Eliminating Waste in Business: Run Lean, Boost Profitability (2014)

Chapter 7. Finance

Accounting for Your Waste

A bad system will beat a good person every time.

—W. Edwards Deming

Finance and accounting operations are by their definition effective because the people who perform these functions, and the functions themselves, are very detail focused. The issue in this area of business is the efficiency of operations. Now before all the business leaders with finance backgrounds throw this book away, we are not saying that finance people don’t work hard. Some of the hardest working people we know have worked in accounting or finance. The question is whether all of the activities that we do in these areas of the business are value-added activities. Friends of ours who are financial leaders in their companies have admitted that not all of the work that they do provides value. We are not just talking about some of the hoops that they jump through for regulatory compliance. Some of the analyses and internal controls that they put in place cause waste and provide little improvement for the organization. Some examples of these controls are the auditing of the financial records or segregation of duties. Although these are necessary activities, they provide no value to the organization. This chapter is about the waste in those processes and how you can limit that waste to create a leaner organization.

Tiered Approval Processes

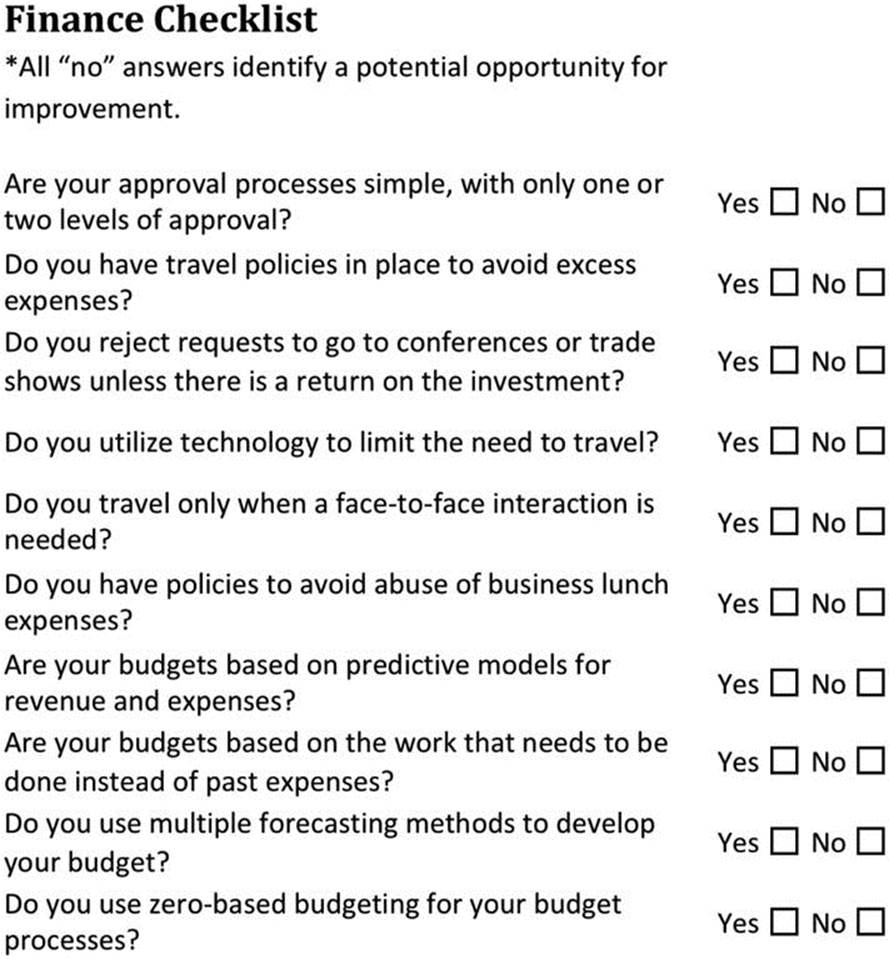

We all have approval processes in our companies. But, when you have extra processing due to redundant approval processes, your processes are extremely wasteful. Moreover, consider that when more than one person is responsible for any given activity, then nobody is responsible.

I once did a lot of quoting for products to sell to customers. We had a pretty good process to turn around quotes. We had a pool of suppliers that was committed to giving us good prices and delivery times. We also had a nice spreadsheet that we could use to calculate the internal cost and margin we could expect from our products. For our larger customers, we had contract rates we used that made the formula rather mistake proof. The spreadsheet was password protected so the formulas could be changed only by the two people who knew the password. By limiting the people who could use the spreadsheet, there was less chance for error.

We also had a format for our request for quotes from our suppliers, which made it difficult to get inaccurate supplier quotes. And we always got at least three competitive quotes. Our suppliers would provide a quote in two or three days, which worked well because our customers rarely gave us more than a week to provide a complete quote. By the fifth day, we had the completed quote ready for the customer.

But then our accounting department wanted to ensure that all quotes were properly evaluated prior to being sent to customers. The process included a review and sign off by eight executives for every quotation. Due to a variety of factors, including travel schedules, the average turnaround time for a review became ten days. So this internal process to ensure that all quotations were properly analyzed ensured that our company was unable to submit any quotations on time. Therefore, we were disqualified from every negotiation process and could not get any sales! Although the process was well intended, it caused more problems than it solved. Ultimately, our Vice President of Engineering told all people who were creating quotations to submit to the customer as soon as he had evaluated the quotation and to “get the signatures after you sent it.”

