The Profitable Supply Chain: A Practitioner’s Guide (2015)

Chapter 1. Introduction

The importance of supply chain management (SCM) is undeniable. Companies have invested a significant amount of time and money hiring personnel and implementing expensive software systems to help realize improvements. Although SCM is now offered as a course in many universities, the reality is that the knowledge required by the practitioner has mainly been gathered tediously on the job. The reason is that, unlike manufacturing and engineering, SCM is a relatively new field that originated in the industry in the early 1990s; as a result, it has not had the time to mature and become well understood.

Compounding the problem is that the term supply chain is now used in several industries with differing interpretations. For example, a government organization may view SCM as a form of procurement, while an electronics manufacturer may view it as a process for aligning activities across manufacturing, transportation, distribution, and order fulfillment. Universities have only recently started offering supply chain courses. As a result, new entrants to the field of SCM may be expected to have a better formal understanding of supply chain concepts. The majority of established practitioners, on the other hand, will not undergo retraining and may be expected to retain widely differing views on the practices.

It is not just a matter of biding time, however, until the newly minted practitioners have established their presence and disseminated a common understanding of SCM. The problem goes deeper. First, there is disparity in the course material across universities, the content being largely dictated by the background of the teacher. Second, there is often an extreme focus on complex mathematical methods (such as linear programming) rather than simple, easy-to-use mathematical models. Third, the concepts and methods taught tend to focus on a few simple, well-understood business cases and are not comprehensive enough to enable the practitioner to deal with situations encountered on a daily basis while operating a supply chain.

This book attempts to address these drawbacks by providing the practitioner with (a) a process-oriented approach to implementing change, (b) simple mathematical models that are easily understood, and (c) application of these models to several real business situations to provide an understanding of their pragmatic utility.

This chapter provides you with a background on some of the changes to the business that have increased the importance of supply chain management, and it shows you why traditional management approaches are not effective. The structural changes are explained from a network and financial perspective, followed by a discussion of the limitations of the current process framework and systems. I then introduce an SCM process framework that I have developed, based on my work with several leading manufacturers, to address these limitations.

A Changing Supply Network and Cost Structure

Supply chains have been reshaped since the 1990s. The need to grow and meet worldwide demand has driven many vertically integrated product companies to outsource manufacturing and logistics functions and become brand-oriented companies focused on product design and marketing. Even companies that have not adopted outsourcing have expanded local manufacturing operations to a network of factories in several continents. In tandem, other market forces, including a larger customer base, varied consumer preferences, and the need to innovate to stay ahead of the competition have resulted in a marked increase in the number of products offered by a company. For example, Nike states:

Our success depends on our ability to identify, originate and define product trends as well as to anticipate, gauge and react to changing consumer demands in a timely manner.

—2010 Annual Report, Nike Inc.

Such a need is easily comprehended in consumer-oriented specialty products. However, this trend is true in other industries as well, including electronics, automotives, and consumer durables. Consider the example of Whirlpool, a manufacturer of refrigerators and washing machines:

High consumer preference for our versatile brands has helped Whirlpool Corporation strengthen our No. 1 position in Latin America. We drove ongoing margin expansion in 2013 due to our impressive new product launches, effective management of our resources and continued non-core appliance growth. There were 50 major new products introduced in 2013.

—2013 Annual Report, Whirlpool Appliances Inc.

Product proliferation increases the variability in demand for each product, which, in turn, results in an increase in the inventory investment required to stock shelves or fulfill customer orders. In addition, there is a higher level of monetary risk the company faces due to this increased inventory position: If a particular product falls out of favor and does not sell, the company has no choice but to mark it down or declare the inventory scrap. Such write-offs are expensive and have a significant impact on profits.

Companies are of course also becoming more and more global. Nike’s revenues from the US declined from 78% in 1990 to 41% in 2013. Such changes are experienced by companies in all parts of the world; for example, Samsung Electronics, a Korea-based company, saw domestic sales decline from 36% to 10% from 1998 to 2013. These globalization trends impact the supply chain in many ways, including increased complexity from operating the business in several countries. The many costs associated with importing goods into various countries (such as import duties and tariffs), when combined with fluctuating exchange rates and political influences, makes it hard to estimate margins. Furthermore, the challenges in estimating local demand and competition combine with extended shipping lead times to further increase inventory costs and liabilities.

