically exchange US dollars for Japanese yen or Mexican pesos. For small amounts of money, you could probably find a friend to exchange a few dollars for the currency you want. For moderate amounts, you can visit a currency exchange shop, like those at most international airports, which is convenient but charges high fees. If you want to exchange thousands of dollars or you are a currency day trader and don’t want to pay high fees, you need to register an account at a major currency exchange. All of this is true for bitcoins as well, except that the infrastructure is not yet as well developed as it is for traditional currencies (right now, an airport currency exchange shop probably couldn’t tell you the difference between a bitcoin and a banana).

The bottom line is that you have many different ways to buy bitcoins, even today: You can buy them locally, from your friends or those in your area; you can buy them from middlemen, both online and in brick-and-mortar stores; or you can buy them from major Bitcoin currency exchanges. It’s important to remember that whenever you buy bitcoins, you are buying them from someone who has them already (exchange services merely facilitate this transfer); bitcoins are not sold directly from a Bitcoin company. Therefore, no individual sets the price of a bitcoin; the price is decided collectively by those who buy and sell them every day (i.e., by the free market).

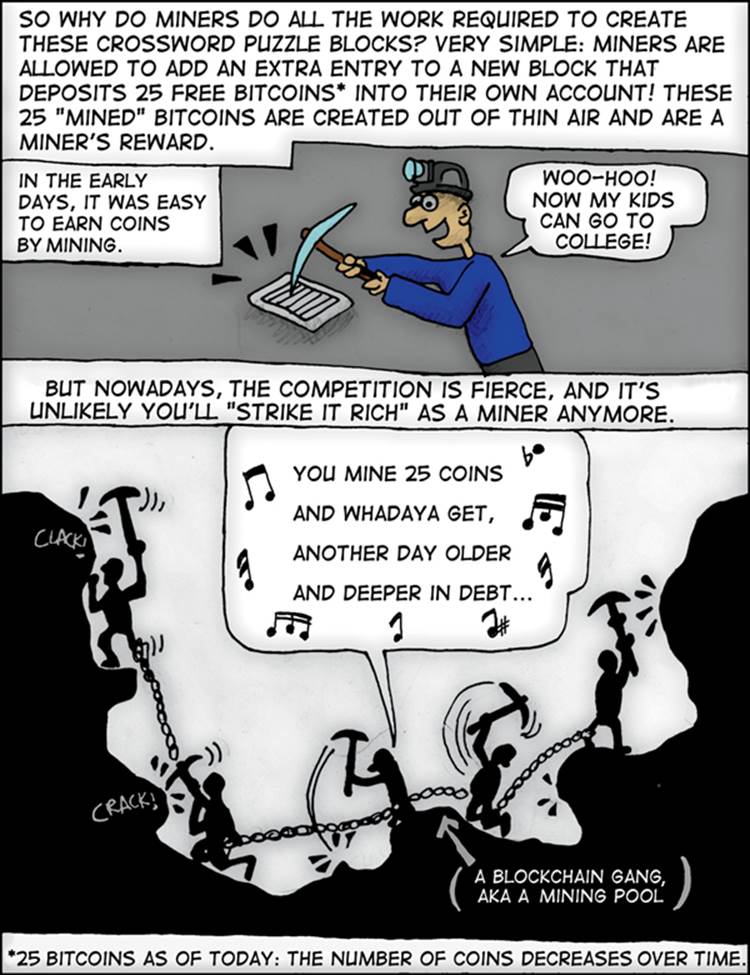

Why Not Just Mine Bitcoins?

Although you can obtain bitcoins by mining them, it is not easy (or free) to do so. Unless you plan to quit your day job and become a full-time Bitcoin miner (see Chapter 8), it’s not practical to obtain significant amounts of Bitcoin through mining. Bitcoin mining requires highly specialized computer hardware, cheap electricity, and a high degree of patience.

Ways to Buy Bitcoins

Broadly speaking, you can buy bitcoins in three main ways:

• The easy way: Through middleman companies

• The efficient way: Through currency exchanges

• The fun and futuristic way: Through person-to-person purchases

Middleman companies make money helping people buy bitcoins easily, with a minimum of fuss. These companies usually have decent customer service and shield you from needing to understand all the complexities of currency trading. However, like all middlemen, they charge a fee for this convenience.

A more efficient way is to buy bitcoins directly from a Bitcoin exchange. Exchanges directly connect people buying and selling bitcoins using a sophisticated currency exchange system. These exchanges are somewhat advanced and can be intimidating for a beginner. However, exchanges are where most large Bitcoin purchases and sales happen. For this reason, exchanges usually offer the best prices for purchasing bitcoins. Also, by purchasing directly from an exchange, you minimize the number of parties involved in a large purchase, which decreases the risk of a problematic transaction. For large Bitcoin purchases ($5,000 or more), always deal directly with an exchange. Using an exchange is also a good choice for smaller purchases, as long as you have the time and inclination to learn the ins and outs of how a currency exchange works.

Simply buying bitcoins directly from folks in your area, person-to-person, is the most fun because you get to meet others interested in this new currency. Of course, trading money directly with strangers might make some people uncomfortable. But most bitcoiners believe that person-to-person purchases are most likely the wave of the future. Some hope for a more decentralized world in which large corporations become obsolete as technology makes it more practical and convenient for people to interact directly. Perhaps someday face-to-face exchanges will become the most efficient, cheapest, and fastest way to buy bitcoins.

Buying Bitcoins the Easy Way

At this time, the easiest way to buy bitcoins is through an established Bitcoin middleman, more accurately called a Bitcoin exchange intermediary. Exchange intermediaries consist of companies that have already registered their own accounts on one or more Bitcoin exchanges and will buy or sell bitcoins on your behalf. Typically, exchange intermediaries offer to sell bitcoins only at the market price; you can’t set your own price. Additionally, these companies may only convert currency in one direction. For instance, during the 2013 Bitcoin price run-up, many folks new to the Bitcoin community wanted to purchase bitcoins quickly. Not surprisingly, many businesses that traded bitcoins for dollars, but not necessarily dollars for bitcoins, quickly appeared to fill this need.

There are also clear benefits to using a middleman, however. The paperwork involved is minimal, and many services offer to get you bitcoins in mere minutes (as opposed to days or weeks). The fees typically range from 1 to 10 percent, but the service and customer support are often better than with exchanges.

NOTE

Bitcoin intermediaries are roughly analogous to PayPal, which acts as a middleman to help you make Internet purchases using your bank account. If you’ve used PayPal, you’ll find that using an exchange intermediary is a very similar experience.

Table 4-1 lists some popular exchange intermediaries. You should try to choose a company that charges the lowest fees and offers the best user experience. Be sure to check online for reviews of these services and try to find out if they have a good reputation in the Bitcoin community before making your decision. Many of these services operate only in limited geographical regions, so some might not be available to you.

Table 4-1: Popular Bitcoin Exchange Intermediaries

|

Company name |

Services offered* |

Location |

Established |

|

Bitcoiniacs |

Buying or selling bitcoins at market price; brick-and-mortar Bitcoin store |

Kelowna, Canada |

2013 |

|

BTCquick |

Buying bitcoins using a credit card |

Denver, CO |

2013 |

|

Circle |

Buying and selling bitcoins via bank or credit card. |

Boston, MA |

2013 |

|

Coinbase |

Buying and selling bitcoins at market price; Bitcoin wallet hosting |

San Francisco, CA |

2012 |

* Only a partial description of services

WARNING

Unfortunately, many times in the past fraudulent and poorly run companies have been involved in the buying and selling of Bitcoin. Undeniably, in the future this may be true of any of the companies we mention in this chapter. It is your own responsibility to properly vet specific companies before trusting them with your money.

Before we walk you through the exact steps involved in buying bitcoins from one of these companies (see “Buying Bitcoins with Coinbase” on page 58), we first need to discuss a couple of technical concepts. One concept you absolutely need to understand is two-factor authentication, which is a way to do online transactions (as well as a framework for thinking about such transactions) that can greatly reduce your risk of getting hacked and/or robbed. Another concept we need to discuss is the difference between reversible and irreversible financial transactions. Understanding this difference helps explain why long waiting periods are often involved when acquiring bitcoins from service companies.

Authentication Factors

Since the dawn of digital technology, many methods have been conceived for computer users to prove their identities: passwords, iris scans, key fobs, face recognition, and several others. However, all of these security measures can be defeated. If you enjoy science fiction movies, you’re familiar with the myriad ways this can be done.