This is just one example of a tiered approval process causing waste. Similar things happen in processes designed to control expenses. For example, consider the manager who has a spending limit of $1,500. In such a situation, in order to avoid the tiered approval process, spending isn’t discouraged but rather creative spending is encouraged. I have caught people splitting expenses between multiple purchases in order to avoid expense caps and still get the full expenditure paid for. Although this is not an ethical practice, I have seen it used multiple times with no negative recourse. So along with the waste of time in coming up with a creative way to get around accounting policies, now the expenses associated with each payment to a vendor are double or triple because of multiple invoices and multiple sign-offs and approvals.

To get rid of this waste, you need to make each manager in control of her budget. Structure each department so that it runs like its own business. A manager who is empowered to think like a business owner is more likely to control expenses. Nobody in an accounting or purchasing department knows more than you about what your business unit needs. If the manager is not capable of doing this, she probably is not going to be a good manager overall and either should be coached into developing these skills or replaced.

![]() Note If more than one person is responsible for an activity or process, then no one is. Eliminate your tiered approval processes in favor of accountability.

Note If more than one person is responsible for an activity or process, then no one is. Eliminate your tiered approval processes in favor of accountability.

Travel and Business Expense Policies

Travel policies must be structured to avoid abuses. Almost ten years ago, I spent some time in sales. The sales manager had quit in order to pursue another job, and I took over at the request of our division president. I used to love traveling with the prior sales manager. We stayed almost exclusively at Hilton hotels. We flew business or first class whenever we could. And we ate great. We went to fancy steak houses and famous restaurants. The company had no policy on travel. No limits on any expenses whatsoever. Such extravagance is an obvious source of waste. But when I took over the sales role, the company’s travel expenses were cut by more than half. And I traveled more often than the previous guy.

Another example comes from the academic world. Professors spend thousands going to academic conferences every year. Professors write conference proceedings, which are frequently research in progress with little impact to the discipline. These proceedings do not affect research, teaching, or tenure. The conferences are typically at very nice hotels in very nice locales, such as Marriott on the beach in Tampa, Florida. There are even many conferences in fancy Mediterranean locales. There are a lot of fancy meals and alcohol at these events, all on shrinking budgets.

Travel, whether business or academic, should not occur unless it is a bona fide value-added activity. Certainly travel policies must be structured to allow reasonable expenses when customer interaction is needed, but they also must be limited to lower expenses when employees are traveling and not meeting with customers. In sales, as described in Chapter 4, the need to see customers in person is becoming less necessary every year. Even when there is a need for the salesperson and customer to get together, there is no need for expensive entertaining. Specifying maximum amounts to be spent on food, lodging, and airfare with a policy to pre-approve amounts that are expected to be greater is a good approach to controlling travel expenses.

Conferences and trade shows, as noted in Chapter 4, can be beneficial when there is a specific outcome planned. If you sell or purchase products where trade shows are a main avenue to get sales leads, there is a true business purpose. If there is some knowledge that can be gained only by attending a conference and that knowledge will lead to a change in the operations of your organization, then there is a true business purpose. Otherwise, you should question whether the expense is necessary. Conferences and trade shows are often an excuse to get out of the office or see past colleagues. These types of activities should be justified with a specified purpose and measureable outcome, much like what you would expect for a project. What is your baseline measure of performance? What is your goal? How will you know if you achieved your goal?

Similarly, business lunches can be a tremendous source of waste. The waste comes in many forms. The obvious one is the actual expense of the meal, which we put conservatively at $10 to $15 per person. Just compare how much a person could save by packing a lunch. With an average cost of $5 to $10 per lunch and working 250 days per year, you spend between $1,250 and $2,500 per year. This is 2.5 to 5 percent of the median household annual income.1 The average number of workers per household is 1.22.2 For families with more than one worker, the annual lunch expense could be 5 to 10 percent of their income. Now imagine how much the business lunches could cost.

Lunches are also wasteful due to the fact that all the workers are not working and being productive while they are at lunch. There are conflicting studies about this. Some studies show that workers are more productive if they take a break for lunch. Others show that it is better to work straight through lunch and get done early. While stopping to eat lunch is all wasted “down-time,” people are more creative while their brains are doing low mental energy tasks. Many people get their best ideas in the shower or while vacuuming their home. These low mental energy tasks allow the brain to be creative. However, many times, lunches are very long—upwards of an hour—and are not really low mental energy tasks. If you are eating with co-workers, you might still be at a high stress level because of focusing on managing your reputation and talking about office politics.

We are not saying that you should not give your workers breaks. Some workers may feel rejuvenated by them. Many people need to run errands and will feel and be more productive after they have cleared their personal to-do lists. However, trying to conduct business over lunch is typically very wasteful. Using lunch breaks to encourage team building in similarly wasteful.

![]() Note Travel and meal expenses don’t lead to happier employees or happier customers. Create robust policies with checks and balances to avoid these wasteful expenses.

Note Travel and meal expenses don’t lead to happier employees or happier customers. Create robust policies with checks and balances to avoid these wasteful expenses.

Budgeting

A few weeks ago, I was discussing the budgeting process with a colleague. He shared with me his experience as a leader in the United States military. He managed a budget and at the end of the year, he would purchase surplus supplies. My colleague did this because if he did not spend the money, his unit would not get as much money the next budget cycle. Sadly, many businesses use this same process.

