Tax Insight: For Tax Year 2014 and Beyond, 3rd ed. Edition (2015)

Part IV. Business Income and Deductions

Chapter 17. Business Use of the Home

The Way to Deduct “Personal” Expenses on Your Home through Your Business

Wouldn’t it be nice to write off some of your personal expenses, such as utilities, home repairs, or even lawn care? It would be even better if you could write off these expenses against both income and self-employment taxes. Under normal circumstances the tax code explicitly categorizes these types of personal expenses as non-deductible. However, if you work at home, or even store things at home for your business, you may be able to claim a tax deduction for some of your otherwise “non-deductible” expenses.

You may have heard of this deduction as the Home Office deduction. A more accurate name, however, is the Business Use of the Home (BUH) deduction. As the accurate name indicates, you can claim this deduction in many more ways than simply having an office in your home. You may also qualify for this deduction if you store inventory, have a greenhouse or workshop on your property, have a lab or studio, run a daycare service, or even work from home for an employer. Don’t limit your possibilities for this deduction by thinking you have to have an office in your home. Any use of your home or property for business purposes may qualify you for the deduction.

![]() Example Mike is an elementary school teacher. He also has a side business making wooden toys that he sells at craft fairs. Mike converted an old shed on his property into a workshop that he uses exclusively for his business several nights a week. Because of this exclusive business use, Mike can deduct from his business income a portion of his mortgage interest, utilities, and cost of improvements on the shed. This deduction lowers his income and self-employment taxes by $1,500 each year.

Example Mike is an elementary school teacher. He also has a side business making wooden toys that he sells at craft fairs. Mike converted an old shed on his property into a workshop that he uses exclusively for his business several nights a week. Because of this exclusive business use, Mike can deduct from his business income a portion of his mortgage interest, utilities, and cost of improvements on the shed. This deduction lowers his income and self-employment taxes by $1,500 each year.

There are so many ways in which the BUH deduction opens up opportunities for tax savings. For one, it allows you to write off expenses that are normally non-deductible. For another, it allows self-employed individuals to reduce their income and self-employment taxes, resulting in an extra 15% tax savings on top of their marginal income tax rate. Most personal deductions, if allowed at all, can be taken only against income tax.

Yet another benefit of the BUH deduction is that it provides opportunities to avoid the limitations that are often placed on the deductions of personal expenses. Itemized deductions on Schedule A are often limited by Adjusted Gross Income (AGI) as well as by the total value of the deductions combined, compared to the standard deduction. The BUH deduction can reduce the effects of those limitations. For example, if your AGI is too high, the amount of real-estate taxes you can deduct from Schedule A is reduced by the Alternative Minimum Tax (discussed inChapter 31). If you can claim a portion of those real-estate taxes as business expenses instead, a portion of the deduction can still be claimed (and also used to reduce self-employment tax).

The mortgage interest deduction also illustrates how the BUH deduction can reduce the limitations placed on personal expenses. Normally you are allowed to deduct mortgage interest only on loans up to $1,100,000. However, with the BUH deduction you can claim the excess interest if you can show that the excess interest is necessary as a result of the business.

Another great benefit: if your home office is your principal place of business you can claim a mileage deduction for any distance you travel for business purposes. Under normal circumstances, the distance of the commute between your home and your office is considered a personal expense and cannot be deducted; only trips conducted after the arrival at the office can be claimed. However, when your home is your office, any business travel can be claimed. It is not uncommon for this additional mileage deduction to be worth even more than the BUH deduction.

First Things First

The BUH deduction is one of the most commonly used deductions by small-business owners. In my experience it is also one of the least understood and most abused deductions around. Because it is so commonly used and abused, it is also one of the most consistently audited deductions on a tax return. Before claiming this deduction you must be sure you fully understand the pros and cons associated with it, as well as its very specific rules.

Determining the BUH deduction is a fairly complicated, multistep process. To claim the deduction you must satisfy many requirements. In addition to meeting those requirements you must also make a complex series of calculations (using as many as three tax forms) in order to determine the value of the deduction you are entitled to. So, take a deep breath, sit back, and try to take in the rest of this section as best you can. This is one area of taxes that has a lot of thorns clinging to it, but with care it can be navigated successfully and bring sweet returns.

Determining Whether Your “Business Use” Qualifies for the BUH Deduction

The first thing to understand about this deduction is that it is contained in a part of the tax code known as the disallowance section—because in most circumstances the expenses related to your residence are specifically not allowed as deductions. Then, within that section of the code are narrowly defined exceptions to the rule. With this in mind, you must answer several questions to figure out whether your use of the home is considered “business use,” as defined by the tax code. The following sub-sections address these key questions.

1. Is the activity a “business” in the eyes of the IRS?

The mere fact that a certain activity brings a profit does not mean it is a business. You must determine that the IRS considers your income-making-activity to be a legitimate business and not a hobby or other activity. If it is not considered a “business,” you cannot claim the deduction.

![]() Example Mike’s wife, Susan, is a retired chemist. She devotes a significant portion of her time each week to managing her stock portfolio. She does this in an office in her home for several hours each day. She cannot claim this as a business use of her home, however, because, for tax purposes, personal investment management is not considered a business. Even though Susan makes a profit from her trades, this use of the home is not eligible for the BUH deduction.

Example Mike’s wife, Susan, is a retired chemist. She devotes a significant portion of her time each week to managing her stock portfolio. She does this in an office in her home for several hours each day. She cannot claim this as a business use of her home, however, because, for tax purposes, personal investment management is not considered a business. Even though Susan makes a profit from her trades, this use of the home is not eligible for the BUH deduction.

2. Is the space you use for business part of a “home”?

You must determine whether the space you use is part of a home, or “dwelling unit,” as the code refers to it. You’ll need to consider several factors. First, the term “dwelling unit” includes any property that provides basic living accommodations, such as a toilet, a place to sleep, and a place to cook. From this description you can see that even some RVs and boats fall into the category of dwelling units, or homes. In addition to these minimal requirements, the place must actually be used as a residence (not just qualify as one).