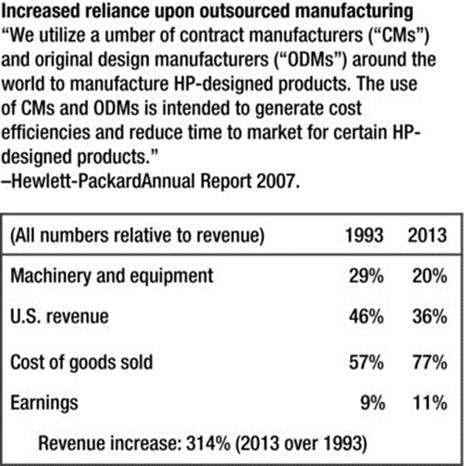

For a majority of companies, the complexities associated with bringing new products to market in various parts of the world have been partly addressed by outsourcing the design and manufacture of products to contract manufacturers. One such company is Hewlett-Packard, a manufacturer of computers and peripherals. The illustrative quote in Figure 1-1 from the company’s annual report clearly indicates the strategy that the company has adopted in order to provide investors the enormous revenue growth from 1993 to 2013 (from almost $21 billion in 1993 to $84 billion in 2013 for its computers and peripherals business divisions).

Figure 1-1. Illustration of Hewlett Packard's increased reliance on contract manufacturing (revenues are for computers and peripherals business divisions only)

This reliance on contract manufacturers has impacted the cost structure of the company. And while the investment in machinery and equipment relative to revenue has decreased, the cost of goods sold has significantly increased. However, the earnings relative to revenue has remained the same, possibly due to lower systems and administrative costs associated with divesting large manufacturing facilities.

Outsourcing manufacturing activities to a contract manufacturer that operates plants in countries with low-cost labor can result in reduced cost of goods that have high labor content. This trend toward offshoring is highlighted in the following excerpt from the annual report of a now-defunct furniture manufacturer:

There has been a significant change in recent years in the manner by which we bring products to market. Where we have traditionally been a domestic furniture manufacturer, we have shifted to a blended strategy, mixing domestic production with products sourced from offshore.

An increasing percentage of our products are being sourced from manufacturers located offshore, primarily in China, the Philippines, Indonesia, and Vietnam. We design and engineer these products, and we have them manufactured to our specifications by independent offshore manufacturers. We have informal strategic alliances with several of the larger foreign manufacturers whereby we have the ability to purchase, on a coordinated basis, a significant portion of the foreign manufacturers’ capacity, subject to quality control and delivery standards. Two of these manufacturers represented 20% and 12% of imported product during 2005 and three other manufacturers represented in excess of 5% each.

—Furniture Brands International, Inc., 2005 Annual Report

Indeed, this offshoring to reduce manufacturing costssss is a trend seen in other industries as well, including apparel, building materials, electronics, pharmaceuticals, and telecommunications. However, if the company is utilizing broadly available technologies or commodity-based products, then cost of goods may increase, because the company is forced to share margins with the contract manufacturer. In such cases, the company’s role becomes more of a distributor for overseas markets.