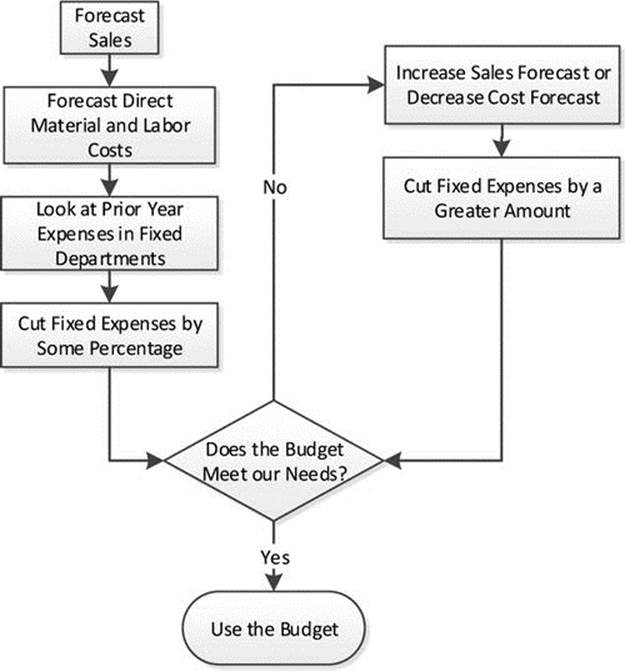

Companies or departments with revenue and expenses are relatively simple to operate. Figure 7-1 shows a simplified budget process for a sales dependent business or department. The strength of your budget is largely dependent upon your ability to predict revenue and costs. A basic concept of business is that if your revenues are greater than your costs, you make money. In a small company, this concept is not forgotten. A financially sound small company makes money because each expense is controlled and spent only if it is necessary. There is no such thing as spending as much as you can at the end of the year so that you can get the same budget the following year.

Figure 7-1. Simple Budget Process

Large companies, however, allocate their large pools of money to all of the departments. Due to the scope of the operation, this allocation is not based upon need or expense minimization but rather on entitlement. If you needed $200,000 last year then you must need $200,000 this year, right? This is a disease in budget management. We talk more about productivity in Chapter 8, but each department’s expenses must be based upon the work to be done and not on past performance.

Forecasting

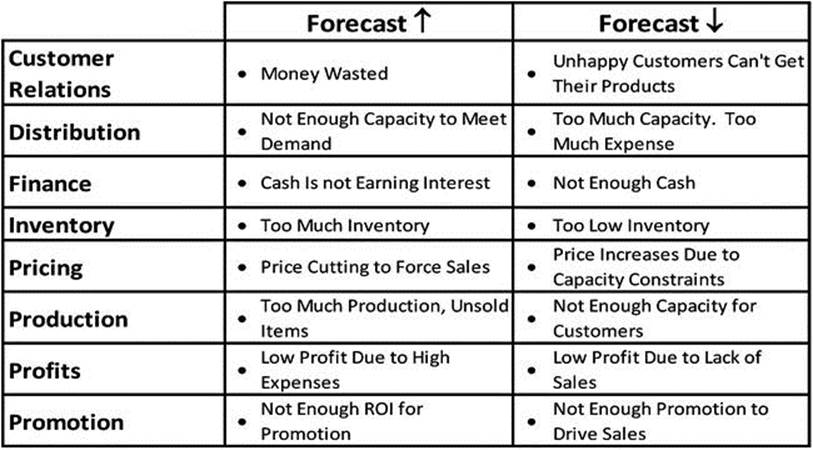

Part of creating a good budget is accurately forecasting revenue and expenses. We have both seen very questionable forecasting methods used by companies. Yet, all decisions filter down from the forecast. For example, managers need to know how much inventory to have on hand, how much workforce to employ, and how much cash flow will be on hand. As Figure 7-2 shows, the impact of erroneous forecasts can be very dangerous.

Figure 7-2. The Impact of Bad Forecasts

Accurate forecasts are rare in business for many reasons. This is usually because the company has chosen not to change the way it forecasts. Again, companies do things the way they have always done them, even despite new computer software and hardware programs that can handle much more sophisticated models.

Asking your customer to tell you what your forecast should be is normally a poor choice, but many companies and even whole business sectors use this method. One reason this method is a poor choice is that buyers typically overstate their future purchases. Also, this method is not suitable in estimating sales for the long term, especially in unstable industries in which there is irregular demand. More or less, if there are large fluctuations in the industry, buyers are not going to know how to predict them any better than anyone else in the industry. If the company using the forecast is a B2C company, they could not use this method to any great reliability. Household consumers are too numerous, making this method rather impracticable and costly. Also, a basic limitation of this method is that it is passive and does not expose and measure the variables under management’s control. Buyers do not know what is going on inside a company.

There are a few companies who have created great software to forecast using multiple quantitative methods. Unfortunately, many companies don’t collect enough of the right data or employ the right analysts to effectively use this software. With the basis for most budgets being the sales forecast, you simply cannot afford to use the guess-and-pray method that many companies use.