![]() Tip I have some clients who use this broad definition of a home to their advantage. They claim some of the expenses related to their RV as legitimate business expenses and write them off under this deduction.

Tip I have some clients who use this broad definition of a home to their advantage. They claim some of the expenses related to their RV as legitimate business expenses and write them off under this deduction.

A tricky part of this “dwelling unit” rule is determining how to treat structures that are not connected to the dwelling unit—such as Mike’s shed in the earlier example. If a structure (like a shed) is “appurtenant” to a dwelling unit, it is considered a part of it. “Appurtenant” means that the structure is related to, or belongs to, the main property. In fact, all such structures must be deducted under the BUH rules, even though they are not actually a part of the home.

If the space you’re using for business purposes is a dwelling unit, or is appurtenant to one, the special rules for BUH must be applied before you take any deductions for that space. This is important because the deductions that are allowed will be in proportion to the total square footage of the home and other structures combined, which will make the deduction more limited than if you could write off 100% of the expenses related to the separate structure.

![]() Example Mike’s workshop shed is not considered a dwelling unit, in and of itself, because it has no bathroom, kitchen, or place to sleep, and because he does not use it as a residence. However, the shed is on the same lot as his home. It has no separate address and is not separate from the home in its expenses, such as property taxes, utilities, and insurance. For these reasons the shed is considered appurtenant to (belonging to or related to) the home and as such, is subject to the rules of the BUH deduction.

Example Mike’s workshop shed is not considered a dwelling unit, in and of itself, because it has no bathroom, kitchen, or place to sleep, and because he does not use it as a residence. However, the shed is on the same lot as his home. It has no separate address and is not separate from the home in its expenses, such as property taxes, utilities, and insurance. For these reasons the shed is considered appurtenant to (belonging to or related to) the home and as such, is subject to the rules of the BUH deduction.

If, on the other hand, the shed were on a separate piece of land that Mike owned, which had its own real-estate taxes and utility bills, Mike could deduct the shed expenses directly from his business income, without being subject to the BUH deduction guidelines.

3. Do you use the space exclusively and regularly for the business?

“Exclusively” means that the space is used for no other reason than its business use at any time during the year. For example, if a computer and desk are used for the business during the day and for video games at night, the use of the space for business purposes is not deductible. If you use the space for personal reasons at all during the year, it is not eligible for use for this deduction.

![]() Example If Mike uses his workshop all year for his business, but in the fall he also uses it to make gifts for his grandchildren, he cannot claim any of the expenses for the space under the BUH deduction. No personal use of the space is allowed during a year in which the deduction is claimed.

Example If Mike uses his workshop all year for his business, but in the fall he also uses it to make gifts for his grandchildren, he cannot claim any of the expenses for the space under the BUH deduction. No personal use of the space is allowed during a year in which the deduction is claimed.

“Regular” use requires that the area be used more than occasionally or incidentally. Mike satisfies this requirement because he uses the workshop several times each week. If he used it only a few times each year he may not qualify for the deduction.

Did you answer yes to the first three questions?

The first three questions regarding business use of your home are:

· Is the activity a “business” in the eyes of the IRS?

· Is the space you are using part of a “home”?

· Do you use the space exclusively and regularly for business?

If you were able to answer yes to each of these three questions, you are close to being able to claim the BUH deduction. All that remains is meeting one of the following three requirements:

1. Is it your principal place of business?

You satisfy the “principal place of business” requirement if:

· You use the space to conduct administrative or management activities for the business, and

· There is no other fixed location where you conduct substantial administrative or management activities for the business.

Under certain circumstances it may appear, by a strict interpretation of the preceding definition, that you do not meet these two requirements. However, you may still qualify based on additional guidance that the IRS has given. Based on this guidance you may still meet the preceding requirements if one of the following cases applies to you:

· You oversee administrative and management activities, but other people take care of them at a location other than your home. (Administration and management activities include overseeing outsourced bookkeeping, payroll, or billing.)

· You perform administrative and management activities at other locations (such as in a hotel or a car) that are not fixed locations of the business, in addition to doing them at home.

· On a minimal and occasional basis, you perform these activities at another fixed location of the business.

· You perform a significant amount of non-administrative and non-managerial activities at another fixed business location.

![]() Example Mike’s neighbor, Drew, is a traveling vacuum-cleaner salesman. To spend as much time as possible selling his products, Drew outsources his bookkeeping. After filling out invoices at customers’ homes he sends all of the paperwork, along with expense receipts, to his bookkeeper downtown. However, he still has a few administrative tasks that he must do on his own, such as ordering new supplies. Drew handles all such administrative tasks when he gets home, using a spare bedroom that he has set aside exclusively for the use of his business. In this scenario, Drew can claim the spare bedroom as his principal place of business, because it is where he conducts his administrative activities (including overseeing those that he has outsourced).

Example Mike’s neighbor, Drew, is a traveling vacuum-cleaner salesman. To spend as much time as possible selling his products, Drew outsources his bookkeeping. After filling out invoices at customers’ homes he sends all of the paperwork, along with expense receipts, to his bookkeeper downtown. However, he still has a few administrative tasks that he must do on his own, such as ordering new supplies. Drew handles all such administrative tasks when he gets home, using a spare bedroom that he has set aside exclusively for the use of his business. In this scenario, Drew can claim the spare bedroom as his principal place of business, because it is where he conducts his administrative activities (including overseeing those that he has outsourced).

![]() Tip I have found that the “administrative and management” criteria are excellent ways for many small-business owners to qualify for the BUH deduction. If you carefully study the preceding guidelines, you may find that structuring your business in a way that meets these guidelines is your ticket to being able to claim this deduction and thereby write off expenses that would otherwise be non-deductible.

