eCommerce in the Cloud (2014)

Part I. The Changing eCommerce Landscape

Chapter 1. The Global Rise of eCommerce

The growth of ecommerce around the world is unstoppable, with double- or even triple-digit growth seen annually since its emergence in the mid-1990s. This growth has enormous technical implications for both application and deployment architecture, with all indications that this growth is likely to continue for the coming decades. According to a 2013 report by Morgan Stanley, global ecommerce as a percentage of total retail sales is expected to grow by 43%, between 2012 and 2016.[8]

The reasons for this growth are as follows:

§ Increasing use of technology

§ Internet use

§ Internet-enabled devices

§ Inherent advantages of ecommerce

§ Price advantage

§ Convenience

§ Large product assortment

§ Technological advances

§ Closer tie-in with the physical world

§ Increasing maturity of ecommerce offerings

Let’s explore each of these further.

Increasing Use of Technology

Internet Connectivity

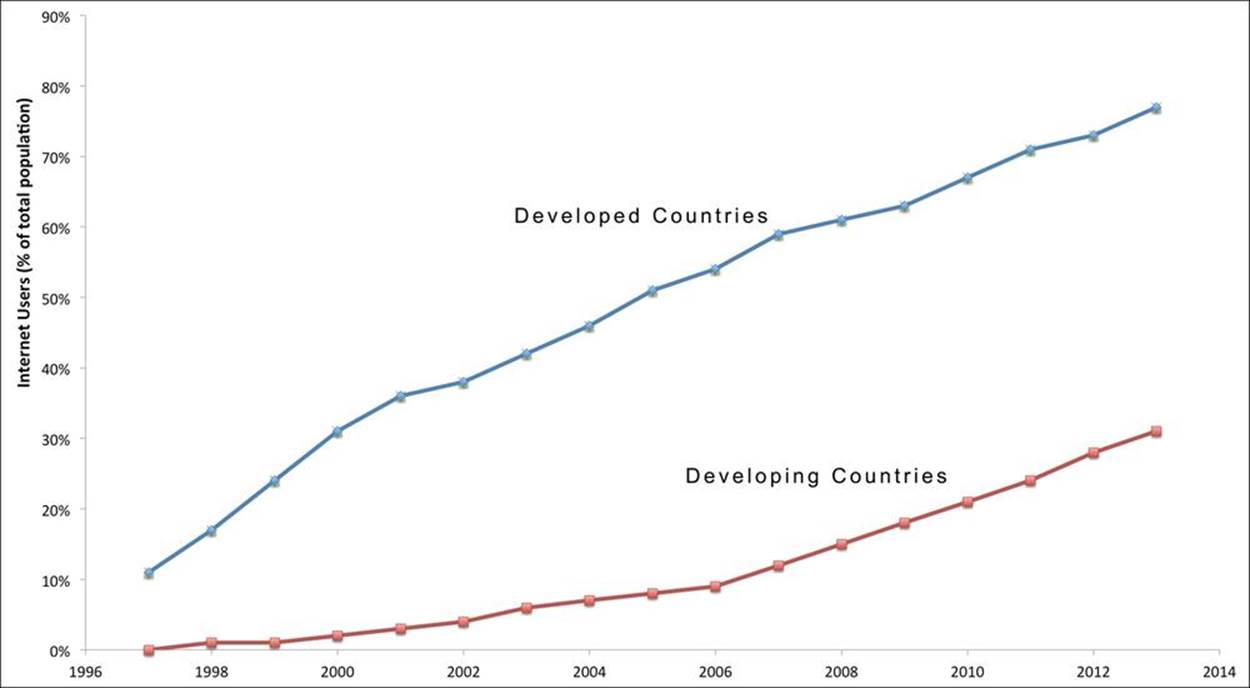

Ubiquitous internet connectivity has been a direct driver of ecommerce growth, as the Internet is a prerequisite to the “e” in “ecommerce.” In developed countries, 77% of individuals use the Internet, whereas in developing countries, that figure is a lower 31%.[9]

Figure 1-1. Internet Users of Developed and Developing Countries (% of total poulation), 1997-2013

Internet users heavily skew young. In the US, 97% of 18–29 year olds are Internet users, but that figure drops to 57% for those aged 65 and older. Over time, Internet use will increase to nearly 100% across all age groups.

NOTE

Forty percent of men aged 18–34 in the US agree with this statement: “Ideally, I would buy everything online.”[10]

As ISPs mature, the reliability and bandwidth of their offerings has increased, while the cost has dropped. At the same time, there are an increasing number of devices that can be used to access the Internet.

Internet-Enabled Devices

Internet-enabled devices of all types now make it easier to shop wherever and whenever. It wasn’t too long ago that the only way to get online was through a stationary computer connected to the Internet over a dial-up modem. Today, the primary means of Internet access around the world is through mobile devices. They’re everywhere and always connected. An incredible 84% of UK citizens won’t leave home without their cellphones.[11] Tablets have gone from being nonexistent to almost a billion in circulation projected by 2017. In North America, 60% of Internet users are expected to own a tablet by 2017.[12] These devices are ubiquitous and each one of them is capable of facilitating ecommerce, with many ecommerce vendors offering custom applications specifically built for each device.

Even when customers visit a physical retail store, they often research products and check prices online while in the store. A recent survey found that 77% of all American customers have done this, while those in the millennial generation do this 85% of the time.[13] Customers want information about the products they’re buying and they want to make sure they’re paying a fair price.

Today’s customers, especially younger ones, want to be able to make purchases on their own terms. They want full control over when, where, and how they shop.

Inherent Advantages of eCommerce

Price Advantage

Many customers believe that pricing is better online. For example, an Accenture survey showed that 52% of customers in the US and UK believed that prices online were cheaper than in store.[14] For the most part, this is true. Lower overhead, lower taxes, and disintermediation have all played roles in driving down prices online.

Online-only vendors have much less overhead, and ecommerce around the world is led by pure play vendors—online-only vendors whose business model is to not operate out of physical stores. For example, Macy’s, a retailer with a physical and online presence, is investing $400 million in the renovation of its flagship store in New York.[15] With even the largest ecommerce implementations costing less than $100 million, the return on investment is much higher than $400 million spent on one physical store. The fixed costs are so high in traditional retail that some retail chains are seen by investors as real estate investment firms first and retailers second. The lower overhead of pure play ecommerce vendors often translates to lower prices.

Taxes are another downward driver on prices. Taxes on goods purchased in a physical retail store in most developed markets can exceed 20%.[16] The regulations that apply to physical retailers often don’t apply to ecommerce vendors, especially those across borders. Many jurisdictions charge taxes only when the retailer physically has a presence in that jurisdiction. For cross-border shipping, especially of expensive electronics and luxury goods, this is often not the case. The cost savings can be substantial.

Disintermediation continues to play a big role in pushing down prices, as manufacturers set up direct-to-consumer ecommerce platforms and sell on marketplace-like exchanges. Prior to ecommerce, manufacturers had to sell to wholesalers who then sold to retailers. Now it’s fairly easy, at least technically, to set up a direct-to-consumer business and keep those margins.

Online prices are not always lower, though. An advantage ecommerce offers is the ability to price discriminate based on anything—from previous purchasing history, to geographic location, to demographic information like gender and income. For example, an Australian retailer was recently found to be imposing a 6.8% surcharge on all Internet Explorer 7 users.[17] Prices can be set however and whenever the vendor pleases. Outside of not causing public relations headaches or running afoul of local laws, there are no rules or restrictions online. In physical stores, it’s a logistical nightmare to change prices, and it’s often impossible to charge people different prices for the same goods. Coupons and targeted promotions can help, but the sticker prices are exceedingly hard to change.

Convenience

The costs to customers of shopping in a traditional retail store can be substantial. Quantifiable costs include the following:

§ Time away from home or work

§ Transportation costs, including fuel for your car or public transportation costs

§ Often higher costs due to an inability to comparison shop

Unquantifiable costs include listening to your toddler scream for candy at checkout, among others.

The costs of online shopping are virtually nothing. It takes seconds to purchase a product from a vendor that you’ve done business with in the past and it can even be done from the convenience of a smartphone. Even when shopping with new retailers, it takes no longer than a few minutes to find and buy the product you’re looking for. Return-friendly policies make it easy to return products that may not fit properly, like shoes or clothing. And the maturity of ecommerce, as we’ll discuss shortly, makes it easy to quickly find exactly what you’re looking for.

Large Product Assortment

Most physical retail stores are small—between 3,000–10,000 square feet, usually selling a few hundred products in one category of merchandise. For example, it would be very difficult to find this book and car parts in the same physical store. Even larger-format hypermarkets, which can be as large as 260,000 square feet,[18] sell only a few thousand products. Their assortment tends to be wide but not very deep. It’s hard to sell a wide range of products in physical stores because retailers have to procure and take physical possession of products, get the products to each physical store, continually stock the shelves, and so on. This is all very capital and labor-intensive, resulting in low margins.