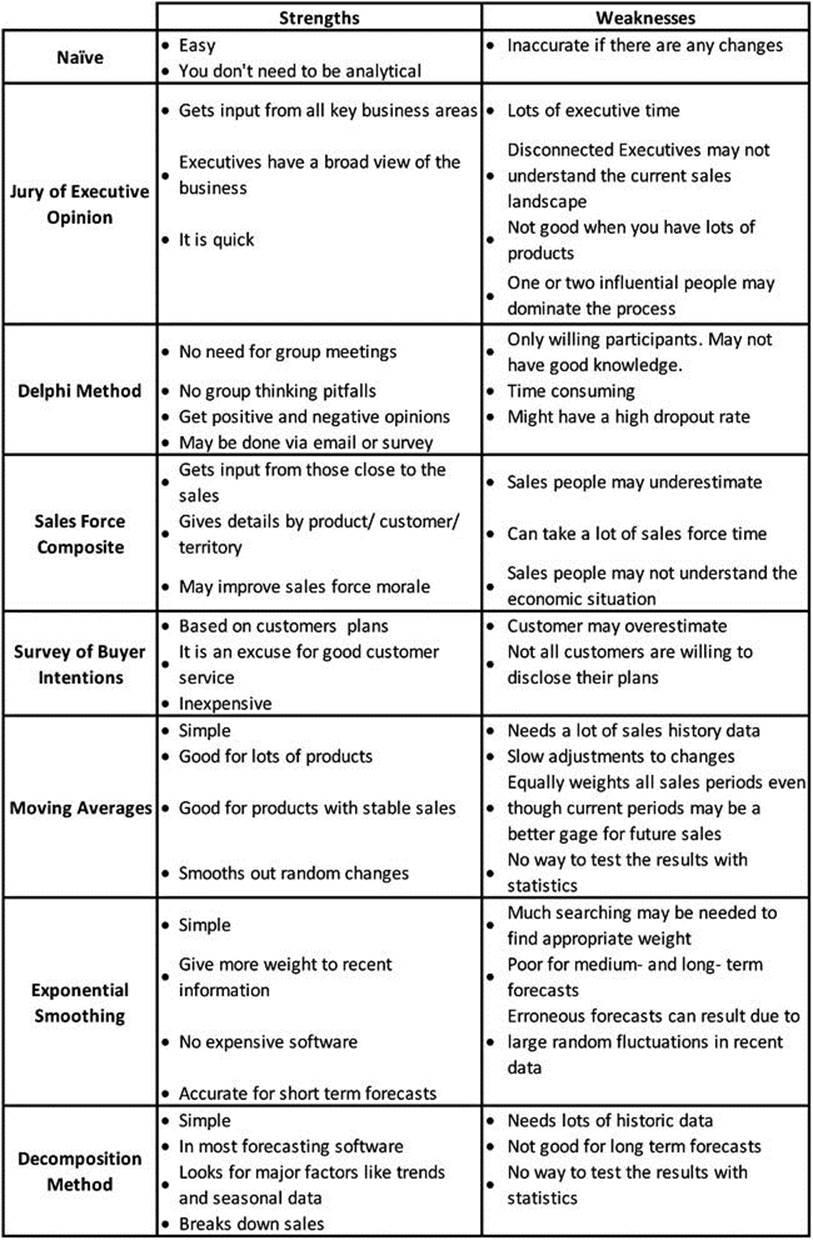

Instead you should use several methods to identify the lowest and highest forecast alternatives and realize that your actual forecast is somewhere in between. If you cannot break even at your lower forecast, then you need to tighten your budget. Once you have done this, you should create contingency plans to achieve the high forecast if it happens. This plan should be triggered by some leading indicators of your forecast accuracy. You must understand your industry to know which methods to use and to use them accurately. Figure 7-3 shows some common forecasting techniques, along with their strengths and weaknesses.

Figure 7-3. Some of the Available Forecasting Methods

Qualitative methods of forecasting are nice because they are cheap and work well when you have limited data, but they are not the most accurate. Stable industries with minimal fluctuations may use the naïve forecast and assume that the next period will be the same as the prior period. Executive forecasts ask the opinions of the company executives. The Delphi method is a structured form of the jury of executive opinion, with multiple rounds that take the executive opinions and whittle them down to the best answer. The sales force composite is a similar forecasting method, but only includes the sales force’s opinions. The buyer intentions method is simply asking your customers what they will buy. All of these methods have bias and significant room for error, but are very cheap and easy. If you use any of these methods, you should absolutely combine it with a quantitative method.

Quantitative forecasting is great if you have enough good data and the skills to analyze it. With time-series forecasting, you look at known future events to predict sales based upon similar past events. When conducting a time-series analysis, you look for trends, periodic movements, cyclical movements, and erratic movements. Trends are movements in a time-series where a linear or curvilinear performance can be seen. Periodic movements include patterns like seasonal sales. Cyclical movements include long-term fluctuations like business recessions. Erratic movements include special events like wars, strikes, snowstorms, hurricanes, fires, and floods.

Moving averages are forecasts developed using a rolling mean to predict future sales. For example, if I were to use a five-year moving average, I might forecast sales for 2017 by averaging 2011–2016. Then, to forecast 2018, I would get the average of 2012–2017. This continues as the years go along. This method is especially helpful if you have growth, as the rolling nature of the average will account for the continued growth. Exponential smoothing is a type of moving average with weights that give more credibility to recent data. A weighted average allows you to pick which periods will have the greatest weight in the analysis. This is helpful if, for example, you wanted to lessen the impact of years that vary because of recessions.

There are also many other more complex forecasting methods. Every business should either employ a statistician who can perform forecasting or hire a statistician as a consultant at least once a year. You absolutely should not just wing your forecasting. You have to know how much your sales will be or all other business decisions could be drastically affected.

Forecasting is probably one of the most important things a business can do. The waste here is in not creating an accurate forecast. As was shown in Figure 7-2, not forecasting appropriately can be disastrous and wasteful. Take the time and resources to forecast accurately. If not, you will pay by not really budgeting well and dealing with the downstream effects of a bad budget, such as the ones outlined in Figure 7-2.

Zero-Based Budgeting

In a zero-based budgeting company, each department or function gets a full cost-and-needs analysis. The budget is based upon the current and future needs of the department, not prior performance. Not only does this encourage a real analysis of the ROI, but it also helps foster some budget responsibility.3

In order to build a functional zero-based budget, you first need to understand your costs. This is where having knowledge of activity based-costing is essential. Simply defined, activity-based costing is a method in which you define the incremental cost of each activity performed. Traditional cost accounting takes all costs that are not directly attributed to each product or service and spreads them across all products or services based upon some metric such as machine hours. In activity-based costing, only items that can be attributed to a product or service are assigned to the costs. All other costs are extra expenses in addition to the product or service. This is helpful because if you have an activity that costs you $100 and you charge $150, you understand that each time you do that activity, you earn $50 to pay for overhead and profit. If another activity costs you $75 but you are able to charge $150, then you are able to get $75 each time you do that activity. Obviously, you should try to do the second option more than the first.

