Platform Ecosystems: Aligning Architecture, Governance, and Strategy (2014)

Part I. The Rise of Platforms

Chapter 3. Why Platform Businesses Are Unlike Product or Service Businesses

Abstract

This chapter explains how, unlike product and service businesses, platform businesses can target microsegments of their markets, create durable revenue streams, and offer opportunities to sustain higher margins. It explains how managers’ mindsets, assumptions, and mental models must evolve to be cognizant of fundamental structural differences in platform ecosystems. Therefore, platform businesses must be managed differently from product and service businesses, with architecture rather than authority and contracts providing coordination, orchestration foreshadowing conventional notions of management, and platform owners walking the tightrope between granting sufficient autonomy to app developers and ensuring integration of the outputs of diverse ecosystem participants. These differences require a shift in the managerial mindset, which an appreciation of the inseparability of the success of the platform owners from the success of app developers, an emphasis on designing for evolvability to survive Darwinian marketplace competition, and understanding how the two gears of a platform’s evolutionary motor—architecture and governance—must interlock for it to move forward. We conclude the chapter with a four-lens framework to help managers in product and service businesses spot opportunities to transform those entities into platform businesses.

Keywords

platform models; service business models; product business models; business ecosystems

It's not that we need new ideas, but we need to stop having old ideas.

Edwin Land

In This Chapter

• How platform businesses differ from product and service businesses

• Why platforms need a mindset different from products and services

• How products and services can evolve into platforms

• Four lenses for spotting platform opportunities

3.1 Introduction

To appreciate the distinctive challenges and opportunities that platforms bring, it is important to first recognize precisely how they differ from the two dominant models of industrial organization: product and service industries. The significance of platform thinking lies in the distinctive ways in which the market potential, structure, and management of platform businesses diverge from traditional product and service businesses. These differences nullify the ingrained assumptions and the managerial mindset that works well in product and service businesses. The mindset needed for managing platform businesses is sufficiently different that it throws most managers and technology professionals out of their comfort zone.

This chapter explores these differences and explains how managers' mindsets, assumptions, and mental models must evolve to be cognizant of them. Unlike product and service businesses, platform businesses can cost-effectively target microsegments of their markets, potentially create durable revenue streams, and offer opportunities to sustain higher margins than products or services in equally competitive markets. However, their structure with potentially vast armies of ecosystem partners rather than a smaller network of supply chain partners resembles no familiar product or service business. Their unique cost structures allow highly asymmetric pricing across their different sides and disperse the locus of where innovation is generated, as well as the costs and risks associated with innovation generation around the platform. Therefore, platform businesses must be managed differently from product and service businesses, with architecture rather than authority and contracts providing coordination, orchestration foreshadowing conventional notions of management, and the need for platform owners to walk the tightrope between granting sufficient autonomy to app developers and ensuring integration of the outputs of diverse ecosystem participants. These differences require a shift in the managerial mindset, which an appreciation of the inseparability of the success of platform owners from the success of app developers, an emphasis on designing for evolvability to survive Darwinian marketplace competition, and understanding how the two gears of a platform's evolutionary motor—architecture and governance—must interlock for it to move forward. We conclude the chapter with a four-lens framework to help managers in product and service businesses spot opportunities to transform them into platform businesses.

