QuickBooks 2014: The Missing Manual (2014)

Part II. Bookkeeping

Chapter 10. Invoicing

Telling your customers how much they owe you and how soon they need to pay is an important step in accounting. After all, if money isn’t flowing into your organization from outside sources, eventually you’ll close up shop and close your QuickBooks company file for the last time.

Although businesses use several different sales forms to bill customers, the invoice is the most popular, and, unsurprisingly, customer billing is often called invoicing. This chapter begins by explaining the differences between invoices, statements, and sales receipts—each of which is a way of billing customers in QuickBooks—and when each is most appropriate.

After that, you’ll learn how to fill in invoice forms in QuickBooks, whether you’re invoicing for services, products, or both. If you send invoices for the same items to many of your customers (and don’t use the program’s multiple currencies feature), QuickBooks’ batch invoice feature can help: You select the customers, add the items you want on the invoices, and the program creates all the invoices for you. If you track billable hours and reimbursable expenses with QuickBooks, you can also have the program chuck those charges into the invoices you create.

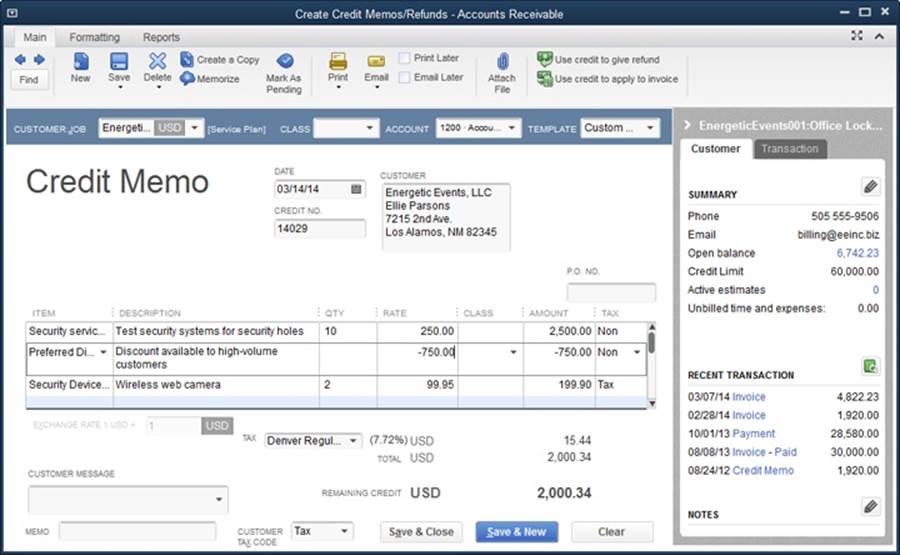

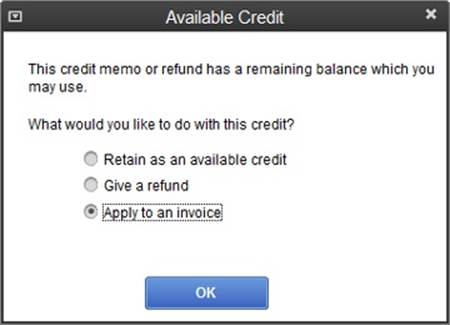

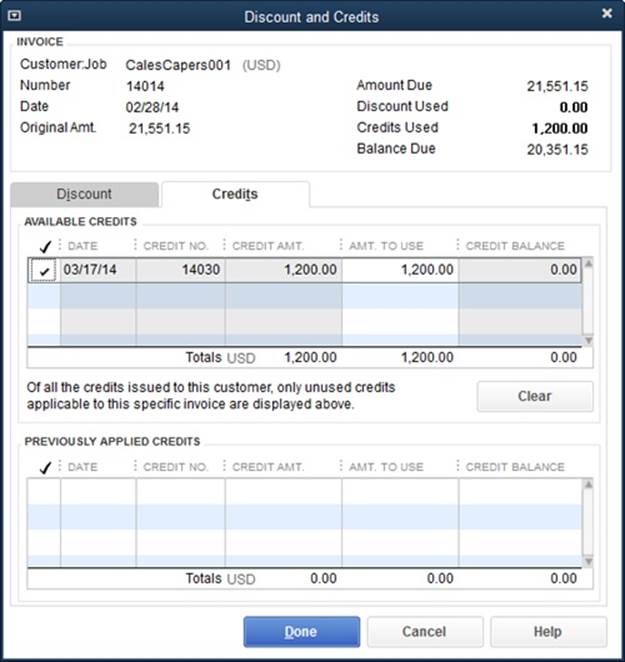

Finally, you’ll find out how to handle a few special billing situations, like creating invoices when products you sell are on backorder. You’ll also learn how to create estimates for jobs and then use them to generate invoices as you perform the work. And, since you occasionally have to give money back to customers (like when they return the lime-green polyester leisure suits that suddenly went out of style), you’ll learn how to assign a credit to a customer’s account, which you can then deduct from an existing invoice, refund by cutting a refund check, or apply to the customer’s next invoice.