Once you understand the cost versus revenue for activities that provide revenue for your company, you can analyze the other expenses for a return on investment. For instance, if you need to have marketing activities, a data-based ROI calculation can justify those expenses, although you may not be able to attribute that expense to a single product or service.

With all of this data in hand, you are ready to start your zero-based budget. You start with analyzing the products or services where your costs are higher than your revenue or where your contribution to the company beyond direct costs is small. Are there opportunities to reduce expenses? Be honest with this question. Think about all the areas of waste we have identified in this book. Can you get a higher price? Is there an interaction between this product or service and a higher priced item? Maybe in a healthcare organization, screening or testing activities yield a low or negative margin, but if a serious health issue is found through these activities, then a higher margin results. You may decide to keep or even increase the volume of the low margin work because your data shows that the number of high margin procedures will pay for those activities. In this case, you may make the argument to add the costs of these low-margin jobs as a part of the activity-based cost for the high-margin jobs.

The following is an example in which you may choose to discontinue a product. Once the true costs are understood, this part of the analysis is easy.

The harder part of the analysis is deciding if there is an interaction between the sales of this product and the sales of another product. I once worked to eliminate the third largest customer for my company because when we did this analysis for the whole body of work, we found that it cost us more to sell the products than if we didn’t sell them at all.

Once you have identified the fate of each of your products or services, you need to look at your fixed overhead. What basic functions do you need? How many resources do you need to support them? For instance, if you know that you get a certain amount of invoices to pay per month and you know how long it takes you to pay each invoice, you can easily figure out how many people you need in accounts payable. You need to do this for all remaining departments in the company.

Once you have done this, you look at what is left from your sales forecast and the risk associated with the forecast. What additional strategic initiatives do you have? What are their priorities? What margin must you maintain? This helps you figure out what you can do next. Your budget should cover the basics of operations. The sales forecast with your highest risk level minus the costs that you have identified as essential should provide you with your margin. The remaining margin is what you have left to support strategic initiatives.

Of course, this is a simple representation of the overall concept of zero-based budgeting, but there are books based upon the topic that explain this in more depth. The point of this section is to make you realize that one solution to the entitlement budget disease is the zero-based budgeting method. It can help you identify large sources of waste in your organization and determine how to eliminate them. Even if you apply some of the concepts associated with zero-based budgeting, you will see a positive effect on your bottom line.

![]() Note Look at activity-based costing and zero-based budgeting as ways to improve your financial performance and better understand your business.

Note Look at activity-based costing and zero-based budgeting as ways to improve your financial performance and better understand your business.

Fake Numbers

The world of accounting does not just exist to count real money. Accounting does sometimes use statistics that have no real value. They use factors, such as an efficiency factor, to make the numbers work. Although these are generally accepted accounting principles, you need to operate your businesses on more than a cash basis. What did you provide that will bring you revenue? What was the unit cost for that product or service? How much do you owe your creditors? When you receive money from your customers and pay your bills, how much is left? The point is that whether you are looking at operations management or accounting, the facts and figures that you should look at must have real and tangible meaning.

For instance, there is no point in having good absorption costing statistics if you are producing inventory that you will not sell. You need to do absorption costing for GAAP, but you should make your decisions based upon a combination of variable costing and the actual sales forecasts, along with other real numbers. I once watched a factory manager build inventory to absorb the fixed overhead without the supporting sales to get rid of the inventory. This act caused significant strain on the organization since now all of its cash was in inventory.

![]() Note Make sure that the metrics that you use actually make you money.

Note Make sure that the metrics that you use actually make you money.

Getting and Keeping Money

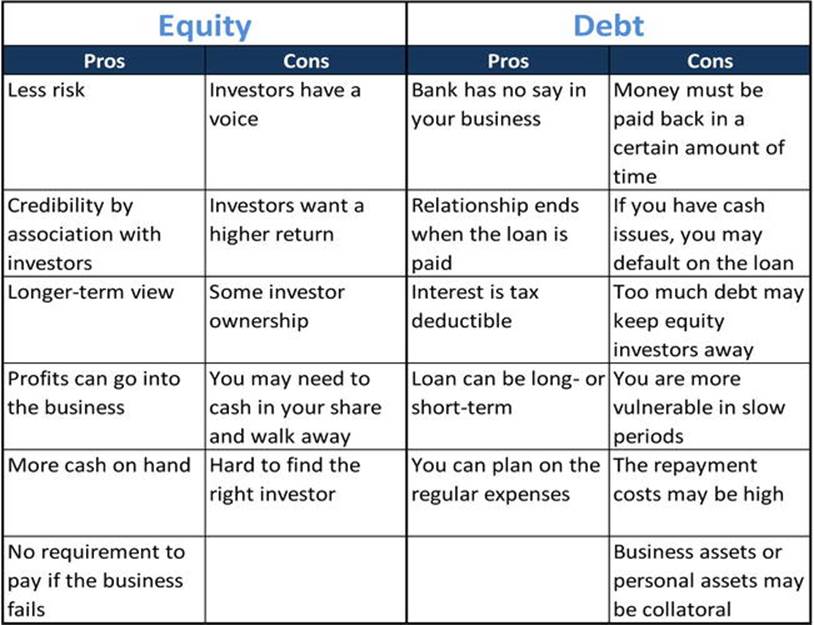

Many U.S. businesses operate on the same premise that U.S. consumers use. If they don’t have the cash, they will get a loan or credit to pay their bills. This works fine if you have the income that exceeds your commitments. In fact, many financial professionals will tell you that you should have a certain amount of debt and equity. There are pros and cons to both debt and equity financing. Figure 7-4 shows some of these issues to consider when looking for external funds.