Tip I have found that the “administrative and management” criteria are excellent ways for many small-business owners to qualify for the BUH deduction. If you carefully study the preceding guidelines, you may find that structuring your business in a way that meets these guidelines is your ticket to being able to claim this deduction and thereby write off expenses that would otherwise be non-deductible.

2. Do you use the area to meet or deal with customers?

Even if your “home office” is not your principal place of business, as defined earlier, you may still be able to claim the deduction if you regularly use the office to meet with customers, clients, or patients. To meet this requirement you must meet with customers in the home office during the regular course of business and these meetings must constitute a substantial and integral part of your business. In addition, the meetings must be in person—phone calls and e-mails don’t count. Courts have consistently held firm on the stance that, for the purposes of the BUH deduction, a meeting is a meeting only if it is in person.

![]() Example Mike’s other neighbor, Russ, is an optometrist. He has an office near the hospital, where he conducts appointments with most of his patients. However, about 20% of his patients are friends and family, with whom he conducts his appointments in his home office on Fridays. Even though the home office is not his principal place of business, nor is it the location of his administrative duties, he can claim the business use because he meets with patients there regularly, and because these appointments constitute a substantial part of his business about 20%.

Example Mike’s other neighbor, Russ, is an optometrist. He has an office near the hospital, where he conducts appointments with most of his patients. However, about 20% of his patients are friends and family, with whom he conducts his appointments in his home office on Fridays. Even though the home office is not his principal place of business, nor is it the location of his administrative duties, he can claim the business use because he meets with patients there regularly, and because these appointments constitute a substantial part of his business about 20%.

3. Is the area you use in a structure separate from the home but still part of the home under the “appurtenant” rules ?

If the space you want to claim for business use is separate from but appurtenant to your home, the building needs to be used only “in connection” with the business to qualify for the deduction—it doesn’t have to be the principal place of business or a place where you meet with customers. Remember, though, that the area must still be used exclusively and regularly for the business.

![]() Example Mike’s woodworking business began to really take off, and he decided to quit his teaching job and open up a storefront downtown, where he could sell things every day—not just at craft fairs. This storefront would likely be considered his principal place of business. However, he would still be able to claim a deduction for the shed where he creates all of his woodwork because it is used “in connection” with his business, and it is appurtenant to the main structure of his home (not under the same roof).

Example Mike’s woodworking business began to really take off, and he decided to quit his teaching job and open up a storefront downtown, where he could sell things every day—not just at craft fairs. This storefront would likely be considered his principal place of business. However, he would still be able to claim a deduction for the shed where he creates all of his woodwork because it is used “in connection” with his business, and it is appurtenant to the main structure of his home (not under the same roof).

Can you claim the deduction?

If you answered yes to all of these questions:

· Is the activity a “business” in the eyes of the IRS?

· Is the space you are using part of a “home?”

· Is the space used exclusively and regularly for business?

And you answered yes to at least one of these three questions:

· Is this the principal place of business?

· Do you use the area to meet or deal with customers?

· Is the area you use in a structure separate from the home but still part of the home under the “appurtenant” rules?

Then you probably qualify to claim a business use of your home and deduct the related expenses. Of course, there are always exceptions to tax rules. Before making a final determination on your eligibility based on the six questions above, you should consider three more questions to see if you fit the criteria of some important exceptions to the rules.

1. Are you claiming the business use as a business owner or as an employee ?

If you are claiming business use of your home as an employee, not a business owner, you must satisfy one more rule. The use of your home must be for the convenience of the employer. Using your home for business purposes must benefit the employer for some reason, and that reason cannot be solely that it is more convenient for the employee.

![]() Example While Mike was still teaching, he used a spare bedroom in his home, regularly and exclusively, to grade homework and tests. The school provided a place for Mike to do this work, but he preferred to do it at home. Because it was Mike’s choice to use his home in this way, for his own convenience and not for the convenience of the employer, he could not claim this as a business use of the home.

Example While Mike was still teaching, he used a spare bedroom in his home, regularly and exclusively, to grade homework and tests. The school provided a place for Mike to do this work, but he preferred to do it at home. Because it was Mike’s choice to use his home in this way, for his own convenience and not for the convenience of the employer, he could not claim this as a business use of the home.

If, however, Mike had been employed as a teacher for an Internet-based home school program, and the school required all of its teachers to work from home because it did not maintain a campus, then Mike would have been able to claim the BUH deduction.

![]() Tip If your employer requires you to work from home for the convenience of your employer, I would highly recommend getting a letter from them stating that this is the case. Although the possession of such a letter is not a guarantee, it should add great support to your case if you are audited by the IRS in regard to this deduction.

Tip If your employer requires you to work from home for the convenience of your employer, I would highly recommend getting a letter from them stating that this is the case. Although the possession of such a letter is not a guarantee, it should add great support to your case if you are audited by the IRS in regard to this deduction.

2. Is the business use you are claiming related to storage space ?

The rules regarding storage space can actually be a little easier to satisfy than those related to other business uses of the home because the area is not required to be used exclusively for business. However, to qualify for the deduction for storage space, you must satisfy all of the following requirements:

· The storage space must be used for inventory or product samples of items that you sell through your business.

· The storage space must be separately identifiable from other areas and must be suitable for storage.

· The home must be the only fixed location of the business, and the storage space must be used regularly.

Some of the key determinants for “business use” do not apply to storage space. For example, the home does not need to be the principal place of business (but it must be the only fixed location), nor do you need to meet with customers there. Also, the space does not need to be used for business exclusively—it only needs to be used for that purpose regularly. Remember, though, that the items you are storing must be inventory of goods you sell in order to use these more lax rules.

![]() Example As an accountant, if I used space in my home to store client files I could not claim the space used for storage because I am not in the business of selling client information—it’s not inventory (thank goodness). However, if I tried to maintain a supply of 5,000 copies of my book , Tax Insight, on hand (in order to meet high demand), I could claim the space for a deduction because the book is an item I sell.