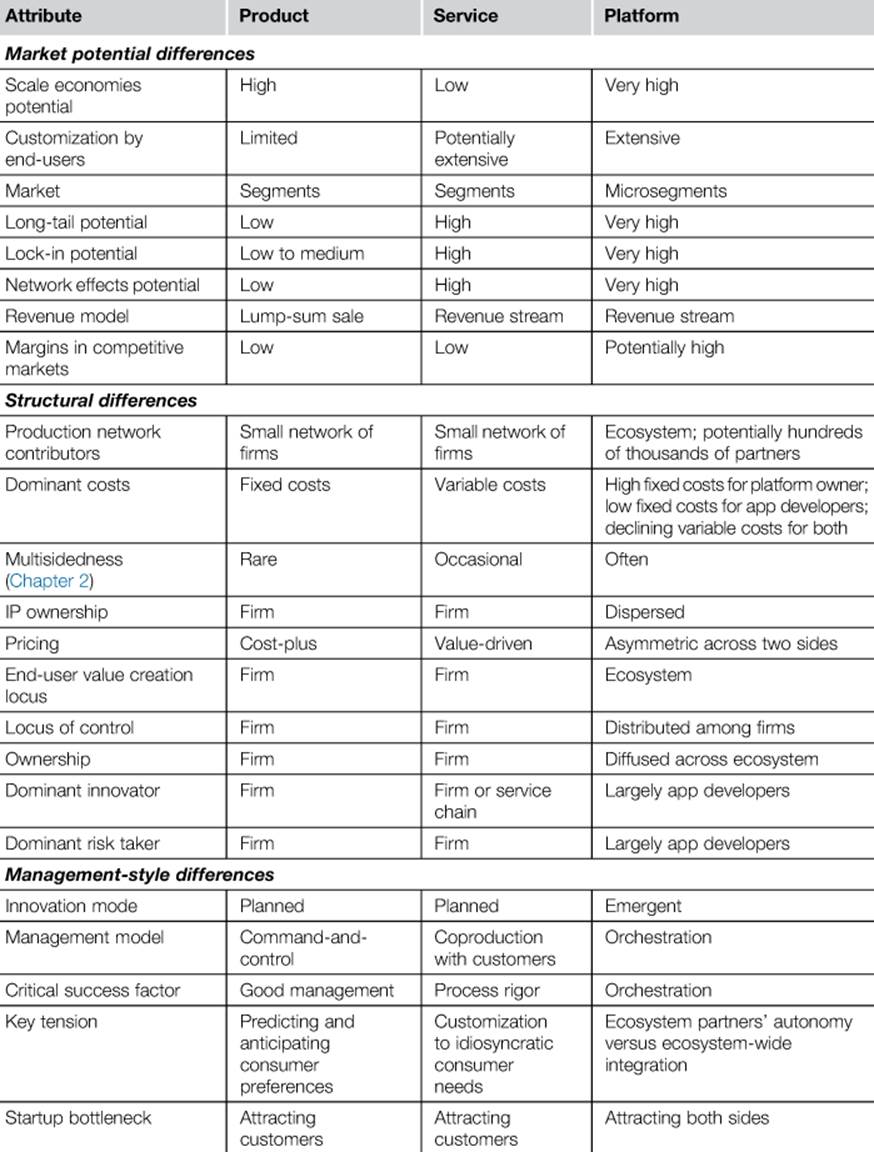

We begin by contrasting platform businesses with product and service businesses. Table 3.1 briefly summarizes the commonalities and differences among them.

Table 3.1

How Platforms Differ from Products and Services

3.1.1 Market potential differences

A key difference between products and platforms is that platforms are multisided while products are rarely so. This dramatically expands the market potential of platforms. Platforms offer the potential for economies of scale for platform owners and app developers that far exceed that in products and services. By tapping into both mass markets and long-tails of those markets through extensive customization by end-users, they can capture a larger extent of the market than even mass-produced products. Finally, they offer distinctive ways of locking in customers and potentially transforming a one-time lump-sum sale model for products into a service-like revenue stream. Lock-in coupled with the potential for strong network effects (where more users make a platform more valuable to all other users; see Chapter 2) allows successful platforms to enjoy potentially high margins in highly competitive markets compared to products and services in equally competitive markets. These features mean that the economic returns from successfully transforming a product or service to a platform significantly grow its revenue potential.

3.1.2 Structural differences

The market potential of platforms comes from their distinctive difference in how they are structurally organized vis-à-vis products and services. Although both products and services increasingly use complex supply chains spanning the globe, their size pales in comparison to the bigger platform ecosystems. Interfirm networks such as supply chains and production networks are an important source of value creation in most product and services industries. But such networks in platform ecosystems are much larger, more diverse, and more fluid (Williamson and De Meyer, 2012). They are like partner networks on steroids. Ecosystems can therefore be orders of magnitude more complex than supply chains used for products and services (Williamson and De Meyer, 2012). Contrast the 50 firms that collaborated to develop Boeing's Dreamliner or the 37 firms that contribute to producing the iPhone device to the half million app developers who develop apps for the iOS and Android platforms. But platform markets offer less concentrated control than product or service markets. A platform is only partially under the platform owner's control (Gawer and Cusumano, 2008). The ownership of a platform ecosystem and the associated intellectual property is also highly fragmented among the platform owner and app developers, unlike products and services where one firm often maintains proprietary control over its core products or services. Unlike products or services that must attract customers, platforms are inherently “multisided” (see Chapter 2); they need to simultaneously attract at least two distinct groups of participants with very different needs and motivations (e.g., end-users and app developers). But unlike products or services, the risks and costs of most innovation are borne by outsiders who are also the locus of innovation generation.