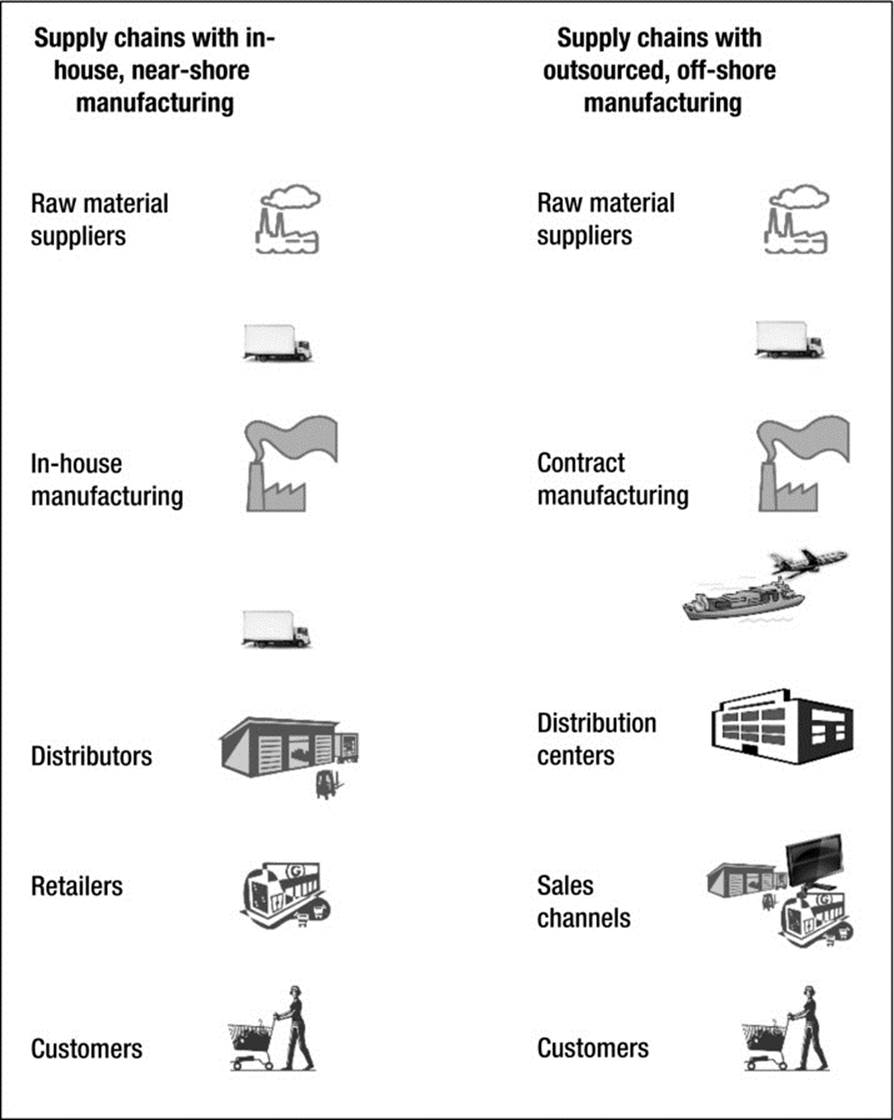

Figure 1-2 captures some of the ways in which supply chains have changed over the years. The dominant link in the traditional supply chain (with in-house, near-shore manufacturing) is the company’s manufacturing plant. In many cases, the company may not be required to operate separate distribution centers. That’s because a portion of the plant may be utilized for storing the produced materials, and the company can ship material directly from the plant to the distributor with facilities in various regions. In turn, the distributor would receive orders from the retailer and ship material to the retailer’s distribution centers or directly to the retail stores.

Figure 1-2. Structure of supply chain with in-house, near-shore manufacturing vs. outsourced, off-shore manufacturing

In contrast, the off-shore and often outsourced supply chain is different in many ways: The manufacturing plant is now owned by the contract manufacturer, and the company negotiates capacity contracts spanning several months or quarters and issues purchase orders for the production and delivery of materials. Since the company has divested its manufacturing facility, it is now necessary to operate distribution centers to receive material from the contract manufacturer and hold buffer inventory. The company may choose to operate the distribution centers or utilize the facilities of a third-party logistics provider (3PL). While distributors remain one channel for distribution of products, the channel focus has often shifted to direct sales to large retailers and online sales to consumers.

The overall trend has been to reduce the assets required to deliver products, with reliance on contract manufacturers for production, third-party logistics providers for holding inventory, transportation providers for overseas and inland movement of goods, and web stores in lieu of a physical presence. This shift to a virtual supply chain has far-reaching impact on the flow of goods and information, and the importance of inventory as a buffer between the various parties.

In addition, outsourcing affects the cost structure in one other significant way: It reduces fixed costs and increases variable costs. This results in very different outcomes when the company experiences variability in demand or supply. This change is better understood via an example. Table 1-1summarizes costs for a manufacturing plant that produces goods worth $10 million on a cost-basis. For simplicity, the plant is assumed to produce only one type of product. In the example, 65% of the entire cost is fixed, while the variable cost is 35%.

Table 1-1. Sample Cost Data for In-House Manufacturing

|

Cost Categories |

Details |

|

Units produced (per month) |

100,000 |

|

Material cost (delivered, per unit) |

$ 25.00 |

|

Labor costs (per month) |

|

|

Contract labor |

$ 2,500,000 |

|

Supervision |

$ 500,000 |

|

Administration |

$ 500,000 |

|

Total labor |

$ 3,500,000 |

|

Shipping cost (per unit) |

$ 10.00 |

|

Maintenance and repair (per month) |

$ 2,000,000 |

|

Utilities, rent, other (per month) |

$ 1,000,000 |

|

Cost, per unit |

|

|

Fixed cost |

$ 65.00 |

|

Variable cost |

$ 35.00 |

|

Total cost |

$ 100.00 |

Contrast this situation with an outsourced manufacturing situation shown in Table 1-2. Because the company sources this product from a contract manufacturer, the contract would typically include a commitment to purchase a certain volume of product at a certain unit price over a particular time period (such as per quarter or per year). Since the goods produced by the contract manufacturer needs to be shipped to the company’s distribution centers, additional transportation and warehousing costs needs to be incorporated. Additionally, since the company does not operate a manufacturing plant, there are no operating assets, maintenance and repair, or utilities to be paid.

Table 1-2. Sample Cost Data for Outsourced Manufacturing

|

Cost Categories |

Details |

|

Units produced (per month) |

100,000 |

|

Material cost (delivered, per unit) |

$ 70.00 |

|

Warehousing cost (per unit, per month) |

$ 15.00 |

|

Transportation cost (per unit) |

$ 10.00 |

|

Administrative cost (per month) |

$ 500,000 |

|

Total cost, per unit |

|

|

Fixed cost |

$ 5.00 |

|

Variable cost |

$ 95.00 |

|

Total cost |

$ 100.00 |

Comparing the cost summaries in Table 1-1 and Table 1-2, you can see several differences. The first is that fixed costs have been greatly reduced with outsourced manufacturing. These costs have been converted to variable costs since payments are made on a per-unit basis to the contract manufacturer and the third-party warehouse logistics provider. Since the total cost remains $100 per unit, it would appear that there is no difference between the two cases on a cost basis. Indeed, if the company were able to realize sales as targeted, then the two situations would provide identical margins. If, however, the company experiences variability in demand and price, then the two situations have very different outcomes on a cost basis, as shown in Table 1-3.