Example As an accountant, if I used space in my home to store client files I could not claim the space used for storage because I am not in the business of selling client information—it’s not inventory (thank goodness). However, if I tried to maintain a supply of 5,000 copies of my book , Tax Insight, on hand (in order to meet high demand), I could claim the space for a deduction because the book is an item I sell.

3. Is your business a daycare service ?

The question is not, “Does your home business feel like a daycare service?” However, if you actually run a daycare service in your home, special rules apply to you in regard to claiming the business-use deduction. You must meet each of the following requirements:

· You must be licensed or otherwise approved by your state for the type of care you provide.

· Your primary service must be the custodial care of children, adults older than age 65, or those who are physically or mentally unable to care for themselves.

· The care you provide must be limited to certain hours of the day—it cannot be 24-hour care.

If your business is a qualified daycare there is no exclusivity rule, as there is with other businesses. So, if you use your kitchen and living room for the daycare, but also use it for personal reasons as well, you are still able to claim the deduction. (There is a specific formula that must be used in this circumstance, which I discuss in the next section.)

Which Expenses You Can Deduct

Once you determine that you are eligible to claim expenses related to the business use of your home, the next step is to determine which expenses are deductible, and to what extent. Expenses fall into three potential categories, which in turn determine the deduction you can take. These three categories of expenses are:

· Directly related expenses

· Indirectly related expenses

· Unrelated expenses

Under the following three subheadings I discuss each of these categories of expenses in detail.

Directly Related Expenses

Directly-related expenses are those which benefit the business-use portion of the home exclusively. Two examples of directly related expenses are improvements or repairs to the area used for the business, or additional insurance on the business property in that room.

![]() Example The improvements Mike made to the shed in his backyard, when he converted it to a workshop, are directly related to the business because they did not benefit any other part of the house. For this reason they are fully deductible business expenses.

Example The improvements Mike made to the shed in his backyard, when he converted it to a workshop, are directly related to the business because they did not benefit any other part of the house. For this reason they are fully deductible business expenses.

![]() Tip Whenever possible, separate out receipts and bills into business and non-business portions. If you are having your home interior painted, for example, ask the contractor to specifically separate on the bill, or on separate bills, the cost for painting the home office. In this way you will have a clear way to distinguish the business-use expense and you will be able to count that portion as a fully deductible business expense (rather than a pro-rated amount).

Tip Whenever possible, separate out receipts and bills into business and non-business portions. If you are having your home interior painted, for example, ask the contractor to specifically separate on the bill, or on separate bills, the cost for painting the home office. In this way you will have a clear way to distinguish the business-use expense and you will be able to count that portion as a fully deductible business expense (rather than a pro-rated amount).

Indirectly Related Expenses

Indirectly related expenses are those that benefit both the business and non-business portions of the home. Some examples of these kinds of expenses are utilities, roof repairs, mortgage interest, insurance, or real-estate taxes. These expenses can’t easily be divided between the personal and business portions of the home on a direct basis—only in a pro-rated fashion.

Generally, these types of expenses will be deducted proportionately to the amount of space used for business in the home. If the home office is 250 square feet, for example, and the home is 2,500 square feet, 10% of indirect expenses can be deducted as business use (250 sq. ft. of office space ÷ 2,500 total sq. ft. in the home = 10% of the total sq. ft. used for the office). However, certain expenses may be treated differently than this because it does not make sense to divide the expense proportionately.

One indirect expense that may receive special, non-proportionate treatment is utilities. If the nature of the business lends itself to using a disproportionately high or low percentage of the utilities, the amount deducted should be adjusted to reflect the actual usage.

![]() Example The tools Mike has in his workshop use a lot of electricity. In fact, based on the difference in his electricity bill between months when he is spending a lot of time making crafts, and those when he is not, he estimates that 35% of his annual electricity usage is related to the workshop. Although the shop makes up only about 8% of his home’s total square footage (the combined square footage of the shed and home together), he will actually deduct 35% of the electricity bill for tax purposes.

Example The tools Mike has in his workshop use a lot of electricity. In fact, based on the difference in his electricity bill between months when he is spending a lot of time making crafts, and those when he is not, he estimates that 35% of his annual electricity usage is related to the workshop. Although the shop makes up only about 8% of his home’s total square footage (the combined square footage of the shed and home together), he will actually deduct 35% of the electricity bill for tax purposes.

On the other hand, he really doesn’t use any water for his business. Practically all of the water used at his home is for personal reasons. Because of this he won’t deduct any portion of the water bills as business use.

![]() Tip If you are going to claim a disproportionate amount of utilities as deductible business use—especially if you’re claiming a higher amount—be sure that you can substantiate that claim with good records and evidence. In the preceding example, Mike should keep records of all of the electric bills and mark months in which he used the shop less so that the difference in usage can be substantiated.

Tip If you are going to claim a disproportionate amount of utilities as deductible business use—especially if you’re claiming a higher amount—be sure that you can substantiate that claim with good records and evidence. In the preceding example, Mike should keep records of all of the electric bills and mark months in which he used the shop less so that the difference in usage can be substantiated.

Another indirect expense with special treatment is homeowners’ insurance, if it is paid annually. The IRS allows only the portion of insurance premium that applies to the current year to be deducted in that year. So, if you make an annual payment for your insurance on October 1, this year you can deduct a quarter of that premium (3 out of 12 months’ worth of insurance), multiplied by the proportion of square-footage that the business uses. You would deduct the remainder of the pro-rated annual premium in the following year, since it pertains to insurance coverage in that year. Of course, this year you could also claim the 9 months’ worth of premium that you paid the previous year and were unable to claim.

Finally, the IRS allows no deduction for the first phone line into the home—period. The cost of basic local service, plus taxes, for the first phone line is considered 100% personal, even if you could prove that it was used 100% for business. However, the cost of additional services on that phone line, such as long-distance service or voice mail, can be used as business deductions to the extent that they can be shown to be for business use (or any portion thereof ).

