The Resilient Investor (2015)

CHAPTER 7

Dancing with the Future

Resilient Investor Profiles:

What Is Your D-Type?

CHAPTER 6 OPENED SOME PRETTY BIG WINDOWS, LOOKING BOTH inward and outward. With a view in each direction, the panorama invites you into the vast potential and freedom that resilient investing offers. You can see how to embrace the qualities of the martial artist, gracefully moving across the landscape of our future, engaging its unlimited potential, and aware of its unprecedented challenges.

In this chapter we see how your assessment of future scenarios helps shape the ways you direct your investments across the RIM. We will have a bit of fun with this, introducing some characters that represent various perspectives on the scenarios. They provide a playful and practical way to ensure that your resilient investing plan reflects your best thinking about what the future will ask of us. You will undoubtedly see some of yourself in one or more of these archetypes, and you’ll draw on the insights you find here when you design your new RIM in chapter 8.

While these examples illustrate a range of opinions and feelings about how to be in the world and best face its future prospects, we recognize that there is a common thread that unites people of all worldviews: we all try to be diligent and discerning about the choices we have before us. Therefore we are honoring this human commonality by defining our distinctions with descriptions that start with the letter D!

The D-Types Guide to Future Forecasting

Most of the D-dudes and D-dames you are about to meet hold a mixed view of the future, though, as you will see, several have an abiding faith in one particular scenario. In these narratives you will see that each D-type’s view of the future—his or her weighting of the scenarios’ likelihoods—leads to a generalized curve that illustrates the respective forecast; and each D-type is likely to use a distinctive mix of the three investment strategies introduced in chapter 3.

We suggest that you consider connecting your selection of investment strategies (the columns in the RIM) with your assessment of the future. For example, if you rank breakthrough as having a significant probability, it is likely that you will want to devote a proportionate amount of your eggs to the evolutionary strategy. If you think breakdown is on the horizon, you might not want to have everything invested in the global economy. And if, like most of us, you are uncertain just where we are headed, you will want to be prepared for more than one scenario.

Without further ado, let’s meet our merry band of investment caricatures! We start with three fairly straightforward ones, each of whom is closely tied to a single scenario: the Doomer, the Dreamer, and the Dealer.

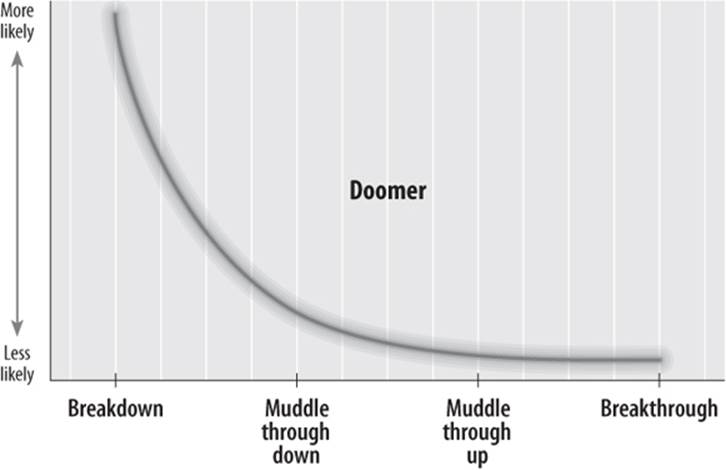

The Doomer

The Doomer is convinced that we have already overstretched the earth’s resources and distorted social equity to the point that environmental and socioeconomic breakdown is inevitable. SEE FIGURE 5 Some are hunkering down to survive in a dystopian wasteland, while others are looking for constructive ways to prepare for a postindustrial world, trying to create a soft landing by working together to make it happen. Either way their primary investments are made according to the close-to-home strategy, with survivalists focusing more on personal and tangible assets and skills, and soft-landers putting significant energy into community and regional resilience.