Table 1-3. Margin Sensitivity to Changes in Demand and Price

|

Situation |

||

|

High Fixed Cost |

High Variable Cost |

|

|

Revenue target |

$ 15,000,000 |

$ 15,000,000 |

|

Volume (units) |

100,000 |

100,000 |

|

Price |

$ 150.00 |

$ 150.00 |

|

Fixed cost |

$ 6,500,000 |

$ 500,000 |

|

Unit variable cost |

$ 35.00 |

$ 95.00 |

|

Variable cost |

$ 3,500,000 |

$ 9,500,000 |

|

Gross margin |

$ 5,000,000 |

$ 5,000,000 |

|

Gross margin % |

33.33% |

33.33% |

|

Scenario: Sales are light, therefore price is decreased by 10% to achieve revenue target. |

||

|

Price |

$ 140.00 |

$ 140.00 |

|

Units sold |

107,143 |

107,143 |

|

Revenue |

$ 15,000,000 |

$ 15,000,000 |

|

Total cost |

$ 10,250,000 |

$ 10,678,571 |

|

Gross margin |

$ 4,750,000 |

$ 4,321,429 |

|

Gross margin % |

31.67% |

28.81% |

In the example, a price rebate situation is analyzed. The company experiences demand variability and is not on track to sell the projected volume at the planned price (i.e., 100,000 units at $150 per unit). In order to meet the revenue target, the price is reduced by $10, which boosts sales and allows the company to meet its revenue target. However, the resulting impact on margins is very different for the two situations. In the in-house manufacturing situation with high fixed costs, the margin erosion is only 1% (from 33% to 32%); however, in the outsourced manufacturing situation with high variable costs, margin erosion is 4%. The lower margin erosion in the former case is due to the fixed cost being spread over additional sales units, thus reducing unit costs by a greater value for the in-house manufacturing situation. The outsourced manufacturing situation behaves poorly since unit costs are maintained at the original level ($95 per unit) even though price is reduced. If unit costs were to be proportionally reduced, then margin erosion could be contained; however, such cost reductions are often hard to enforce since supply commitments and purchase prices are typically made several months prior to demand due to longer lead times associated with contract manufacturing and ocean transportation.

Conversely, if a price reduction was not initiated and demand were to come in below the target value, the in-house manufacturing situation would result in higher margin erosion because fixed costs are distributed over fewer units. As a result, the predominant behavior in the in-house manufacturing situation is to plan production for the plant (usually for a two- or three-month horizon) and then maximize sales, relying on price rebates if necessary. However, this management approach will perform adversely in the outsourced manufacturing situation due to the markedly different cost structure.

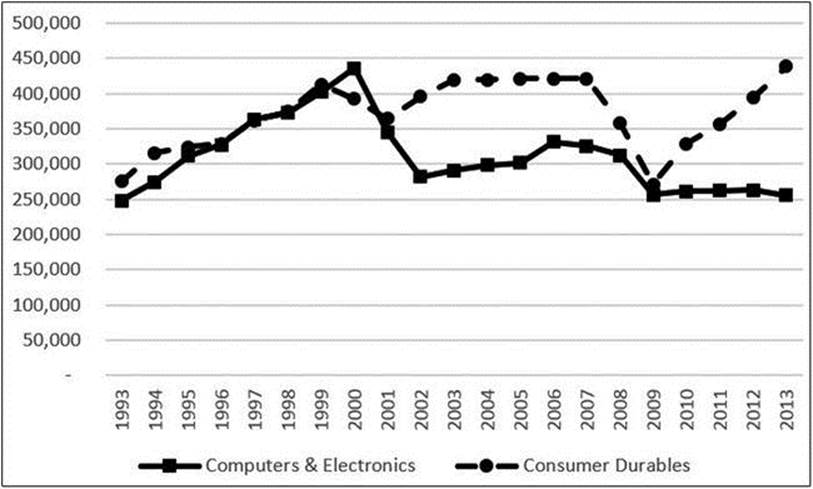

The difference is exacerbated if business variability is high. Figure 1-3 examines demand variability for two industries—consumer durables and computers and electronics—measured by new orders for manufacturers, as tracked by the U.S. Census Bureau. The data reveals that the computer industry exhibits more variability than the consumer durables, as can be expected due to the shorter product lifecycles associated with computer products. Additionally, the inherent variability has remained at a high level for over two decades in both industries. Wise supply chain managers therefore review new order data for their own and other industries and note a similar trend in variability. Several reasons contribute to the variability, including frequent new product launches, product proliferation, increased competition, and rapidly changing customer preferences.