Figure 7-4. Debt versus Equity (Source: National Federation of Independent Business, “Debt vs. Equity Financing: Which Is the Best Way for Your Business to Access Capital?”, October 17, 2009.)

There is risk in both financing options so the best option is cash. For example, my parents bought the house I grew up in with cash. They never worried about paying a mortgage because there wasn’t one to pay. I have known a few people in my life who have done this and have yet to know one who regretted this. A business that is wholly owned and supported with cash reserves is better prepared to handle business fluctuations. There are no loan payments or even lease payments that must be covered to stay in business. If there is a downturn in the economy, a solid business with no debt and cash reserves just reduces its variable costs. Companies who have debt or equity commitments don’t have this luxury. Referring back to Chapter 2, many companies need to borrow because they think they need cash to grow. As the studies in Chapter 2 showed, growth does not create money. Money must come before growth. Perhaps if you look at the real reason why you want to grow and think about whether you are trying to grow too quickly, you may realize you do not need to borrow.

There are many other reasons that businesses get in a position where they need cash. Small businesses can get squeezed between large customers and large suppliers. The suppliers demand high prices and favorable payment terms while the customers demand low prices and favorable payment terms. What happens when a company is in this position? The company either uses its own cash or the loans that it holds in order to act as a bank for its customers.

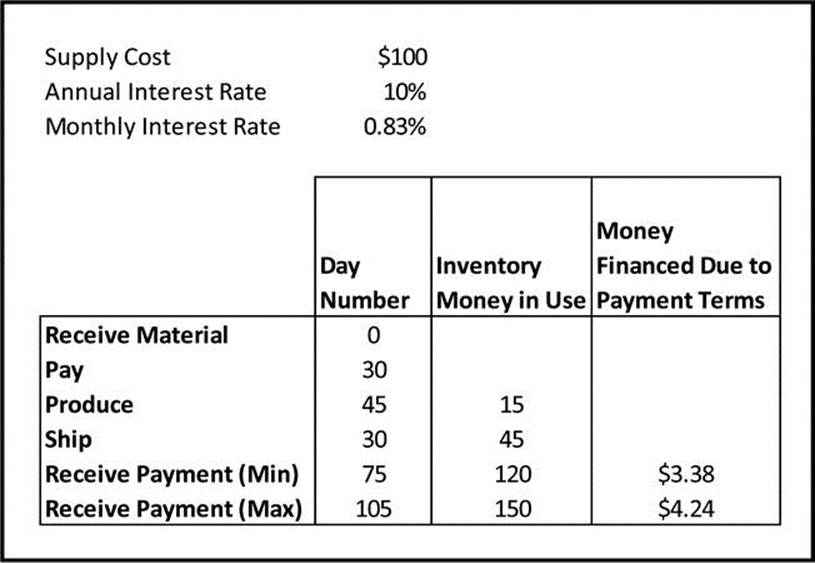

This tactic can get out of hand very quickly. Pretend Company ABC buys raw materials with net 30 payment terms. This means that ABC needs to pay the supplier within 30 days. The company takes 45 days to produce its products once it receives its materials. The customer requires ABC to hold 30 days of inventory on hand. When the customer orders the products, it demands a single monthly invoice with net 75 payment terms. Figure 7-5 illustrates this example.

Figure 7-5. Payment Term Example

Although the dollars seem small in this example, it could present a problem on a larger scale. Consider if this is a company with $3,000,000 in sales and a 30 percent material cost. That means that this company is borrowing between $30,000 and $40,000 just to provide good payment terms for customers and suppliers. The better option is to have the cash on hand without borrowing to cover these terms.

Each company has individual needs and the reality is that sometimes you need to get extra cash through equity or debt. The point is that you should not leverage your company too much because of the risks of doing so. Too many companies fail because they don’t plan for bad times and take on too much debt or other ownership for the sake of growth. Don’t get caught in this trap. Any good finance person will tell you that you should make sure that you have months of cash on hand to pay for your bills. If your regular use of cash for business depletes those resources too much, you should consider your options for debt and equity. You just need to make sure that you understand the downside to that decision. More importantly, you should think about your business needs and whether they have gotten out of hand.

![]() Note Cash is king. Make sure that you don’t over-leverage your company or lose control by taking on too much equity financing.

Note Cash is king. Make sure that you don’t over-leverage your company or lose control by taking on too much equity financing.

Managing Business Taxes

The key waste in business tax management is the ignorance of the tax codes. We have all heard stories of wealthy executives or politicians who pay very low tax rates. Is this because these people are unethical? Are they smarter than the average American? The answer is that they employ people who are experts in the tax codes whose job it is to limit tax liability. The effect of taxes could influence many of your business decisions in a positive way.

Tax incentives or loopholes may make one location for your business a better decision than another, for example. There are tax benefits to the ownership structure that you choose. There are benefits that will influence your supply chain. While we all probably realize the absurdity and inefficiency of the tax code, as long at the tax code remains as complicated as it is, you must work with people who understand it so that you can take advantage of the benefits.

Since the majority of companies are not large enough to employ full-time tax experts, using consultants can be a good option. Such consultants can ensure that you reap all of the tax benefits to which you are entitled.