However, you can overcome these weaknesses by organizing the many authentication methods into three main categories and then choosing two to use. This is known as two-factor authentication. The three categories are as follows:

• Something you know: Your password, your first pet’s name, your signature, and so on

• Something you own: A key fob, your smartphone, and so on

• Something you are: Your fingerprint, your face, your eyes, your voice, and so on

It turns out most of the weaknesses in each of these categories are very different. That means that if you pick two authentication methods in two different categories, it will be far more difficult for a hacker to break into your account. This is what we mean when we say two-factor identification. We will discuss an example of this in practice shortly.

The Hassle of Converting Dollars (or Other Currencies) into Bitcoins

One common criticism of bitcoins is that it can be such a hassle to obtain them. Typically, you’ll wait several days before you can buy bitcoins with your dollars through an exchange intermediary. People are often mystified by the fact that they can buy items on Amazon in 10 seconds but that it takes many days to buy bitcoins, no matter where people try to buy them.

Reversible Transactions

The reason, surprisingly, is that the world economy as it currently exists is built around contracts and reversible transactions. Transfers of financial value between two parties usually involve very similar steps, whether we’re dealing with a credit card payment, check deposit, bank wire, stock purchase, or mortgage loan. Any financial asset that is typically tracked in a financial ledger (which nowadays includes most things besides paper cash) are handled in this way. The steps are as follows:

1. One of the parties, or both parties together, draft a legally-binding contract. Sometimes this contract is written out formally (such as when you initiate a mortgage loan) and sometimes it is made implicitly based on previously agreed-upon terms. For instance, when you enter your credit card information into Amazon, you are bound by a contract you signed ahead of time with your credit card issuer, a contract that stated that you would honor the debt incurred by using your credit card in this way.

2. The terms of the contract are broadcast to all affected parties. If you initiate a bank wire, your bank, as well as the bank receiving the funds, will be notified about the bank wire request. Similarly, someone selling decorative soaps on Amazon would be notified that you used your Visa card to purchase a bottle of raspberry hand soap. At this point, there is usually still some leeway for the parties to still opt out of the contract, in a time period which may be called a settlement period (or a hold or rescission period, depending on the type of asset and the exact circumstances involved.)

3. The purchased assets are delivered and financial records are updated. After a period of time, once the banks have updated their ledgers, the balance from the bank wire shows up in the recipient’s bank account. Similarly, your raspberry hand soap is handed off to the post office for delivery.

The crucial step in this process is that the information entered in the bookkeeping ledgers by your bank (or at E-Trade, the mortgage company, or the soap seller) is really meaningless in terms of determining who “owns” an asset—these ledgers have no legal bearing. The only way to know whether you own the money in your bank account, the money in your Paypal account, or a share of Google at E-Trade is to look at the original contracts. If somebody contacts your bank and says, “Actually, all the money in Bob’s account belongs to me because Bob and I signed this contract that proves this is the case” and this person can go through the many legal hurdles required to prove that that money indeed belongs to her, Bob’s money will not be safe at that bank. It does not matter whether the bank’s internal ledgers say he is entitled to that money.

The bottom line is that because legal contracts almost always remain open to dispute and because ledgers maintained by banks, mortgage companies, E-Trade, Amazon, etc., are all subject to the legal system, it is reasonable to argue that our traditional financial system is based upon financial transactions that are reversible. Unless there are statutes of limitation that supersede the original contracts years into the future, the settlement period we mentioned in step two is indefinite.

This is true in theory and in practice. All of the following types of transactions can be (and frequently are) reversed by at least one person involved in the transaction days after the fact (and usually also weeks or months after the fact):

• Bank wires

• Credit card transactions

• Mortgage loan contracts

• Stock purchases

• Check deposits

For some of these transactions, the only party that can reverse the purchase may be the larger, more powerful entity involved in the transaction. For instance, you may not be able to change your mind about the share of Google you bought a day ago, but you wouldn’t be surprised to learn that E-Trade makes you wait 10 business days before pulling that share out of your E-Trade account and will be more than happy to take that share away from you if the bank wire you used to fund that share is reversed by your bank after the fact.

Irreversible Transactions

However, there are some types of financial transactions that are completely irreversible. The most common transaction of this type is a transfer of physical, paper money. If the ATM machine goes crazy one day and spits out $10,000 in cash that you don’t actually own and you decide to bury that money in the woods that evening, no legal contract, action by the bank, or action by the government will ever be able to recover that cash; if you decide not to tell them where you buried this money, it is not directly reachable by the legal system.1

Bitcoins have this same property, which is why people sometimes call it digital cash. If you give somebody bitcoins using a standard Bitcoin transaction, nothing you can do or say can ever reverse that transaction. Such a transaction is enforced using pure mathematics and is not a party to any legal contract, in itself.

Combining Reversible and Irreversible Assets

Now we can finally understand why it is often a hassle to buy bitcoins. When you buy an irreversible asset using a reversible asset it leads to something call an impedance mismatch: While it is possible to build efficient financial systems that involve reversible transactions (our modern financial system) and those that involve irreversible transactions (as is currently found in the world of cryptocurrencies), it is difficult to exchange assets between these two categories.

This is why banks have such strict cash withdrawal limits at ATMs and why it can take several days to buy a bitcoin. In both cases, the institution has no way of reversing the irreversible transaction if something goes wrong and needs to take extra precautions that the reversible half of the transaction has a high probability of completing successfully before agreeing to the transaction, especially if large amounts of money are involved.

NOTE

If you are sent raspberry hand soap by mail via an Amazon purchase, this is arguably also an irreversible transaction. However, such products, if obtained fraudulently, are hard to sell to another party (unlike Bitcoin). This is another reason why an online seller of soaps is less at risk of fraud than a company selling bitcoins.

Why Irreversible Transactions Are Arguably Superior

Many people, when they hear that Bitcoin transactions are irreversible, will have the following thought: “I kind of like the fact that I can reverse a credit card transaction if someone sells me a deficient product.” However, it is still straightforward to perform reversible transactions with Bitcoin. Many systems exist for doing this, usually using a feature in Bitcoin called multi-signature transactions, which we will discuss in some detail in later chapters.

It is true that currently, with standard Bitcoin transactions, the protections a buyer has when buying something off of the Internet are not as strong as those built into the credit card system. This is a weakness of Bitcoin and something the Bitcoin community needs to strive to resolve. But the fact is that both reversible and irreversible transactions are useful depending on the circumstances. For instance, if you are selling a bicycle to a stranger for $100, you probably wouldn’t want a potentially reversible asset in exchange, such as a personal check. Instead, you would say to the stranger, “cash only please” (or maybe “Bitcoin or cash only please” after you finish this book).

Therefore, because Bitcoin allows for reversible transactions wile your Visa credit card will never allow for a strictly irreversible transaction, one can argue that irreversible financial instruments are superior: They are a more basic building block on top of which more complicated forms of transactions can be built, including reversible financial transactions with enforcement via traditional contracts, if desired.

In conclusion, we believe it can be a bit unfair to criticize the design of Bitcoin for the fact that bitcoins are hard to purchase with a credit card or bank wire. Part of this difficulty is caused by the design of the traditional financial system itself.

Buying Bitcoins with Coinbase

In the United States, the most popular Bitcoin exchange intermediary by far is Coinbase. Let’s walk through the steps of buying bitcoins using Coinbase. As with all of the methods of buying bitcoins that we will discuss, it is prudent to start small; buy only modest amounts of bitcoins until you are comfortable with the process.

NOTE

If you decide to use another middleman instead of Coinbase, the steps involved are roughly the same, even if some of the details are different.