NOTE

Chapter 11 continues the invoicing lesson that starts with this chapter by teaching you how to produce statements that show your customers’ account status. It also explains how to create sales receipts when customers pay you right away. Chapter 12 explains how to get any kind of sales form into your customers’ hands, along with a few other timesaving techniques, like finding transactions and memorizing them for reuse.

Choosing the Right Type of Form

In QuickBooks, you can choose from three different sales forms to document what you sell, and each form has strengths and limitations. Invoices can handle any billing task you can think of, so they’re the best choice if you have any doubts about which one to use. Table 10-1 summarizes what each sales form can do. The sections that follow explain the forms’ capabilities in detail and give guidance on when to choose each one.

Table 10-1. What each QuickBooks sales form can do

|

ACTION |

SALES RECEIPT |

STATEMENT |

INVOICE |

|

Track customer payments and balances |

X |

X |

|

|

Accept payments in advance |

X |

X |

X |

|

Accumulate some charges before sending sales form |

X |

X |

X |

|

Collect payment in full at time of sale |

X |

X |

X |

|

Create summary sales transaction |

X |

X |

X |

|

Apply sales tax |

X |

X |

|

|

Apply percentage discounts |

X |

X |

|

|

Use Group items to add charges to form |

X |

X |

|

|

Add long descriptions for items |

X |

X |

|

|

Subtotal items |

X |

X |

|

|

Include customer message |

X |

X |

|

|

Include custom fields on form |

X |

X |

NOTE

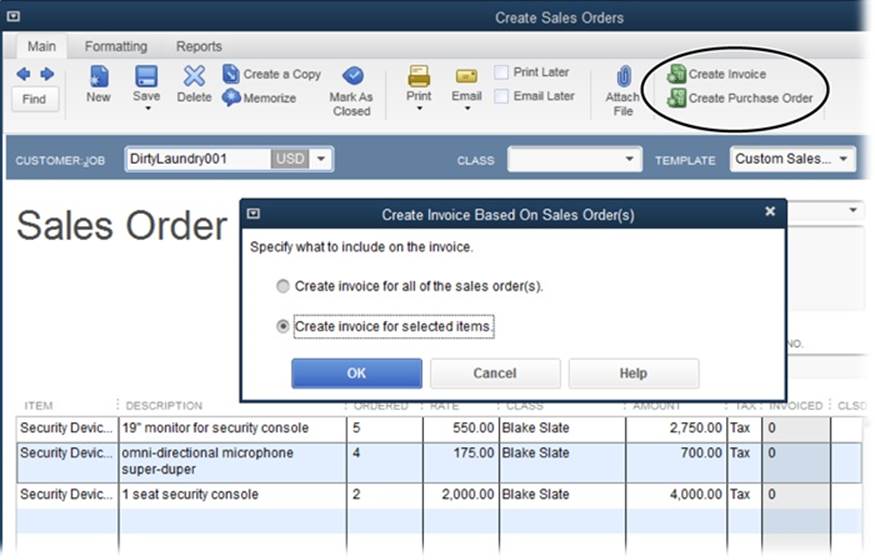

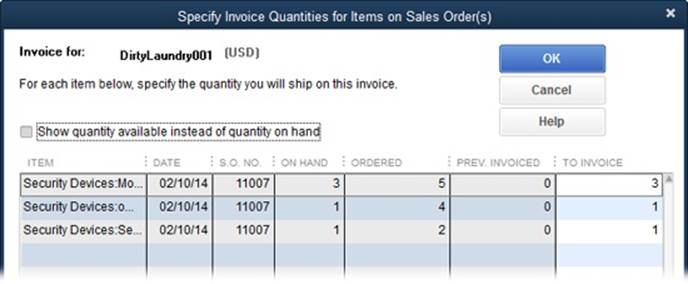

QuickBooks Premier and Enterprise editions include one more type of sales form: the sales order. In those editions, when you create a sales order for the products that a customer wants to buy, you can create an invoice for the items that are in stock and keep track of out-of-stock items that you’ll need to send to your customer when a new shipment arrives (Using Sales Orders for Backorders).

Sales Receipts

The sales receipt is the simplest sales form that QuickBooks offers, and it’s also the shortest path between making a sale and having money in the bank (at least in QuickBooks). But this form is suitable only if your customers pay the full amount at the time of the sale—for example, in a retail store, restaurant, or beauty salon. However, you can accumulate charges for time (Entering Time for One Activity) and billable expenses (Entering Bills) and then add them to a sales receipt. But for products you sell, sales receipts handle only payment in full.

When you create and save a sales receipt in QuickBooks, the program immediately posts the money you receive to the Undeposited Funds account or to the bank account you choose. As you’ll learn in this chapter and the next, invoices and statements take several steps to move from billing to bank deposits, so ease of depositing is one advantage of sales receipts over those other sales forms.

Sales receipts can handle sales tax, discounts, and subtotals—or any other item in your Item List. But when you operate a cash business, creating a sales receipt in QuickBooks for each newspaper and pack of gum your newsstand sells is not good use of your time. Instead, consider creating a sales receipt that summarizes a day’s or a week’s sales (Creating Sales Receipts), using a customer named Cash Sales that you create specifically for that purpose.