Figure 1-3. Demand variability of new ordersfor consumer durables and computer industries.($ Million). Source: U.S. Census Bureau

Given the changing cost structure and dynamic business environment faced by most companies, the natural question is how management practices should change. Are the company’s current processes ready to handle these changes? Are the systems in place appropriate for the dealing with this extended and increasingly virtual supply chain? Are the people in the company schooled to think in a different way? Each of these areas is examined in detail in the following sections of this chapter.

The Process Framework: MPC vs. SCM

The historical focus on manufacturing efficiency needs to change in order to manage a network of companies responsible for timely supply, production, and distribution. Practitioners have typically been trained to rely on the manufacturing planning and control (MPC) process framework to manage the business. This section describes the MPC process, lists some of the drawbacks with this approach, and specifies the SCM process framework that addresses these drawbacks.

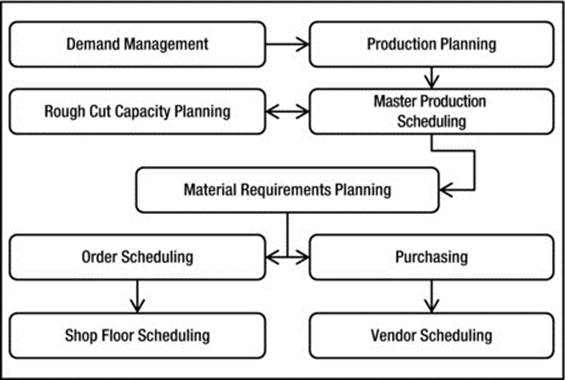

The MPC framework, shown in Figure 1-4, supports activities related to the production of sub-assemblies and finished goods and the procurement of raw materials. These steps are briefly described below.1

Figure 1-4. The manufacturing planning and control (MPC) process framework

The main steps for managing the flow of material and use of resources are demand management, production planning, master production scheduling, rough cut capacity planning, and materials requirements planning.

Demand management encompasses forecasting customer and product demand, order entry, and order processing.

Production planning specifies the manufacturing plan that will support the specified demand, frequently expressed as output in financial units such as dollars. When it is not possible for the factories to produce a sufficient amount of goods to meet demand, the production plan provides a basis for understanding the extent of the shortfall, and how scarce material or capacity should be best utilized. Therefore, one of the main goals of production planning is to match demand with supply, and provide a framework for optimizing resource utilization. The production plan is often expressed in monthly periods and can span several quarters, depending on the lead time required to manufacture goods.

Master production scheduling (MPS) is the detailed version of the production plan, expressed in production units for each product, usually for an 8- to 13-week time horizon. While converting the monthly production plan into weekly schedules, the MPS considers guidelines related to setup times and production batch sizes, which helps reduce costs and create a feasible schedule.

When appropriate, the MPS is modified based on rough cut capacity planning (RCCP), which checks for capacity shortfalls and bottlenecks. The calculations for this are based on setups and time taken to perform various production tasks. When a capacity shortfall is encountered, the production schedule is modified to best meet the production plan. However, if capacity shortfalls are severe and it is not possible to meet the plan for the entire month, then the financial impact of the shortfall (in terms of variance from the production plan) is computed and made available to management for decision making.

The master production schedule is converted into raw material supply requirements using material requirements planning (MRP). MRP uses a bill of material to connect finished goods to sub-assemblies and raw materials, and a specific time phasing logic (based on production lead times) to convert production requirements into supplies. Finally, shop-floor scheduling and purchasing use the output of MRP for creating detailed production schedules and purchase orders, respectively.

Each of the process steps of the MPC framework is executed according to a schedule: demand management and production planning are typically performed at the beginning of each month, while master production scheduling, capacity planning, and material requirements planning are performed at the beginning of each week. The remaining activities are performed on a daily basis or prior to each shift.

The process flow shown in Figure 1-4 is illustrative of a “pull” process, in which demand drives supply activities such as production and purchasing. If a demand forecast drives supplies, then the production activities are classified as build-to-forecast; if actual customer orders drive supplies, then production is build-to-order. While a build-to-order supply chain has less risk, it is typically not feasible to operate entirely in this mode due to long lead times associated with certain manufacturing or purchasing activities. Therefore, most companies operate as build-to-order for activities closer to the customer (such as final assembly and packaging) and build-to-forecast for longer lead time activities.

Conversely, a company that commits to a certain level of production and subsequently aligns demand based on this plan is classified as a “push” supply chain. Examples include mining, oil extraction, and the recycling industries. In each of these cases, there is a commitment for a certain level of production over an extended period of time (ranging from several quarters to several years). During this time period, the companies need to “find” the demand for the produced volume. If there is a significant mismatch between market supply and demand, production volume changes can be initiated only at the end of the commitment period. For such a push supply chain, the process framework would look different since supplies are the driving factor. Therefore, demand management is driven by the production schedule. Additionally, the demand management process mainly deals with the allocation of the production schedule to specific customer accounts and orders.

