The Profitable Supply Chain: A Practitioner’s Guide (2015)

APPENDIX A. Managerial Cost Accounting

Supply chain analysis requires the use of cost concepts for calculating metrics and making decisions. Managerial accounting is the process of identifying and interpreting cost information for the pursuit of an organization’s goals. The difference between managerial and financial accounting is that the former is aimed at helping managers in the organization make decisions, while the latter is aimed at providing information to parties outside the organization. As a result, there is more latitude in the principles and methods used in managerial accounting.

Accounting recognizes expenses as product costs or period costs. A product cost (also referred to inventoriable cost) is an expense assigned to goods that were either purchased or manufactured for resale. Product cost is used to value the inventory of manufactured goods until the goods are sold. In the period of sale, product costs are recognized as an expense called cost of goods sold (COGS). The product cost of goods acquired by a retailer or wholesaler for resale consists of the purchase cost of inventory plus any shipping charges. For manufactured products, product cost includes labor cost for production and the costs of raw material.

All costs that are not product costs are called period costs. Period costs are identified with the period of time in which they are incurred rather than when goods are purchased or produced.

These concepts can be applied to each of the stages in the supply chain—manufacturing, storage, and transportation. Because manufacturing operations tend to be complex, additional considerations are required for the treatment of overhead, as discussed in the next section.

Manufacturing Costs

The raw material and human labor required to produce a product are easily accounted for and are referred to as direct material costs and direct labor costs, respectively. For example, direct material refers to the printed circuit boards and lenses used to manufacture a digital camera, and direct labor refers to the production worker responsible for assembling the camera.

However, the complexity of most manufacturing operations results in significant fixed expenses, termed manufacturing overhead. One category of overhead cost is indirect material, which represents the cost of materials that are required for the production process but do not become an integral part of the finished good. Examples include drill bits and saw blades used in manufacturing equipment. Another category is termed indirect labor, which is the cost of personnel who do not work directly on the product but whose services are necessary for the manufacturing process. Examples include department supervisors and security guards. Finally, other costs include property taxes, insurance, and utilities.

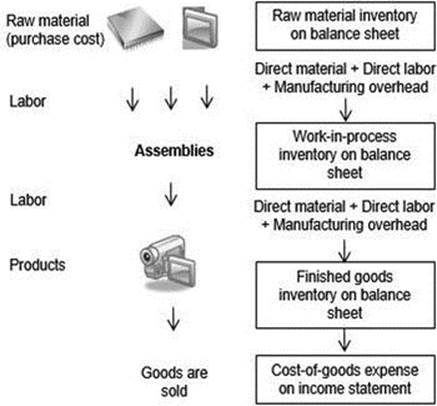

The overhead is treated differently by two accounting methods—absorption costing and variable costing. Absorption costing includes both variable and fixed manufacturing overhead in product cost, in the form of work-in-process or finished goods inventory (Figure A-1).

Figure A-1. The absorption costing method

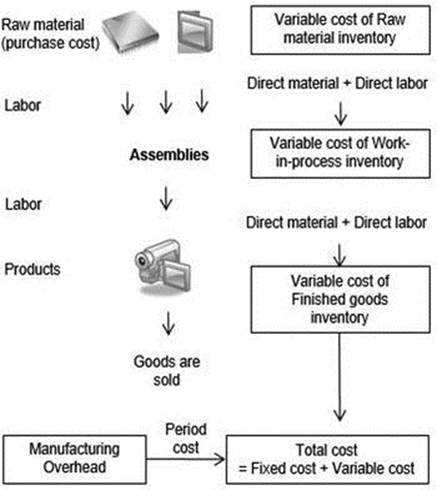

Variable costing treats manufacturing overhead differently, with these costs being expensed in the period that they are incurred. An example of variable costing is shown in Figure A-2. The margin obtained by subtracting variable costs from revenue is referred to as the contribution margin. Due to this difference in accounting for overhead, variable costing will result in a lower value of work-in-process and finished goods inventory and higher fixed costs. When inventory is consumed in the same period, both costing methods result in the same value of income; however, when inventory is manufactured and held for several periods, the income from the two methods differ.

Figure A-2. The variable costing method

Variable costing enables cost-volume-profit analysis, which is a useful method providing insight into the demand volumes required for profitability, as well as pricing levels required to achieve a certain level of profits. The number of units required to break even can be calculated by Equation A-1:

![]()

Which of these two methods should be used for analyzing the supply chain? Several companies use absorption costing for cost-based pricing in order to ensure that true costs (inclusive of overhead) are covered. On the other hand, variable costing proponents argue that it is the better alternative for pricing because any price over the product’s variable cost contributes to covering fixed cost and a profit, and is therefore beneficial.

The trend toward outsourced manufacturing has resulted in a reduction in fixed costs and manufacturing overhead and higher variable costs; therefore, most outsourced situations lend themselves to variable costing. But even outsourced situations can have several operational complexities that require special attention. For example, if a supplier makes capacity investments for the manufacturer in order to accommodate the production of custom parts or to provide dedicated capacity, these tooling costs are eventually charged back to the manufacturer. If the cost is to be recovered by the unit price charged by the supplier, the item cost needs to be increased by a factor equal to the investment divided by the projected lifetime volume of the product. In essence, this approach absorbs tooling costs in the variable cost, so it utilizes a hybrid costing model.

Storage Costs

For a company that owns distribution centers, storage costs can include:

· Labor for receiving and inventorying material.