Unrelated Expenses

Unrelated expenses are those that benefit the home, but not the business portion of the home. If, for example, you run an Internet-based search-engine optimization business and you replace your kitchen stove, you can’t claim any portion of that expense as a business deduction because it has nothing to do with the business.

One unrelated (disallowed) expense that I want to highlight is landscape installation or maintenance. The IRS does not allow you to pro-rate a portion of these expenses as business-related unless you see clients, customers, or patients in your home, or if the business use is renting out a portion of your home.

How Much of a Particular Expense Can I Deduct?

If an expense is directly related, you can deduct all of it. A caveat to that statement is that if the expense was for an item that falls under the rules of depreciation, such as furniture, equipment, or permanent upgrades to the home, you must follow the depreciation rules. Depreciation deductions will be taken on a different portion of the tax return.

If the expense is indirectly related, you can deduct the amount that is proportionate to the amount of space your business uses in the home (see the explanation and example in the preceding “Indirectly Related Expenses” sub-section).

If your business is a daycare service, you must follow one additional rule for indirect expenses. As is the case with all businesses, you must first multiply the percentage of space used by the expense (for example, 10% of all utilities). Then, as an additional step, you must multiply that value by the percentage of hours used the space is used for the business.

![]() Example Mike’s mother, Nancy, runs a daycare service in her home 10 hours per day, 5 days per week, 50 weeks per year. This makes a total of 2,500 hours per year that she is “open for business.” There are 8,760 hours in a non–leap year, so the daycare service is run 28.54% of the available hours in a year. If Nancy makes 50% of her house available to the children in the daycare service, and her annual electricity bill is $1,800, she can deduct $257 of her electricity bill as business use (50% of home used × 28.54% of the time × $1,800 = $257).

Example Mike’s mother, Nancy, runs a daycare service in her home 10 hours per day, 5 days per week, 50 weeks per year. This makes a total of 2,500 hours per year that she is “open for business.” There are 8,760 hours in a non–leap year, so the daycare service is run 28.54% of the available hours in a year. If Nancy makes 50% of her house available to the children in the daycare service, and her annual electricity bill is $1,800, she can deduct $257 of her electricity bill as business use (50% of home used × 28.54% of the time × $1,800 = $257).

![]() Tip If you run a daycare service, you should be aware of several other special deductions that are available to you. Be sure to consult a tax advisor or the IRS publications.

Tip If you run a daycare service, you should be aware of several other special deductions that are available to you. Be sure to consult a tax advisor or the IRS publications.

Depreciation

Once you establish a qualified business use of the home, you can begin to depreciate the business-use portion of the home as an additional deduction. Depending on the value of your home, this could be one of the larger deductions available to you under the business-use rules. To claim depreciation you must first establish a “basis” in the home, or in other words, the home value on which you can base the depreciation.

For the purpose of the BUH deduction, the basis of the home is the lesser of either:

· The original cost of the home, plus the cost of improvements, minus any depreciation previously taken

or

· The fair market value of the home when you started using it for business

Given the conditions of the housing market, your current home value may be less than what you paid for it. If this is the case, you must use that smaller value in your depreciation formula.

![]() Tip Get a third-party valuation of your home at the time that you begin to take this deduction. An appraisal would obviously be the best documentation—one that is hard to dispute. But I think that even a realtor’s evaluation or a website such as Zillow.com would be better than nothing. I don’t know how these latter sources would hold up in an audit, but you could at least show that you had reasonable evidence for the depreciation value you chose.

Tip Get a third-party valuation of your home at the time that you begin to take this deduction. An appraisal would obviously be the best documentation—one that is hard to dispute. But I think that even a realtor’s evaluation or a website such as Zillow.com would be better than nothing. I don’t know how these latter sources would hold up in an audit, but you could at least show that you had reasonable evidence for the depreciation value you chose.

Once you have established the total cost of the home, or its current value (if less), you must subtract from that number the value of the land the house is built on (because land cannot be depreciated). The best way to establish the value of your land (other than an appraisal) is by referring to your real-estate tax bill. It will usually show the value the county assessor has given the land, separate from the value of the building or buildings. After you have subtracted the land value from the total property value, you arrive at the home’s depreciable basis.

The next step is to multiply the home’s basis by the percentage of the home used for business purposes. This will give you the net depreciable basis of the home for business purposes.

![]() Example Mike’s home is 2,300 square feet, and the workshop is 200 square feet, making a total of 2,500 square feet for business-use calculations. This means that 8% of his home (200 ÷ 2,500 = 8%) is qualified for business-use deductions.

Example Mike’s home is 2,300 square feet, and the workshop is 200 square feet, making a total of 2,500 square feet for business-use calculations. This means that 8% of his home (200 ÷ 2,500 = 8%) is qualified for business-use deductions.

Mike purchased his home for $200,000 and has made $40,000 in improvements, for a total cost of $240,000. His home was appraised at $600,000 when he recently refinanced. The cost of $240,000 is lower than the appraisal, so this cost will be used as the basis. The depreciable basis for Mike’s home is $19,200 (8% × $240,000 = $19,200). All depreciation for the business use of his home will be based on this number.

If you began using your home for business after 1993, your home office will be depreciated over 39 years. (If you began using your home for business purposes during or before 1993, you need to consider other rules that I will not cover here. See a tax advisor or the IRS publications for assistance.) That means you would take 2.564% (1/39th) of the depreciable basis each year as a deduction.

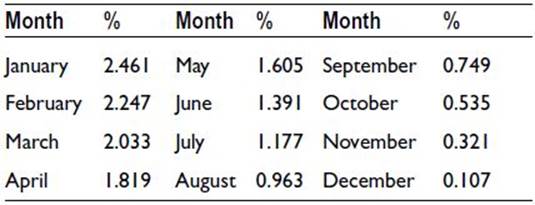

The exception to the standard annual depreciation rate would be in the first year depreciation is claimed (or in any year the business does not use the space for that full year). In the first year, you can claim a deduction only for the portion of the year in which you used the property for business. Table 17-1 lists the percentage you should use for depreciation in the first year of business use.