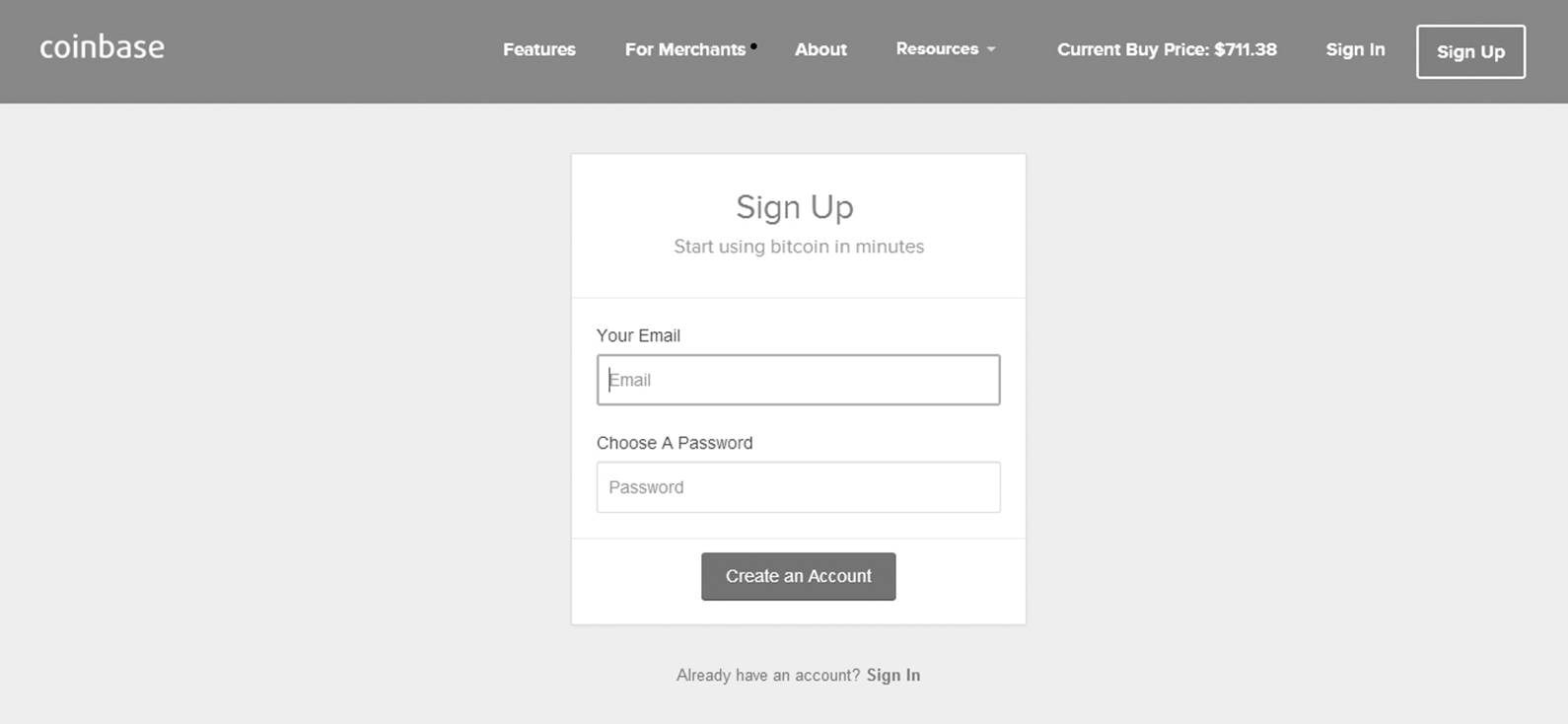

Step 1: Registering at Coinbase

To register at Coinbase, go to http://coinbase.com/, and choose Sign Up. Then enter your email address and choose a password (Figure 4-1).

Figure 4-1: Sign Up screen for Coinbase

Click Create an Account. At this point, Coinbase will send an email to your account to have the address verified.

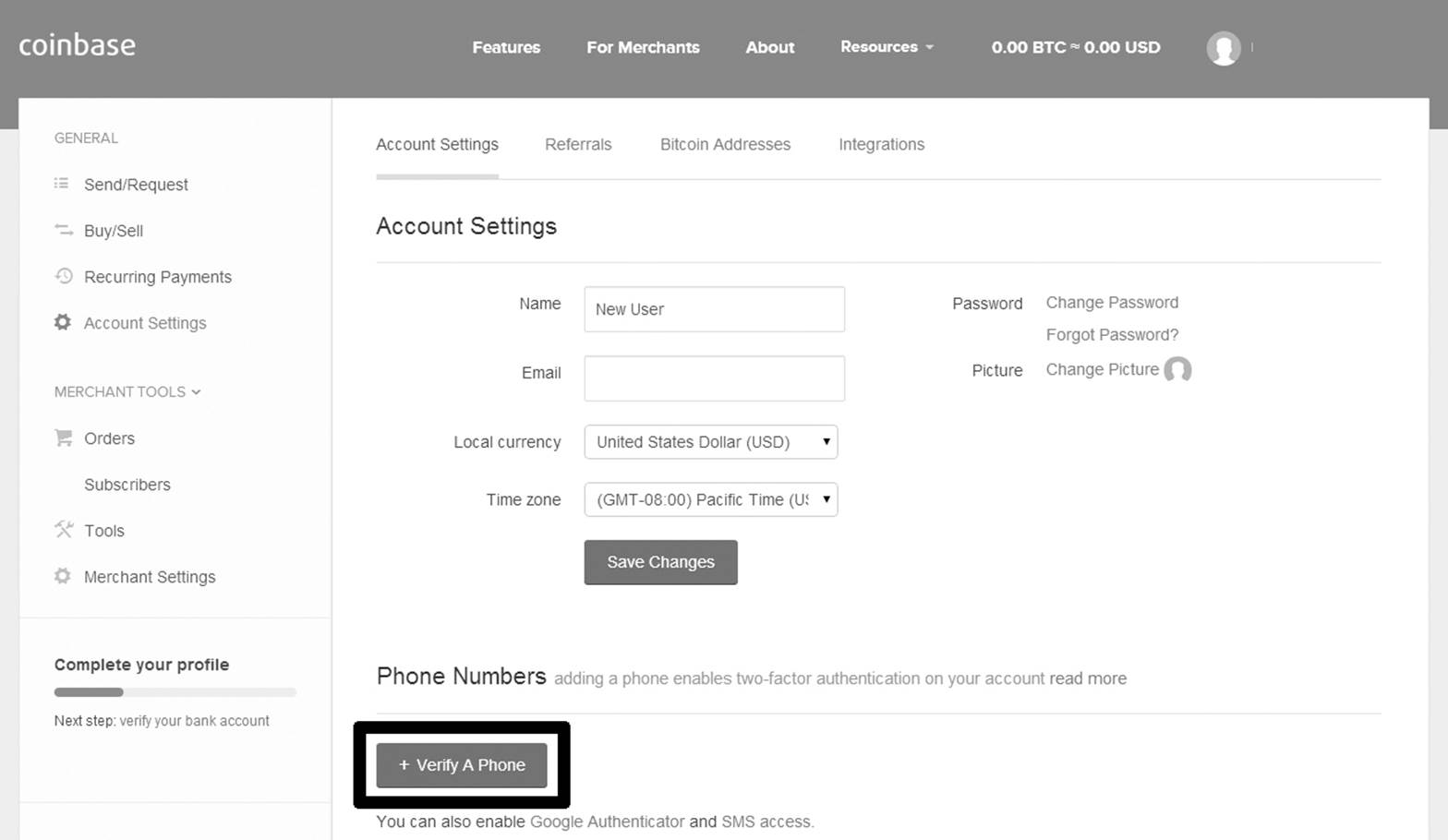

Step 2: Setting Up Two-Factor Identification

The easiest way to set up a second authentication method is to run an app on your iPhone or Android phone that proves you own a phone with a specific phone number. Coinbase lets you do this. Once set up, your two-factor authentication for your Coinbase account will be:

1. Something you know: Your Coinbase password

2. Something you own: Your smartphone

Currently, Coinbase uses an app called Authy that you can install on your phone from the iTunes App Store or Google Play Store. After installing this app on your phone, configure it by following the instructions, which require you to enter your phone number and verify your email address again.

Now you’re ready to use Authy to link your phone to your Coinbase account. After logging into Coinbase, go to Account Settings and verify your phone (Figure 4-2).

Figure 4-2: Account Settings screen for Coinbase

Click Verify A Phone and enter your phone number. Authy will detect that you’re trying to link to Coinbase and display a Coinbase option (Figure 4-3).

Choose Coinbase in Authy to display a code, which Coinbase will ask for as the next step. Enter the code to verify your phone.

Now, if others try to access your Coinbase account, they’ll need to not only know the Coinbase password but also have access to your smartphone.