Similar to MPC for manufacturing organizations, warehouse management systems (WMS) help manage the distribution section of the supply chain, providing functionality for tracking inventory, entering sales orders, placing purchase orders, and receiving and shipping goods.

Companies have found that the MPC framework does not provide adequate support for the new business environment. A few of the issues include:

· Lack of support for scale and globalization. Businesses have grown from a single factory to multiple factories distributed across the world and distribution networks consisting of central and regional warehouses in several continents. The traditional MPC framework is oriented to the management of a single facility and is not well-equipped to deal with this network of suppliers, factories, distribution centers, and customers. As a result, coordination of material and capacity across these different facilities needs to be performed outside the scope of MPC.

· Lack of support for the outsourced environment. The outsourcing of manufacturing operations to other companies has required increased formality and structure between the different functions. What used to be operations under the same roof have now been transferred to different companies, often in different continents. MPC provides limited support for the increasingly collaborative relationships required to operate in this environment.

· Inadequate treatment of variability. The MPC framework has limited treatment of demand uncertainty and supply variability. When lead times were of the order of two or three weeks and demand was localized, ad hoc procedures and simple rules sufficed since the cost impact was limited. However, global markets, a proliferation of products, and increasing lead times have increased variability and stressed the MPC framework.

· Inadequate treatment of network optimization. Since the MPC framework focuses mainly on a single plant, it does not provide guidance regarding optimal placement of manufacturing and distribution facilities. These analyses are performed outside the framework, and the results of the analysis in the form of material routings and costs are provided as inputs to MPC. The current business environment requires that companies re-evaluate and reconfigure the network on a more frequent basis, due to higher fuel prices, expansion into new markets, or an increase in the number of facilities due to mergers and acquisitions. Lack of support for this important function is a significant drawback of the MPC framework.

· Limited analysis of variable costs. While demand management and production planning are expressed in financial terms, the remaining MPC functions are completed using production units. Since several important decisions are taken during capacity planning and MRP, there is no visibility to the impact of these actions on profits. This approach may have been justifiable when fixed costs were high and estimating costs for specific activities were not clear or subject to error. However, as variable costs have increased, it has become important, and increasingly feasible, to estimate cost impact and to include these considerations in the decision-making process.

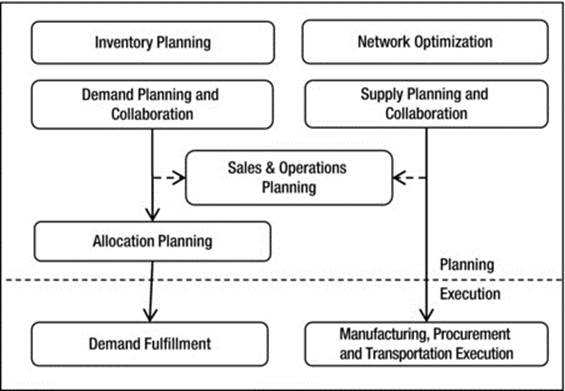

In conclusion, while MPC continues to be a useful framework for managing the individual plant, a new approach is required for managing the entire supply chain. SCM emerged toward the beginning of the 1990s to address some of these drawbacks. Unlike MPC, there is little standardization in the specification of the SCM process, and it had achieved a good deal of adoption by companies before being offered as part of the management sciences curriculum in business schools. You are likely to see different representations of SCM across manufacturing companies and software vendors. A common illustration of SCM is shown in Figure 1-5.

Figure 1-5. The supply chain management (SCM) process framework

The SCM framework consists of several processes: inventory planning, network planning, demand planning, supply planning, and sales and operations planning (S&OP). This framework directly addresses several of the issues present in MPC:

· Network planning reduces costs by optimizing the placement of facilities and flow of goods, considering transportation, warehousing, and manufacturing costs.

· Inventory planning calculates optimal customer service levels, inventory levels, and cash budgets considering uncertainty in demand, variability in supply, as well as costs for holding inventory and for missing demand.

· Supply planning utilizes these targets to plan production and purchases for the entire network of distribution centers and manufacturing plants. Thus, it addresses the single-facility limitation of MPC.

· S&OP is a cross-functional process for reviewing and reacting to demand and supply imbalances. This process involves executives and stakeholders and addresses the inwardly focused nature of MPC.

· Demand collaboration and supply collaboration explicitly include partners (retailers, contract manufacturers, and strategic suppliers) into the information-sharing process.

As with MPC, the supply chain management framework divides the processes into planning and execution categories. This distinction is important since the nature of activities differ between the two: While execution processes tend to be transactional and numerous, planning activities are performed less frequently, are more analytical, and often involve upper management. Demand planning, supply planning, and S&OP are usually performed on a monthly basis. Inventory planning may be performed on a monthly or quarterly basis, depending on the extent to which the demand plan fluctuates month-to-month. Network planning may be a quarterly or even an annual activity.

