Tax Insight: For Tax Year 2014 and Beyond, 3rd ed. Edition (2015)

Part III. Investment Income and Deductions

Chapter 15. Retirement Investment Strategies-Alternatives

Non-Traditional Tax Strategies for Saving for Retirement

In addition to the traditional tax-sheltered retirement accounts discussed in Chapter 14, there are many alternative options available for individuals to invest for the future in ways that bring tax benefits. Excellent means of doing this are through Roth IRAs, Roth IRA conversions, and Non-Deductible IRAs as discussed in Chapter 10. Another way is through life insurance products, such as annuities and cash-value life insurance policies.

Some strategies are best for people who have already contributed the maximum amount available to them in the traditional retirement accounts. Other strategies are focused on finding alternative investments to the traditional stock-market-based options. A few strategies combine the two. While there are many tax-preferred opportunities for alternative retirement savings strategies, there are four in particular that I cover in this chapter:

· Self-directed IRA accounts

· The secret of Health Savings Accounts

· Deferred compensation and defined benefit plans (pensions)

· Livestock, agriculture, and land

Self-Directed IRA Accounts

All retirement accounts are maintained in the name of a custodian. A custodian exists, in part, to assure the IRS that you have not tapped into your accounts during the year (thus triggering taxes and, possibly, penalties). In addition, these custodians often assume a level of fiduciary responsibility. As a fiduciary, they limit the investments that you can choose from so that they are not held liable for allowing you to invest in something “crazy.” For example, traditional custodians would not allow you to use money in a retirement account to invest directly in a piece of real estate or to buy shares of a non-public corporation.

A few custodians, however, offer what is called a self-directed IRA. In this case the custodian withdraws its fiduciary responsibility and allows you to choose the investments that you think are appropriate. With this option, you can take the money that is in your IRA—or in a 401(k) from a previous employer that you roll into an IRA—and use those funds to purchase investment property, precious metals, or even a new business. The ability to use these funds in such a way opens your investments up to significant risks, but also offers two great benefits that would not otherwise be available.

The first benefit is probably obvious from what has been said so far. You are able to invest the money in your retirement savings account in almost any way that you feel is best. You can choose the investment that you think will bring the greatest success in preparing for your future needs, and you have a source of money to make such investments that would not have otherwise been available to you.

![]() Example Chelsea has not been happy with the results of the investments she has made in her retirement accounts. For a long time she has wanted to invest in real estate— believing that she could have better results from owning rental property than from owning shares of a mutual fund. However, all of the money that she has available to invest is tied up in her IRA account and her IRA custodian does not allow direct investments in real estate. If Chelsea were to move her money to a custodian that offers self-directed IRAs she would be able to use the money in her IRA to purchase property and begin building her rental portfolio.

Example Chelsea has not been happy with the results of the investments she has made in her retirement accounts. For a long time she has wanted to invest in real estate— believing that she could have better results from owning rental property than from owning shares of a mutual fund. However, all of the money that she has available to invest is tied up in her IRA account and her IRA custodian does not allow direct investments in real estate. If Chelsea were to move her money to a custodian that offers self-directed IRAs she would be able to use the money in her IRA to purchase property and begin building her rental portfolio.

The second benefit may not be quite as obvious, but could prove even more beneficial. Since the real estate (or business) is held within an IRA, all income and gains on the investment are tax-deferred. You don’t need to pay taxes each year on the rental or business income—it is deferred to a future time. You keep the income within the IRA account and reinvest it elsewhere, or have it in reserve for future expenses.

Even more exciting is that when you decide to sell the property or business and buy another, or even if you just keep the gains and invest in something else, it isn’t necessary to deal with the headaches of a 1031 exchange (to avoid taxes on real estate) or pay capital gains. Because of this, the timing of buying and selling assets can be when it is optimal to do so, without having to figure in the effect of taxes or be tied down to the strict timing connected to 1031 exchanges.

![]() Example After 15 years, Chelsea has been able to use the cash flow from the rental property in her IRA to purchase two additional properties. She has not needed to pay any taxes on the income and, instead, used the money to reinvest in other opportunities as they have arisen.

Example After 15 years, Chelsea has been able to use the cash flow from the rental property in her IRA to purchase two additional properties. She has not needed to pay any taxes on the income and, instead, used the money to reinvest in other opportunities as they have arisen.

At this point in time she believes that there are some looming problems with the neighborhood of the first property a-nd wants to sell the house before the market values in the area decline. The great news for Chelsea is that when she sells the house she will not have to pay any taxes on the gain and can use the entire proceeds from the sale to reinvest in another home when she finds the right deal.