3.1.3 Management style differences

The diversity of ecosystem participants is the biggest strength of platform-based thinking, but it is also its biggest challenge. Specialization requires each participant in a platform's ecosystem to focus narrowly and deeply on their own unique capabilities and on leveraging those of others. This requires the platform owner to walk a delicate balance between granting app developers unfettered autonomy to innovate without compromising ecosystem-wide integration of their outputs. The fundamental structural differences in how platforms are organized vis-à-vis products and services means that several assumptions in how products and services are managed no longer hold. It requires control without ownership, orchestration without authority, and direction without enough expertise by the platform owner. The closest analogy that we develop extensively in Chapter 6 on governance is the notion of orchestration, where the platform owner provides just enough guidance to the platform's app developers to gently but invisibly nudge the evolutionary trajectory of the platform in a desirable direction. In platforms, emergent innovation therefore foreshadows centrally planned innovation (Dougherty and Dunne, 2011); orchestration of ecosystem partners replaces coordination through command-and-control and authority over employees and contractors. Solid execution and good management intuition still have a place, but secondary to ecosystem orchestration.

3.2 Why platforms need a different mindset

Platforms require a significant shift in the prevailing mindset among managers in the software industry as well as just about high other industry with any information content. The differences violate the assumptions that most managers are trained to make, particularly about ownership and control. And they take away the tools and frameworks that help conventional firms prosper. The five reasons for this are summarized in Table 3.2.

1. Product competition is migrating to platform competition. Competition in many industries is increasingly shifting away from product against product toward platform against platform. This means that having a superior standalone product does not guarantee market success against an inferior product with a more powerful ecosystem. This trend is pervasive in browsers (e.g., Firefox, Chrome, and Opera), smartphone operating systems (iPhone, Android, MS Mobile), Web services (Google Payments, Amazon Elastic Cloud, Hadoop), social media (Facebook, Twitter), marketplaces (SABRE, eBay), and gaming (Xbox, Apple's Touch, Sony Playstation). As software is embedded in more products—washers, refrigerators, cars, shoes—and business processes in more service businesses—hourly-wage jobs, healthcare, finance, marketing, accounting—are embedded in software, this migration toward platform competition is beginning to reach far beyond the IT industry from which it originated. In such environments, the success of a platform offering is inseparable from the platform's ecosystem partners' ability to deliver. The platform owner and complementors depend on each other and share a common fate. Innovations are not generated by a single firm, but the entire ecosystem (Dougherty and Dunne, 2011). Systems competition is therefore replacing product competition. But this requires managers to think in terms of ecosystems and manage the delicate balance between their own firms' interests and those of their partners. And it requires recognizing that their fates are intertwined. An ecosystem is not a zero-sum game: Instead of thinking in terms of how the pie can be more favorably split between a platform owner and its myriad partners, it requires thinking in terms of how the pie can be expanded.

2. Organizational boundaries are blurring. The conventional notion of organizational boundaries expands and becomes more porous in platform markets. It is increasingly difficult to draw a line where the platform owner's boundary ends and the ecosystem partners' organizational boundaries begin. Conventional coordination mechanisms and command-and-control hierarchies that make conventional organizations work are neither scalable to thousands of interdependent ecosystem partners, nor does the platform owner have the legitimate authority to dictate their work as it can in conventional organizations and supply chains. Yet the need for effective coordination is paramount for maintaining coherence and delivering value to the end-user. Nuanced and more sophisticated governance is then key to coordinating the ecosystem without stifling ecosystem partners' autonomy to innovate. Governing platforms therefore requires a delicate balance of control by a platform owner and autonomy among independent app developers. Orchestration rather than management becomes key. Orchestration entails control without the tried-and-tested coordination mechanisms of ownership and authority. Platform managers must therefore shift their mindset to emphasize orchestration over management, evolvability over stability, autonomy to innovate over control, and integration over efficiency.