Statements

Suppose you’re a lawyer and you spend 15 minutes here and 15 minutes there working on a client’s legal problem over the course of a month. Each time you do so, that’s another charge to the client’s account. In QuickBooks, each of those charges is called a statement charge. You can enter them individually (Creating Statement Charges) or, if you track time in QuickBooks, you can add your time to an invoice just as easily, as described on Invoicing for Billable Time and Costs.

Businesses often turn to statements when they charge the same amount each month, such as a fixed monthly fee for Internet service or full-time work as a contract programmer. Although statements work for these fixed fees, you can also use memorized invoices (Creating a Memorized Transaction) and QuickBooks’ batch invoice feature (Adding a Memo to Yourself) to do the same thing just as easily.

Where statements really shine is summarizing a customer’s account. Behind the scenes, a statement adds up all the transactions that affect the customer’s open balance over a period of time, which includes statement charges, payments, and invoices. The statement shows the customer’s previous balance, any payments that the customer has made, any invoices that they haven’t paid, and any new charges on the account. From all that information, QuickBooks calculates the total and displays it on the statement, so you know how much money is outstanding and whether it’s overdue.

NOTE

Although statements can track customer payments and balances, they can’t handle the following billing tasks:

§ Tracking sales tax

§ Using Group items to add several items

§ Accepting multi-paragraph descriptions of services or products

§ Subtotaling items

§ Applying percentage discounts to items sold

§ Including a message to the customer

§ Including custom fields

§ Summarizing the services and products sold (on statements, each service or product you sell appears as a separate statement charge)

Invoices

If statements or sales receipts don’t work for your situation, don’t be afraid to use invoices. They accept any item you’ve created in your Item List (see Chapter 5) and they track what customers owe you.

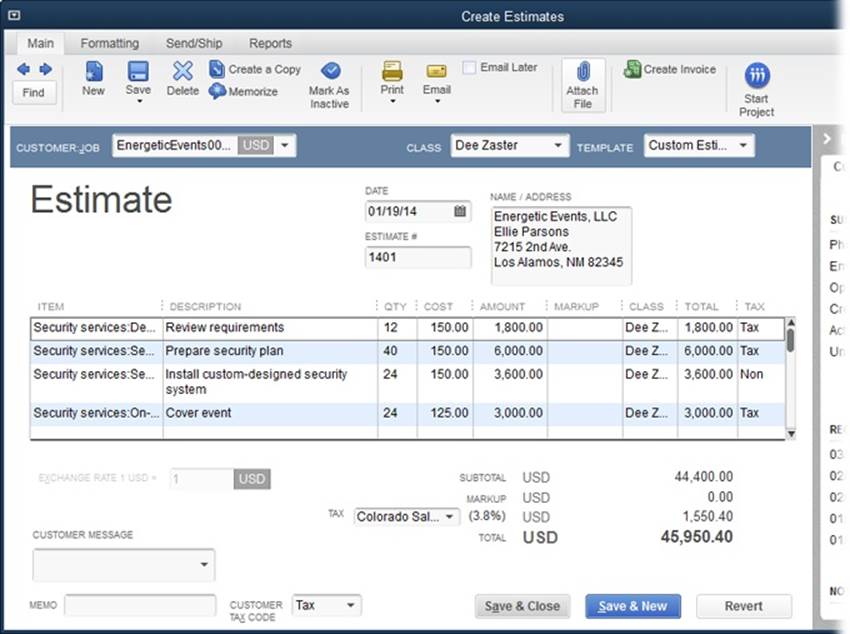

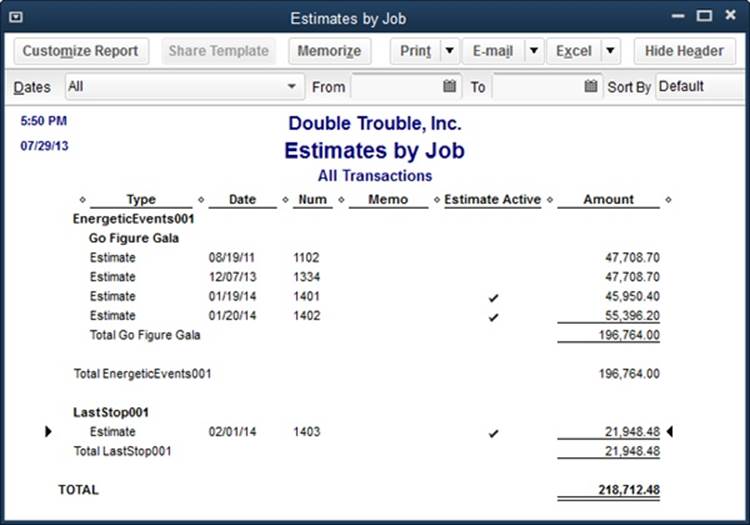

Besides offering the features listed in Table 10-1, an invoice is the only type of QuickBooks sales form you can generate from an estimate (Progress Invoicing Options). If you’re a general contractor and prepare a detailed estimate of the services and products for a job, you’ll save a huge chunk of time by turning that estimate into an invoice for billing. And if you have to refund some of your customer’s money, you can also turn an invoice into a credit memo (Handling Customer Refunds and Credits).