Of course, you must use great prudence and caution when investing your retirement savings. It would probably be best to not “put all of you eggs in one basket” by using all of your money to buy one property or one business. You must also be aware of the many risks that are inherent in real estate, including a measure of illiquidity.

It is very important to recognize that the IRA owns the asset. It is critical that you keep your non-IRA money (as well as your time and labor) separate from every aspect of the ownership in the real estate or business. For example, if you need to make repairs or replace the roof of a rental property, the money to fund these projects must come from the IRA. Otherwise, if you pay for anything out of pocket, it is considered a contribution to your IRA (subject to all of the maximum annual contribution limitations and income thresholds of an IRA). Putting more money in the IRA than the contribution limits allow subjects you to an annual penalty tax. Therefore it would be wise to have a significant portion of your IRA money in reserve (not invested in the property) so that you are free to make adjustments as needed.

You must also need to be aware of some special rules regarding self-directed IRA that limit your involvement in the investment. For example, in the case of rental real estate you must use an independent property manager to receive the income from the property and pay the expenses. You are not allowed to touch the money in your IRA; otherwise it is considered a distribution, and in this situation any money involved in the investment would count. The property manager would collect income and send it to the IRA custodian and would bill the custodian for the property’s expenses. The custodian will also charge a fee for this service. You are allowed to have control over the property manager; you just can’t touch the money. The rules for owning a business within an IRA become even more complicated. Your involvement in the business must follow strict guidelines. When investing in a business or rental property, it is critical that you work with an experienced and competent tax professional who can guide you through all of the potential land mines.

With all of that said, the tax benefits of a self-directed IRA can be enormous. If you have sufficient funds in a Roth IRA, the benefits from self-directing can be even greater because a Roth IRA can lead to tax-free income in your retirement. Investments in a small business or portfolio of rental properties within a Roth IRA could eventually lead to a retirement with a steady stream of tax-free income that is withdrawn at whatever pace you deem appropriate.

The Secret of Health Savings Accounts

The main purpose of Health Savings Accounts (HSAs) is to encourage individuals to choose higher-deductible health plans and save for future medical expenses. It is believed that the more a person is paying for medical expenses from his or her own account (instead of with the funds of an insurance company) the more careful the person will be. This in turn would lead to lower medical costs overall. In addition, if people have saved significant amounts of money for their own health care needs they will likely be less dependent on the government to cover those expenses in the future. For these reasons the government has created tax incentives to save for medical expenses, including the HSA.

The general concept of how an HSA works is that you receive a tax deduction for making contributions, the growth is tax-deferred, and if the funds are used for qualified medical expenses they are tax-free when withdrawn. It is like the best features of a Traditional IRA and Roth IRA combined—deductible contributions and tax-free withdrawals. HSA accounts are the best tax-saving opportunity around. While all of the ins and outs of HSAs are discussed in detail in Chapter 26, there is one specific aspect of an HSA that I want to discuss in this chapter as it pertains to alternative retirement strategies.

Generally, HSAs are intended to help pay for medical expenses and you will be penalized for using the funds for other purposes. However, once an individual reaches retirement age (59½), he or she can make non-medically related withdrawals from the HSA and they will be treated the same as a withdrawal from a Traditional IRA (meaning the money is taxed, but there is no penalty for using the funds for non-medical purposes). If you don’t need the HSA money for medical expenses, but do need an additional funding source for your retirement, you have an additional resource available to draw upon.

This rule is made even more beneficial by the fact that contributions to an IRA or 401(k) do not limit your ability to contribute to an HSA. If you have made the maximum contribution to an IRA, an HSA could be a great way to significantly increase the contribution you can make to an IRA-like account each year. In addition, HSA contributions have no high-income cap. High-income earners, who might not be allowed to make contributions to an IRA can contribute to HSAs no matter what their Adjusted Gross Income (AGI) happens to be.

![]() Example Maggie earns $250,000 per year. She contributes the maximum amount to her 401(k) each year, but cannot contribute to an IRA because her income is too high. She is also subjected to many phase-outs for deductions and credits because of her high income and does not have many ways available to her to reduce her tax burden. However, Maggie is able to contribute to an HSA account and receive the full deduction because there are no income limits on HSA contributions and they are not affected by other contributions to retirement plans. The HSA provides a great opportunity for Maggie to put more money away for retirement and reduce her taxes.

Example Maggie earns $250,000 per year. She contributes the maximum amount to her 401(k) each year, but cannot contribute to an IRA because her income is too high. She is also subjected to many phase-outs for deductions and credits because of her high income and does not have many ways available to her to reduce her tax burden. However, Maggie is able to contribute to an HSA account and receive the full deduction because there are no income limits on HSA contributions and they are not affected by other contributions to retirement plans. The HSA provides a great opportunity for Maggie to put more money away for retirement and reduce her taxes.