![]() Note The biggest waste in business taxes is not using the tax code to minimize your tax liability.

Note The biggest waste in business taxes is not using the tax code to minimize your tax liability.

Leasing versus Buying

There are various reasons to lease assets rather than buy them. These include, but are not limited to, the growth of technology, how long you need the asset, tax benefits, and financing options. You must also look at the terms for leasing or purchasing agreements available to you. Every business has risk, so you want to make sure that you don’t put your business or yourself at risk if you find you have to break the lease or purchase agreement.

Technology

In areas where technology changes rapidly, it’s wasteful to purchase an item when you can keep up with technology through lease agreements. This is partially why the SAAS (software as a service) model using cloud computing has become popular, as discussed in the Chapter 6. Essentially, you are leasing software and hardware because it would cost you more to keep up these items internally than to use cloud computing.

As discussed, for small-to-midsized companies, the lease versus buy decision comes down to economics. The price per user for the software is lower than the cost to buy the software and hardware and maintain those assets with internal personnel. The point at which it makes sense to buy technology and support and upgrade it will vary depending on the company size and the software and hardware in question. You should always make sure that you evaluate both options if they are available.

Timeframe and Industry Volatility

Leasing is a perfect way to handle short-term needs when a long-term purchase would not make sense. More importantly, if you can get used items and don’t need the latest technology advancements, such as the case in many industrial applications, buying makes more sense.

For instance, when working in the injection-molding industry, I have looked at the decision to lease or buy the molding machines, ancillary equipment, and other items such as powered industrial trucks. Due to the dynamics of this industry, including the frequent bankruptcies, it is often a better decision to buy these items. The challenge in doing this is ensuring that you maintain similar models of equipment so that maintenance costs are low.

The restaurant industry is very similar. So many restaurants go out of business all the time that it is almost always preferable to buy used equipment. In another industry without this level of volatility, the lease decision could be a better option because cheap, good-quality equipment may not be available. Overall, many executives get caught up in the notion of needing the latest and greatest things. If customers do not enter the area where the equipment is used, there is absolutely no reason to buy new and expensive items.

Taxes and Financing

We discussed the decisions to finance your company using debt or equity. One thing to consider when you are looking at leasing versus buying is how much debt you are currently carrying and how much cash you have on hand. Companies with high amounts of debt that are low on cash often tend to lease rather than buy just to avoid more debt. Some companies will actually sell assets to another company just to lease the assets back in order to build a cash reserve. This is very popular with companies that need the cash to improve their financial position or that want to invest to grow the company but cannot get good debt or equity financing deals.

There are also potential tax benefits to leasing that may drive the decision to lease versus buy. The benefits will vary depending upon the state and the details of the lease, but it is definitely worth exploring if you are considering a lease-versus-buy decision. You may be able to deduct the full cost of a purchase.

![]() Note Failure to evaluate your options when you need new equipment, facilities, or software may lead to lost opportunity to boost your financials and to lower your risk. Also, do not let your ego lead you to buy overpriced items. Find used items when you can.

Note Failure to evaluate your options when you need new equipment, facilities, or software may lead to lost opportunity to boost your financials and to lower your risk. Also, do not let your ego lead you to buy overpriced items. Find used items when you can.

Finance Metrics

There are countless financial metrics that businesses monitor. Kaplan and Norton criticized businesses for not taking a balanced approach to looking at metrics outside of financial ones.4 Dr. Deming also criticized businesses for focusing too much on the financial metrics. We highlight just a few common metrics that a business leader or even a department manager should understand.

Pre-Tax Net Profit

This metric is simply the total revenue from sales minus all expenses prior to taxes. This metric helps you understand how well you are managing your expenses versus your sales.

![]()

It is also important to know how your profit compares to your forecast. If there is a large difference, you need to reevaluate your forecasting methods.

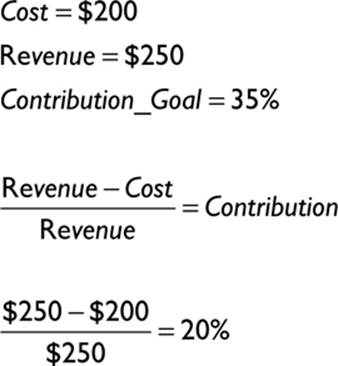

Contribution Margin

Contribution margin is the contribution per unit of sale divided by the price per unit. This tells you how much each product or service you sell helps pay for your fixed costs.

![]()

In cost accounting, fixed costs are applied to products. This means that each product will increase in cost if the company has an overall increase in expenses or a decrease in sales. Contribution takes the noise out of the equation but shows what each item contributes to covering the expense of the fixed costs and, eventually, to the profit margin.

Net Cash Flow

For any given period of time, net cash flow is the incoming cash minus the outgoing cash:

![]()

You want this metric to be positive and large. It helps you understand if you are paying your suppliers too quickly or not getting paid by your customers quick enough.

Return on Investment

This is a key concept that all business professionals need to understand—I have seen it misunderstood many times. Return on investment (ROI) is the gain from investment minus the cost of investment, divided by the cost of investment.

![]()

This indicator is misused when determining the gain from investment. For instance, the gain from a marketing campaign is not the sales revenue generated from the campaign, but rather the contribution margin generated from the campaign. That is, the funds generated by the campaign minus the variable costs from the new sales. But even this example is faulty. You must also factor out any other variables that might have increased sales during the same time period. You should know the ROI of every business decision and even every employee.

Current and Quick Ratios

Current ratio is current assets divided by current liabilities. It shows whether you have enough assets to cover your liabilities. You want to make sure that this ratio is greater than one. A larger number is even better.