Figure 5 The Doomer Curve

Some will move all of their money out of the global economy column; others may keep a foot in that world, ready to divest when things really start to crumble. There will be little focus on the evolutionary column, as the emphasis is more on hunkering down with their guns, solar panels, and food or on reviving preindustrial rhythms of local self-sufficiency. Still, a few of those who have concluded that we are doomed will continue to put energy into evolutionary initiatives, including personal growth, ecosystem regeneration, and new forms of currency and exchange.

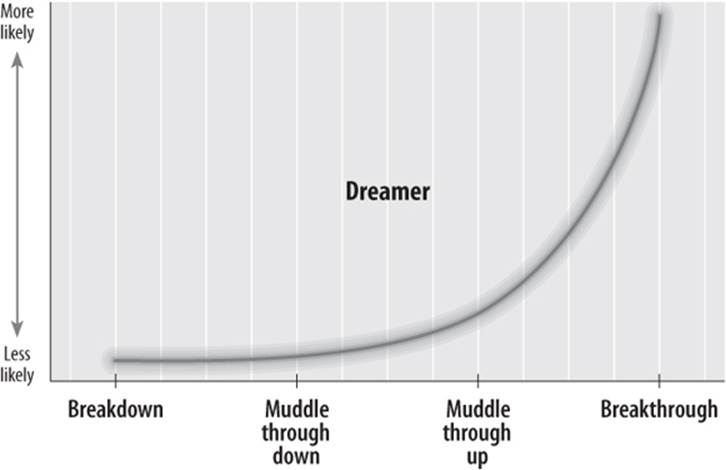

The Dreamer

The Dreamer has great faith in humanity’s evolutionary destiny and is eager to be in the vanguard of the change he or she wants to see in the world. SEE FIGURE 6 Not surprisingly, most of a Dreamer’s investing energy is directed toward the evolutionary strategy, with a significant secondary focus on building healthy and sustainable homes and communities. For many Dreamers there is little purpose in remaining invested in the global economy, which seems devoid of dreams; though as with Doomers, there is a place for limited engagement in areas of the global economy where they feel they can make a difference, including personal buying and lifestyle decisions.

Figure 6 The Dreamer Curve

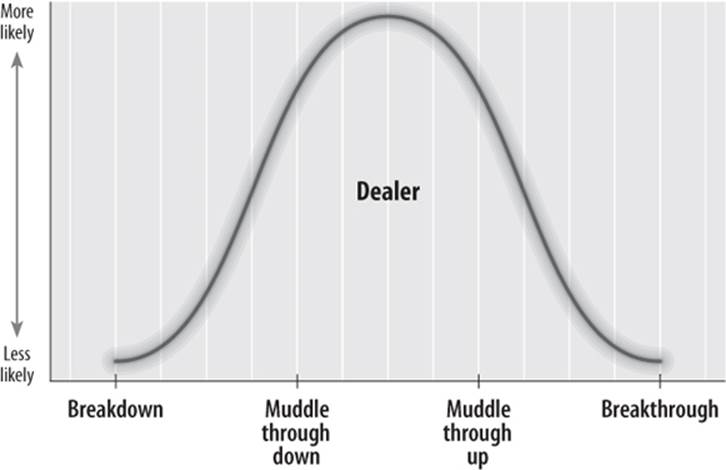

The Dealer

The Dealer buys heavily into the muddle-through scenarios, as he foresees that the system as it is will continue to hold together through thick and thin. SEE FIGURE 7 Dealers are aware of all of our challenges and are doing their best to “just deal with it,” trying to make things better. They will often seek out investment options that are more in line with a muddle-through-up scenario, emphasizing investment in a sustainable global economy strategy while leaning away from investments and personal choices with negative social or environmental consequences.

Figure 7 The Dealer Curve

Dealers slightly hedge their bets because they recognize that our current trajectory is uncertain. They may put a bit into forward-looking breakthrough efforts and some toward local and personal resilience that provides a buffer against modest systemic upsets or possible breakdown scenarios.

Now we turn to a couple of interesting blends: the Dualist and the Driver.