Sales Forms and Accounts

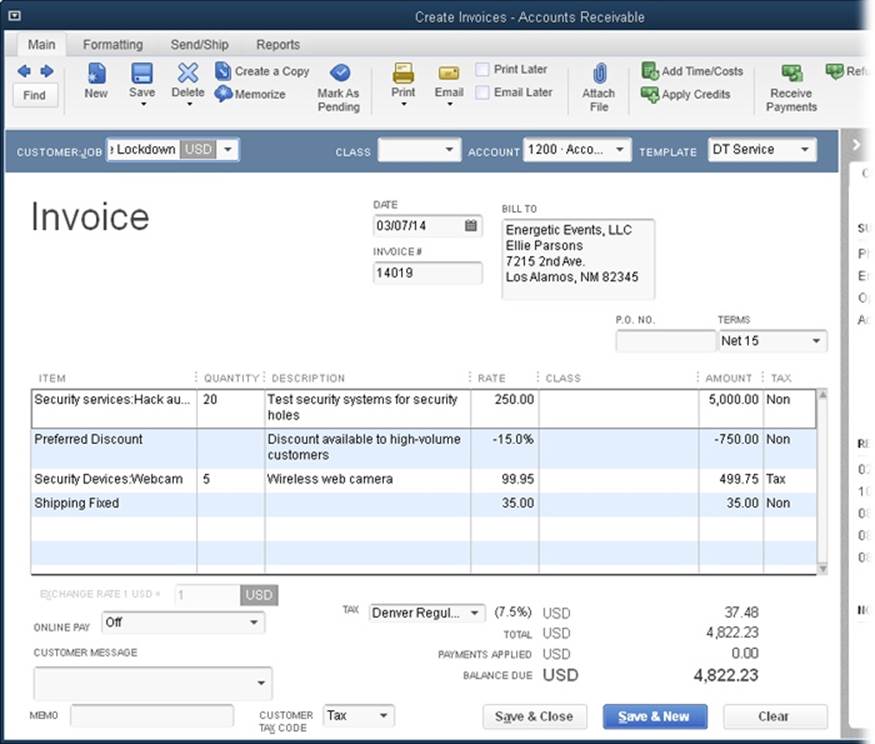

An invoice or other sales form is the first step in the flow of money through your company, so now is a good time to look at how QuickBooks posts income and expenses from your invoices to the accounts in your chart of accounts. Suppose your invoice has the entries shown in Figure 10-1.Table 10-2 shows how the amounts on that invoice post to accounts in your chart of accounts.

NOTE

The lines on the invoice in Figure 10-1 don’t show all the movements between accounts listed in Table 10-2. Behind the scenes, QuickBooks transfers money to your cost of goods sold and inventory accounts.

Here’s why the amounts post the way they do:

§ You sold $5,000 of services and $499.75 of products, which is income. The income values appear as credits to your Services Income and Product Revenue accounts to increase your income because you sold something. In this example, the discount is in an income account, so the discount is in the Debit column to reduce your income.

Figure 10-1. If you’re still getting used to double-entry accounting, balancing the debit and credit amounts for an invoice is a brainteaser. For example, the items for services and products on the invoice shown here turn up as credits in your income accounts, as in Table 10-2. The discount reduces your income, so it’s a debit to the Sales Discounts income account. Although the debits and credits appear in different accounts, the total debit must equal the total credit.

Table 10-2. Debits and credits have to balance

|

ACCOUNT |

DEBIT |

CREDIT |

|

Accounts Receivable |

4,822.23 |

|

|

Services Revenue |

5,000.00 |

|

|

Product Revenue |

499.75 |

|

|

Sales Discounts |

750.00 |

|

|

Sales Tax Payable |

37.48 |

|

|

Shipping income |

35.00 |

|

|

Cost of Goods Sold |

249.78 |

|

|

Inventory |

249.78 |

|

|

Total |

5,822.01 |

5,822.01 |

§ The $37.48 of sales tax you collect is a credit to the Sales Tax Payable account.

§ The shipping charge ($35.00) is a credit in your shipping income account to show what you charged for shipping.

§ All those credits need to balance against a debit. Because your customer owes you money, the amount owed ($4,822.23) belongs in the Accounts Receivable account, indicated by the debit.

§ You also sold some products from inventory. You credit the Inventory account with the cost of the products, $249.78, which decreases the Inventory account’s balance. You offset that credit with a debit for the same amount to the Cost of Goods Sold account, which is an income statement account.

Creating Invoices

Depending on which edition of QuickBooks you use, you have up to three features for creating invoices:

§ Create Invoices can handle everything you throw at it: services, products, billable time, and billable expenses. It’s available in QuickBooks Pro and higher.