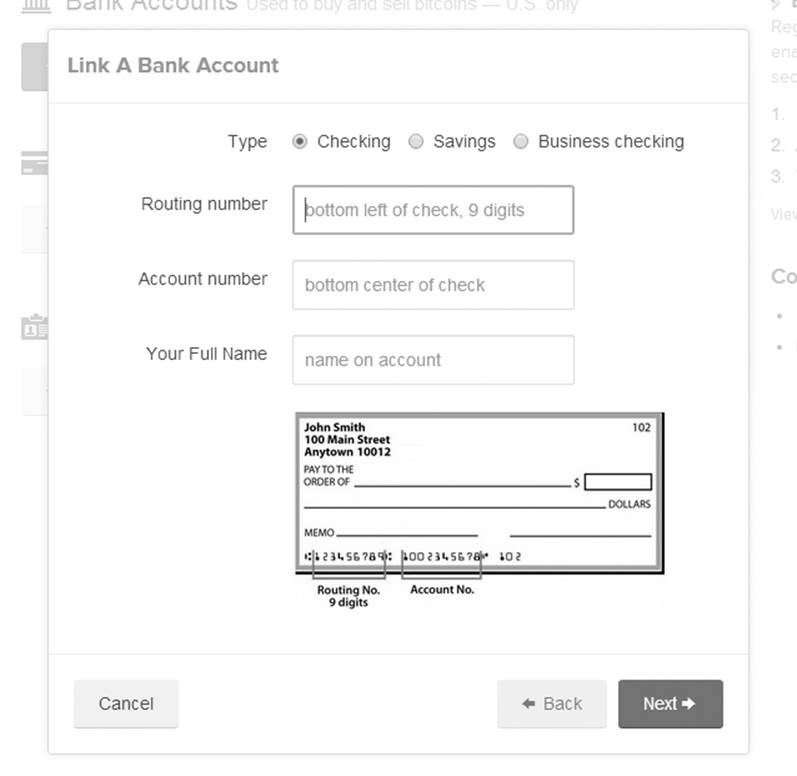

Step 3: Linking Your Bank Account to Coinbase

To purchase bitcoins in Coinbase, you need to link your Coinbase account to a bank account. Log into Coinbase, choose Buy/Sell, and then choose Payment Methods. Click Add Bank Account and provide your bank account information (Figure 4-4).

Figure 4-3: The Authy app detects your use of Coinbase.

Most likely, you’ll have to wait several days before your bank account is fully verified. Then you’ll be ready to continue with step 4 of the instructions.

Figure 4-4: Screen for entering bank account information on Coinbase

Step 4: Buying Bitcoins on Coinbase

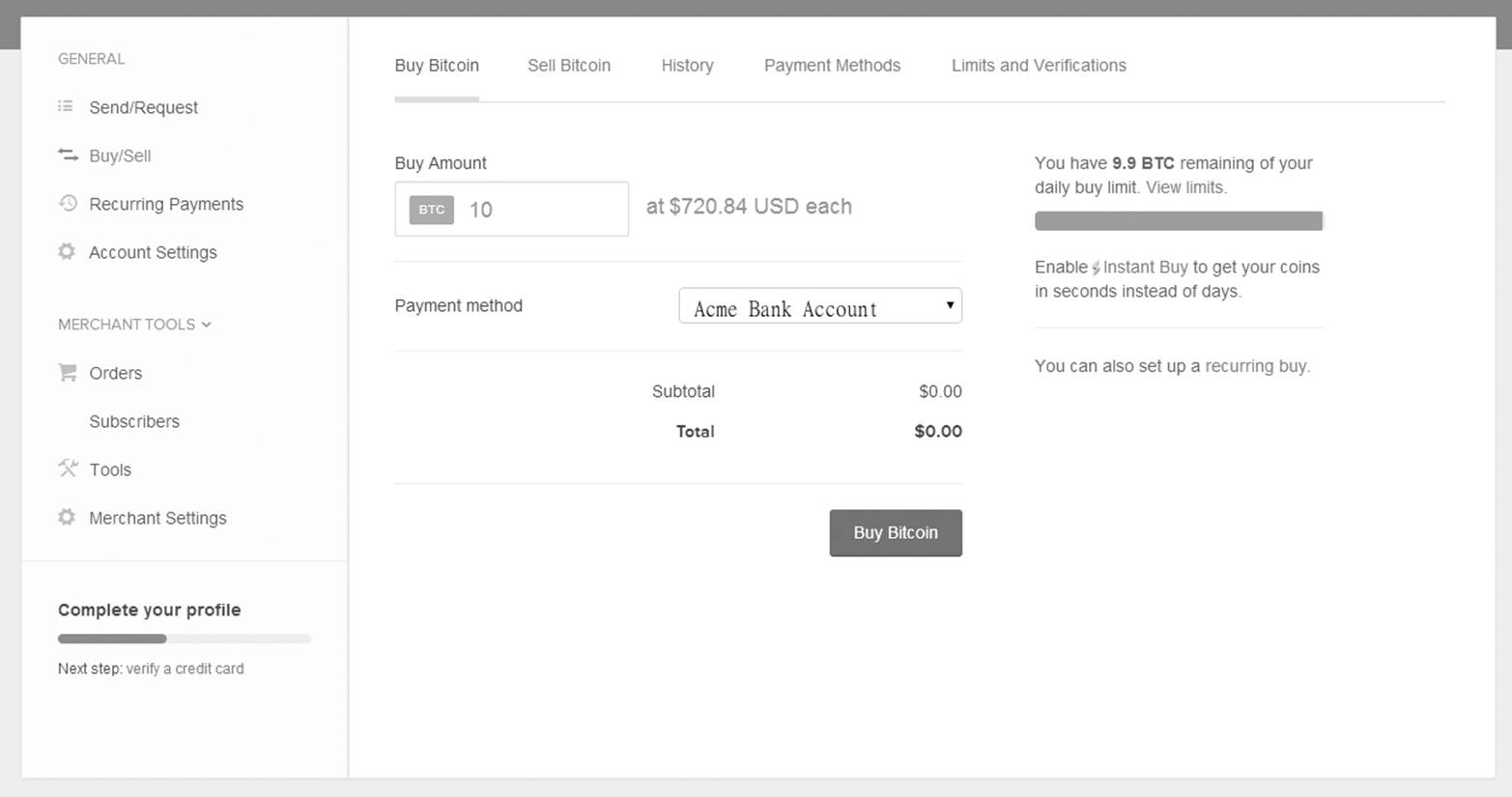

With your bank account confirmed, you can place your first Bitcoin order. Figure 4-5 shows the screen you’ll see when you click Buy/Sell.

This screen is self-explanatory: You simply type in the number of bitcoins you want to buy and then click Buy Bitcoin. After confirming your purchase, Coinbase will transfer the dollar equivalent of these bitcoins from your bank account. After waiting a few more days, you should have your first bitcoins!

Figure 4-5: The Buy Bitcoin screen on Coinbase

Step 5: Protecting Your Shiny New Bitcoins

When your bitcoins are available, Coinbase will notify you via email that your bitcoins are in your Coinbase wallet. But because your Coinbase wallet is managed by Coinbase, if Coinbase ever crashes, gets hacked, or goes bankrupt, your funds could be at risk. Consequently, you should take some extra steps to protect the bitcoins you’ve bought.

Although Coinbase might be a trustworthy company and has a marginal chance of going bankrupt, why take even the slightest chance of losing your bitcoins? By simply transferring your coins from your Coinbase wallet into your own self-managed wallet, you can make sure the risk of loss from a third-party company are zero percent.

NOTE

Be sure to read Chapter 3 to learn about personal wallets and safe Bitcoin storage.

In the past, bitcoins stored in wallets managed by Bitcoin middlemen and Bitcoin exchanges have been lost. Nowadays, the risk of this happening is much lower due to the maturation of the financial Bitcoin ecosystem. Nonetheless, it’s always smart to store your bitcoins on these sites only for the absolute minimum amount of time possible. Bitcoin makes it extremely easy to manage your own money. Take advantage of this ability and don’t trust the management of your money to an exchange intermediary.

BITCOIN ATMS: THE ULTIMATE BITCOIN MIDDLEMEN?

As previously stated, one of the annoyances of purchasing bitcoins at this time is that buying them can be a bit cumbersome due to traditional financial instruments, like credit cards and bank wires, being reversible. But the most obvious irreversible financial instrument is the almighty dollar bill. If a person hands you a dollar bill, that person can’t reverse that transaction (short of being charged with physical assault).

Consequently, an ATM-like Bitcoin-buying device would make it extremely convenient to simply buy bitcoins using paper dollars. Such a machine could let you purchase bitcoins very quickly, because both currencies involved would be irreversible. The convenience of an ATM that charges comparable fees to Coinbase’s could potentially make it the ultimate Bitcoin middleman. And, indeed, some Bitcoin ATMs have been built and have proven very popular. The first was set up in a coffee shop in Vancouver, Canada.

However, it is impossible to know whether such ATMs will ever be widespread or be completely legal in the United States. The reason is that dollar bills and bitcoins share more than just irreversibility. They also both allow for a certain amount of anonymity. For this reason, a Bitcoin ATM would indirectly be a fantastic tool for anonymizing money for money laundering and other nefarious purposes. And, unfortunately, many countries will not hesitate to ban anything that can aid a criminal, even if it would be tremendously beneficial to law-abiding citizens. Therefore, it’s difficult to predict how commonplace Bitcoin ATMs will be in the future.

Buying Bitcoins the Efficient Way

The most efficient way to buy bitcoins is directly from a currency exchange. This requires a bit more time and has a steeper learning curve than using a middleman, but it is a somewhat safer and more cost-effective way to buy a large amount of bitcoins.