3. Architecture matters. As innovation moves out of the realm of a single firm and emerges from the orchestrated effort of a multitude of specialized, independent firms, the capability to both partition and integrate the work of many independent firms in the ecosystem becomes essential to creating and sustaining a competitive advantage. Managing these dependencies is the crux of coordination. Unfortunately, all known coordination mechanisms that have served firms well in the industrial age—authority, hierarchies, multinationalization, performance metrics, ownership, contracting—are unscalable to networks of firms as potentially large as platform ecosystems. Coordination in platforms is achieved instead by their architecture—a concept largely absent in business strategy—which provides a blueprint for coordination and integration of the work of many organizations. Architecture is central for both partitioning innovation work across many firms and for integrating their work into a coherent product or service offering. Platform architecture is the DNA that—and much like our own—sets a platform on a largely unchangeable evolutionary trajectory. The graveyard of once-dominant platforms (think: Palm and Blackberry) is a poignant reminder that they were not designed to evolve. Early architectural choices by a platform owner are almost impossible to reverse later on, but influence who can participate in the ecosystem, how aggressively they invest, and their incentives to participate. Architecture is no longer just a technical decision but one with irreversible strategic consequences, both in the short term and in the long term. Architecture must therefore earn a place in the nucleus of strategy in platform markets. This requires understanding what architectural choices exist, when and how they facilitate coordination, and their longer-term business consequences. Architecture, however, is often the realm of IT departments and is outside the comfort zone of most managers. Good managers are trained to make sure that every little thing that goes into a product or service fits well. The problem is that such thinking obsesses over the upstream but forgets the downstream, where the bulk of platforms' ecosystems reside. That might be the recipe for making a good product, but not one that can prosper in a platform marketplace. Similarly, great software designers can code technical marvels but be oblivious to how their technical choices can cripple strategic options. (Chapter 5 focuses on platform architecture.) Effective platform orchestration therefore requires a nuanced appreciation at the intersection of traditionally disparate perspectives of software design and business strategy.

4. Survival requires guided evolution. Business strategy generally emphasizes predictability and efficiency. These are necessary but insufficient for a platform to thrive in a dynamic competitive environment (Katz and Shapiro, 1994; Schilling, 2000). Successful platform ecosystems don't just materialize and sustain; they need a carefully thought-out roadmap to evolve. The roadmap must be flexible enough to not be overly constraining yet be sufficiently defined to provide an overarching vision. Therefore, the focus must shift to understanding evolutionary dynamics and guiding the evolution of platforms and their ecosystems. Much like biological species, platforms that outlast their rivals are ones whose ecosystems evolve more rapidly. It is the alignment between platform architecture and platform governance that jointly determines their evolutionary trajectories, and in turn platform differentiation. But different subsystems in an ecosystem might evolve at different rates, and coping with these differential rates of change within an ecosystem is a challenge for managers. (Part III of this book focuses on evolution and its metrics and drivers in software platforms.)

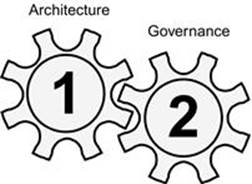

5. Evolution requires the platform’s two gears—architecture and governance—to interlock. Architecture and governance are like the gears in a platform’s evolutionary motor: one must interlock with the other for it to move the evolutionary motor forward (see Figure 3.1). Realizing the potential of thoughtfully designed architectures requires ensuring that a platform is governed to take advantage of its architecture. (Governance simply means who makes what decisions and how the pie is split among the platform owner and app developers.) The two can be perfect in isolation but will underdeliver on their potential if one does not align well with the other. Traditional software businesses pay close attention to the architecture of software products, but little to governance. Traditional business strategy pays close attention to governance, but little to architecture. The unique characteristic of platforms is the need for the two to be codesigned to interlock, and more importantly to coevolve. Technological developments might lead to incremental changes in architecture; shifts in the competitive environment can require changes in how the platform is governed. Changes in either can result in mislocking of architecture and governance, with evolutionary penalties. Managers in platform businesses must simultaneously tackle both technology and strategy decisions, which are inseparably intertwined. The two must be constantly realigned and coevolve to ensure that they interlock. This interlocking determines how well a platform responds to dynamics in the competitive environment, evolving user bases, and emergent market opportunities. This is often outside the comfort zone of most managers because it requires understanding the interplay between technology and strategy. Most managers specialized in one are rarely immersed in the other. (Platform governance is discussed in Chapter 6, and their interlocking in Parts III and IV of this book.)