§ Create Batch Invoices (Adding a Memo to Yourself) lets you select all the customers to which you want to send the same invoice (that is, the same items and the same amounts). If you send the same invoice to the same customers all the time, you can set up a billing group for those customers and, from then on, simply choose the group. After you create the invoice, you can print or email it to the customers in the list. This feature is available in QuickBooks Pro and higher, as long as you don’t use multiple currencies.

§ Invoice for Time & Expenses, available only in QuickBooks Premier and Enterprise editions, can do everything that the Create Invoices feature can do, but it’s a real time-saver when you invoice for billable time and expenses. As you’ll learn on Using Invoice for Time & Expenses, you specify a date range and QuickBooks shows you all the customers who have billable time and expenses during that period. When you choose a customer or job and tell the program to create an invoice, it opens the Create Invoices window, fills in the usual fields, and fills the invoice table with the customer’s billable time and expenses. Once you’re in the Create Invoices window, you can add any other items you want, like products you sold or discounts you’re offering. This feature also lets you create batch invoices for time and expenses (Creating a Batch of Time and Expenses Invoices).

Invoices tell your customers everything they need to know about what they purchased and what they owe you. If you created customers and jobs with settings such as payment terms, tax item, and sales rep (Entering Payment Information), as soon as you choose a customer and job in the Create Invoices window’s Customer:Job field, QuickBooks fills in many of the fields for you.

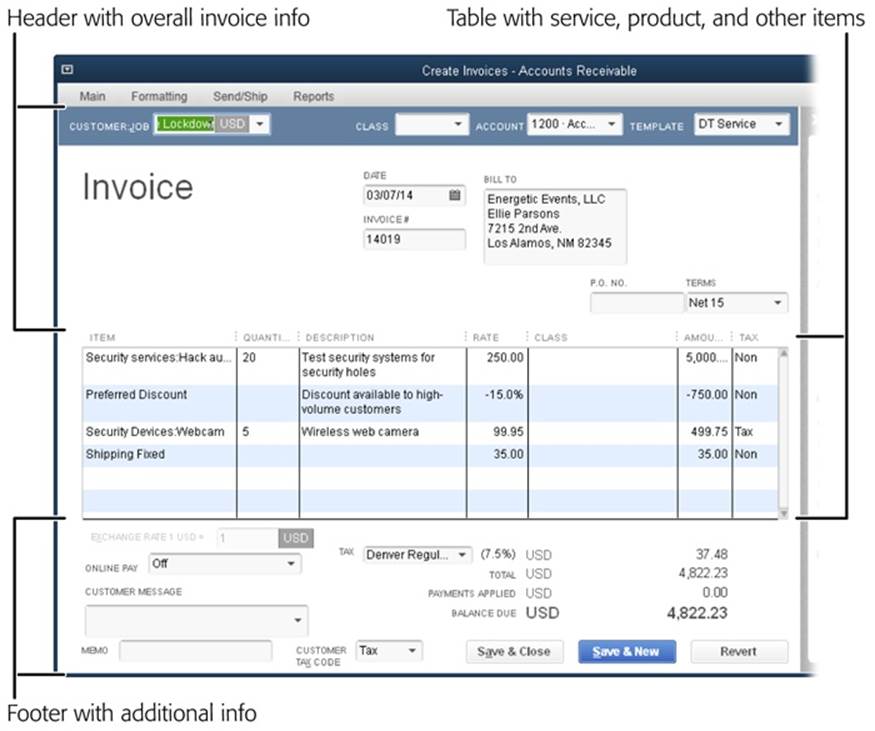

Some invoice fields are more influential than others, but they all come in handy at some point. To understand the purpose of the fields on an invoice more easily, you can break the form up into three basic parts (see Figure 10-2). Because the invoices you create for product sales include a few more fields than the ones for services only, the following sections use a product invoice to explain how to fill in each field you might run into on the invoices you create. These sections also tell you what to do if the information that QuickBooks fills in for you is incorrect.

Figure 10-2. The top of the invoice has overall sale information, such as the customer and job, the invoice date, who to bill and ship to, and the payment terms. The table in the middle has info about the products and services sold, and other items, such as subtotals and discounts. Below the table, QuickBooks fills in the Tax field and the Customer Tax Code field with values from the customer’s record, but you can change any values that the program fills in. You can also add a message to the customer, choose your send method, or type a memo to store in your QuickBooks file.

NOTE

If you charge customers based on the progress you’ve made on a project, invoices are a little more complicated, but you’ll learn how to handle this situation on Comparing Estimates to Actuals.

Creating an Invoice

In the sections that follow, you’ll find details about filling in all the fields on an invoice. (The box on Invoicing for Nonprofits describes some of the ways nonprofit invoicing differs from for-profit invoicing.) For now, here’s the basic procedure for creating and saving one or more invoices by using the Create Invoices feature:

1. Press Ctrl+I; in the Home page’s Customers panel, click the Create Invoices icon; or, in the Customer Center toolbar, choose New Transactions→Invoices.

If you use QuickBooks Pro or if the preference for invoicing time and expenses isn’t turned on, clicking the Home page’s Create Invoices icon opens the Create Invoices window immediately.