NOTE

Using a Bitcoin exchange is similar to using a brokerage account (like E-Trade or Ameritrade). If you’ve done any online equity trading, most of the information in this section should be familiar.

At a currency exchange, you can deposit money in one currency and offer to exchange it for another currency at a rate that you choose. For example, you could offer to exchange $1 for 100 bitcoins, but you might find few takers. Other users who already own bitcoins might be equally generous and offer to trade their bitcoins for $100 million. Neither party is likely to have its offer satisfied. However, by raising your bid and other users lowering their ask, you will eventually meet in the middle and an exchange will take place. At popular exchanges, at any given moment, thousands of bids and asks are submitted for a wide range of offered rates. But the official rate is usually a number in between the highest bid and the lowest ask.

NOTE

The more users involved in the offering, the closer the bid and ask rates tend to be. But it’s theoretically possible for the highest bid to be $200/BTC and the lowest ask to be $300/BTC, in which case it is difficult to say what the real exchange rate.

Many Bitcoin currency exchanges are available to choose from, so which one should you register with? The currency exchanges make their money by charging a small fee for every trade (usually less than 0.5 percent), so basing your choice on the fee structure is one possibility. However, more important than fee structure are security, regulatory compliance, and trade volume. Many Bitcoin exchanges have been running successfully without issue for years, but some exchanges have been hacked (i.e., robbed) in the past or pressured by government authorities into shutting down for not obeying financial regulations. Trade volume is also an important factor to consider when choosing an exchange. The larger the trade volume, the more likely you are to get a fair price for your bitcoins, and the more bitcoins you are able to buy and sell per day. A small currency exchange that trades only 10 bitcoins per day on average will not be able to fill your bid orders quickly if you are trying to buy 100 bitcoins. Large trade volume is also indicative of the trust in and security of the currency exchange.

Of the three factors to consider when choosing an exchange, only trade volume information is easy to find. Table 4-2 lists exchanges that have reasonably high volume. In lieu of concrete information about a currency exchange’s security practices and regulatory compliance, it is advisable for beginners to do business only with exchanges that have been operating for several years. The reason is that presumably, any issues with security or regulatory compliance have already been resolved or the exchange wouldn’t exist. This statement may seem unfair to new exchanges, because they might even offer better security than older do exchanges. But when it comes to matters of money, being cautious is justifiable.

Table 4-2: Bitcoin Exchanges with Reasonable Volume

|

Exchange name |

Currency pairs offered |

Physical location |

Established |

|

ANXBTC |

AUD/BTC, CAD/BTC, |

Hong Kong, China |

2011 |

|

Bitstamp |

USD/BTC |

Bank in Slovenia, HQ in UK |

2012 |

|

BTC China |

CNY/BTC |

China |

2011 |

|

BTC-E |

EUR/BTC, RUR/BTC, |

Ukraine* |

2010 |

|

CampBX |

USD/BTC |

Atlanta, Georgia, USA |

2011 |

|

Cavirtex |

CAD/BTC |

Canada |

2011 |

|

Kraken |

EUR/BTC |

San Francisco, California, USA |

2012 |

* It is not exactly clear which country BTC-E is located in, because this company maintains a certain level of anonymity. If you’re thinking to yourself, “Why would I send my money to a company if I don’t even know what country it’s located in?” then we think you’re asking a very sensible question.

The country in which you live and the currency you want to exchange for bitcoins are also factors in choosing an exchange. Some exchanges facilitate only USD to BTC operations, whereas others offer multiple currency pairs.

You might notice that some Bitcoin currency exchanges offer currency pairs you have not heard of—for example, LTC, FTC, TRC, PPC, XPM, and so on. These other digital currencies—called alternative coins or altcoins—were created after, and largely inspired by, Bitcoin. To learn more about such digital currencies, check out “The Strange World of Altcoins” on page 181.

Many exchanges also have different BTC/USD exchange rates! This means you can sell bitcoins at a higher price on one exchange and buy them for a lower price on the other exchange. So this is free money, right? Well, yes and no. If the price difference is substantial and you are the first person to notice it, then indeed you have an opportunity to make some free money. However, you do need to keep in mind the amount of work it takes to transfer non-Bitcoin money in and out of exchanges; your time and effort aren’t free. But more than likely, others will have noticed this difference before you and will have seized the free money opportunity, which is known as taking advantage of arbitrage. Any remaining difference in price between exchanges reflects the costs, due to trading fees and transfer fees (and other factors beyond the scope of this book), of moving money from one exchange to another. If one Bitcoin exchange rate is substantially different from all the others, it may indicate an underlying problem and probably should be avoided.

Additionally, it is important to remember that a currency exchange is not a bank. You should not leave significant amounts of money, whether fiat currency or bitcoins, sitting your exchange account. After purchasing bitcoins, transfer them to your personal Bitcoin wallet for safekeeping.

Buying Bitcoins from a Currency Exchange

Currently, no clear front-runner exists among the Bitcoin currency exchanges. Therefore, the following are general steps that you should apply to any Bitcoin exchange.

Step 1: Setting Up an Account and Linking to Your Bank Account

The first steps when buying bitcoins on an exchange are identical to the steps you used with Coinbase: Go to the exchange’s website, create an account, and then connect it to your bank account. Some exchanges cannot be directly linked to your bank account and instead require you to send money via a bank wire or another method.

Step 2: Transferring US Dollars to Your Exchange Account

Bitcoin exchanges are different from exchange intermediaries in that they don’t transfer the dollar equivalent from your bank account. On these sites you first need to transfer just dollars to your exchange account before you can turn them into bitcoins.

Step 3: Placing an Order to Buy Bitcoins

Once you’ve funded your exchange account with bitcoins, you can participate in the exchange market by placing an order for bitcoins. Usually, an exchange site will let you enter two types of orders: market orders and limit orders. Let’s explore the properties of each order type so you can determine which is right for you.

Market Orders

By placing a market order, you specify that you want to buy bitcoins immediately at the best price currently available. The advantage of market orders is that they are executed quickly, so you won’t have to wait for your bitcoins. Closing an order quickly is valuable if you have reason to believe the price will soon increase.

However, market orders have several important shortcomings. First, because you’re specifying that you’ll take any price to obtain your bitcoins quickly, there is always a rare chance the Bitcoin price might exhibit a momentary spike, forcing you to pay a much higher price than expected.

Second, if a commodity (any commodity, in fact) is traded at a low volume, it usually will also have a large spread, which is a large gap between the current best buy price and best sell price. Traders commonly make a guess as to the fair value of a commodity by taking the average of the buy and sell prices. If a commodity has a large spread, the price you’ll pay at a market buy price will be significantly higher than the theoretical true price. Therefore, you should use market orders only for commodities that are traded at a high volume, which would have a small spread. For the most part, bitcoins have a relatively high volume at the large exchanges. So you might be satisfied paying this small premium for your bitcoins in exchange for getting your coins immediately.

Another more nebulous risk with market orders is that they make it possible for your order to be manipulated if another person learns about your order ahead of time, even if only by milliseconds. An outside person, a person inside the exchange company, or even the actual company that knows about your order in advance could buy some coins before your order is processed and then resell them to you at a slightly inflated price.

NOTE

Surely you’ve heard about the recent high-frequency trading shenanigans on Wall Street, some of which involved similar tricks with market orders.

Limit Orders

To buy bitcoins with a limit order, you specify that you don’t want to pay more than X dollars for each bitcoin and that you’re willing to wait until you can get this price. Typically, you’ll name a price lower than the current market price for bitcoins; then you’ll wait for the price to drop to your price target. The risk with a limit order is that if the price of bitcoins keeps rising nonstop after your order is placed, your order will never execute. However, usually enough small market fluctuations occur in the Bitcoin markets that most limit orders with a limit close to a recent trade price will be successful.

Despite the extra time involved in obtaining your coins and despite the fact that your order may never be executed, a limit order has more advantages than a market order. For this reason, if you can wait to get your bitcoins, it’s best to always use limit orders.

One advantage of using limit orders is that you won’t be surprised by an unexpectedly high purchase price because you’re the one who gets to decide on the ceiling for the price. Another advantage is that you can get a decent price, even if the trading volume on the exchange is low (with a large spread). Still another advantage is that other parties have more difficulty manipulating limit orders.

One final advantage is that limit orders are considered market-making orders by the operators of the exchanges. In essence, this means limit orders narrow the spread of a commodity by putting a new price on the table, whereas market orders widen the spread by eliminating prices. Although most current Bitcoin exchanges charge identical fees for market and limit orders, in other financial markets, limit orders often are available at a discount due to the benefits they offer the exchange operators. Therefore, in the future it is likely that Bitcoin exchanges will offer special discounts for limit orders on bitcoins as well.