FIGURE 3.1 Architecture and governance are the two gears of a platform’s evolutionary motor.

Table 3.2

How Platform Thinking Requires a Different Mindset Toward Business Strategy

|

Driver |

Traditional Product/Service Markets |

Platform Markets |

|

Migration from product competition to platform competition |

A good product that offers a valuable value proposition to customers has a fair shot in the market |

Rival platforms’ ecosystems compete with each other; a good product without a compelling ecosystem has no shot in the market |

|

Organizational boundaries blur |

Coordination is achieved through authority and command-and-control structures |

Conventional coordination mechanisms cannot scale to large platforms; alternative coordination mechanisms must be created |

|

Architecture matters |

Architecture rarely enters strategic thinking beyond centralized and decentralized organizational design choices |

Architecture provides the blueprint for coordination across thousands of ecosystem partners where conventional coordination mechanisms fall apart |

|

Evolutionary fit—not just efficiency—determines a platform’s fate |

Focus on operational efficiency and maximizing predictability |

Platforms that evolve faster outlast their rivals |

|

Coevolution of architecture and governance |

Architecture of products and services are designed separately from the governance of the organization that produces them |

Architecture and governance are the two gears of a platform’s evolutionary motor; the two must be mutually reinforcing, interlock, and coevolve |

3.3 How products and services can evolve into platforms

Most successful platforms start out as successful standalone products, and some as services or one-sided platforms. Most unsuccessful platforms that you have never heard of started out as platforms. History is replete with promising platforms that should have made history but never took off because they forgot that it takes two to tango. The biggest challenge to getting a platform off the ground is simultaneously attracting two distinct sides to the platform (see the chicken-or-egg problem in Chapter 2) (Rysman, 2009). There are ways around the problem in textbook theory (such as price subsidies), but they are costly and prone to failure in practice. The safest approach is to get one side onboard first by offering a product or service that is valuable and attractive by itself. In real options lingo (Chapter 8), this would be investing in a future option to create a platform. The iPhone did not become successful on the coattails of the iOS ecosystem; rather, the ecosystem became successful on the coattails of a successful product that was innovative, well made, valuable to buyers, and backed by good support and service. The most successful software platforms started out as stellarly successful products that subsequently evolved into platforms. The iPhone (the precursor to iOS) began life as a standalone product—not as a multisided platform—as did Microsoft Windows; so did Facebook, Skype, Amazon, eBay, Google, Firefox, and Dropbox. Only after one side—the consumers—adopted it in droves did each of these add a second side to evolve into a real platform. The iPhone added the App Store a year later, Windows added APIs, Facebook and Google added advertising, Skype and Firefox added extensions, and Dropbox added apps and API services. The very reason the second side—the complement producers—found these platforms attractive was that there was already a large group on the first side (the end-users). If your bread-and-butter is a successful product or service, you’re already past the first hurdle that stymies most fledgling platforms: Attracting the first side.

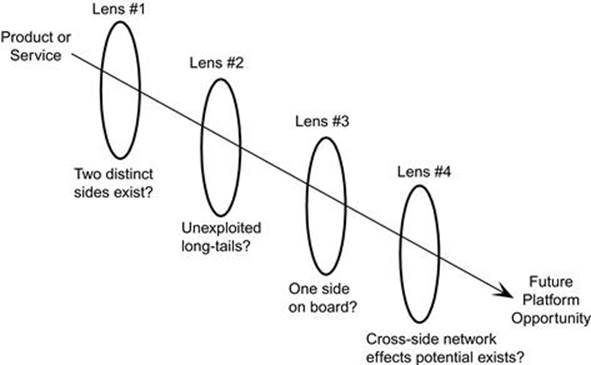

3.3.1 The four lenses for spotting platform opportunities

Many products and services have the potential to morph into a platform. But how does one recognize a potential platform opportunity? Four simple questions can get you started. These four questions are like the lenses of a telescope; you’ll spot fertile platform opportunities better if you use all four simultaneously. The four-lens platform opportunity spotting framework is summarized in Figure 3.2.