Large ecommerce vendors sometimes don’t even take physical possession of the goods they sell, using arrangements such as drop shipping, whereby the manufacturer or wholesaler ships directly to the end customer. Many ecommerce vendors are using marketplaces where the sellers are clearly identified as being a third party, usually the manufacturer or a small wholesaler. Both drop shipping and marketplaces have eliminated a lot of inventory, risk, capital, and labor associated with carrying that inventory.

To further add to the benefits of ecommerce, products can be shipped from a few centrally located warehouses, with the vendors having to worry about keeping only a few warehouses stocked, as opposed to thousands of physical stores. Amazon.com ships its products out of over 80 physical warehouses around the world, with many over one million square feet.[19] It can still be profitable for an ecommerce vendor to sell 100 units of a given product, whereas it would never be profitable for a physical retailer. This has revolutionized entire industries, like book selling and auto parts distribution, as people want to buy niche products that aren’t economically feasible to stock in physical retail stores.

Technological Advances

Closer Tie-in with the Physical World

Because of its nature, ecommerce has some distinct advantages and disadvantages over traditional retail. We discussed many of the advantages earlier, including price, convenience, and assortment. The main disadvantages, also discussed earlier, include the inability to see and/or try on goods, and shipping. This is where ecommerce vendors with physical stores can have an edge over pure play ecommerce vendors. They can leverage their physical stores to bridge the gap between the virtual and physical worlds.

Let’s start with the inability to see and try on goods. Many retail stores, whether belonging to the ecommerce vendor where the purchase is ultimately made or not, have become virtual showrooms. Showrooming refers to the trend of customers viewing and trying on the products in physical stores but then buying online. Traditional retailers without a strong ecommerce offering abhor this behavior and have even hidden barcodes in a feeble attempt to stop it. Retailers with a strong ecommerce offering have even begun to encourage the practice by offering free in-store WiFi, advertising wider assortments that are available online, encouraging customers to view product reviews online, and offering detailed content that’s featured only online. The thought behind this is that it’s better to cannibalize revenue from your physical stores with your ecommerce offering as opposed to someone else’s ecommerce offering. Having a strong physical and ecommerce presence is what’s required to succeed in today’s increasingly digital world.

Many ecommerce vendors with physical stores now offer in-store pickup and in-store return of goods purchased online. A few offer fulfillment from physical stores, meaning any item from any physical store can be picked off the shelves and delivered to customers. This makes all of the inventory from a retailer’s entire network available to anybody in the world. Certain types of ecommerce vendors, like grocers, have always featured in-store fulfillment as well as delivery from the local store. In the UK, this is a $10 billion/year business, with physical retail stores both fulfilling and shipping (via delivery vans) the goods to individuals.[20] Other categories of goods that have traditionally been fulfilled from local retail stores include large electronics, furniture, and other items that are too big to ship or require custom installation.

To compensate for the advantage that retailers with physical stores have, leading-edge online-only ecommerce vendors are experimenting with same-day delivery and offering customers the ability to pick up goods from drop boxes, which are simply automated kiosks containing your goods that you unlock with a code. Often these drop boxes are scattered throughout metropolitan areas in places like convenience stores. This makes it faster for customers to receive and return goods while lowering shipping costs.

Customer-friendly policies

By its nature, ecommerce is at a distinct disadvantage over traditional retailers because of the physical distance between the products and the customers. In a purely physical retail world, this isn’t an issue. You pay for the products at a point-of-sale terminal and walk out the door with your products in hand. Specific problems with ecommerce and shipping include the following:

§ Cost of outbound shipping (sending goods from vendor to customer)

§ Cost of inbound shipping (sending returned goods from customer back to vendor)

§ Time it takes to receive goods

§ Delays and taxes incurred at border crossings

§ Cost/time to return

These problems are made worse by the fact that customers want to physically see and try on goods. There’s a reason that many physical retail stores, especially those selling higher-end noncommoditized merchandise, sometimes spend hundreds of thousands of dollars for lighting and changing rooms in their stores. Customers often want to see and try on those categories of goods including clothing, shoes, leather goods, jewelry, watches, and so on. You can’t do that with ecommerce, so the return rates tend to be higher. Return rates can be as high as 20%–30% for apparel.[21]

To compensate for these deficiencies, many vendors offer these incentives:

§ Free inbound and outbound shipping to at least some customers—often those who are the most loyal or those who need to be enticed to complete a purchase

§ Reduced-price expedited shipping, sometimes offered as part of an annual membership

§ Free same-day delivery, especially in smaller countries or large metro areas

§ In-store pickup and returns for vendors with physical stores

§ Depot-based pickup, where you can have your goods delivered to a secure locker in a local convenience store or gas station

Customer-friendly policies such as free shipping and free returns are cutting into margins less as shipping costs are being reduced. The clear trend of the past decade has been away from giant monolithic fulfillment centers to smaller, more regional centers that are closer to customers. A package is going to cost less to ship and will show up faster if it has to travel 500 miles instead of 2,000. These policies hurt margins in the short run but ultimately lead to satisfied customers who buy more in the long run.

Increasing Maturity of eCommerce Offerings

We’ve come a long way since the beginning of modern ecommerce in the mid-1990s. Back in the early days of the Internet, ecommerce suffered from a dearth of Internet-enabled devices, slow connection speeds, little or no web browser standardization, and little public awareness. The year 1994 was the turning point, when people in the US began to buy personal computers for the first time and hook them up to the Internet. Netscape, the original web browser for the masses, began in early 1994 and supported Security Sockets Layer (SSL) later that year. Dial-up Internet, while slow, was better than the nothingness that preceded it. Money follows eyeballs, as the old adage goes, and ecommerce began to grow in tandem and then much faster than Internet use. As people began to use ecommerce, established retailers and entrepreneurs of all stripes began to invest. For example, Amazon.com was founded in 1994, and eBay was founded in 1995. This cycle of investment and growth has been repeated in countries all around the world, beginning when Internet access is available to the masses.

The investments in ecommerce have led to both incremental improvements and major innovations, including:

§ Better functionality through new tools and features that make it easier to shop

§ A more personalized shopping experience

§ Use of social media to both directly transact and influence sales

§ Rich interfaces offered across multiple device types

§ Transfer of control from IT to business

§ Improvements in underlying technology that improved performance and availability

§ Customer-friendly policies, like free shipping and no-hassle returns

§ Closer tie-in with the physical world—from in-store returns to kiosks in public places

While innovation is always good, it has come at the cost of complexity. It’s not uncommon for a large ecommerce platform to have over a million lines of actual source code. You need to integrate or build solutions for management, monitoring, ratings and reviews, product recommendations, load balancing, static content serving, load testing, and more. You need dozens of products or services, each having its own lifecycle and service-level agreements. It’s a lot of work. But it’s precisely these technologies and newfound ways of using them that have led to the widespread and rapid adoption of ecommerce around the world.

Let’s explore each of these further.

Better functionality

Over the years, ecommerce has evolved from a collection of more or less static HTML pages to a rich shopping experience, complete with tools and features to help you find and purchase the goods or services you may or may not even know you want. Shopping online is now so enjoyable that many prefer to do it under the influence of alcohol when they’re in a good mood.[22] Not many intoxicated customers feel inclined to walk into a physical retail store in the middle of the night.