Table 17-1. First-Year Depreciation Percentage Rates

![]() Example The first year Mike used his workshop for business, he began using it in September. In that year he could claim $144 in depreciation expenses ($19,200 depreciable basis × 0.749% from the table = $144). In all other years he could claim $492 ($19,200 × 2.564% = $492) until the basis is fully depreciated.

Example The first year Mike used his workshop for business, he began using it in September. In that year he could claim $144 in depreciation expenses ($19,200 depreciable basis × 0.749% from the table = $144). In all other years he could claim $492 ($19,200 × 2.564% = $492) until the basis is fully depreciated.

Claiming the BUH Deduction

If you’re a business owner, use Form 8829 to calculate and report expenses related to the business use of the home. On this form is where most of the number crunching occurs; it shows the IRS how you arrived at the deduction you are claiming. Once you determine the total deduction, the number then flows to the Schedule where you report the other business income and expenses. That would be Schedule C if you’re self-employed, and it would be Schedule E for the partner, S-corporation owner, or rental-property owner.

If you’re an employee claiming this deduction, report the expenses on Form 2106. Your expenses will then flow to Schedule A and are subject to the 2%-of-AGI threshold for miscellaneous deductions, as unreimbursed employee expenses. An employee is not required to use Form 8829 to compute the deductible expenses. Instead, the IRS provides a worksheet to help you calculate the deductible amounts, which you should keep with your other tax records.

![]() Tip Employees who claim a BUH deduction should not include any mortgage interest or real-estate tax as part of that deduction. Rather, those expenses should be reported as completely personal expenses on Schedule A. The IRS instructs taxpayers to do this because it will bring a potentially greater benefit to you: those personal expenses are not subject to the 2% floor that employee expenses are subject to, and so they are better used outside of the BUH deduction.

Tip Employees who claim a BUH deduction should not include any mortgage interest or real-estate tax as part of that deduction. Rather, those expenses should be reported as completely personal expenses on Schedule A. The IRS instructs taxpayers to do this because it will bring a potentially greater benefit to you: those personal expenses are not subject to the 2% floor that employee expenses are subject to, and so they are better used outside of the BUH deduction.

The Simplified Home Office Deduction

Beginning with the 2013 tax year, the IRS is offering taxpayers a much simpler way to calculate their Home Office Deduction. The simplified version does not change any of the rules that determine whether you qualify to claim the deduction. However, what it does simplify is the calculation of the deduction and the record-keeping requirements.

There are several benefits to this option. First, you will not need to keep records of all of your business-use expenses. You will simply claim $5 in expenses per square foot of business-use space. The maximum space allowed to be claimed is 300 square feet, for a maximum $1,500 deduction. If your previous deductions have been much greater than $5 per square foot (or your square footage is much larger than the 300 foot cap) you may want to continue using the traditional method for claiming the deduction. On the other hand, if your true expenses are less than $5 per foot, you will get a greater tax benefit by using the simplified method than you would by doing it the traditional way.

Second, you may switch between using the simplified method and the traditional method every year. This allows for deduction arbitrage, where you time expenses to be heavy in the year that you claim the traditional method and light in the year that you use the simplified method. If in the light years your expenses are less than $5 per foot, you can still claim $5 and get a larger deduction than you really “deserve.”

Third, if you use the simplified method, you do not have to allocate any of your mortgage interest or real estate tax to the business use deduction, allowing the entire amount to be deducted from your personal itemized deductions on Schedule A.

A few other things to note: You cannot claim depreciation on the home when using the simplified method (which is often better, anyway), and you cannot use the method for two separate houses in one year (although you can still use the traditional method for the second house).

This new, simplified method is a huge breakthrough in the tax code for taxpayers. It will make many people’s record-keeping tasks much easier and it will also result in a larger deduction for some.

Your BUH Deduction May Be Limited

Although you are allowed to deduct expenses related to the business use of your home against business income, you are not allowed to claim a loss because of those deductions. In fact, you must deduct each expense in a specific order to determine which expenses will be allowed and which will not. The order is as follows:

1. From your gross business income, you must subtract all business expenses that are not related to your home. For example, expenses for things such as office supplies, wages, meals, and depreciation of business assets (not including the home) would be subtracted from income first.

2. Deduct expenses related to your home that you would be able to deduct regardless of business or personal use. These expenses include mortgage interest and real-estate taxes.

3. If a positive net income remains, you can then subtract other expenses related to the home that would not be allowed as deductions if they were solely personal expenses. Some examples of these expenses are utilities, insurance, repairs, and maintenance. None of these deductions can lead to a negative net income. Once the net income reaches $0, these deductions must stop.

4. As long as sufficient net income remains, you can deduct depreciation on the business-use portion of the home. As with the previous deductions, the deduction for depreciation cannot exceed the net income that remains after all previous deductions.

At no time will the deductions claimed in the third and fourth group be allowed to produce a loss. However, any unused deductions can be carried forward to a future year when you have sufficient income from which to deduct them.

![]() Example In Year 4 Mike had a hard time selling his woodwork because of a down economy. Although he made a profit, it wasn’t as much as he was accustomed to. In fact, his income wasn’t even enough to be able to claim all of his BUH deduction:

Example In Year 4 Mike had a hard time selling his woodwork because of a down economy. Although he made a profit, it wasn’t as much as he was accustomed to. In fact, his income wasn’t even enough to be able to claim all of his BUH deduction:

Year 4 Gross Income $25,000

Ordinary Business Expenses − $21,000

Net Income Remaining $4,000

Business % of Mortg. Int. & Taxes − $2,300

Net Income Remaining $1,700

Other Business-Use Expenses − $1,500

Net Income Remaining $200

Depreciation on the Home − $492

Net Income − $292

Depreciation on the home is not allowed to create a negative net income. For this reason Mike had to carry over $292 of BUH deductions to a future year when he had sufficient net income to deduct it and still leave a positive balance.