Buying Bitcoins the Fun and Futuristic Way

As stated earlier, the fun and futuristic way to buy bitcoins is person to person. Today, it is relatively easy to find other bitcoiners online who live in your vicinity and meet them to buy bitcoins for cash. It can be fun to meet other people with whom you share an interest in bitcoins. Of course, some risk is always a possibility when performing financial transactions with strangers, so person-to-person transactions aren’t for everyone. But we’re currently seeing a major renaissance in person-to-person transactions in many fields.

Recently created businesses—such as Airbnb (a service that helps people privately rent out rooms), RelayRides (a service that lets you rent out your car), and Moxie Jean (a site for reselling children’s clothes)—have proven that in our modern world most people are actually rather trustworthy. Additionally, if a good online rating system is available to mitigate cheating, you can perform financial transactions with strangers with relative safety.

These facts drive home one of the central lessons of the Bitcoin revolution: Technology can help society become more decentralized and less reliant on traditional, top-down companies and governments to perform many useful tasks. For this reason, person-to-person Bitcoin transactions are likely the future and might one day be faster, safer, and more cost-effective than any other Bitcoin-buying method.

Step 1: Finding Someone to Buy From

Your first step when finding a Bitcoin seller might be to simply ask your friends and family if they want to exchange bitcoins with you. Perhaps your uncle, niece, or cousin’s best friend has a large amount of bitcoins. Also, by searching local Bitcoin listings, such as the listings maintained by LocalBitcoins.com, you can find people in your area who might be willing to meet up to exchange bitcoins. Other popular local listing sites, like Craigslist, sometimes list people who want to exchange bitcoins for dollars or vice versa.

When you’re dealing with strangers, it’s always best to find out whether they’ve previously engaged in successful Bitcoin transactions. LocalBitcoins.com also has a rating system that can help you determine this information. If no information about the sellers is available, purchase only a small amount from them the first time.

Step 2: Deciding on a Meeting Place

Any public place should be fine for a Bitcoin transaction; the most popular choice is usually a coffee shop. Keep in mind that you’ll be carrying cash, so make sure you park your car in a public area if you’re driving.

If you are performing a large transaction and want more safety, several additional options may be available to you. Some banks are more than happy to lend you a conference room for a business transaction, so be sure to ask. (They might charge a fee for this.)

NOTE

For very large Bitcoin transactions, you can’t rely on an informal process. Instead, you’d be smart to get legal representation, write up a formal contract describing the transaction, and perform the trade in a law firm’s office.

Step 3: Handing Over the Money and Getting Your Bitcoins

You are at the coffee shop and are face-to-face with the seller. What happens next? Well, it depends on whether you want to use a Bitcoin escrow service as part of the transaction. We’ll explain how escrow works shortly, but let’s assume you’re not using an escrow service for this transaction (most person-to-person transactions are done without escrow).

A Face-to-Face Bitcoin Purchase Without Escrow

By convention, the person who posted the online ad is paid first. Because most Bitcoin ads are for selling bitcoins, you (the buyer) will hand an envelope containing your dollars (or other fiat money) to the seller first. (Typically, people who place ads have established a long transaction history on LocalBitcoins.com, so it’s only fair they get their payment first.)

The Bitcoin seller should then send the agreed-upon number of bitcoins to the public Bitcoin address in your Bitcoin wallet. Be sure to ask the seller to include a reasonable transaction fee in the transaction (currently, 0.0001btc is a reasonable fee). Within a few seconds, you should receive notification on your smartphone or laptop (connected to the Internet) that the money has been sent to your wallet.

For small transactions, you can now consider the exchange complete! However, for larger transactions, ask the seller to wait for additional confirmations in the blockchain. The first transaction confirmation should arrive in approximately 10 minutes and reliably guarantee that the money was transferred correctly. However, for very large transactions, you may want to wait for up to six confirmations just to be safe.

NOTE

Some wallet apps on your computer may not show the number of confirmations by default. In this case, try hovering your mouse over the transaction in question. Likely a pop-up hint will appear that will give you this information.

Problems During Person-to-Person Transactions

Most transactions are straightforward and successful, especially if the seller has an established history of legitimate transactions. However, in the rare cases that problems arise, two types of complications tend to occur.

One is getting robbed on your way to the coffee shop: This happens when the seller has set up a meeting simply as a ruse for a convenient robbery. To avoid this scenario, be cautious if a seller asks for too many details about your appearance or the type of car you drive. These questions should raise a red flag.

The other dangerous scenario plays out as follows:

• You: “Okay, here’s the envelope with my $500.”

• Fraudulent Seller: “Okay, I just sent the bitcoins to your address. We’re done!”

• You: “Hold on a second; I didn’t get a notification that the money arrived.”

• Fraudulent Seller: “I sent it properly. You’re a beginner and don’t know what you’re doing. Now you’re going to have to wait an hour for the money to show up because blah blah blah. I can’t wait here all day; it’s your fault you messed this up. Gotta run.” (The fraudulent seller then tries to hurry out the door with your envelope.)

Again, this type of scenario rarely happens and is of course outright theft. You can avoid it by dealing only with sellers who have a solid reputation. You can also avoid it by relying on a Bitcoin escrow service, as discussed next.

A Face-to-Face Bitcoin Purchase with Escrow

One of the benefits of Bitcoin is that the Bitcoin blockchain has a builtin scripting language that allows you to use some convenient and secure techniques that are impossible with other types of money. One such technique is a multi-signature transaction, which gives you additional safety when performing Bitcoin transactions with another person. A multi-signature transaction requires multiple people to agree to a payment before it can be completed. In finance-speak, this allows you to set up a Bitcoin escrow service. An escrow service is a third party that holds on to an amount of money and makes sure the transaction goes smoothly before releasing the cash. However, a multi-signature transaction is more elegant than a traditional escrow service. Theoretically, a conventional escrow service can abscond with the money, but this is impossible with a multi-signature transaction. This is because the third party does not actually have full control of the money—it is merely an arbitrator that can only make a binary decision as to whether or not the buyer or seller deserves the funds. Also, because multi-signature transactions are baked in to the Bitcoin system, they are very inexpensive to use, if not free.

NOTE

Even though multi-signature transactions are technically a slightly separate concept from escrow services, we’ll still use the term escrow service for the remainder of this discussion.

Currently, the most popular way to set up a Bitcoin escrow service is to use Bitrated (http://bitrated.com/), which is free at this time (although you need to choose an independent arbitrator, some of whom charge fees).

In addition, be aware that LocalBitcoins.com offers a similar escrow service, although it does not use Bitcoin’s multi-signature feature. Therefore, you would need to trust the LocalBitcoins.com website with your money. Also, it is more expensive than using Bitrated.

NOTE

It’s also technically feasible to set up a similar escrow system without an arbitrator. Instead of requiring the arbitrator to side with the buyer or seller to process the transaction, the buyer and seller can commit to a multi-signature transaction where they have to agree with each other. However, the money simply ends up in a black hole if a dispute transpires between the parties involved. The benefits of using this system are saving the expense and avoiding the complexity of dealing with an arbitrator. But this type of escrow is less popular because of said black hole.

Because most person-to-person transactions are completed without a Bitcoin escrow service, you’ll need to make sure the seller agrees if you intend to use this service. Not everyone is familiar with this concept yet. If you and the seller agree to use the service, your face-to-face transaction should go as follows:

1. The Bitcoin seller sends the bitcoins to the escrow service.

2. As the buyer, you verify that the bitcoins are in the escrow account as promised.

3. You hand the seller your envelope of dollars (or other fiat currency).

4. The seller signs off on the escrow, and you get your bitcoins.

As a result, at no time can the seller abscond with your dollars without sending bitcoins.

Satoshi Square

If meeting with strangers one-on-one makes you uncomfortable, you may be interested in going to a Satoshi Square event. Several major cities, such as New York, San Francisco, Boston, Toronto, and Vancouver, have had regular live Bitcoin exchanges where large groups of people meet in public spaces to buy and sell bitcoins. These meetups are also called buttonwood exchanges, named after the buttonwood tree under which the original Wall Street traders supposedly traded in the 1700s.

Still Don’t See a Buying Option That Works for You?

If none of the options discussed in this chapter meet your needs for acquiring bitcoins, you have another alternative to acquire bitcoins that is probably better than any other: Sell something to bitcoiners for bitcoins! Die-hard bitcoiners dream that someday they’ll be able to relinquish all fiat currencies. Someday, we can imagine, you won’t need to buy bitcoins with other money, because bitcoins will be the money.