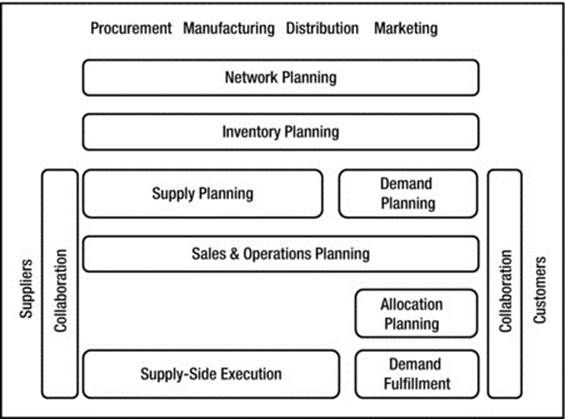

Figure 1-6 illustrates the various uses of these processes by different departments within a company. There are several processes—network planning, inventory planning, and S&OP—that involve all departments. Indeed, as SCM continues to evolve, additional stakeholders are included; the involvement of finance in the cross-functional processes has become standard. In addition, the engineering department may also be included for network and inventory planning, since product design features such as modularity and component commonality can significantly supply chain performance. This is one of the key features of supply chain management—it explicitly considers the impact of actions of one part of the company on another, involves all parties impacted, and allows for decisions to be made that are beneficial not just for a department, but for the company as a whole.

Figure 1-6. Relevance of supply chain processes to different departments of a company

Supply Chain Systems

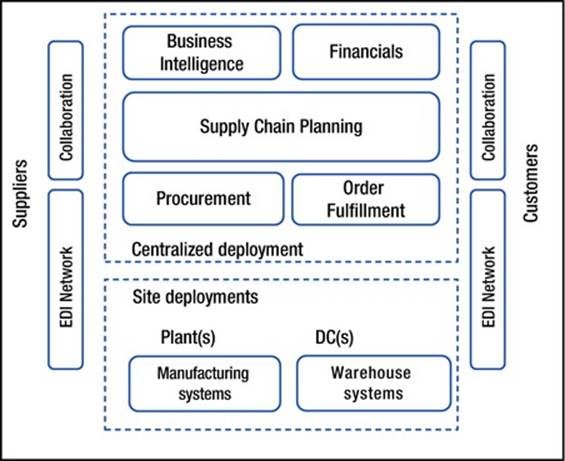

The use of software applications in SCM is extensive, mainly due to the growing scale of businesses, the adverse impact of process variances, and the need to stay competitive in an increasingly digital environment. An example of system layout for SCM is shown in Figure 1-7; these systems are segmented based on enterprise vs. collaborative systems, as well as centralized vs. site deployments. Planning and business intelligence systems are usually deployed in a centralized fashion, so that operations can be viewed across sites and synergies and cross-site decisions can be taken. Systems for communication and collaboration have gained in importance due to the need to quickly communicate new and important information to partners, and electronic data interchange (EDI) networks are being augmented with web-based collaborative systems that allow partners to analyze the data and make changes.

Figure 1-7. Systems layout for supply chain management

Some of the key differences between traditional MPC and supply chain systems are the following:

· Site vs. corporate deployment. Manufacturing planning and control systems are deployed to specific manufacturing plants (i.e., decentralized deployment). For example, for a company with five plants, five different instances of the MPC systems, one for each plant, must be installed. Similarly, warehouse management systems are deployed to specific distribution centers. In contrast, supply chain systems are deployed at a corporate level (i.e., centralized deployment). This centralized deployment allows for activities to be coordinated across plants and distribution centers, providing the company the opportunity to optimize operations across facilities. However, centralized deployments come with their own challenges, such as the effort required to synchronize the collection of data across multiple facilities.

· Desktop vs. server deployment. The traditional desktop deployment of production planning systems has changed over time to server deployments. This has allowed for plans to be shared between people and better support cross-functional workflows. Servers also provide greater computational power, which is required for supporting increased scale due to product proliferation and multi-site supply chains. Additionally, for companies providing supply chain systems, server-based systems are far easier to maintain and manage.

· Batch vs. real-time data collection. The prevalence of bar codes or Radio Frequency Identification (RFID) tags on shipments has resulted in the collection of a significant volume of data related to in-transit and on-hand inventory. Since this data can be used in the demand and supply planning processes to obtain a real-time view of inventory and make better decisions, real-time (or near real-time) data collection has become an integral part of the supply chain systems design.

· Manual vs. automated workflows. The prevalence of server-based systems and high-bandwidth networks has enabled automation with respect to data transfers between systems and partners. Workflows have also become automated, and review and approval steps for various decisions are now completed within the system, without having to documents and emails. As a result, it is rely on cumbersome common for a workflow system to be an integral part of the system landscape.

