The Resilient Investor (2015)

CHAPTER 9

Tales of Resilient Living

The Authors’ Stories

NOW THAT YOU HAVE LEARNED TO DANCE AND DESIGNED YOUR RIM, perhaps your head is spinning as you consider the multitude of destinations that you could choose to visit. We have asked you to do some challenging work, but now you can put away your colored pencils and sketches. This chapter offers a change of pace and provides a more personal perspective on the journey.

Travelers have always gathered together, around watering holes and in roadhouses, to unwind, share stories, and tell tales. Swapping travel guides and poring over tattered maps is half the fun of it all! More importantly, it helps us remember that the map is not the territory; even a big map can convey only a fraction of what you will find once you get started.

In this spirit, here are three snippets about how we are personally using the Resilient Investing Map. Of course we don’t hold ourselves up as role models; each of us has banged his head against many hard objects, juggled too many balls in the name of wanting it all, or found his own bad habits getting him into trouble. And we are not the most diverse collection—three college-educated white guys who all co-own a specialty investment company. Yet we’ve earned our gray hairs by practicing what we preach, particularly in the investment realm; we hope that our experience and expertise offer some lessons that have value to others.

So make yourself comfortable, and the Natural Dudes will regale you with some highlights from our travels. As you will see, we all use the RIM differently, and each shares his tale in his own distinct voice and style.

Hal Brill: Dilemmas of a Dualist

It ain’t easy being a Dualist! We lack faith in the status quo but are uncertain about what might replace it. Some days I’m optimistic that the long trajectory of civilization will continue on its arc of development, with new technologies in the service of evolving human consciousness bringing us into a breakthrough future. Other times I’m dejected, seeing that we are destroying the biosphere and mired in economic and social quicksand. This is my Dualist cross to bear, and I know I’m not alone, so let me tell you how I’ve lightened its load.

I was raised with a great love of nature, so it was fitting that my first jobs were in outdoor education. But I was keenly aware that my students would forget what they learned as soon as they returned to their suburbs and cities, places that to me symbolized man’s separation from nature. I felt that society as a whole needed to change, but I did not know what I could do about it.

So I traveled, including a pilgrimage with a group called Walk for the Earth, crossing the United States and Europe. Later, in remote Middle-Eastern villages, I saw Coca-Cola signs and TV antennas beaming in Western consumer values. All of this reaffirmed my commitment to activism in my home country. Now, using the RIM, I can see that I was investing my time and energy (I didn’t have extra money) into zones 1 and 2.

On my thirtieth birthday, I moved to Santa Fe, New Mexico, where I helped launch several organizations. My passion was to start an “eco-village,” demonstrating how to sustainably meet human needs (zones 3 and 6). I participated in community finance, as it was necessary to raise capital to make this dream a reality (zone 7). Many of the ecological design principles we promoted worked their way into the mainstream (zone 6). But I also learned some painful lessons, as our band of visionaries fell short on our dream of creating the model village.

Next I helped my father, Jack Brill, research his book Investing from the Heart: The Guide to Socially Responsible Investments and Money Management, and we soon founded Natural Investments. Paul Hawken’s The Ecology of Commerce: A Declaration of Sustainability strongly influenced me, as it clarified the importance of mobilizing corporations to address the spiraling ecological crisis (zone 8). Knowing that capital could be a potent leverage point, I decided to become a financial advisor so that I could help investors shift their money.

But as a Dualist, this choice felt strange. I wanted nothing to do with Wall Street! The global economy always seemed tenuous to me; I couldn’t fathom how a system that depends on exponential economic growth could continue indefinitely on a finite planet. Fortunately, I found business partners who shared a vision of growing an investment company that does consider systemic risk and offers meaningful alternatives.