As you can see from this example, even if you meet all of the qualifications for the BUH deduction you may still be unable to claim it all in the current year. This reduces the benefit of claiming the deduction at all—unless in most years your income is more than sufficient to allow you to claim the full deduction.

![]() Tip If your net income after non–home expenses is low enough that you cannot even claim all of the business-use portions of your mortgage interest and property taxes, consider the possibility of not claiming a business use of your home at all. You may have a greater benefit in being able to claim all of your mortgage interest and real-estate taxes on Schedule A (itemized deductions), rather than carry forward the business deductions to a future year. You will discover which option is best only by the result of both scenarios in the current year.

Tip If your net income after non–home expenses is low enough that you cannot even claim all of the business-use portions of your mortgage interest and property taxes, consider the possibility of not claiming a business use of your home at all. You may have a greater benefit in being able to claim all of your mortgage interest and real-estate taxes on Schedule A (itemized deductions), rather than carry forward the business deductions to a future year. You will discover which option is best only by the result of both scenarios in the current year.

Multiple places of business complicates the calculation

The preceding scenario (deductions limited by the amount of income) becomes even more complicated when you have multiple places of business. This is because the deduction is actually limited by the amount of income derived from the business use of the home. So if you run most of your business elsewhere and perform administrative duties only at home, for example, it may be difficult to claim sufficient income derived in the home to cover the expenses claimed.

![]() Example Mike’s neighbor Russ, the optometrist, sees 25% of his patients in his home. Because this is the only business activity he performs in his home, he can use only the income from those in-home visits against the expenses he claims for the business use of the home.

Example Mike’s neighbor Russ, the optometrist, sees 25% of his patients in his home. Because this is the only business activity he performs in his home, he can use only the income from those in-home visits against the expenses he claims for the business use of the home.

![]() Tip When allocating income to the home, take into account the amount of time you spend at each business location, the amount of money you spend on capital assets at each location, and any income that is easily attributed to each location (meaning, you wouldn’t have to estimate where the income was earned because it clearly came from a specific location).

Tip When allocating income to the home, take into account the amount of time you spend at each business location, the amount of money you spend on capital assets at each location, and any income that is easily attributed to each location (meaning, you wouldn’t have to estimate where the income was earned because it clearly came from a specific location).

Warning I: The BUH Deduction May Haunt You Later

You’ll want to give thoughtful consideration to the future tax consequences of claiming a deduction for the business use of your home. By declaring that a part of your home is, in essence, business property, you can lose some of the tax benefits of home ownership when you sell the home.

In most cases, when you sell your principal residence you can realize up to $250,000 in gains ($500,000 for couples who file jointly) on the home without paying taxes on those gains. Specific rules govern this exclusion of gains and are covered in Chapter 10. For the purposes of this chapter I will assume that you would otherwise qualify for the exclusion.

![]() Example Mike and Susan purchased their home in 1990 for $200,000 and made an additional $40,000 in improvements. They sold their home in 2011 for $603,000—a gain of $363,000. If they had realized a gain from the sale of any other asset, they would be required to pay taxes on that gain. In this case the taxes for Mike and Susan would add up to $54,450 ($363,000 gain × 15% capital gains tax bracket = $54,450).

Example Mike and Susan purchased their home in 1990 for $200,000 and made an additional $40,000 in improvements. They sold their home in 2011 for $603,000—a gain of $363,000. If they had realized a gain from the sale of any other asset, they would be required to pay taxes on that gain. In this case the taxes for Mike and Susan would add up to $54,450 ($363,000 gain × 15% capital gains tax bracket = $54,450).

However, because this asset was their home, the tax code offers an exclusion from tax on the first $500,000 of capital gains if all of the rules are met. Under normal circumstances this would mean that Mike and Susan would not be required to pay the $54,450 in taxes.

When part of the home has been treated as business property (instead of personal property) the rules that govern the tax exclusion change. The primary difference is that any depreciation you have taken on the home must be “recaptured.”

The idea behind depreciation is that over time an asset becomes less valuable. The tax code allows you to expense, or deduct this theoretical loss in value over the estimated useful life of the home. However, if you sell the home for a higher price than its basis (the price you bought it for, plus improvements, minus depreciation) the home has not really gone down as much in value. For this reason you are required to “recapture” the depreciation you have claimed and then pay taxes on that amount, because you paid fewer taxes in the past by claiming it.

When this depreciation is recaptured, it is taxed at rates determined by special tables. The maximum rate for this recapture is 25%, as opposed to the maximum 15% capital gains rate. The reason for the higher rate is that you have previously deducted depreciation from ordinary income (and in some cases from self-employment income as well). In recapturing this depreciation you will pay taxes on a portion of the gains from the sale of your home which would have normally been tax-free (because of the homeowner exclusion).

![]() Example Mike used his shed for about 6½ years before he and Susan sold the house. During that time he claimed $3,000 in depreciation as a part of the BUH deduction. Although the gain he realized from the sale of his personal residence would normally be excluded from taxes, he will have to pay up to $750 in tax on the recaptured depreciation ($3,000 recaptured × 25% maximum rate = $750).

Example Mike used his shed for about 6½ years before he and Susan sold the house. During that time he claimed $3,000 in depreciation as a part of the BUH deduction. Although the gain he realized from the sale of his personal residence would normally be excluded from taxes, he will have to pay up to $750 in tax on the recaptured depreciation ($3,000 recaptured × 25% maximum rate = $750).

If the space you claim for business use is within the main walls of your residence, this is the only adjustment you will need to make to the treatment of gains when you sell the home. However, if you claimed business use of a structure appurtenant to your home, as Mike did with his workshop, you’ll need to make an additional adjustment on the taxation of the gains. When the portion of the home you depreciated is separate from the “dwelling unit,” you must divide the gain on the home and pay taxes on the business portion of that gain, in addition to the recaptured depreciation. The taxable gain is based on the total gain, minus depreciation that has been recaptured.