If you use QuickBooks Premier or Enterprise and you’ve turned on the preference to invoice for time and expenses (Spelling), the Home page displays the Invoices icon instead of the Create Invoices icon. Clicking Invoices displays a shortcut menu with two entries: “Invoice for Time & Expenses” and Create Invoices. Choose Create Invoices to create a regular invoice. See Using Invoice for Time & Expenses to learn how to use the shortcut menu’s other entry to invoice for billable time and expenses.

2. In the Create Invoices window’s Customer:Job box, choose the customer or job associated with the invoice.

When you pick a customer or job, QuickBooks fills in many of the invoice fields with values from the customer’s record (see Entering Payment Information), the job’s record if you selected a job (Creating a New Job), and preferences you set (Entering Address Information). For example, QuickBooks pulls the data for the Bill To address, Terms, and Rep fields from the customer’s or job’s record. And your Sales & Customers preferences (Sales & Customers) provide the values for the Via and F.O.B. fields. (FOB stands for “free on board,” which is the physical point where the customer becomes responsible for damage to or loss of the shipment.)

NOTE

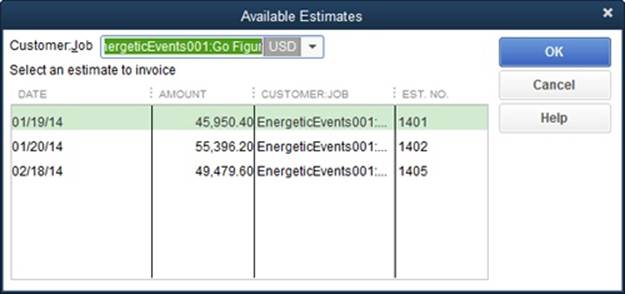

Depending on the QuickBooks edition you use and transactions you’ve entered, a few other windows may open when you choose a customer or job. If the customer or job you selected has an available estimate, the Available Estimates dialog box opens so you can fill in the invoice simply by selecting an estimate and clicking OK. If you use QuickBooks Premier and there’s an outstanding sales order (Using Sales Orders for Backorders), the Available Sales Order window appears so you can select the one you want to invoice.

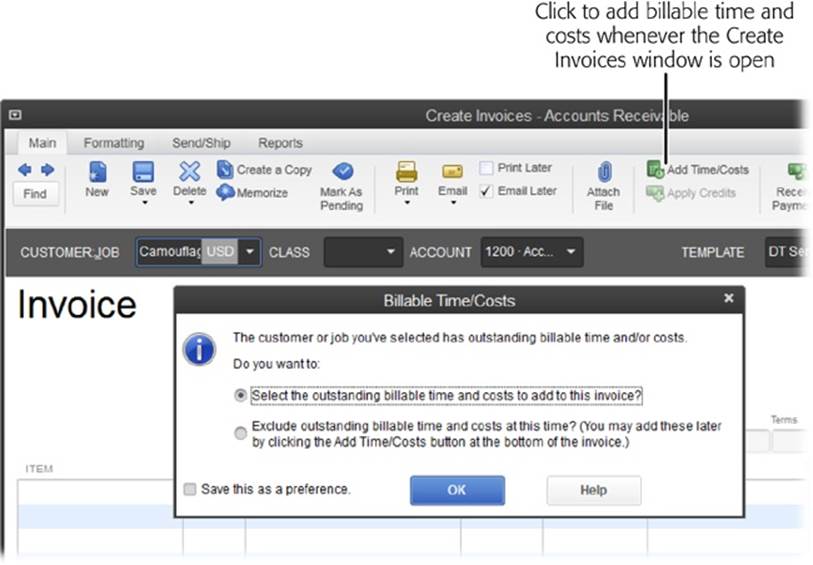

In QuickBooks Premier, if the preference for invoicing time and expenses is turned on and the customer or job has associated time or expenses, the Billable Time/Costs dialog box opens with the “Select the outstanding billable time and costs to add to this invoice” option selected. If you don’t want to add the time and expenses to this invoice, select the option whose label begins with “Exclude,” and then click OK. (To learn more about invoicing for time and expenses, see Invoicing for Billable Time and Costs.)

3. For each product or service you sold, in the line-item table, enter the info for the item, including its quantity and price (or rate).

If you want, you can also fill in the boxes below the line-item table, such as Customer Message and Memo. If you’ve signed up for online payments (Specifying Sales Tax Information), you can choose whether to include an online payment link on the invoice you send. And you’ll rarely need to change the sales tax rate associated with the customer, but you can if necessary.

4. Maintain your professional image by checking for spelling errors before you send the invoice.

To run QuickBooks’ spell-checker, at the top of the Create Invoices window, click the Formatting tab, and then click Spelling. (If you checked spelling when you created your customers and invoice items, then the main source of spelling errors will be edits you’ve made to item descriptions.) If the spell-checker doesn’t work the way you want, then change your Spelling preferences (Spelling).

5. To save the invoice you just created and close the Create Invoices window, click Save & Close.

If you’re unhappy with the choices you made in the current invoice, click Clear to start over with a fresh, blank invoice. If you have additional invoices to create, click Save & New to save the current invoice and begin another.