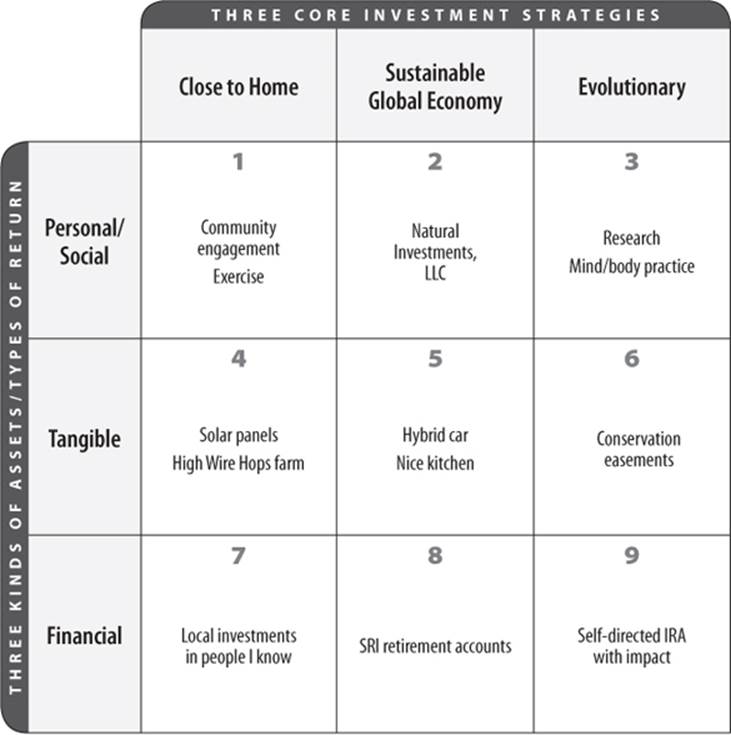

Today my resilient investing plan looks something like this. SEE FIGURE 14

Close to Home

My wife and I designed a natural, passive solar home, and Hawks Haven, a green neighborhood in tiny Paonia, Colorado. We voraciously support our local farmers and serve on nonprofit boards. I have invested in an organic hops farm and have lent money to neighbors for their land purchases. I’m always looking for ways to enhance local and regional resilience.

Sustainable Global Economy

This has been my main livelihood focus, and my retirement money is invested using Natural Investments portfolios. We try to make our purchases as green and conscientious as possible. I would like to get an electric bicycle to help me up the hill with our farm produce and groceries.

Figure 14 Hal Brill’s RIM

Evolutionary

This has mostly been about learning, personal growth, yoga, hiking and skiing, and playing the bass. I have protected land with conservation easements, invested in tree farms and solar projects, and have long been part of the community investing world, both through my work and as an investor. My goal is to use this book as a platform to help bring about an evolutionary future!

Most of my life has unfolded in a mostly unplanned manner; John Lennon’s well-known line about life being what happens while we are busy making other plans resonates with me. I regularly spend time in nature, reflecting on my life and noticing what a long, strange trip it’s been. I’ve never been disciplined enough to do the 3 × 5 card process in chapter 8, but I do find it exceedingly helpful to sketch out my RIM at least annually so that I can see how things have unfolded and glimpse areas for future focus.

Michael Kramer: Weaving the Dream

As a Dreamer, I am the first to embrace anything that can help raise consciousness and improve the human condition. While being aware of the structural problems and risks of civilization’s trajectory, I prefer to focus on game-changing solutions and feel fortunate to have discovered the sustainable design discipline of permaculture 25 years ago. That inspiration gave me hope and spawned investments in my own learning and teaching about regenerative living (I still lead a permaculture teacher training periodically), conscious shopping and business practices, and sustainable and responsible investing. I was one of Hal’s first clients in 1990 before joining the firm as an advisor in 2000.

I moved to Hawaii in 1999 as I was studying for my securities license, a decision steeped in resilient thinking. I wanted to live in a place with year-round agriculture and adequate water and also felt the need to make more money to support my family. More profoundly, I was harboring some major political and economic concerns about the future direction of the country and so wanted to have “lifestyle immunity” from mainstream America; I had every intention of moving to another country if things fell apart in the United States, so it felt like a strategic self-preservation move. As I sit here 15 years later writing this from my outdoor home office overlooking a jungle forest, it feels like one of the best decisions I ever made.

I have explored green lifestyle choices for 25 years, joining CSA farms, building a passive solar house with radiant floor heat, catching rooftop rainwater, and having vegetable gardens and fruit and nut trees. Here on Hawaii Island there is a sense of food abundance, and I can trade my homegrown produce for fish. To foster community self-reliance, I eat and buy locally as much as possible, including owning a diesel Jeep so that I can use biodiesel fuel produced from locally sourced waste oil. I am fully committed to recycling, composting, and shopping at locally owned businesses whenever possible. I even founded the island’s Think Local Buy Local campaign to encourage this.

I am also working to create an eco/agricultural neighborhood on Maui that will fulfill my dream of living in community among fields and orchards of organic food, using renewable energy, and living in the greenest possible home. This seems resilient for my future food, shelter, and energy needs and will intentionally diversify and localize my income.

A great deal of my time and energy goes into being a voice for positive change through civic engagement, writing columns, and volunteerism, including my role on the national SRI policy committee and dialogue with corporate management. Local green economy and sustainability initiatives are another focus of my time. I am active at the state legislature on matters of sustainability and environmental protection, and I serve on civic commissions and nonprofit boards.

Clearly, I invest a lot of time and personal energy in pursuit of my Dreamer agenda. Meanwhile my financial assets primarily include co-owning Natural Investments and investment properties; I also have an IRA with SRI mutual funds and community development investments. These support societal resiliency and my eventual retirement, though I am aware of how tied to the global corporate economy my livelihood is.