![]() Example Mike claimed on his tax return that 8% of his home was used for business purposes. Because his workshop is a separate structure from his home, he will have to claim 8% of the gain on the sale of his home as taxable, although it would otherwise be excluded under the personal residence rules. This will cost him an additional $4,320 in taxes [($363,000 gain on the sale of the home – $3,000 depreciation recapture) × 8% of the home used for business × 15% capital gains tax rate = $4,320]. This brings the total tax paid on the sale of the home to $5,070 ($750 depreciation recapture tax + $4,320 capital-gains tax = $5,070 total tax).

Example Mike claimed on his tax return that 8% of his home was used for business purposes. Because his workshop is a separate structure from his home, he will have to claim 8% of the gain on the sale of his home as taxable, although it would otherwise be excluded under the personal residence rules. This will cost him an additional $4,320 in taxes [($363,000 gain on the sale of the home – $3,000 depreciation recapture) × 8% of the home used for business × 15% capital gains tax rate = $4,320]. This brings the total tax paid on the sale of the home to $5,070 ($750 depreciation recapture tax + $4,320 capital-gains tax = $5,070 total tax).

As you can see, there are some potentially significant tax consequences when you sell a home that you have claimed for business use. These consequences could be compounded further by the fact that when you sell the home, the full tax impact happens in one year, whereas the tax benefits of the deduction have been split over multiple years. The impact of the sale could even change your marginal tax bracket or cause you to become ineligible for certain tax deductions in that year because your income becomes too high.

In addition, you cannot fully anticipate future tax rates. You could end up saving a little each year from the deductions in a lower tax bracket that the brackets you pay the tax in when you sell the home, if the rates change (or your income changes) before you sell. Take all of these factors into consideration before deciding to claim a BUH deduction.

![]() Tip The gain on a home sale, the excluded portion of the gain, and the recapture of the depreciation need to be reported in special ways. I recommend working with a tax professional or studying the IRS publications before finalizing a tax return that includes this type of transaction.

Tip The gain on a home sale, the excluded portion of the gain, and the recapture of the depreciation need to be reported in special ways. I recommend working with a tax professional or studying the IRS publications before finalizing a tax return that includes this type of transaction.

Warning II: The BUH Deduction Will Increase Your Chances of an Audit

As I mentioned at the beginning of this chapter, the BUH deduction is one of the most commonly audited deductions on a tax return. The IRS has not officially admitted that this is the case, or that the deduction increases your chances of an audit. However, in a couple of instances high officials in the IRS have stated in public forums that this is the case. I have personally been told by an IRS auditor that the computer system ranks the BUH deduction higher on the list of reasons to audit. In addition, IRS statistics show that self-employed individuals are twice as likely to be audited as other individuals. Claiming the BUH deduction only adds to that risk.

This fact alone is a reason to consider carefully whether to claim the deduction, even if you are entitled to it. The cost of defending yourself in an audit, both in time and in money, plus the potential for the IRS to find other deficiencies while examining your return, can add up to a lot more than the deduction is worth. If the tax benefit you get from the deduction is not significant it may not be worth claiming it at all.

If you choose to claim the deduction you can do things to prepare yourself for a possible audit in order to have a more successful outcome. Why go through all of the work to calculate and claim this deduction, only to have the IRS disallow some or all of it and add penalties and interest to boot? If you are going to do it, make it stick. Some of the ways you can protect yourself are:

· Have a floor plan of your home that shows the dimensions of each room, drawn to scale. Most of the time the IRS agent will never see your home. A floor plan will help the agent see that you have correctly allocated the space between business and personal use.

· The old mantra for the three most important considerations in real estate—location, location, and location—can be re-coined for taxes and IRS audits as documentation, documentation, and documentation. I can’t stress enough how important good records are in an IRS audit. They can literally make all the difference. For every expense you claim, be sure to have the documentation (bills, bank statements, and so on) to back it up.

· Take pictures of the space you use for business, from different angles. Print these pictures each year, making sure the date is printed on the picture. The audit of your return will usually happen two to three years after the actual year of the tax return. In that time you may have moved, changed the layout of the room, or gone out of business and repurposed the area for personal use. A picture of the way your room looked during the tax year will help a lot when your return is examined.

· Those who claim to use more than 20% to 25% of their home for their business are far more likely to be questioned. If you are going to claim more than that, be extra certain that you can back up your claim.

· If you are renting, send a 1099 to the landlord for the business portion of the rent to help substantiate the expense.

· If you conduct business anywhere besides the home, keep a log book that shows the amount of time you spend in the home office during the year.

· Be careful not to double-deduct expenses. I have seen people take a deduction for the business portion of their mortgage interest and real-estate taxes and then deduct the full amount of those expenses on their Schedule A as well. This is a simple error, but the IRS computers will quickly pick up on the fact that you have claimed more mortgage interest than the bank reported and will create an automatic flag on your tax return.

· Avoid having multiple years of “losses” on your business and then having other years of $0 income because of the home business deductions and carryovers. In my opinion it would be better to show income for your business and pay some taxes than to have losses and $0 income. If you have several years of losses, the IRS may say that you have a “hobby,” not a business—and that can mean a lot of taxes, penalties, and interest.

![]() Tip In most cases you can deny the IRS entry into your home if they request a visual examination of your business-use space. Doing so, however, will likely result in the disallowance of all business-use deductions. If the IRS actually wants to see your home, I would strongly recommend getting help from an experienced tax professional who has power of attorney to represent you before the IRS.

Tip In most cases you can deny the IRS entry into your home if they request a visual examination of your business-use space. Doing so, however, will likely result in the disallowance of all business-use deductions. If the IRS actually wants to see your home, I would strongly recommend getting help from an experienced tax professional who has power of attorney to represent you before the IRS.