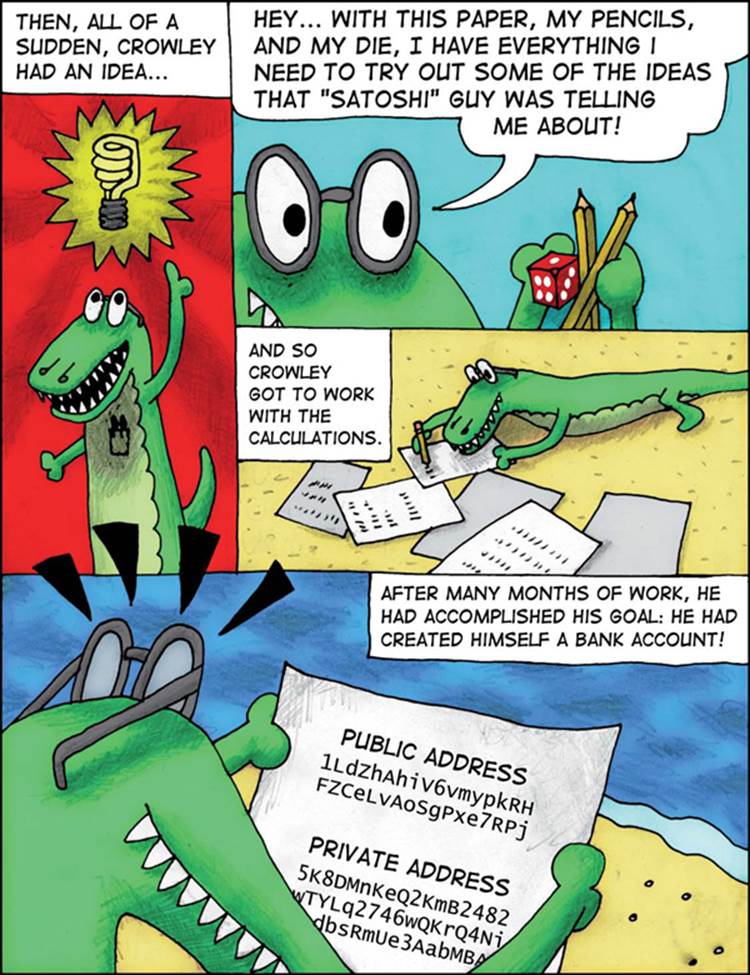

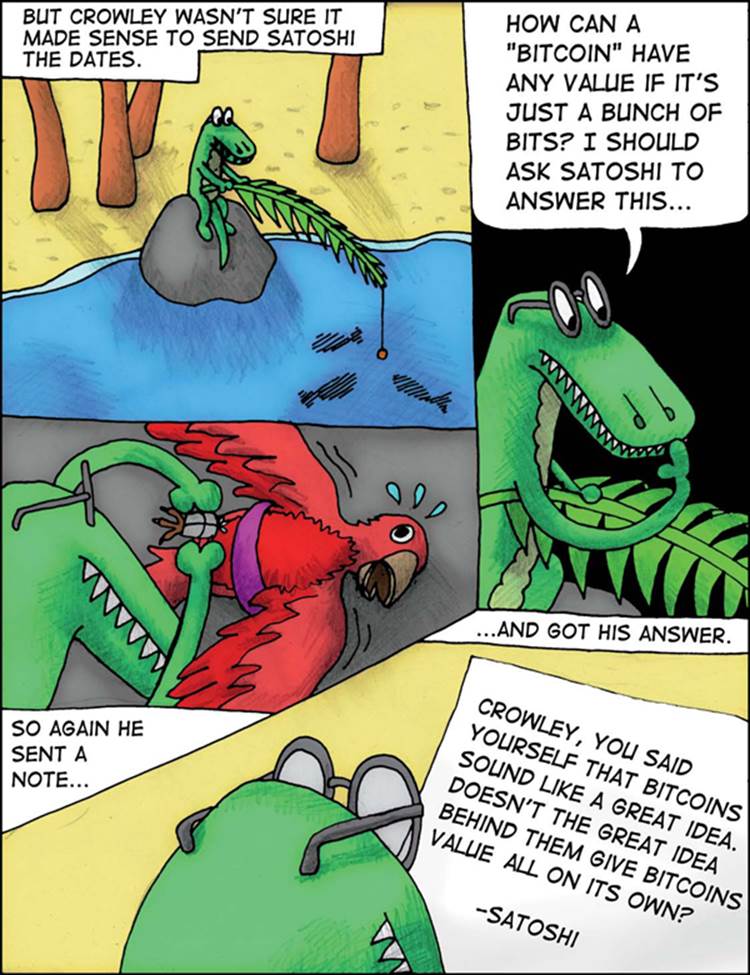

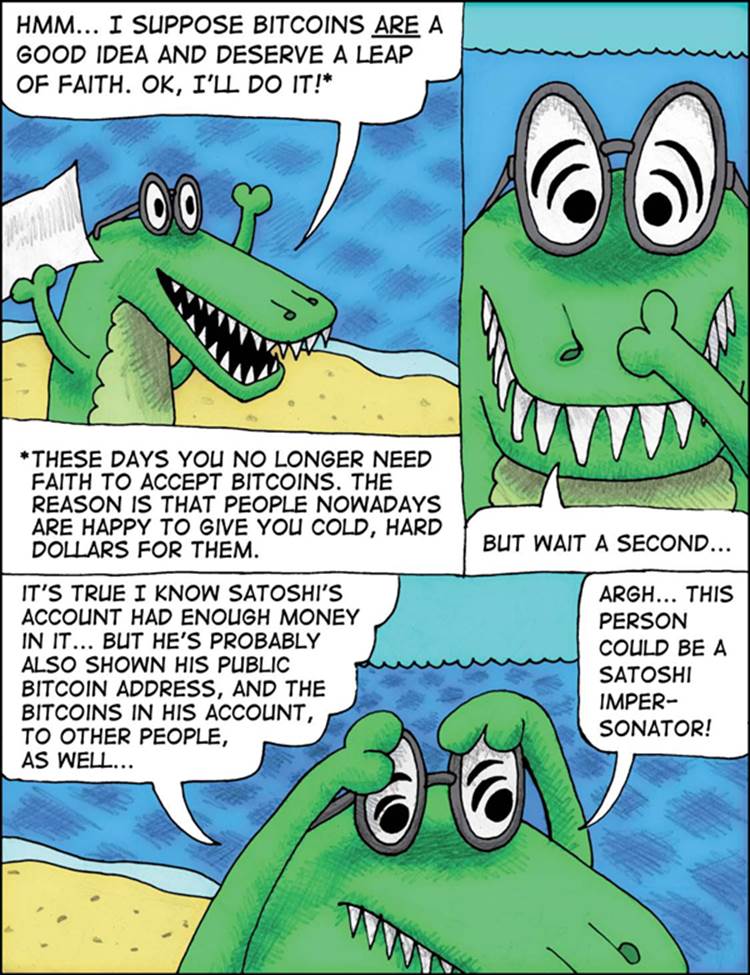

As you can see, Satoshi was able to sign a message with his own private key and thus prove to Crowley that he (Satoshi) owned a certain Bitcoin address. To understand how this is possible, you need to learn about a weird asymmetry that mathematicians discovered a long time ago:

1. It’s very easy to figure out if a large number has factors (i.e., that it isn’t a prime number).

2. It can be very, very hard to figure out what those factors are.

Now, most regular people would expect that these two ideas would be equally hard to figure out: After all, it seems like there’s no way to know whether factors exist without actually finding those factors. But as it turns out, mathematicians came up with some strange algorithms that can solve problem #1 without needing to solve problem #2 (one popular algorithm is called the Miller-Rabin primality test).

So why does this little asymmetry matter? Actually, almost every modern technology you can think of was invented by some clever person who noticed a seemingly inconsequential asymmetry:

• Antibiotics exploit tiny asymmetries in bacterial versus animal cell metabolism.

• A steam engine exploits small pressure differences between steam and water mixed with air.

• Computer chips work due to tiny differences between two impure variants of silicon, called p-type and n-type silicon.

Heck, cosmologists tell us that the only reason our galaxy exists at all is due to tiny asymmetries in the amount of matter and antimatter that were created by the Big Bang, leaving a surplus of matter that went on to create everything we see!

Anyway, some smart guys in the 1970s looked at this asymmetry in number factoring and noticed that if they multiplied two large prime numbers (which are very easy to find, given #1), it was virtually impossible to figure out what the original numbers were (because of #2)!

Most modern cryptography is based on this little fact: It turns out that using such prime numbers, you can create a private/public cryptographic key pair (we cover this cryptography in detail in Chapter 7), which is exactly what private and public Bitcoin addresses are!