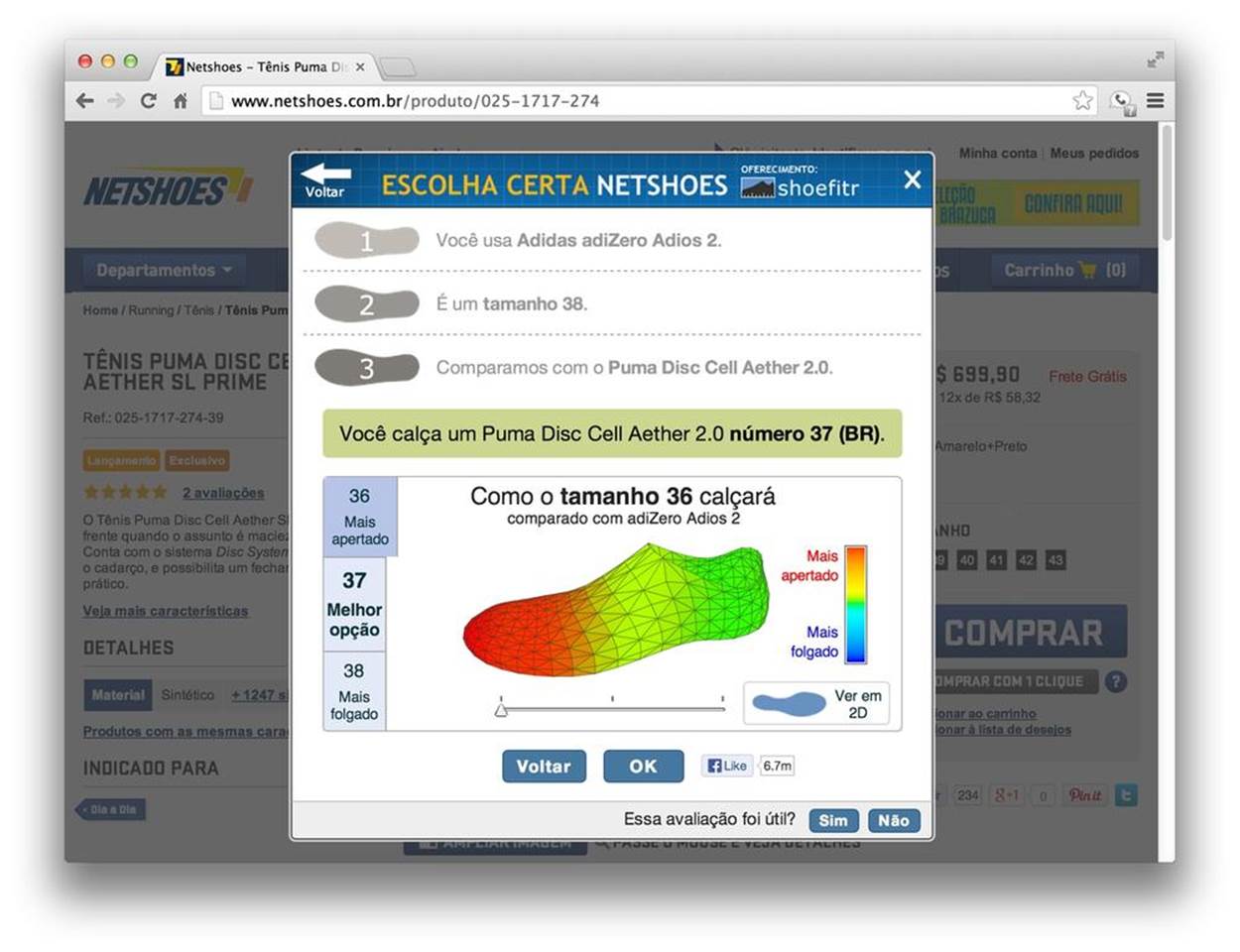

The better ecommerce vendors offer advanced tools to help you find exactly the product you’re looking for. For example, Netshoes.com.br is the largest online apparel retailer in the world. Netshoes.com.br has no physical stores and specializes in selling shoes online. To better compete against physical retail stores, Netshoes.com.br invested in technology to perform 3D scans of shoes. When you create your profile, you can enter in the model number and size of the shoes that fit you best. When browsing for new shoes, you can compare the fit of your old shoes versus new shoes and see how the fit actually differs, as shown in Figure 1-2.

Figure 1-2. Netshoes.com.br’s shoe-fitting tool

Innovations like this highlight the advantage that ecommerce offers. In a physical retail store, you’d have to try on many pairs of shoes until you found the ones that fit you perfectly. Each physical store is unlikely to have as many shoes to choose from.

Another benefit of ecommerce is the ability to customize products and see accurate visualizations of customizations. Customized products sell for a premium and keep customers more engaged. NFLShop.com, for example, does this with custom jerseys.

Enhanced photography, including 360° videos, make it easier to see products. Innovations in static image serving and devices capable of connecting to the Internet have made it easier than ever to deliver and render high-resolution images.

Enhanced search has made it trivial to search, browse, and refine your results to pinpoint exactly what you’re looking for. Modern ecommerce preceded Google’s founding by four years. For the first few years of ecommerce, search didn’t exist or wasn’t accurate. For the most part, you had to manually browse through categories of products until you found what you were looking for. In the 2000s, ecommerce search began to take off, though it didn’t really mature until the mid-2000s. For many years, search results were fairly inaccurate, as they simply did keyword matching against each SKU’s metadata. The goal of retail has always been to get the right products in front of the right customer at the right time. Accurate search enables that.

Modern search is very mature, offering accurate search with the ability to refine by price, manufacturer, and other product-specific metadata. For example, a search for “usb flash drive” across any popular ecommerce website will offer customers the ability to refine by the capacity and USB specification. The ability to quickly refine results has been a substantial driver of conversions.

Maturing ecommerce search functionality has also helped ecommerce vendors by allowing business users to boost results, bury results, redirect to a special page for a given term, and so on. This maturation of technology has allowed today’s business users to help customers find exactly what they’re looking for while maximizing revenue and margins.

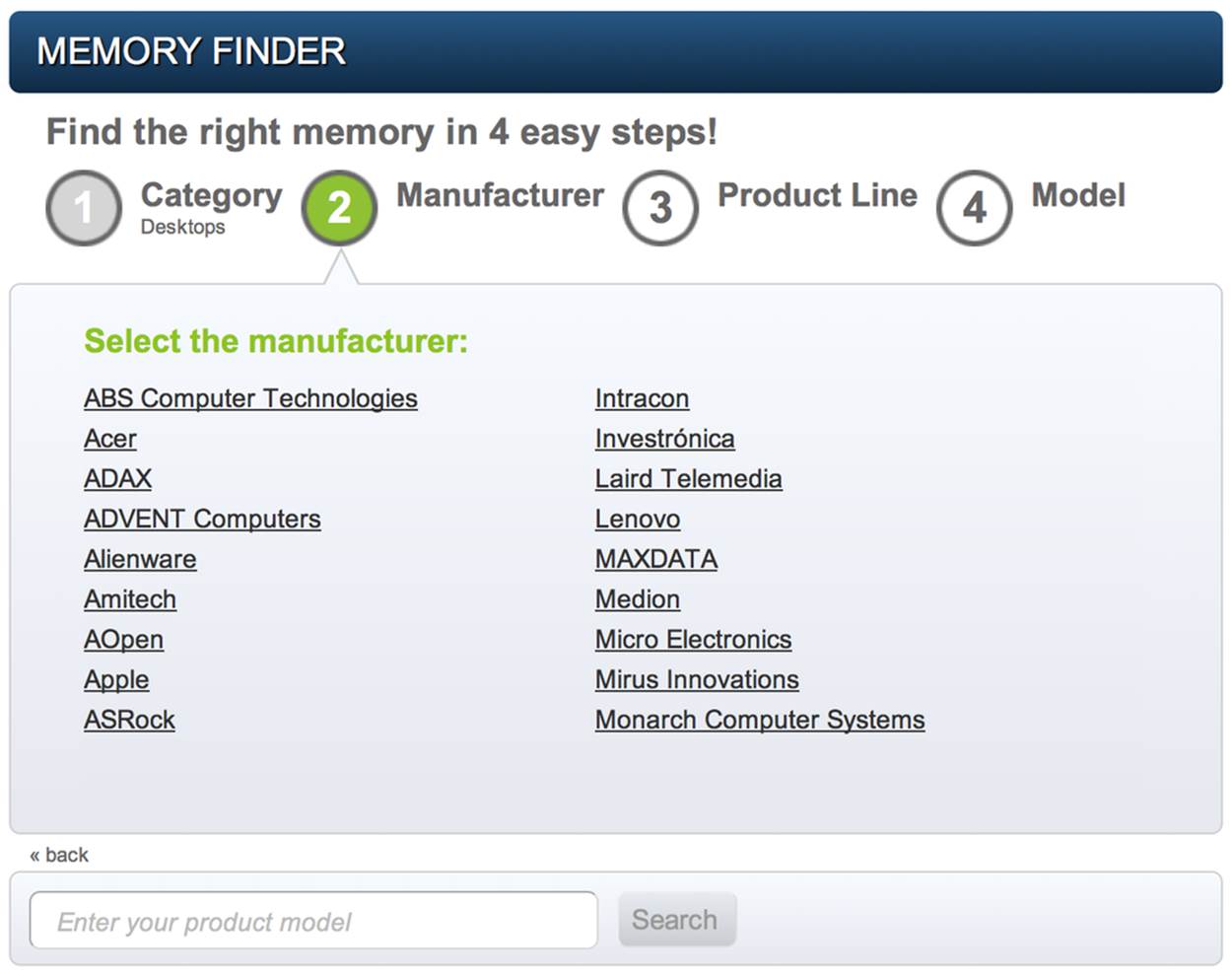

Category-specific tools and guides have also made shopping easier for novices. For example, buying memory has never been easier because of a proliferation of memory finder tools, as depicted in Figure 1-3.

Figure 1-3. Memory finder tool

Empowered by these tools, novices can get what they need without having to chat or call a customer service representative. Customer enablement is a key driver of ecommerce’s success, and these tools exemplify that trend.