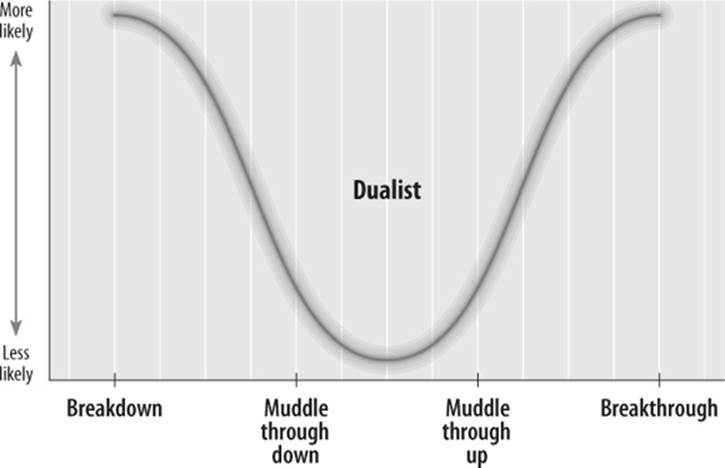

The Dualist

The Dualist is pretty sure we cannot keep going the way we have been and can easily see the potential for either breakdown or breakthrough. SEE FIGURE 8 Some Dualists are simply of two minds: either we will break the world that we have known or we will create an amazing ecosensitive civilization. Other Dualists suggest that we will veer toward the ditch of breakdown but that the shock of that will spur great creative energy and a marshaling of economic resources that spur a subsequent breakthrough.

Figure 8 The Dualist Curve

Both types of Dualists will be heavily invested in close-to-home and evolutionary strategies (with recognition that close-to-home is beneficial for either of the Dualist visions), while their participation in the global economy will vary depending on their job and life circumstances, with investments focused on green technologies and necessary tangible goods.

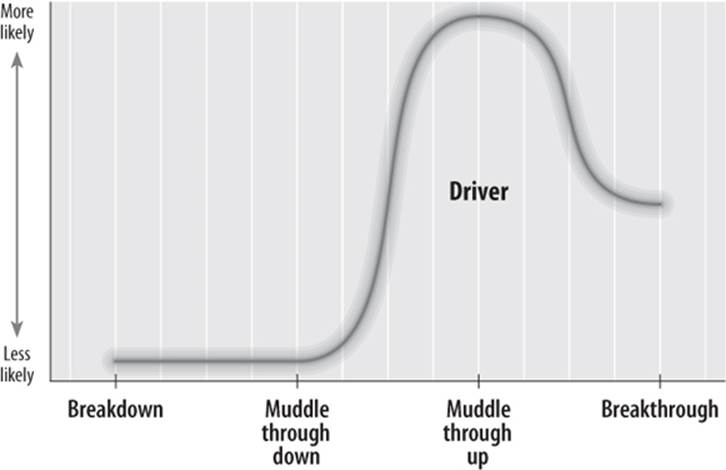

The Driver

The Driver is an eco-techno-optimist. SEE FIGURE 9 Drivers see the dangers on the road ahead but say we just have to drive the car with more care and foresight. To paraphrase one of the seminal Drivers, Stewart Brand, we are at the wheel and might as well get good at it. Drivers put a lot of juice into new technology and renewable energy, both in their homes and by investing in leading-edge companies. They also emphasize the evolutionary strategy, especially social networking and building global community.

![]()

Figure 9 The Driver Curve

The D-types we have introduced here are just some of the more common or obvious archetypes; look around and you are likely discover a dramatic diversity of dames and dudes: the Doer, activists short on cash but rich with personal/social passion and drive; the Dawdler, who has good intentions but does not get around to implementing them; the Depleter, stubbornly insisting that the blind pursuit of private benefit is entirely justified; the Denier, who insists the global economy and environment are fine and has full faith in business-as-usual to carry us forward; the Defender, of the earth or social justice; and the Dynamo, a catalyst for spurring people’s time, attention, and money into new arenas.

What Is Your D-Type?

So, who are you? Does one of our D-types strike close to home, or do you see yourself standing somewhere else in this community of resilient investors? As entertaining as our little archetypal survey may be, these past few pages are actually meant to prod your thinking and open some new windows of self-perception.