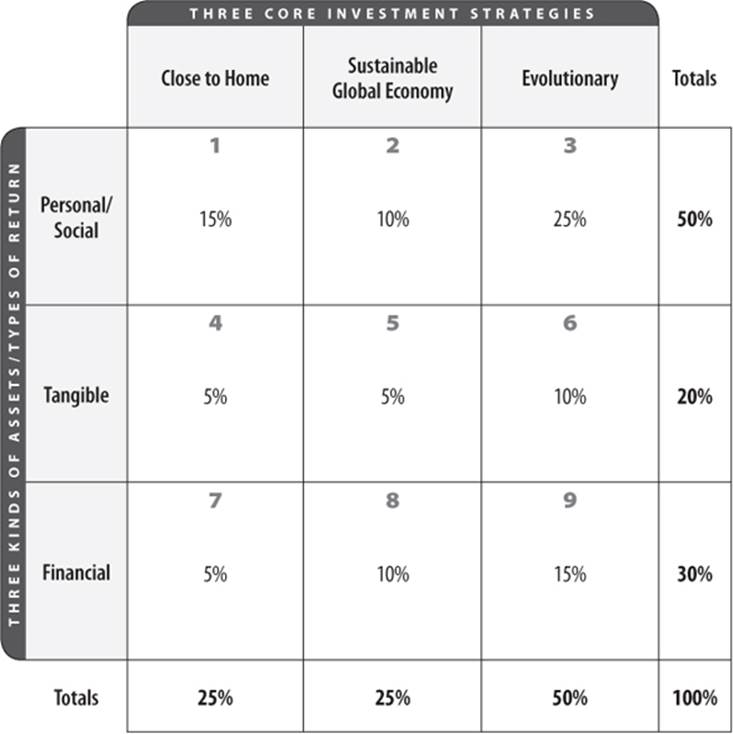

Using the RIM to roughly quantify my overall allocations of time, attention, and money among the nine zones, I have concluded that half of my overall investments are engaged in various evolutionary strategies and that I also clearly prioritize growing my personal assets. SEE FIGURE 15

Being a Dreamer means I have a lot of hope for the future, and my investment allocation reflects that. I continue to work on ways to devote more attention to self-care, especially practicing yoga and playing music, and for my daily life to be more under my local control should the global corporate economy struggle in any significant way. I have other dreams to pursue in the coming years: recording an album, writing more books, public speaking, perhaps even running for elected office. Where’s a cloning machine when you need one?!

Figure 15 Michael Kramer’s RIM

Christopher Peck: Road Map of a Dancing Driver

I see myself as a Dancing Driver. If I had a tagline, it would be I get it; there are problems. How do we solve them? Or maybe, Don’t fight the system—replace it. As an Eagle Scout (“Be prepared!”) and lifelong designer, I love to step back and reflect on systems, evaluate options, decide, act, and persuade others to join me. From a scenario perspective, I believe we have been muddling through up for centuries; Hans Rosling’s graphical representations prove it for the past 40 years,1 and I think that will continue to be our destiny. But I learned about global warming in 1991, and I am old enough to have seen some of my woods turned into parking lots, so I’m sympathetic to breakdown concerns.

I’m inspired by Stewart Brand and Kevin Kelly and the invocation to use tools and ideas to change the world. I clearly remember sitting in the basement of the St. John’s College library in Annapolis in 1987 and discovering the Whole Earth Catalog. I buried myself in it until the library closed, with a mixture of mind-popping delight (so many cool things in one place!) and under-the-skin frustration (why had no one shared this with me before?). Whole-systems thinking, inspired by Buckminster Fuller and Eastern philosophy, became my basis. I found permaculture in 1990, when co-founder Bill Mollison visited Santa Fe, New Mexico, and was enthralled with the comprehensive and positivistic approach.

I left Santa Fe in 1999 to come to California and build a sustainable investment business, with a 10-year plan to find a life partner, buy some land to develop a homestead, and root myself into a climate and a community with more inherent resilience than the high desert. California has its own challenges with water and well-being, but the ease of growing food here can’t be beat. And the community of transformative thinkers and doers on the left coast enhances my growth and learning.

When my wife and I were looking to purchase property in Sonoma County (note the life partner and business success!), we started from a similar holistic perspective. When we told our real estate agents that we were looking for a “just right fixer-upper with good bones on more than an acre, with an east-west orientation and within walking distance of a vibrant downtown,” well, they looked a little shocked. We wanted enough land so that we could grow food for our family; who knows what the future might bring. We wanted to be in town, where the Internet is fast and it is easy to bike to necessities for our growing family (our young son loves homegrown asparagus!). We wanted a house we could live in and where a deep energy retrofit made financial sense; the east-west orientation is for the solar panels. My parents now live on our property, and my wife’s parents live just a couple of blocks away. All this has deepened our family and community resilience.