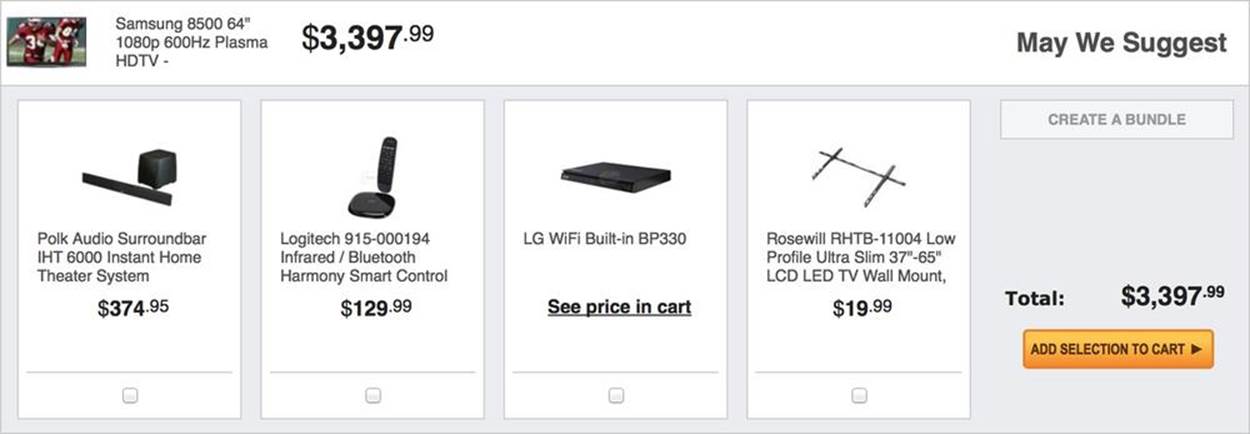

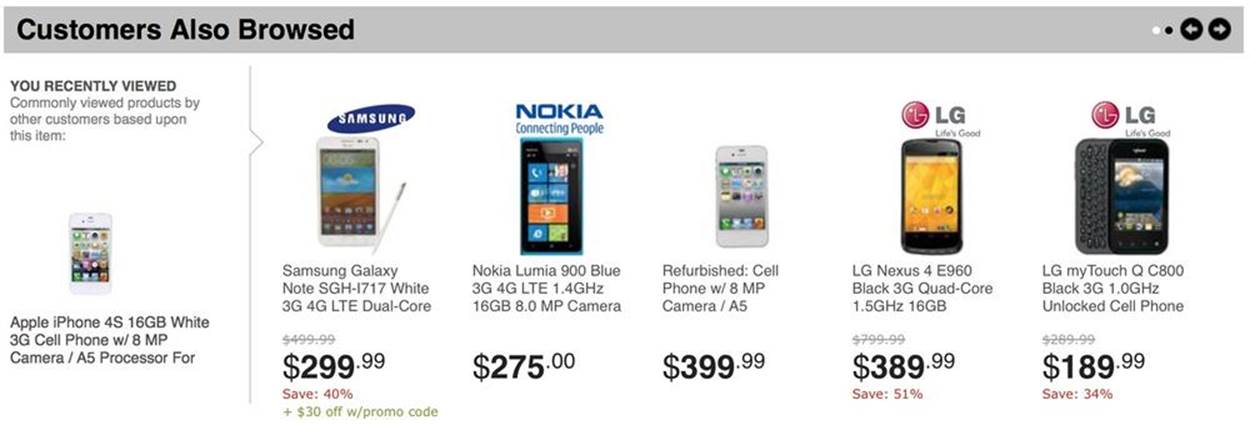

Over the years, ecommerce has moved from being more transactional to more solution-oriented. Many customers now want bundles of products that work better together. For example, viewing the product detail page of a TV now commonly triggers cross-sells, as shown in Figure 1-4.

Figure 1-4. Example of a cross-sell

These cross-sells are often high-margin goods for vendors, and they help the customer by completing the solution.

Personalized shopping

Personalization has proven to be a powerful driver of both customer satisfaction and higher revenue. Broadly, personalization is the ability to customize a shopping experience to individual customers or groups of customers based on an attribute or behavior. Effective personalization drives sales in the way that an attentive sales staff does, except you don’t have to pay commission to algorithms.

Attribute-based personalization often uses demographic information captured during registration, and sometimes browsing behavior. For example, as an apparel retailer, you may want to show your Wisconsin customers winter gloves and your Florida customers swimsuits in January. Customers in Wisconsin simply have little use for swimsuits in January and may not advance past the home page when presented with such irrelevant information. Or imagine a man being presented with the latest lipstick. Chances are, these recommendations are going to be entirely ignored or even perceived as offensive. Outside of a few stores in the world, sales people in traditional retail stores would be fired if they presented a man with lipstick as they walked in the door.

Behavior-based personalization is triggered by specific events—often the viewing of specific products. For example, based on my browsing history, this ecommerce website has determined that I would be interested in the following, shown in Figure 1-5.

Figure 1-5. Example of behavior-based personalization

Behavior-based personalization is often preferred to attribute-based personalization because it’s based on what customers actually do as opposed to stereotypes about what they should do. For example, someone located in Wisconsin could be buying a swimsuit for an upcoming trip to Florida. Displaying related swimsuits because a customer has already viewed five others in the same session is perfectly normal.

From an ecommerce vendor’s standpoint, personalization serves simply to increase sales. Going back to Netshoes.com.br, one of their specialties is selling team apparel for soccer teams in Latin America. Soccer, as with many other sports and activities, can be a very serious matter to many fans.[23]

“Corinthians is like a nation, a religion…people are borrowing money from banks, from relatives to come here. They are quitting their jobs, selling their bikes, their cars, even their fridges. It’s true.”

— A Corinthian’s fan (Sao Paulo’s hometown club) on the legions of fans that followed the team to Japan for an important match

Now imagine this fan creating an account on Netshoes.com.br, identifying as a Corinthians fan during registration, and then seeing apparel from their archrival, Pameiras, on the home page. It would be an insult and it would show that Netshoes.com doesn’t understand him. It’s highly unlikely that a Corinthians fan will ever buy a Pameiras–branded item. In fact, being presented with a Pameiras item is likely to prevent the sale of a Corinthians item to this fan. Presenting customers with a personalized shopping experience has proven to be a substantial driver of sales for many ecommerce vendors.

Imagine the advantages this has over traditional retail, where there’s virtually no personalization whatsoever. A sales associate on a store floor is likely to know nothing about any given customer, whereas the Web has purchase history, browsing history, and a complete demographic profile of each shopper available to build a personalized ecommerce shopping experience.

Personalization can also be used to price discriminate. For example, men between the ages of 30–45 who make greater than $150,000/year have a very inelastic demand for the latest technology gadget and always could be shown the list price. Women aged 60+ are likely to have very elastic demand for the latest gadget and may be more willing to make a purchase with a 30% off discount or free shipping. Price discrimination is a part of our everyday lives, from the price of airfare to how much you pay for your bathroom renovation. Traditional retailers would do it more if they could. It’s shockingly easy to do it with ecommerce.

Social media

Social media, virtually nonexistent a few years ago, has come to be a substantial influencer and even driver of ecommerce sales. Today it’s estimated that 74% of customers have a commercial interaction with social media prior to an ecommerce purchase.[24] Customers interact with social media to learn about products, search for discounts, and then tell others about their experience shopping and consuming the product. The reach of social media today is extensive, with the average Facebook user having 245 friends[25] and Twitter delivering more than 200 billion tweets per day.[26] It’s ubiquitous and becoming an increasing part of our daily lives.

Customers are increasingly taking to social media to research purchases and then tell their friends about their shopping experiences—whether good or bad. Before social media, an upset customer was likely to tell a few close friends about their experience. Now, it’s easy to tell hundreds or even thousands of people in the few seconds it takes to compose a Tweet or update your Facebook status.

Purchases are increasingly no longer made in isolation. Influences come far and wide, especially from social media.

Rich interfaces across multiple devices

In the early days of ecommerce, ecommerce applications were fairly static. You went to http://www.website.com from a web browser and received a single static HTML page as your response, formatted for an 800×600 pixel display. It was probably built exclusively for Internet Explorer.

Today, most ecommerce vendors have native applications for the wide range of devices that are now used to browse or consume content on the Internet. Most browser-based applications automatically resize themselves according to the device resolution. Many modify the way they render based on the connection speed and the capabilities of a wide range of web browsers. Most vendors offer a range of mobile ecommerce offerings, from mobile-friendly HTML (e.g., m.website.com) to iOS and Android applications. Tablets have a fairly wide range of native applications available. Building native user interfaces, capable of leveraging each device’s functionality, pays off with conversion rates as much as 30% higher than mobile-friendly HTML.[27]

Transfer of control from IT to business

Business users include merchandisers, marketers, and managers. In general, the more control business users have over the platform, the better, as they’re closer to customers and allow IT to focus on keeping the website up and delivering on differentiating functionality. For example, athletic apparel retailers need to be able to quickly push promotions live for the winning team of a big game. Similarly, many ecommerce vendors watch social media for trends and frequently merchandise their site differently based on what people are talking about. Waiting days for changes to take effect is no longer acceptable.

Business users today often control the following:

§ Page layout—page templates and the content that fills each slot

§ Customer segmentation rules

§ Promotions

§ Prices

§ Product details—description, display name, parent category

§ Categorization rules—static and dynamic rules

§ Images

§ Text

§ Search rules—boost results, bury results, redirects

§ A/B segments

§ Campaigns (email, social, print)

§ Payment methods and rules

§ Shipping rules and costs

Tools used by business users range from simple spreadsheets to rich drag-and-drop user interfaces.