· Wages for management and procurement.

· Building expenses, including rent, utilities, and building maintenance.

The act of holding inventory results in additional costs, termed carrying costs. These include:

· Insurance for on-hand inventory

· Forgone interest on working capital tied up in inventory (i.e., the cost of money)

· Deterioration, theft, spoilage, or obsolescence. This is especially important for products that age, groceries and lumber).

· Price erosion, especially for electronic components

When making trade-off decisions related to holding inventory, two approaches are possible. The first is to consider the total cost, consisting of storage and carrying, while the second is to consider only the variable costs for storage and carrying. These variable costs provide an accurate picture of the actual expenditure due to inventory, since storage costs are fixed and will not be affected by an increase or decrease in inventory level.

The use of third-party logistics providers (3PL) has become widespread and changed the cost structure. The reasons for the use of 3PL facilities include augmenting storage capacity, gaining geographic presence, or completely outsourcing the storage function. From a cost perspective, third-party logistics has the effect of converting fixed costs into variable costs. In this case, the cost of storage can be specified on a per-unit basis to include the following:

· Handling cost (receiving and inventorying), expressed in appropriate units (for example, per container, per pallet, per pound, or per unit). Depending on the unit-of-measure used, an equivalent per-unit cost can be obtained.

· Insurance cost, usually expressed as a percentage of the cost of inventory at the end of each month.

· Carrying cost (to cover insurance and utilization of space), expressed as a percentage of the cost of inventory at the end of each month. Often, a management cost (for order processing, inventory management, and other management activities) is included.

· Other costs specific to the particular situation, including light assembly, processing of returns, and first level repairs.

For products with stable prices, the holding cost is the same as the storage cost. However, several electronic or commodity products can display large fluctuations in prices; for products that display a decreasing trend, the holding cost is higher than the storage cost. For commodity prices that can fluctuate in either direction, the analysis is more involved and needs to consider options in pricing and trading.

Transportation Costs

The costs for transportation of goods depend on the mode of transportation used: ocean, rail, air, or truck. Ocean freight usually occurs in containers, with sizes ranging from 20' to 45' in length, approximately 8' width, and 8.5' in height. Variations of these dimensions are possible. In addition to the volume, each of these configurations has a weight restriction. The costs for ocean freight include:

· Cost per container, from the source to destination port.

· Transportation from the factory/supplier to the source port.

· Inspection and customs clearance cost, if necessary (for imports).

· Drayage costs, which is the cost to transport the goods from the port to the distribution center. This is usually by truck, expressed as a cost per container.

· Unloading costs at the distribution center.

An important consideration is the selection of the port at which shipments will be received. The selection of a port that is inappropriate for the cargo being transported can result in additional time and cost. Some of the factors to be considered while selecting a port are:

· Support for large shipments and availability of equipment for specific handling needs.

· The number of shipments and carriers that service the specific origin and destination of interest to the shipper.

· Visibility provided regarding status of shipments, and assistance provided in handling claims.

· Cost of handling freight and pickup and delivery windows.

· Proximity to the company’s distribution centers.

Air freight costs can vary depending on the weight of the shipment, with a decrease in cost as the weight of the shipment increases. The total cost of air freight can include the following:

· Cost per unit or per pallet, from the source to destination airport.

· Transportation from the factory/supplier to the source airport.

· Inspection and customs clearance cost, if necessary (for imports).

· Airport transfer cost, which is the cost to transport the goods from the airport to the distribution center.

As with ocean freight, rail cars come in a variety of sizes and weight limits. Costs for rail freight include:

· Cost of rail car, from the source to destination city. The number of units transported can be calculated based on the dimensional or weight restriction. This is used to convert the cost per rail car into a per-unit cost.

· Transportation (drayage) cost from the supplier’s facility to the rail car.

· Transloading cost, which is the cost to transfer goods from truck to rail (at the source), or from rail to truck (at the destination).

Finally, truck costs can vary significantly depending on whether the trucks are owned or a third party is used. If trucks are owned, the costs include:

· Fixed costs for housing vehicles and equipment, maintenance, depreciation, and wages for management.

· Variable costs include fuel for transportation and direct labor expenses for contracted drivers.

On the other hand, if a 3PL is used, costs are expressed on a per-mile basis from a source to destination, for full truckload (TL or FTL) or less-than-truckload (LTL). These per mile costs are converted into per-unit costs for each routing, based on the number of units transported by TL or LTL.

Intermodal transportation refers to the use of more than one mode of transport to move a shipment to its destination. It is common for trucks to be used with rail, ocean, and air freight in order to transfer goods from ports to the warehouse. In addition, global transportation of goods has resulted in an increase in the use of rail, ocean, and truck combinations in order to achieve the lowest cost per unit.

With increase in overseas manufacturing, companies with little international experience rely on freight forwarders for ensuring adherence to regulations. Some of the functions provided by freight forwarders include:

· Providing quotes for ocean and air freight.

· Booking vessel space according to the provided schedules.

· Creating documentation for importing and exporting, and cargo insurance.

· Making payments to the appropriate freight companies on completion of transportation.

· Providing information related to the status of shipments and, if necessary, expediting shipments that are held up.

· Coordinating ground transportation and warehousing, if necessary.

Freight forwarding costs are borne by the shipper and the carriers. Shipper charges are related to the preparation of documents, while carrier charges are usually a percent of revenue generated by the shipment.