I have been a practicing Zen Buddhist for the past 20 years. My worldview is heavily influenced by Taoism and a connection to wilderness. I have a black belt in aikido, and I study tai chi. These practices keep me light on my feet, in the flow, responsive to whatever happens day to day, and lively enough to keep driving toward a better world.

Looking forward, I remember that I am living the dream right now, with additional investments serving to fine-tune an instrument already humming along. As a new dad, boosting personal assets is essential; I work to keep my growth practices lively and my marriage humorous. Lone Palm Ranch, our one-acre homestead, continues to develop, using less energy and growing more food every year. A model of resilient storm water management and delicious perennial plantings, our home has been the destination of garden tours in our region. We have a few more years of five-figure investments until it is fully sustaining. My ownership stake in Natural Investments will continue as my largest financial asset and thankfully a fun, right livelihood.

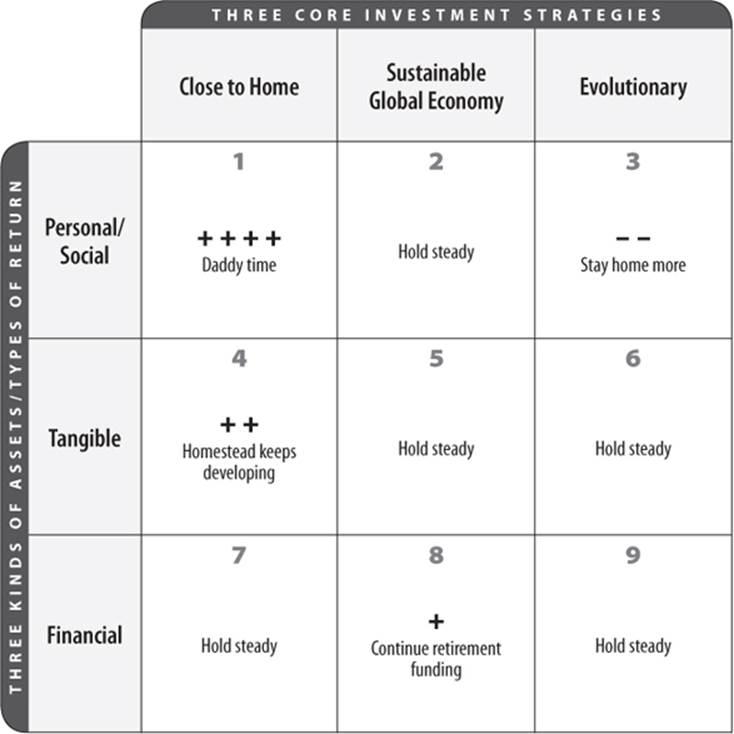

I am showing an abridged version of our RIM, highlighting zone by zone how I have increased, decreased, or stayed the same with my investment. You can see that I have really cranked up zone 1 (daddy time); everything else is seeing modest tunings. SEE FIGURE 16

Reflections

What might we glean from these tales? First it is clear that we have lived fairly unorthodox lives (and of course we’ve left out quite a bit of “color” from these brief bios!). Second, you will notice that our investments evolved as we moved through our lives. In our younger years, with little money, we devoted ourselves to learning skills, connecting in deep ways with nature, and participating in projects that matched our passions (some of which didn’t work out as we had hoped). Later we each gravitated to the idea that money could be used as a transformative tool for societal change, and when we realized this was a shared career goal, we formed our company. And, third, we are now and always will be works in progress. We all rebalance within the RIM as needed, putting more energy into one area for a period (for example, writing this book has been a huge investment of our time into zones 2 and 3); likewise we respond to changes in the world, our family dynamics, and our own aging process—all of which inform our decisions about which zone of the RIM to focus on.

Figure 16 Christopher Peck’s RIM

We have been making investments with our time and money for many years, striving to walk our talk and live meaningful lives. But until now we didn’t have the benefit of the RIM to help us see exactly where we were putting our energies and how it all fits together. Now, at the tail end of the writing process, we can reflect on our own life experience as a way to show that this system really works. The RIM gives us a way to observe and analyze ourselves, to see exactly where on the map we are choosing to invest our time, attention, and money, and to then help us see what changes we wish to make and how to make them.

We hope these examples inspire you to do your own reflections. How would you map out the decisions that you made when you were younger? Where are you at today, and where would you like to be heading? Are you considering the full array of possible futures that awaits us as we head into the mystery?

In the end, despite our continued positing that the idea of investing needs to be expanded, there comes a time to drop the distinctions that divide our lives into categories. There is only one activity that we are all engaged with all the time: we are simply trying to live our lives the best we can. And so, although we have been calling it resilient investing throughout the book, our deepest wish is that this lens, and these tools, will support you on your path toward something even more enticing: resilient living.