NOTE

If you create or modify an invoice and then click the Print icon in the Create Invoices window’s Main tab, QuickBooks saves the invoice before printing it, which helps prevent financial hanky-panky.

ALTERNATE REALITIES: INVOICING FOR NONPROFITS

If you sell products and services, then you create invoices when someone buys something. For nonprofits, however, invoices can record the pledges, donations, grants, or other contributions you’ve been promised.

Invoicing for nonprofits differs from the profit world’s approach. First of all, many nonprofits don’t send invoices to donors. Nonprofits might send reminders to donors who haven’t sent in the pledged donations, but they don’t add finance charges to late payments.

Moreover, because some donors ask for specific types of reports, nonprofits often use several Accounts Receivable accounts to track money coming from grants, dues, pledges, and other sources. When you have multiple Accounts Receivable accounts, the Create Invoices window includes an Account field so you can choose the appropriate Accounts Receivable account (just like when you work with multiple currencies, as described in the Note on Note). For example, when you create an invoice for pledges, you’d choose the Pledges Receivable account.

To compensate for this additional field, QuickBooks provides a handy feature when you use multiple Accounts Receivable accounts: The program remembers the last invoice number used for each one in your QuickBooks Chart of Accounts, so you can create unique invoice numbering schemes for each of them. For example, if you create an invoice for the Pledges Receivable account and set the Invoice # field to “PL-100,” QuickBooks automatically assigns invoice number “PL-101” to the next invoice you create for that account.

Filling in Invoice Header Fields

If you fill in all the fields in your customer and job records (see Chapter 4), QuickBooks takes care of filling in most of the fields in the header section of invoices. Here’s what the header fields do and where QuickBooks gets the values it fills in automatically.

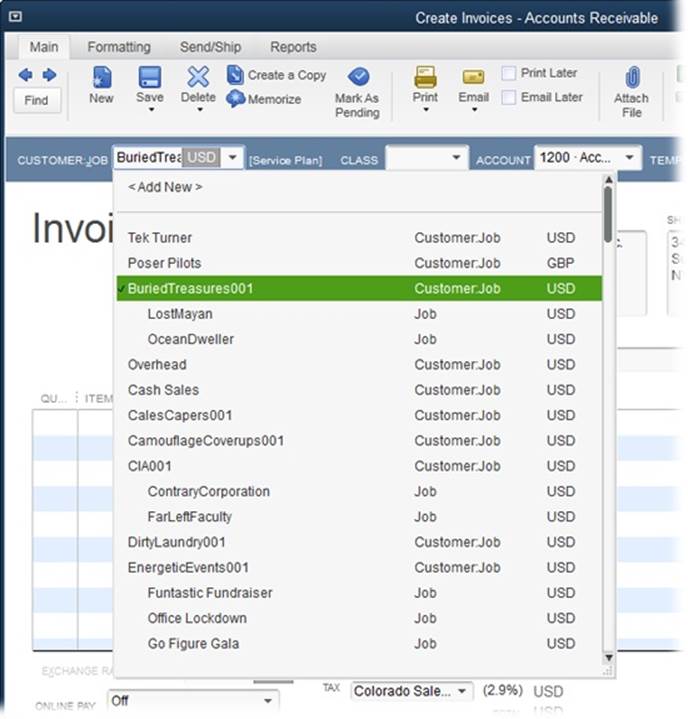

Choosing the Customer or Job

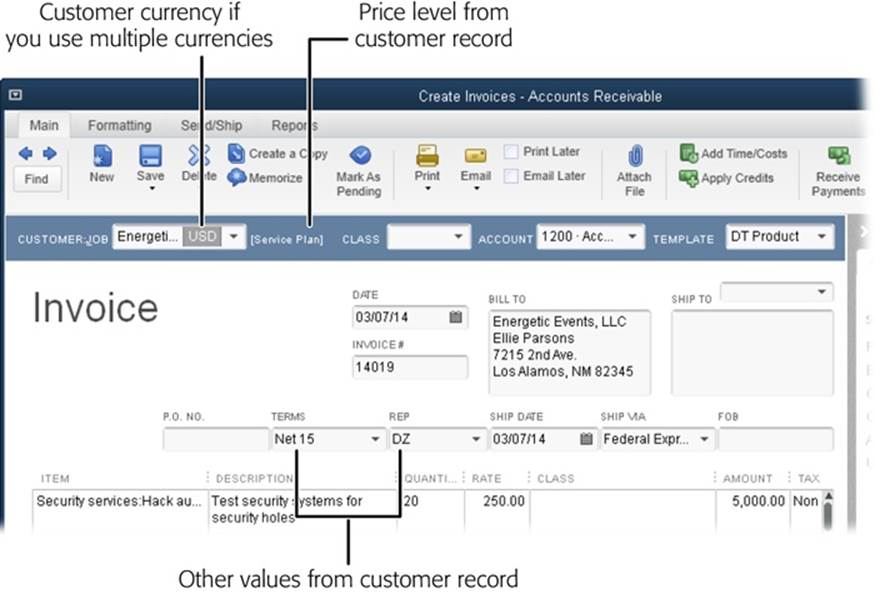

The selection you make in the Customer:Job field (shown in Figure 10-3) is your most important choice for any invoice. In addition to billing the correct customer for your work, QuickBooks uses the settings from the customer’s or job’s record to fill in many of the invoice’s fields.