It used to be that ecommerce applications were entirely code-driven, meaning, for example, that you had to change code in order to swap out the main image on the home page. This was largely because the industry was just getting started. So long as the application was up in production, people were generally happy. Today, most ecommerce applications are data-driven, meaning that pages are dynamically rendered based on data in a persistent datastore, like a database, as opposed to hardcoded strings or variables. With data in a database or some other persistent datastore, it’s fairly easy to build a user interface that allows business users to modify it.

There’s an eternal conflict between business and IT, as the two are so intertwined but often have opposing interests. The goal of business is to make money, often by driving traffic through promotional events. In theory, the goal of IT is to see the business succeed, but in reality IT is rewarded for platform availability over all else. The two sides have to work together to succeed, and to do that, incentives must be fully aligned.

Improvements in underlying technology

Since the beginning, ecommerce has greatly benefited from a virtuous cycle of investment and growth. That continues to this day, with daily advances made in the technology that underlies ecommerce. We’ll discuss many of these advances throughout the rest of the book, but broadly this technology includes the following:

§ Cloud computing

§ Content Delivery Networks

§ Domain name system (DNS)

§ Load balancers

§ Web servers

§ Application servers

§ Applications themselves and the frameworks used to build them

§ Virtual machines

§ Operating systems

§ Hardware

§ Cache grids

§ Network infrastructure

§ Databases

§ Increased bandwidth at all layers

Every single layer has substantially improved since the beginning of ecommerce. These improvements have not been generally reflected in today’s ecommerce deployment architectures.

Changing Face of Retail

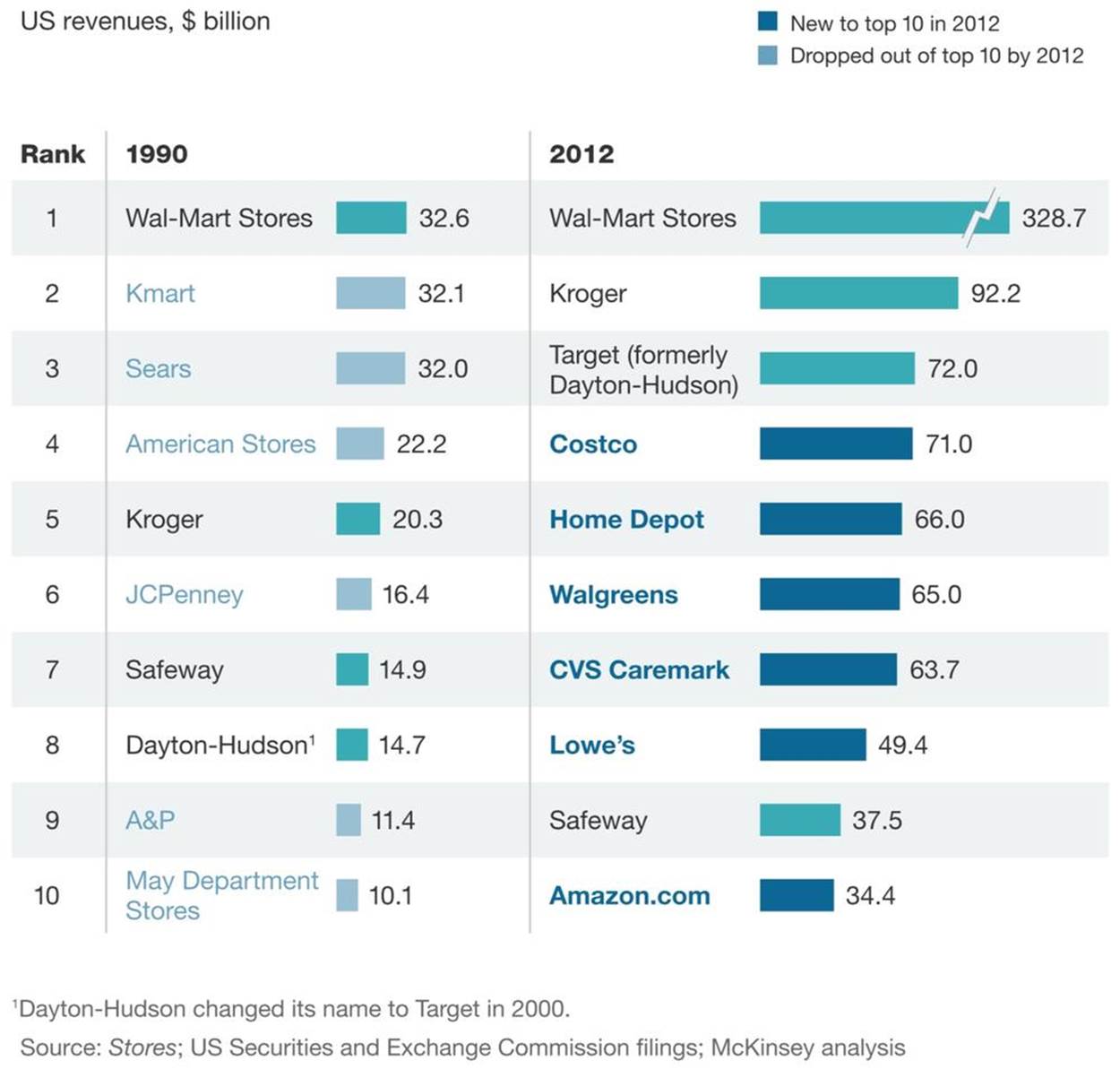

Retail around the world is quickly changing, with the Internet and globalization the two driving forces behind these changes. Like globalization before it, the Internet has proven to be an incredibly disruptive force. The consulting firm McKinsey & Company published a startling chart ranking the revenues of the top 10 retailers in the US in 1990 versus 2012, shown in Figure 1-6.[28]

Figure 1-6. Top ten largest retailers in the US in 1990 versus 2012

Of the top 10 largest retailers in the US in 1990, only four remained on the list in 2012. What’s notable is that Amazon.com is now on the list at number 10, with its revenues quickly growing as traditional retail revenue declines.