· Proprietary vs. open networks. The traditional method of using Electronic Data Interchange (EDI) to communicate with suppliers and customers continues to be used by most companies. However, the inflexibility of EDI combined with the need to communicate additional information has resulted in the creation of communication networks that use the Internet as the transport mechanism, and data models tuned to supporting a collaborative exchange.

· Proprietary vs. industry standards. As companies begin to collaborate with several partners, the need for an industry standard became apparent. For example, consider a manufacturer collaborating with a dozen retailers; if each retailer communicates purchase forecasts and orders in a proprietary format, the manufacturer is forced to accommodate and stay abreast with all these formats, which increases the cost of doing business. This has been the main driver for standards such as RosettaNet for the electronics industry and Collaborative Planning, Forecasting, and Replenishment (CPFR) for the retail industry. These standards define a data model for exchanging information as well as recommended workflows for timing the exchanges.

As the Internet continues to evolve, network bandwidth continues to become more readily available, and new devices for ready access of information are invented, the supply chain systems landscape will continue to evolve to take advantage of these capabilities. The chapter on the evolving supply chain (Chapter 8) covers some of the changes that are forthcoming.

The Supply Chain Organization

Traditionally, supply chain management has not been a separate department within the company, but a set of processes performed by personnel from other departments such as manufacturing and procurement. However, this is changing as large- and mid-sized companies have realized that the cost benefits that can be achieved by focusing on supply chain efficiency are significant. This has resulted in the creation of a dedicated organization with ownership of the cross-functional processes and supply chain systems.

The role of the person performing these planning functions, referred to as “the analyst,” is essential to ensuring that each step is being executed in the best possible manner. In large companies, several people may be required to perform the different functions, but it is important for skills and a common understanding to be shared. Often, the role is filled by an individual from manufacturing, distribution, or procurement. While in-depth knowledge of a particular discipline is important, the requirements of a supply chain analyst are much broader, as described in Table 1-4. Not only does the analyst require an understanding of the different disciplines in the company, but she also needs to be aware of the financial situation and management methods. Finally, in order to be successful, the analyst needs to be able to effectively communicate issues, actions, and results to the company’s executives.

Table 1-4. Breadth of Knowledge Required by the Supply Chain Analyst

|

Area |

Specifics |

|

Disciplines |

Purchasing processes, suppliers contracts and relations |

|

Finance |

Material prices, contract manufacturing costs |

|

Management methods |

Inventory management |

|

Information technology |

Enterprise data availability |

Summary

Supply chain management is the process of efficiently coordinating the flow of material across suppliers, transportation providers, manufacturers, distributors, and retailers. Executed properly, SCM will improve customer service and revenue achievement while simultaneously reducing operating costs. Achieving this goal requires a structured approach towards managing production, distribution, and working capital. The remaining chapters provide the details of the methods for managing demand and supply. Chapter 2 is on inventory planning and describes the approach toward managing mismatches between demand and supply. These approaches connect operating inefficiencies to cost and margins, and this understanding is required for understanding the benefit from planning and effective supply chain management.

Chapter 3 is on demand planning and describes methods for specifying the demand signal considering several factors—historical sales, market conditions, customer budgets, demographics, and environmental factors. The benefit from an accurate demand signal is without debate, and companies in almost every industry will find that some or all these methods are useful for improving accuracy.

Chapter 4 is on supply planning and describes methods for converting the demand signal into a production and procurement signal considering several factors—on-hand inventories within the enterprise and in the channels, open purchase orders, manufacturing and supply lead times, manufacturing capacities, and safety stock targets.

Chapter 5 is on sales and operations planning, which is the process step that brings the different parts of an organization to a common understanding and plan. This process needs to be designed with care since it involves executives from different disciplines—an improperly designed process can have the adverse effect of wasting precious time.

Chapter 6 is on network planning and describes several approaches toward understanding optimal placement of manufacturing and distribution locations in the supply chain network.

Chapter 7 is on supply chain performance and provides metrics for managing the various supply chain functions—manufacturing, procurement, transportation, and the overall supply chain. This chapter also introduces some ideas for continuous improvement.

Chapter 8 is on the evolving supply chain and introduces several developments that can have a lasting impact on the supply chain, specifically in the areas of production, fulfillment, real-time information, systems, and carbon footprint.

Finally, Chapter 9 concludes with some key takeaways from all these areas. For many companies, supply chain practices have been developed in an ad hoc manner, which can result in disparate approaches toward managing different product lines and business situations. The points highlighted in this chapter list some of the common mistakes made by adopting these ad hoc approaches.

_________________

1For more details, see Thomas E. Vollman, William L. Berry, D. Clay Whybark, and F. Robert Jacobs, Manufacturing Planning, and Control Systems, 5th ed. (New York: McGraw-Hill, 1997).