1. Can you identify at least two distinct groups who want to—but cannot cost-effectively—interact with each other? The potential for platforms is greatest where two distinct groups—say innovators and consumers—want to interact with each other more easily but cannot do it on their own (Evans and Schmalensee, 2007; Evans et al., 2006, p. 3). Each side would benefit if someone helped them find each other and transact cost-effectively—the role that a potential platform serves. It need not be impossible for the transaction to occur without a platform; it should just become easier or more cost-effective if a prospective platform can connect them in ways that they directly cannot. The platform therefore serves as a catalyst that facilitates value-creating interactions between two groups (Evans and Schmalensee, 2007). One of these two sides should be the existing core customer group of your product or service.

2. Are there long-tails in your markets that are unattractive to directly pursue but potentially attractive to smaller players in your industry? Think of the core and the niche groups of customers in your product or service’s customer pool. Pursuing the niche group—the so-called long-tails of your core market—with needs sufficiently different from your core group compromises scale economies. Would this niche group be attractive to smaller players in your industry, which is the side other than your core group in a potential platform? Here are a few questions to help identify this other side. Are the five drivers discussed in Chapter 1 creating new opportunities to digitize and unbundle activities or services that are currently done inhouse? Are these necessary to deliver your product or service but not a core competence of your company? Would you be better off if they were handled by an outside firm with a core competence in their domain? The ideal scenario is if this other side can build on your own capabilities as a starting point for their own work and would not be able to cost-effectively replicate the scale of the complementary capabilities that you can bring to the platform. In other words, your potential platform should solve at least one core problem that is common to and widespread in your product or service’s industry (Gawer and Cusumano, 2008). Can you envision ways in which these smaller firms can build their work on your own product or service capabilities? If your answers to these questions are affirmative, think of how you can create a convincing, win–win, pie-expanding proposition for this other side that you would need to attract.

3. Do you already have one of two sides on board? If you already have a successful product or service, you likely have one side already on board to evolve into a two-sided platform. Having a successful product or service is the first step toward solving the chicken-or-egg problem. The challenge then is one of crafting an attractive value proposition for getting the other side on board. (Chapter 6 describes strategies for accomplishing this.)

4. Can you envision ways to generate positive cross-side network effects? Network effects can be same-side or cross-side. Same-side network effects mean that adding more adopters of your product or service will increase its value to all your existing customers. But such network effects primarily increase the value of the product or service to existing customers and do not turn it into a platform. Cross-side network effects are when adding the second distinct group of adopters increases the value of your product or service to your existing and prospective core group of current customers. Cross-side network effects often arise when the second side you’re thinking of produces downstream complements that your core customer group (the first side) can use to enhance what they can do with your product or service. A clearly identified second side with strong cross-side network-effects potential is necessary to survive copycat competitors, noncoercively lock in both sides into a prospective platform, and create a success-begets-more-success type of self-reinforcing feedback loop dynamic in a platform. If you can identify more than one “other side,” narrow down your platform thinking hat toward the group with the clearest cross-side network-effects potential.

FIGURE 3.2 The four lenses for spotting platform opportunities.

If you can affirmatively answer at least two of these four questions, your product or service has the potential to evolve into a platform.

3.4 Lessons learned

Platform businesses differ markedly in their market potential, structure, and management approaches from product and service businesses. This requires managers to change their mindset and ingrained assumptions in how they manage a platform business vis-à-vis a product or service business. A brief summary of the core ideas described in this chapter appears below.

• Platforms have greater intrinsic market potential relative to products or services. Platform businesses offer much higher potential for generating economies of scale. Extensive user-driven customization of platforms with diverse ecosystem complements allows them to penetrate microsegments and long-tails of markets that are usually inaccessible to product and service businesses. They also offer a higher potential for noncoercively locking in customers. Like services, they can generate revenue streams rather than lump-sum sales. Products that can make the leap from product to platform can therefore dramatically alter their revenue model. Finally, the intrinsic properties unique to software platforms allow the successful ones to produce higher margins for platform owners and app developers than products or services can in equally competitive markets.