Stan is married and works for a small business that does not offer a retirement plan. Stan is 55 and wants to put as much money into retirement savings as he can, but his only option is to invest in an IRA that has a pretty low maximum contribution per year. Stan could more than double the contributions he makes to his IRA by also funding an HSA account.

The maximum contributions to an HSA that are allowed each year are set by the IRS and increase annually, based on inflation. Table 15-1 shows where the annual contribution limits are currently set.

Table 15-1. Maximum Allowable HSA Contributions in 2014

|

Tax Year |

Younger than 50 Years Old |

Age 50 or Older |

|

Individual |

$3,300 |

$4,300 |

|

Family |

$6,550 |

$7,550 |

HSAs present a tremendous opportunity for individuals to capture significant tax savings, both when the contribution is made and when the funds are withdrawn. They are governed by special rules, so be sure to read more about them in Chapter 26 before investing. I have found, though, that even under these rules the HSA is one of the greatest gifts that Congress has given the American taxpayer in decades—and that the HSA is also one of the tax world’s best-kept “secrets.”

Deferred Compensation and Defined Benefit Plans (Pensions)

Business owners have an opportunity to shelter a significant amount of income by deferring compensation through defined benefit plans, or what some people refer to as pensions. Most employer retirement plans are based on defined contributions—meaning an employee can contribute up to “X” amount and the employer will, in turn, match those contributions by a fixed amount as well. In such plans there is no guarantee of what the value of an employee’s account will be upon retirement; the contributions are made and the end result is completely dependent upon the performance of the investments made in the account.

In contrast, a defined benefit plan is based on the projected outcome and not as much on the amount of contributions made. Each year the plan is subjected to actuarial scrutiny to determine what contribution needs to be made in order to meet a predetermined retirement income. Based on that projected income and the number of years until the planned retirement, the actuary will determine what the contribution for each employee needs to be.

With defined contribution plans—such as a 401(k)—there is a fairly low ceiling set for allowable contributions ($17,500 by the employee and $52,000 total between the employee and employer). If an individual wants to put more money into a retirement plan, his or her options are fairly limited beyond that amount., With a defined benefit plan, however, the total allowable contribution can be as high as $210,000 in 2014! That is a significant difference, and, for the older business owner who wants to put away as much as possible, the defined benefit plan offers a great opportunity to do so.

The reason that the contribution limits are so high for these plans is that you are required to meet a fixed future benefit. If there are not sufficient funds in the plan to meet that benefit there must be flexibility in contributing significant amounts of money in order to make up for the shortfall. However, an individual cannot just arbitrarily decide to contribute the maximum amount each year—the contribution must be determined by an actuary, based on several assumptions.

![]() Tip The ideal situation in which to use a defined contribution plan is when the owner of the business is nearing retirement and his or her employees are few in number and young in age. This scenario allows for the highest possible contributions for the owner, with very limited contributions required for the other employees.

Tip The ideal situation in which to use a defined contribution plan is when the owner of the business is nearing retirement and his or her employees are few in number and young in age. This scenario allows for the highest possible contributions for the owner, with very limited contributions required for the other employees.

A significant downside to a defined benefit plan is that whatever the required contributions are in a given year, they must be made, regardless of whether the business was profitable in that year. This can pose a significant hardship for businesses that have cyclical ups and downs in their revenue, or that have a sudden downturn in their revenue stream. Defined benefit plans are much better suited to businesses whose revenue streams are relatively steady and predictable from year to year.

![]() Tip Though contributions to the plan are required each year, there is a certain amount of flexibility allowed in how those contributions are determined. An actuary has to make assumptions about the projected growth rate of investments, the individual’s retirement age, and the income stream needed in retirement. Each of these assumptions can be adjusted up or down within a reasonable range, depending on the need for the contribution requirement to be increased or decreased.

Tip Though contributions to the plan are required each year, there is a certain amount of flexibility allowed in how those contributions are determined. An actuary has to make assumptions about the projected growth rate of investments, the individual’s retirement age, and the income stream needed in retirement. Each of these assumptions can be adjusted up or down within a reasonable range, depending on the need for the contribution requirement to be increased or decreased.

Livestock, Agriculture, and Land

In Chapter 10, I wrote about creating a tax-free income stream through investing in livestock or agriculture, by creating a source of food for your family that you do not have to purchase with taxable income. These are also potential opportunities for tax-preferred retirement investments that allow you to contribute as much money as you desire each year into building a herd or orchard and defer the income to a future year. When you do begin to draw upon these investments, you are able to do so at the rate that you choose, instead of being forced to withdraw specified minimum amounts.