Why does this matter? Well, it turns out that if you have such a pair of keys, you can do a couple of almost magical tasks with them:

1. If a person has a public key, they can create a message that only the owner of the private key can read. (This is called public key encryption.)

2. If a person has the private key, they can create a message that cannot be forged, because any person can use the public key to verify the authenticity of this message. (This is called a digital signature.)

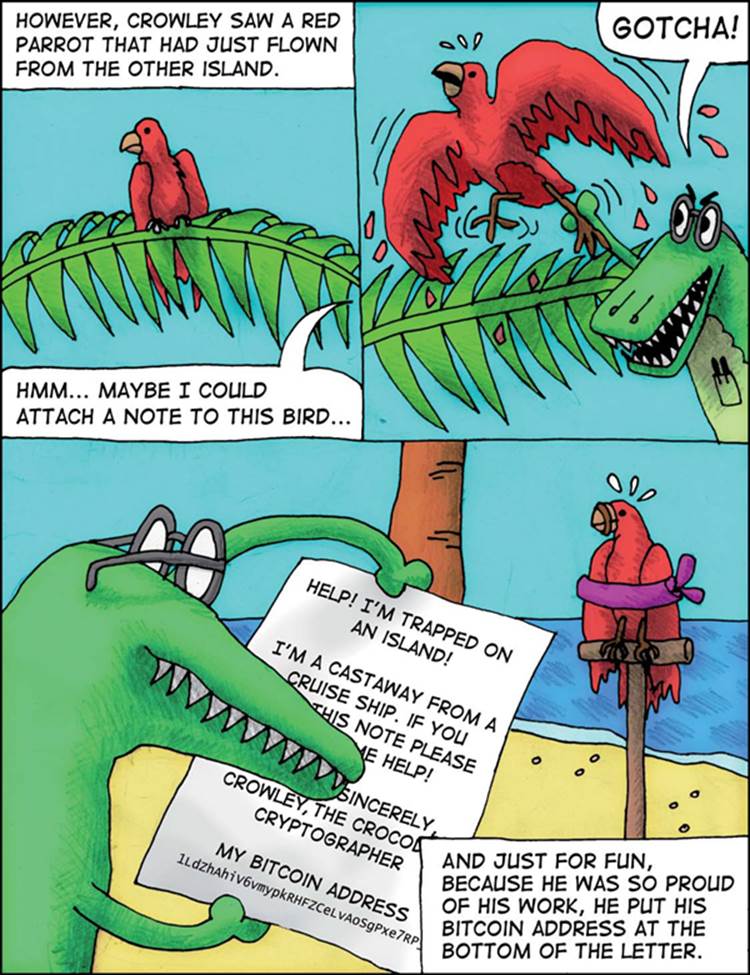

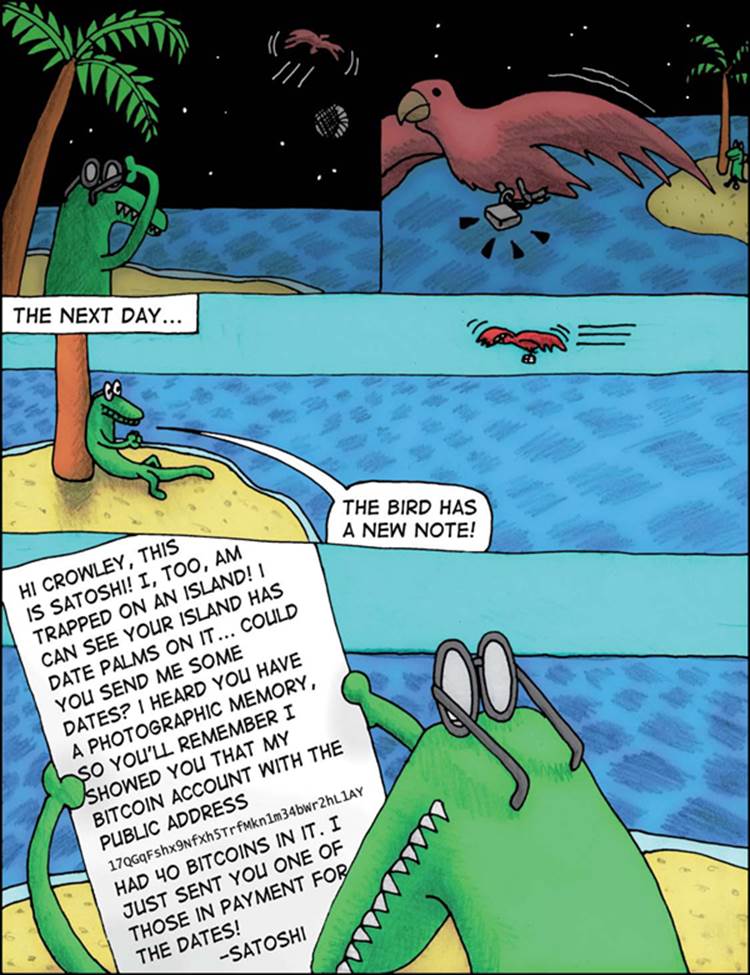

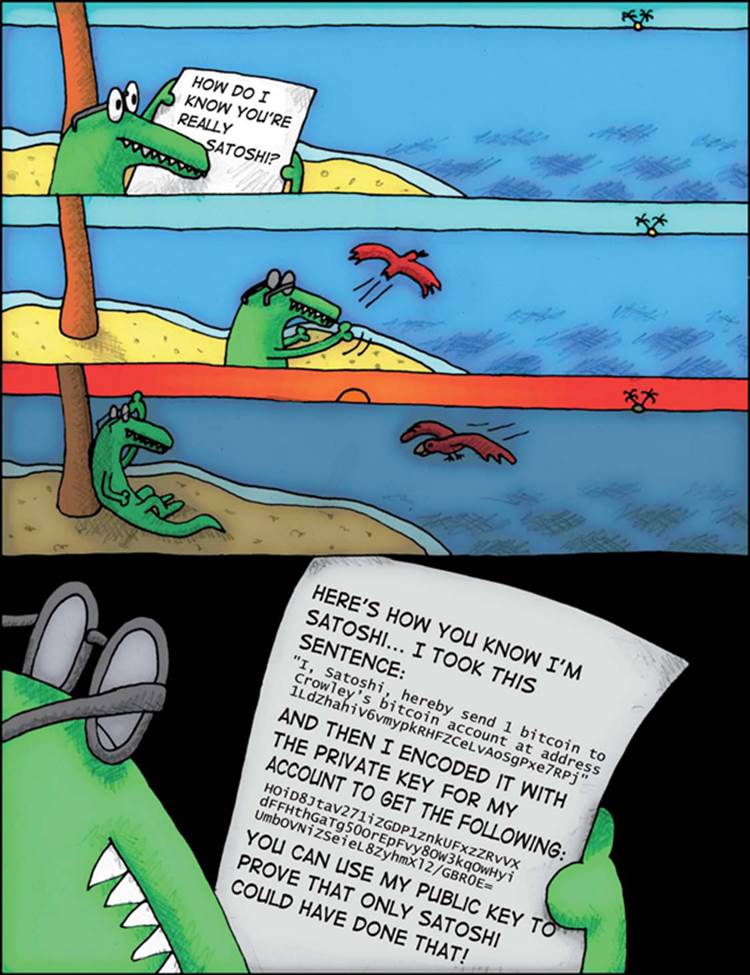

In our example, Satoshi signed a message with his private key in this way while promising 1 bitcoin to Crowley.

As you saw, this is Satoshi’s public key:

17QGqFshx9NfXh5TrfMkn1m34bWr2hL1AY

Here is the message promising the bitcoin to go to Crowley’s Bitcoin address:

I, Satoshi, hereby send 1 bitcoin to Crowley’s Bitcoin account at address

1LdZhahiV6vmypkRHFZCeLvAoSgPxe7RPj.

Here is the signature, created with the fancy-pants cryptography we’ve been discussing:

HoiD8JtaV271iZGDP1znkUFxzZRvVXdFFHthGaTg50Or

EpFvy8OW3kqOwHyiUmbOVNiZSeieL8ZyhmXl2/GBR0E=

At this point, you should be asking one very important question: Can we actually prove that this is a valid, signed message? Why yes, we can do so very easily! Just follow these steps:

1. Go to http://brainwallet.org/#verify (or one of many other sites like it).

2. Enter the message and the signature.

3. Click Verify Message.

4. You can now see that the message was signed by Satoshi, the owner of Bitcoin address 17QGqFshx9NfXh5TrfMkn1m34bWr2hL1AY!