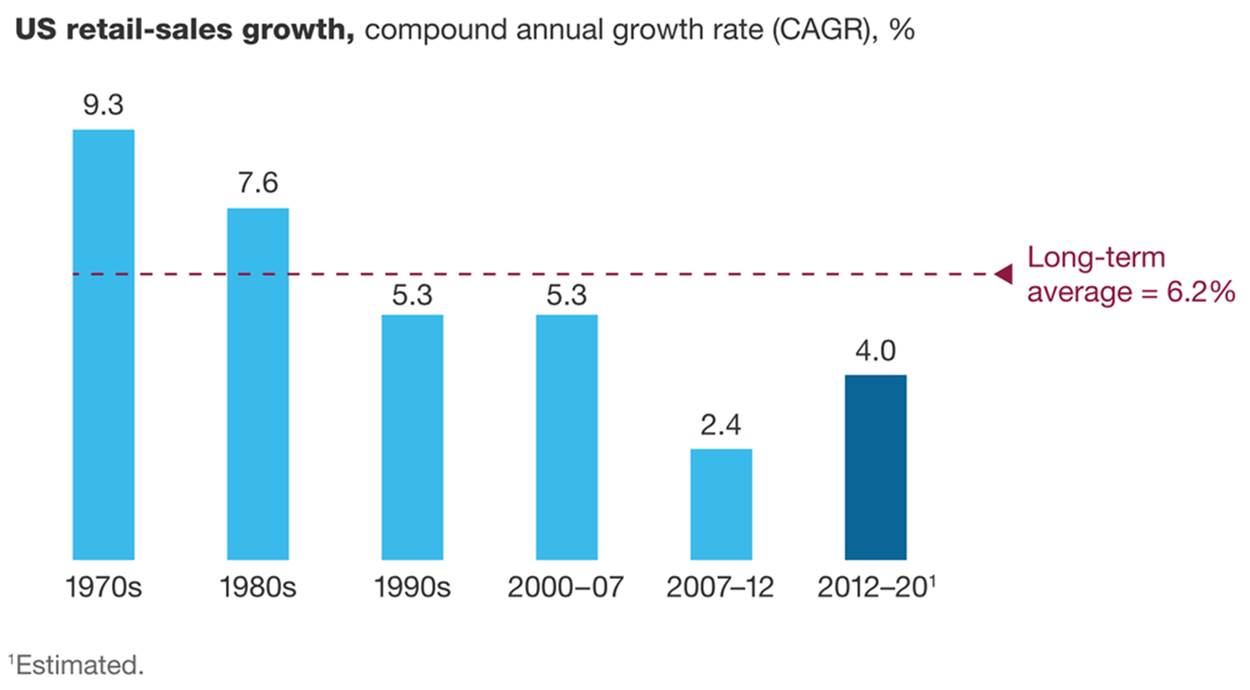

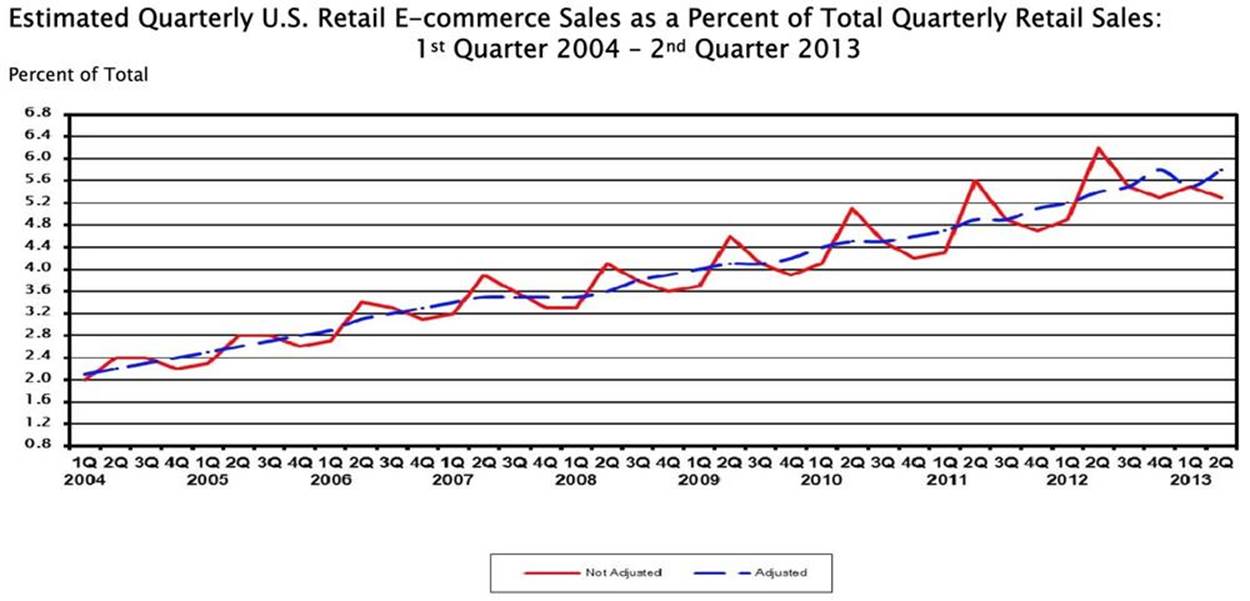

The graphs in Figures 1-7 and 1-8 illustrate the problems facing traditional retailers.

Figure 1-7. US retail sales growth has declined since the 1970s[29]

Figure 1-8. US ecommerce sales have risen steadily[30]

Traditional retailers with physical stores that don’t also excel in ecommerce are doomed to extinction. Very few of today’s top 10 retailers will continue to remain in their present positions 10 or even 20 years from today. While this list is specific to the US, the principles are the same for other countries around the world.

Let’s take Borders as an example. At its peak in 2003, it had 1,249 physical retail stores.[31] By the time it filed for bankruptcy in 2011, it was down to 399 stores. When faced with mounting pressure from pure play ecommerce vendors, Borders decided to outsource its entire ecommerce operation to Amazon.com in 2001.

“In our view, that was more like handing the keys over to a direct competitor.”

— Peter Wahlstrom Morningstar

Borders pulled out of that agreement in 2007, but it was too late. The last time it had earned a profit was 2006.[32] While Borders was investing in building out its physical stores, its competitor, Barnes & Noble, was investing in ecommerce. Barnes & Noble eventually released its own branded e-reader in 2009.

Unfortunately, many retailers suffer from what’s known as the innovator’s dilemma,[33] focusing on business as usual instead of innovating. Innovation is disruptive, both internally and externally, and it’s expensive. In a world that’s increasingly driven by quarterly earnings, long-term research and development isn’t rewarded so much as punished by Wall Street for not “making the number.” True innovation, including the adoption of ecommerce and shifting to the cloud, requires strong leadership and a commitment to investing for the future.

Omnichannel Retailing

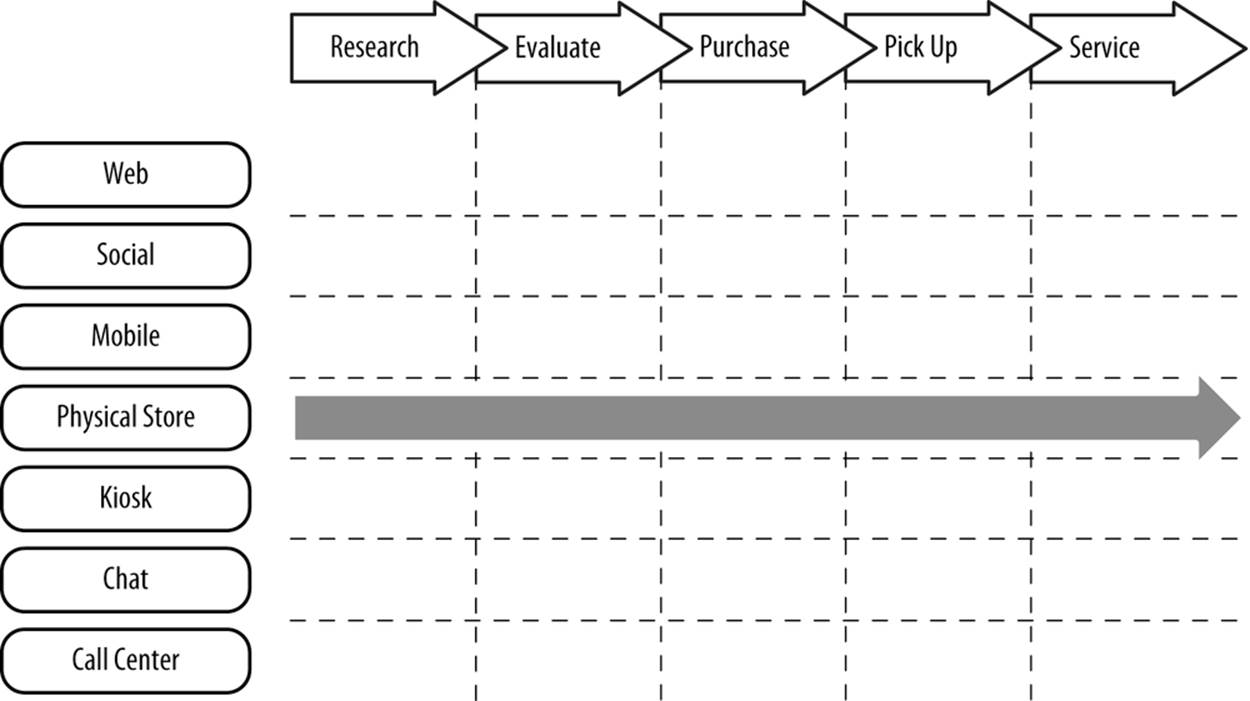

For traditional retailers with physical stores, ecommerce represents a big challenge to the status quo. For many decades, most retailers had just one channel: physical stores. For both retailers and customers, this was a simple model, as shown in Figure 1-9.

Figure 1-9. One channel

Most often, retailers didn’t know who each customer was, as loyalty programs were still in their infancy. The customer would walk in and perhaps walk out with a product in hand. The only real influences were advertising and word of mouth. From an operations standpoint, each store was independently managed, with sales of each store easy to tabulate. If capital improvements were made to a store, it would be fairly easy to see later whether the investment was worth it. Salespeople could be paid commissions because their influence alone was likely the deciding factor in closing the sale. It was a simpler time. Today’s world is much more complicated.

Dozens of channels are used for both influencing and purchasing. Customers now demand that retailers have a presence and be able to seamlessly transact across multiple channels:

§ Web

§ Social

§ Mobile

§ Physical store

§ Kiosk

§ Chat

§ Call center

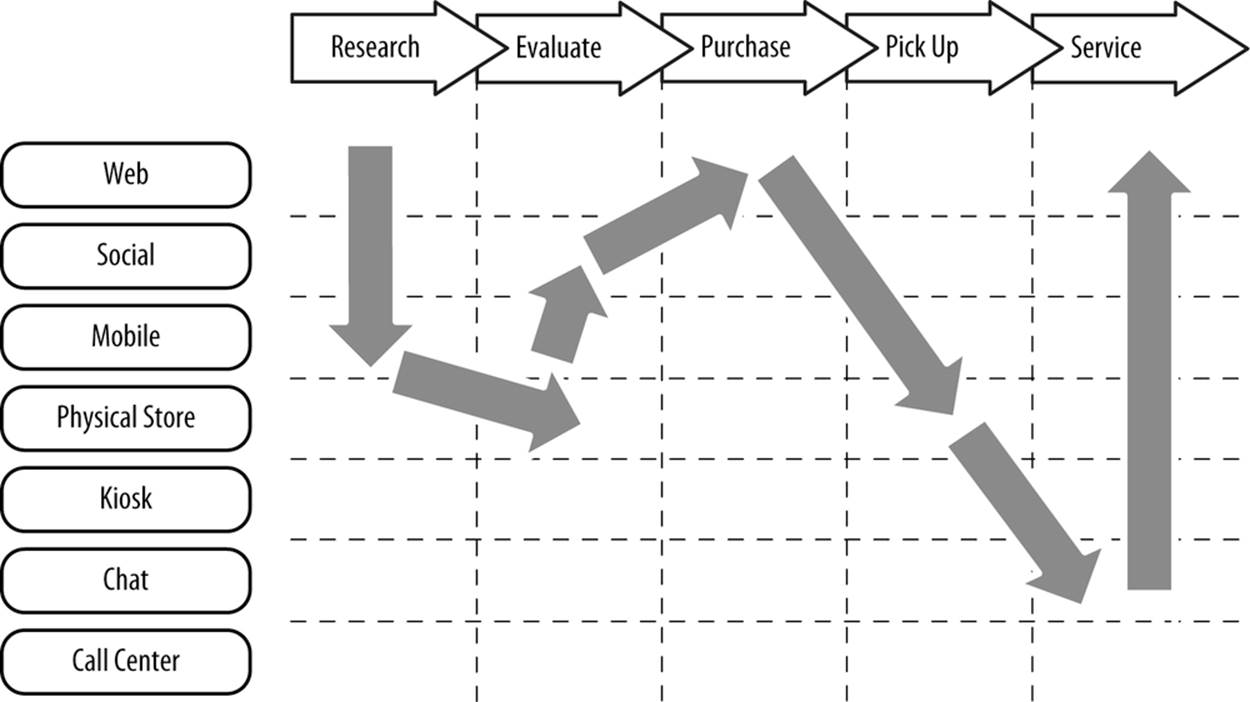

The ability to seamlessly transact across multiple channels is broadly defined as omnichannel retailing. This means reorienting from transaction and channel-focused interactions to more experience and brand-focused interactions. It’s a big change. Figure 1-10 is a picture of what today’s customer journey may look like.

Figure 1-10. The journey today’s customers take before purchasing

Customers constantly jump back and forth between channels, or they may even use multiple channels simultaneously—researching a product on a mobile device from a physical store. Today, the purchase process is typically some form of the following:

1. Research extensively online, leveraging social media

2. Read ratings and reviews

3. Shop for best price

4. Purchase

5. Tell people about the purchase and whether they’re happy

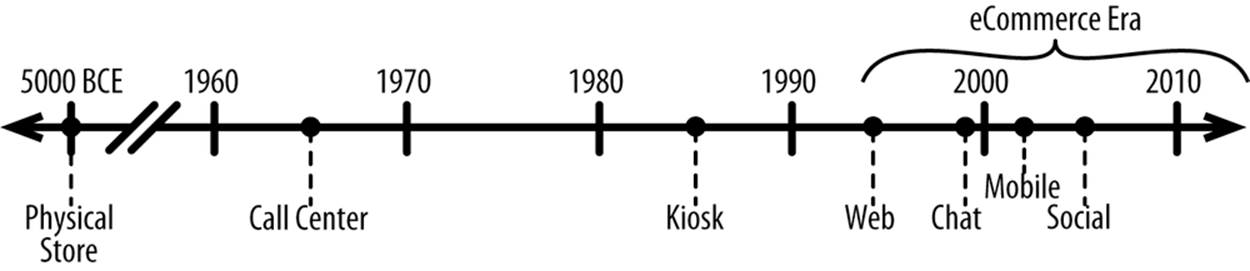

As recently as two decades ago, only three of these seven customer touch points existed. Only one of these seven channels has existed for the first 99.3% of modern retailing. Figure 1-11 shows a breakdown of when each of these channels was first introduced.

Figure 1-11. Timeline of the introduction of channels (not to scale)

This is only when these technologies were introduced. For example, the first modern web browser on a mobile device wasn’t released until 2002, but it wasn’t until the middle of 2007 that the first iPhone was released. It takes a while for these technologies to mature and become adopted by a critical mass of customers.

These changes to retailing are entirely customer-driven and have their roots in our modern consumer culture: technological advances, including the introduction of the Internet and cheap electronic devices, democratization of data, and globalization. Customers are firmly in charge. Retailers have to adapt or they will perish.

Business Impact of Omnichannel

Many retailers with physical stores used to eye ecommerce with suspicion. Sales staff working for and managing individual stores especially feel that ecommerce is a zero sum game. They see customers coming in to look at and try on products, only to have them pull out smartphones and purchase the same product online for less, often from a different vendor.

For the first decade of ecommerce, retailers with physical stores and ecommerce just treated ecommerce as its own physical store. The cost to build an ecommerce platform was roughly the same as the cost of a physical store, and it was easier to manage ecommerce that way, given the rigidity of the backend systems. This treatment of ecommerce kept it relegated to a marginal role in most enterprises because everyone thought of it as a separate physical store, with its own growth targets, staff, and inventory. Today, ecommerce initiatives are strategic to all retailers, with the heads of ecommerce now typically reporting to the chief executive officer, as opposed to reporting to the chief marketing officer or chief information officer.

The growth of ecommerce was also constrained because of a misalignment of rewards. Individual store-level sales staff and managers were paid for sales that occurred within a physical store. As a result, many employees across an organization actively dissuaded customers from purchasing online. From a compensation perspective, an online purchase was often the same as the customer purchasing from a different retailer altogether. Now, some employees and store managers are beginning to be paid commission on ecommerce sales that occur near to their store.

Another problem is that the virtual boundaries of retailers are now wider than ever. It used to be that retailers had to respond only to customers who physically walked into a store. That’s no longer the case today, as customers expect to be able to transact across multiple channels seamlessly. For example, retailers need to be able to monitor multiple social networks and quickly respond to complaints directed at them in a public forum.

Retail now is all about providing a holistic experience, as opposed to being a mere transaction. Interactions across all of these new channels count.

Now that ecommerce has been around for a while, retailers are beginning to figure things out. It’ll take time, as ecommerce hasn’t existed as a channel for 99.7% of retail’s history. It takes time to adapt.

Technical Impact of Omnichannel

As just discussed, omnichannel retailing has brought substantial changes to the business of retailing. But the technology is affected even more, making cloud computing such an attractive technology.

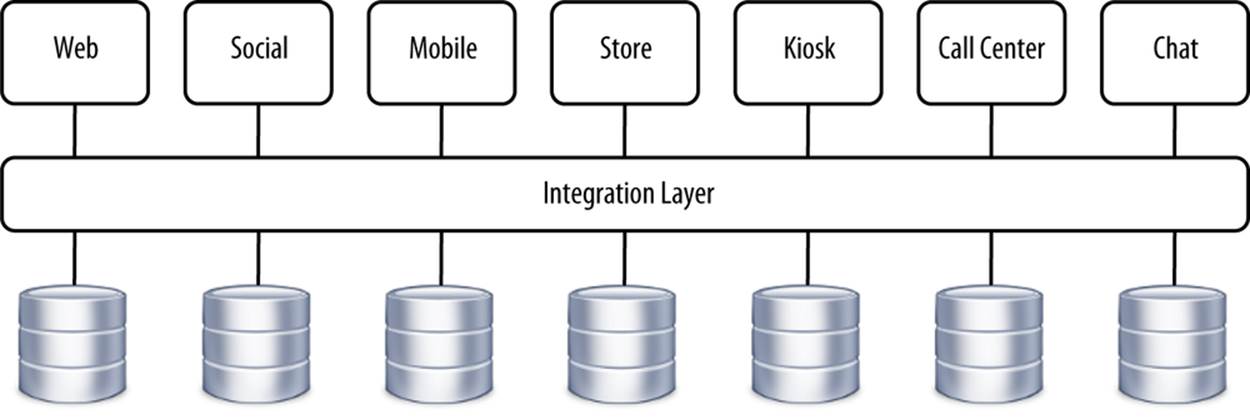

Originally, there were point-of-sale systems in stores. Then ecommerce started out as a single web-based channel with its own database. Over the years, chat, call center, mobile, and eventually social were added under the ecommerce umbrella, but these channels were mostly added from different vendors, each having their own customer profile, order database, and product catalog. Every stack was built with the assumption that it would work independently of any other software. As a software vendor, it’s much easier to sell a chat platform, for example, that works standalone as opposed to only with specific ecommerce platforms. Figure 1-12 illustrates the fragmentation that arises when you have each stack functioning independently.

Figure 1-12. Multichannel coupled with integration layer

There was (and still is) so much growth in ecommerce that the revenue generated from these platforms exceeds the cost arising from suboptimal architecture and implementation. To put it another way, it’s often just cheaper to throw some architects and developers at the fragmentation inherent in multichannel solutions. The problem of fragmentation is especially visible to customers between the store-based point-of-sale systems and ecommerce. The inability of these systems to speak to each other prevents most customers from buying online and picking up in a store, or adding a product in a store to an online shopping cart and then completing the order at home when the customer feels ready to make the purchase. Nothing frustrates customers more than having to re-enter data.