Consider:

![]() How much credence do you give to each of the scenarios we sketched out in chapter 6?

How much credence do you give to each of the scenarios we sketched out in chapter 6?

![]() How confident are you in that assessment? Do you have strong feelings, or are you more undecided?

How confident are you in that assessment? Do you have strong feelings, or are you more undecided?

![]() Does one particular scenario stand out as the most solid and prudent foundation for your resilient investing plan? If so, how much do you want to hedge your bets by preparing for the other scenarios?

Does one particular scenario stand out as the most solid and prudent foundation for your resilient investing plan? If so, how much do you want to hedge your bets by preparing for the other scenarios?

![]() If you are giving serious consideration to either breakdown or breakthrough, what sort of time range do you envision for there to be a decisive break from our current muddling ways? One year? Twenty years?

If you are giving serious consideration to either breakdown or breakthrough, what sort of time range do you envision for there to be a decisive break from our current muddling ways? One year? Twenty years?

These are substantial questions, so take some time to reflect on them; the answers will shape your resilient investing plan for years to come. Your first thoughts tell you one thing; returning to the questions after a few days or weeks may reveal new answers or directions.

The D’s Go Dancing

Before we turn to helping you develop your resilient investing plan, there is one more essential element that needs to be woven into your self-assessment. You may have noticed that our D-types—including the one you most identify with—each have a fairly solid picture of the future and of their “ideal” mix of strategies. Yet by that very quality, they are falling short of the promise of our system: The resilient investor is supposed to be “ready for anything!” Yet each of our D-dudes has neglected some pieces of the puzzle. Yes, indeed, we have left our dude of all dudes, Mr. Versatility, for the end; here he comes now, along with the dame of dames, Ms. Adaptability. Ladies and gentlemen, we are pleased to introduce you to the Dancers!

The Dancers

The Dancers embody the spirit of the martial artist you met in chapter 6: eyes soft and clear, feet light, at home in each and every one of the nine zones of the RIM. This does not mean Dancers have their assets allocated evenly among all nine zones—that would be just as rigid as being devoted to a single strategy or to any unchanging allocation pattern. Dancers nearly always have some degree of investment in every zone, though the weighting they use will be shaped by their worldview, just as with all the other D-types. Indeed any of the D-types we have introduced can become Dancers: just broaden your horizon a bit and you too can be a Dancing Driver or a Dualist Dancer.

Whatever D-type you may be, the final question we encourage any budding resilient investor to ask is: How can I become more of a Dancer? Dancers always remember that whatever their assessment of the future may be—and however they see each scenario’s likelihood—the world is indeed in flux, and they need to remain poised to shift their weight and promenade a few steps in a new direction when the music slows, their children or partners in life have new needs, or the ground beneath them shifts a bit.

Good Dancers will review their investments of both time and money once a year or so; and they make sure that they have clarified how they will assess the returns they are getting on their personal and tangible assets (we offer some tips in chapter 8). They may shuffle time and money among various activities within many of the zones to get familiar with the full range of options at their disposal, and by so doing they become more experienced in making their allocation decisions as the years go by.

As their lives unfold, the areas of the RIM that Dancers prioritize for new and additional investment shift as conditions change:

![]() The global situation and opportunities

The global situation and opportunities

![]() Their personal financial situation

Their personal financial situation

![]() The stages of their life

The stages of their life

![]() The evolution of their own particular passions and capacities over the course of their life

The evolution of their own particular passions and capacities over the course of their life

As you design your own resilient investing plan, be sure to consider what you might add to your initial D-type mix that would help you become a better Dancer. The specific changes will be very individualized; you should target areas of growth that complement what you are already doing, adding to your long-term responsiveness and resilience. Maybe you are a good waltzer, but is it time to tango? Learning new steps means you will be ready when the music changes.

Now, having gained some deeper perspectives on resiliency and our future in chapter 6 and with your newly discovered D-identity in hand, it is time to roll up your sleeves and start designing a fresh, new version of your RIM that reflects all you have learned and all you hope to create in your life.