![]()

Quick ratio is cash plus accounts receivable divided by current liabilities. Again, a larger number is better.

![]()

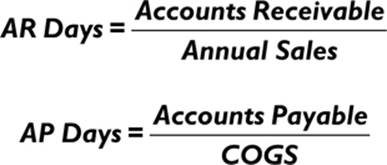

AP and AR Days

Accounts payable (AP) days shows you how many days it will take you to be clear of your liabilities. Accounts receivable (AR) days shows you how many days it will take you to collect all of your assets.

You look at these two metrics together because you want your accounts receivable days to be less than your accounts payable days. The gap in time between the two gives you time to invest or collect interest on your customer payments prior to paying your suppliers. If the accounts payable days is less than the accounts receivable days, that means that you have to use cash reserves or borrow money to pay your suppliers before your customers pay you. This is a problem of being a sustainable organization. It can also limit your growth potential because you would not have the cash to cover this gap.

Conclusion

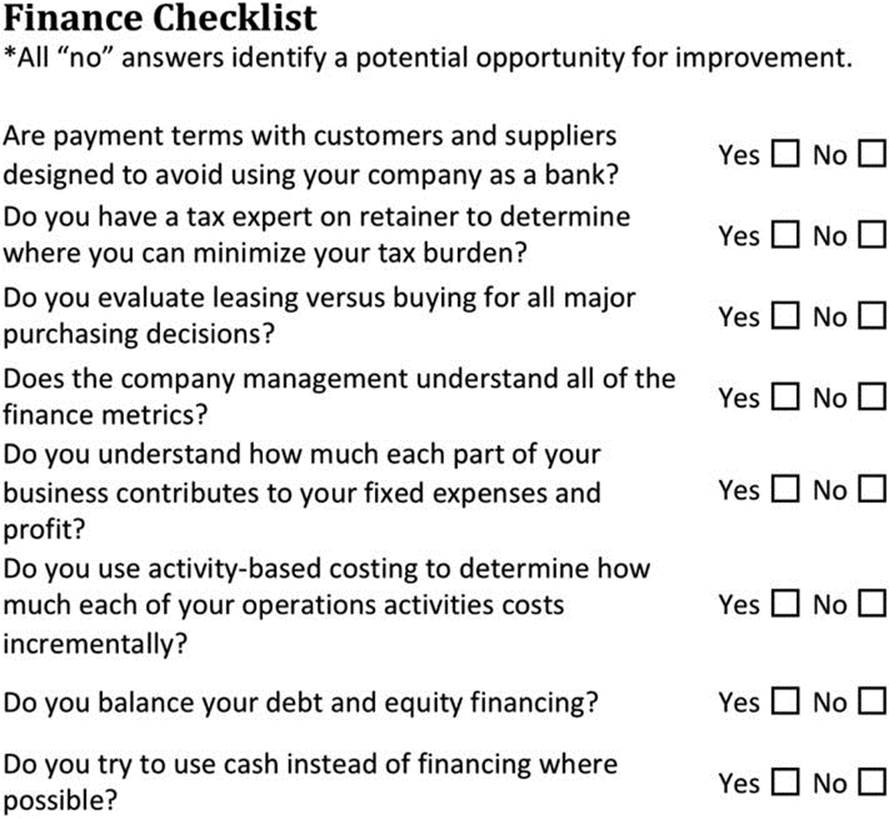

The deciding factor when evaluating finance and accounting processes and procedures for waste is whether or not those functions are adding value to the organization. There are many areas that add value beyond the traditional accounts payable, accounts receivable, and financial reporting functions. By having effective policies and procedures that do not cause waste, like budgets based upon prior year performance or multi-tiered approval processes, finance professionals can help drive improvement that is felt through the company. By having seamless processes for core accounting functions, accounting departments can avoid late payment fees and take advantage of payment incentives because of the efficiency produced from these processes. So even though there is not as much waste in finance operations as in other areas of business, there is still opportunity for improvement. You should avoid tax issues by having experts on staff or on retainer help navigate decisions around taxes in order to minimize tax liability. Making intelligent decisions around leasing and purchasing equipment or software will ensure that money is not wasted unnecessarily. And finally, every business leader must have a key understanding of business financial metrics.

Finance professionals should ensure that leaders understand the metrics produced by the finance team. The greatest waste of talent in the finance and accounting areas of business is to assume that the role simply produces reports and handles regulatory issues. These roles are there to maximize value and eliminate waste. This approach is not taken often enough. Finance professionals have a great deal of information at their disposal. This wealth of knowledge and the logical thought processes that finance and accounting people often have gives your business a resource to eliminate waste. You need to ensure that you are getting value from your finance folks by involving them in your activities to improve your processes and eliminate your wastes.

Waste Checklists

1 U.S. Census Bureau, Current Population Survey, 2009 to 2011 Annual Social and Economic Supplements, “Three-Year-Average Median Household Income by State: 2009–2011 and Two-Year-Average Median Household Income by State: 2010 to 2011,” http://www.census.gov/hhes/www/income/data/statemedian/index.html.

2 U.S. Department of Transportation, “Census Transportation and Planning Products,” April 28, 2011, http://www.fhwa.dot.gov/planning/census_issues/ctpp/data_products/journey_to_work/jtw1.cfm.

3 Bain and Company, “Zero-Based Budgeting,” May 8, 2013, http://www.bain.com/publications/articles/management-tools-zero-based-budgeting.aspx.

4 Kaplan, Robert S. and David P. Norton, “The Balanced Scorecard: Translating Strategy into Action,” Harvard Business Review, September 1, 1996.