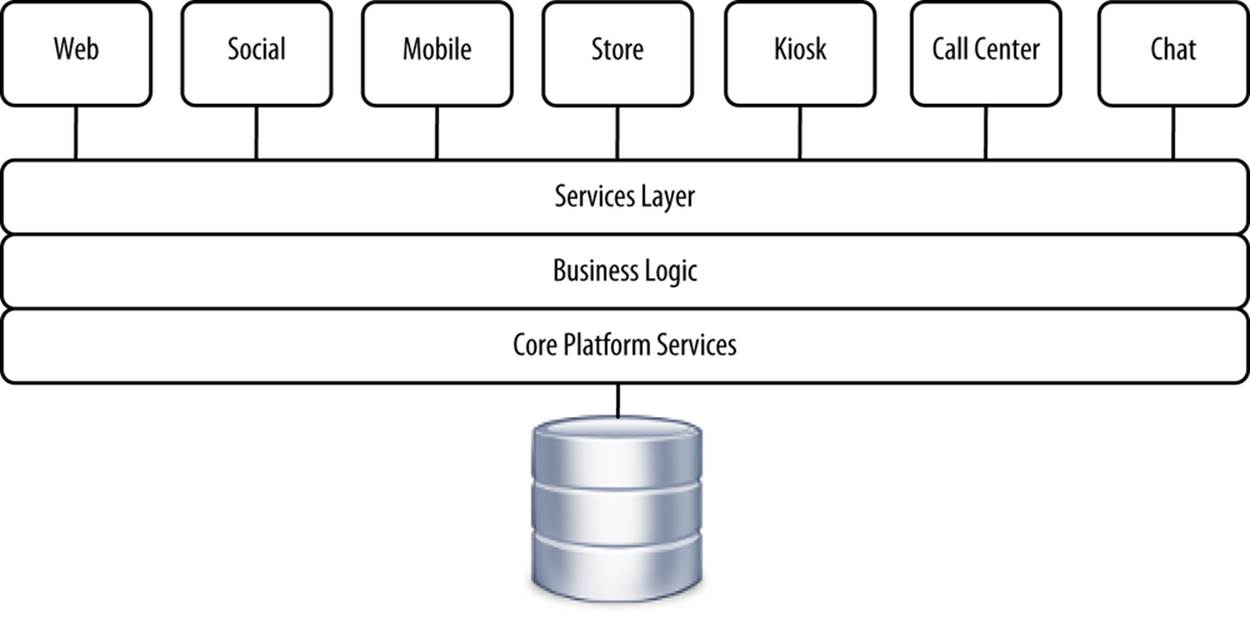

To combat this, retailers are beginning to build what amounts to a headless ecommerce platform using a single logical database or data store, as shown in Figure 1-13.

Figure 1-13. New omnichannel-based architecture

With this architecture, user interfaces are basically disposable, as the business logic all resides in a single layer, accessible through a services-based framework. For example, a RESTful query of:

http://www.website.com/ProfileLookup?profileId=12345

should return:

{

"firstName": "Kelly",

"lastName": "Goetsch",

"age": 28,

"address": {

"streetAddress": "1005 Gravenstein Highway North",

"city": "Sebastopol",

"state": "CA",

"postalCode": "95472"

},

"phoneNumber": [

{

"type": "work",

"number": "7078277000"

}

]

...

}

and so on. Having a single system of record makes it easy for customers to transact with you across many different channels. Multiple integrations, especially point-to-point, are painful. The various stacks are always out-of-date. There are always conflicts to resolve because a customer’s data could be updated simultaneously from two or more channels. A single system of record is basically the same concept as enterprise resource planning (ERP) platforms.

Forward-looking retailers have already removed in-store point-of-sale systems in favor of tablets connecting to a single unified platform.[34] With this type of setup, it’s easy for store associates to pull up customer profiles, saved orders, browsing history, and other data to help make sales.

CASE STUDY: APPLE

Apple is famously a leader in omnichannel retailing, with customers having a seamless experience across multiple channels. Their leadership with omnichannel retailing has led them to have the highest sales per physical square foot in retail, double the nearest competitor.[35]

Apple’s success starts at the top, in the way they approach retailing. They appoint one executive to oversee all retailing, regardless of where the sales are made. Many organizations have ecommerce roll up through the chief information officer or chief marketing officer rather than to a business leader. Having a single leader, a single organization, and a single platform makes it easy to offer a seamless experience whether in a physical retail store or online.

A cornerstone of Apple’s strategy is to give its retail store employees iPads, iPods, and iPhones loaded with an interface to their ecommerce platform. Employees can approach prospective customers with the mobile device and pull up orders started online, review a customer’s purchasing history, view all products offered online, schedule service appointments, and place orders. Normal point-of-sale systems simply allow customers to pay for goods, with little ability to transact.

This unified omnichannel platform is creating challenges for IT, however. As these platforms become larger and more important, scalability, availability, and performance matter even more than ever. A failure in this world knocks every channel offline, including physical stores. Outages simply cannot occur.

Summary

In this chapter, we reviewed the substantial ways that ecommerce and retail itself are changing, along with the change in architecture that’s required to support these changes. Next, we’ll explore the current state of ecommerce deployment architecture to better understand how it’s falling short.

[8] eCommerce Disruption: A Global Theme Transforming Retail, 6 January 2013.

[9] http://bit.ly/1gELPFo, http://bit.ly/QYg8Cq.

[10] eMarketer, “Millennial Men Keep Their Digital Lives Humming,” (23 September 2013), http://bit.ly/OqrRYw.

[11] Alamo, “Phone Home!” (March 2009), http://bit.ly/MrUC5Q.

[12] Natasha Lomas, “Forrester: Tablet Installed Base Past 905M By 2017, Up From 327M In 2013,” TechCrunch (6 August 2013), http://techcrunch.com/2013/08/06/forrester-tablets/.

[13] Pymnts.com, “Online Versus In-Store Shopping Trends: What Drives Consumer Choice,” (18 December 2012), http://bit.ly/1k7ytsc.

[14] Accenture Interactive, “Today’s Shopper Preferences: Channels, Social Media, Privacy and the Personalized Experience,” (November 2012), http://bit.ly/MrUBPf.

[15] The Economist, “Retailers and the Internet: Clicks and Bricks,” (25 February 2012), http://econ.st/1k7yrRe.

[16] Ernst and Young, “Worldwide VAT, GST, and Sales Tax Guide,” (May 2013), http://bit.ly/MrUAe3.

[17] Steven Vaughan-Nichols, “Australian Retailer Charges Customers IE 7 Tax,” (14 June 2012), http://zd.net/1k7ys7K.

[18] Associated Press, “260,000-square-foot Wal-Mart in Upstate NY,” (20 March 2008), http://nbcnews.to/MrUCCR.

[19] Neal Karlinsky and Brandon Baur, “From Click to Delivery: Inside Amazon’s Cyber Monday Strategy,” ABC News (26 November 2012), http://abcn.ws/1k7ysEQ.

[20] Reuters, “Online Grocery Sales to Double in Key European Markets by 2016—IGD,” (23 October 2013), http://reut.rs/MrUCTm.

[21] Mark Brohan, “Reducing the Rate of Returns,” Internet Retailer (29 May 2013), http://bit.ly/1k7ytIW.

[22] Stephanie Clifford, “Online Merchants Home In on Imbibing Consumers,” New York Times (27 December 2011), http://nyti.ms/MrUDXc.

[23] James Montague, “Corinthians: Craziest fans in the world?” CNN (14 December 2012), http://cnn.it/1k7yvAr.

[24] Cooper Smith, “Pinterest Is Powering A Huge Amount of Social Commerce, and Twitter Isn’t Too Shabby Either,” Business Insider, (4 September 2013), http://read.bi/MrUDXp.

[25] Hayley Tsukayama, “Your Facebook Friends Have More Friends Than You,” Washington Post (3 February 2012), http://bit.ly/1k7yufM.

[26] Twitter, Inc., “Amendment No. 1 to Form S-1 Registration Statement” (15 October 2013), http://1.usa.gov/MrUGlZ.

[27] David Eads, “Mobile Web Is Only Half of Retail Mobile Commerce,” Mobile Manifesto (15 May 2011), http://bit.ly/MrUEuq.

[28] “How retailers can keep up with consumers”, October 2013, McKinsey & Company, http://www.mckinsey.com/insights. Reprinted by permission.

[29] http://bit.ly/1g4tbGB

[30] http://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

[31] Mae Anderson, “Borders Closing Signals Change in Bookselling Industry,” Associated Press, (20 July 2011), http://usat.ly/1k7yw7m.

[32] Yuki Noguchi, “Why Borders Failed While Barnes & Noble Survived,” NPR (19 July 2011), http://n.pr/MrUGCy.

[33] From the book by the same name, The Innovator’s Dilemma.

[34] Brian Walker, “IBM Sells POS Business to Toshiba: What It Means,” Forrester (17 April 2012), http://bit.ly/1k7yuMN.

[35] David Segal, “Apple’s Retail Army, Long on Loyalty but Short on Pay,” New York Times (23 June 2012), http://nyti.ms/MrUGT0.