• Platform businesses are structurally different from product or service businesses. Unlike products and services that rely on a small network of supply chain partners, platform businesses rely on potentially vast ecosystems of outside innovators. Platforms are always multisided, with ownership of assets and intellectual property as well as control dispersed among members of the ecosystem. Because of their unique cost structure where the platform owner faces higher fixed costs than app developers, and the potential for self-reinforcing network effects and lock-in over app developers and end-users, pricing across the two sides of a platform business can often be asymmetric (with one side often heavily subsidized). Unlike product and service businesses where the focal firm is the dominant innovator and risk taker, the dominant innovators and risk takers in platform businesses are often the app developers. App developers are therefore often the primary locus of innovation generation in platforms. In return, they also have greater prospects for more handsome payoffs in the marketplace than do suppliers in conventional supply chains of product and service firms.

• Platform businesses must be managed differently from product or service businesses. Unlike product and service businesses where innovation is an outcome of careful planning, innovation in platform businesses is often emergent. The platform owner lacks legitimate authority over app developers to command and control them like employees or contractually bound supply chain partners in a product or service business. Orchestration therefore foreshadows traditional management and process control in platform businesses. The initial challenge of attracting at least two distinct sides to the platforms is therefore as prominent as the need to anticipate and predict customer needs that predominates product and service businesses. The biggest ongoing challenge for platform owners is to balance the delicate tension between respecting the autonomy of its ecosystem partners without compromising the seamless integration of their outputs back into the platform’s ecosystem.

• Platforms need a different managerial mindset. Four assumptions that are reasonable in product and service businesses need to be altered to adapt the mindset with which managers approach platform businesses. First, platform businesses pit a platform’s ecosystem against a rival ecosystem. The success of a platform is inseparable from the success of app developers. It is as important for the platform owner to help the app developers deliver on their promises as it is for it to deliver on its own promises. Second, conventional coordination and control mechanisms that fare well in product and service businesses are unscalable to growing platform ecosystems. Architecture must then assume the dominant coordination and control role. Architecture is usually outside the realm of most managers and strategy is outside the realm of most software architects. This chasm must be bridged for architectural choices to be strategically sound, and platform strategies to be evolvable. Third, platforms that evolve faster are more likely to survive evolutionary competition. Unlike product and service businesses that are designed with short-term efficiency and effectiveness, platform businesses must also emphasize designing for evolvability. Finally, architecture and governance are the two gears of a platform’s evolutionary motor. This requires managers to understand how they can be codesigned to be mutually reinforcing and interlocking, and subsequently how to coevolve them.

• The potential opportunities for evolving products and services into platforms can be spotted using the four lens framework (Figure 3.2). The four thought experiments to recognize this potential for morphing using this framework are: (1) identifying at least two distinctgroups who want to but cannot cost effectively interact, (2) recognizing long-tails in your markets unattractive to you but attractive to other smaller players in your industry, (3) having one of these two sides as the core customer group of your product or service, and (4) identifying ways to generate positive cross-side network effects.

In the next chapter, we delve into how platforms offer a distinctive value proposition to three types of participants—platform owners, app developers, and end-users—with different needs and motivations for joining a platform. We also describe how a platform-centric model can potentially deliver compelling value to these three groups in ways that a product or service without a platform rarely can.

References

1. Dougherty D, Dunne D. Organizing ecologies of complex innovation. Organ Sci. 2011;22(5):1214–1223.

2. Evans D, Schmalensee R. Catalyst Code. Boston, MA: Harvard Press; 2007.

3. Evans D, Hagiu A, Schmalensee R. Invisible Engines: How Software Platforms Drive Innovation and Transform Industries. Cambridge, MA: MIT Press; 2006.

4. Gawer A, Cusumano M. How companies become platform leaders. Sloan Manag Rev. 2008;49(2):28–35.

5. Katz M, Shapiro C. Systems competition and network effects. J Econ Perspect. 1994;8(2):93–115.

6. Rysman M. The economics of two-sided markets. J Econ Perspect. 2009;23(3):125–143.

7. Schilling M. Toward a general modular systems theory and its application to interfirm product modularity. Acad Manag Rev. 2000;25(2):312–334.

8. Williamson P, De Meyer A. Ecosystem advantage: how to successfully harness the power of partners. Calif Manag Rev. 2012;55(1):24–46.

*“To view the full reference list for the book, click here or see page 283.”