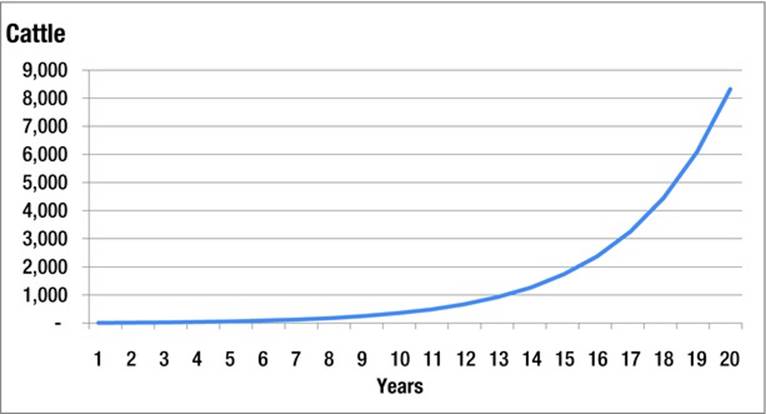

As an example, let’s examine the idea of developing a herd of cattle. I am not a rancher, but from what I am told a herd can triple in size every 3–4 years. Each cow can be bred and nurture a calf every year, and a new calf can be bred when she is 18–24 months. Depending on the breed, cows can mother a new calf each year for 15–20 years. Assuming half of the newborn calves are male and sold off, and the females are kept to build the breeding herd, the size of the herd would grow at around 37% per year. At this rate of growth, the original herd of 20 cows would turn into around 360 in 10 years, 1,700 in 15 years, and more than 8,000 in 20 years (by which time the original 20 cows are no longer breeding). Of course, you would need to have a lot of land for that many cows. Also, the cows are worth more when they are younger (but not calves). But it gives you an idea of the growth potential available. See Figure 15-1 for a visual representation of how quickly a herd can grow.

Figure 15-1. Tax-deferred growth of a cattle herd from 20 original cows over 20 years

The great tax news that comes from such a scenario is that the growth in the cattle herd is tax-deferred—you don’t pay any taxes on the new cows as they are born. You only recognize income when you sell the cows. If you are 10 years from retirement and in a high income tax bracket, you could put money into raising cattle for 10 years and not recognize any significant amount of income from the growth of the herd until you are (presumably) in a lower tax bracket in retirement. At that point you can sell off the herd over a period of time (in order to keep your income down), or even maintain its size and sell only the increase in size as a nice supplement to your retirement income.

In addition to the tax-deferred growth of the herd, you are also able to deduct many of the expenses, such as feed, fertilizer, and other supplies, as they occur. These deductions can help offset any income that you receive from selling male calves or other incidental items. Immediate deductions, coupled with tax-deferred growth and the ability to choose the timing of income recognition, combine to form a fairly significant tax savings opportunity. The opportunities presented in this example of a cattle herd can be repeated with other animals as well, such as sheep or alpacas. The possibilities don’t stop with animals, either.

There are similar opportunities for tax deferral in planting trees. I know a few individuals who have built great wealth (mostly tax-deferred) through lumber. They purchase a large tract of land with mature trees, and then harvest enough trees from the land that the profit from the trees covers the original cost of the land. At that point they own the land free and clear, plant new trees to grow for future years, and sit back while the value of the land grows (literally) over the years, all tax-deferred. It takes a long time for new trees to develop into mature trees that are large enough to bring a significant price when they are harvested—but if you have the time it is a great way for your wealth to grow and have complete control over how and when it gets taxed.

Fruit and nut trees offer a similar opportunity, but on a shorter time scale. Most fruit and nut trees take 5–8 years to begin producing a full harvest. If you are about that far from retirement, or from lowering your income into a better tax bracket, planting an orchard could be a great way to invest money now and reap tax-preferred benefits later (while deferring all the taxes on the growth in the value of those trees).

Finally, another asset that is great for tax-deferred growth is land. Real estate has proven to be one of the most reliable investments for long-term growth. Real-estate taxes that you pay on investment property are tax-deductible each year, and the growth in the value of the land is deferred until you sell it. In fact, there are ways to sell real estate and roll the proceeds into another property without paying any tax. And when you eventually sell the land it is taxed at capital-gains tax rates as long as you have owned it for more than one year. Real estate happens to be one of the favorite investments of wealthy members of Congress, as well—which should probably tell us something about its current tax benefits and the security of maintaining those benefits in the future.