Figure 10-3. If you work on different jobs for a customer, click the name of the job, which is indented underneath the customer’s name. If your work for a customer doesn’t relate to jobs, just click the customer’s name. The column to the right of the customer and job names provides another way to differentiate customers and jobs: It displays “Customer:Job” for a customer entry, and “Job” for a job entry.

NOTE

If you’ve turned on the preference for multiple currencies, the last column in the Customer:Job drop-down list shows the customer’s currency (as shown in Figure 10-3).

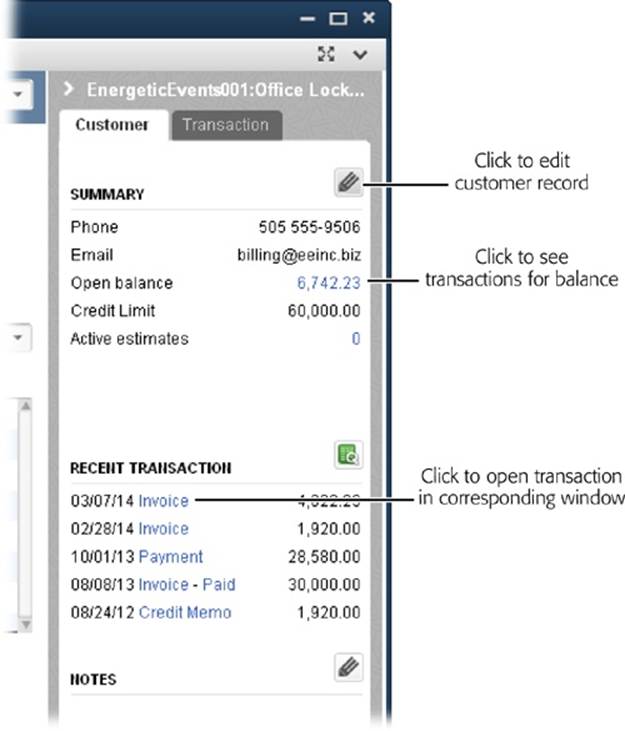

Once you select a customer or job, the panel on the right side of the Create Invoices window shows a summary of the customer’s account and its recent transactions (Figure 10-4). The Customer tab displays the customer’s open balance and the credit limit you’ve set for that customer so you can see whether the new invoice exceeds that limit. You can also review recent transactions to check whether payments have come in before you send an invoice for finance charges. Any notes that you’ve entered for the customer appear at the bottom of the panel. Click the arrow at the panel’s top left to expand or collapse it.

Figure 10-4. If you spot any errors in the customer’s information, click the Edit button (the pencil icon) to open the customer’s record in the Edit Customer window. Click the open balance value to generate a Customer Open Balance report that shows the transactions that contribute to the open balance. To inspect any of the recent transactions, click the blue text to open the corresponding window, such as Receive Payments.

NOTE

The right-hand panel’s Transaction tab shows information about the transaction that’s currently displayed in the Create Invoices window. The tab’s Summary section shows who created and edited the transaction and when. If there are related transactions, such as a payment or credit memo, they appear in the Related Transactions section.

Choosing an Invoice Template

The option you choose in the Template drop-down list near the top right of the Create Invoices window determines which fields appear on your invoices and how they’re laid out. For example, you might use two templates: one for printing on your company letterhead and one for invoices you send electronically. Choosing a template before doing anything else is the best way to prevent printing the wrong invoice on expensive stationery.

QuickBooks remembers which template you chose when you created your last invoice. So if you use only one invoice template, choose it on your first invoice and the program chooses it for you from then on. But if you switch between invoices, be sure to select the correct template for the invoice you’re creating.

NOTE

Templates aren’t linked to customers. If you pick a template when you create an invoice for one customer, QuickBooks chooses that same template for your next invoice, regardless of which customer it’s for.

You can switch templates anytime. When you choose a template, the Create Invoices window displays the appropriate fields and layout. If you’ve already filled in an invoice, changing the template doesn’t throw out the data; QuickBooks simply displays it in the new template. However, QuickBooks won’t display settings like your company logo, fonts, and other formatting until you print or preview the invoice (Choosing How to Send the Invoice).

Many small companies are perfectly happy with the invoice templates that QuickBooks provides. When you create your first invoice, you might not even think about the layout of the fields. But if you run across a billing task that the current template can’t handle, don’t panic: You can choose from several built-in templates. And if you want your invoices to reflect your company’s style and image, you can create your own custom templates (see Customizing Forms).

The options you see in the Template drop-down list depend on the QuickBooks edition you use. Before you accept the template that QuickBooks chooses, in the Template drop-down list, quickly select and review the templates to see whether you like any of them better. Here are a few of the more popular built-in templates:

§ Intuit Product Invoice. If you sell products with or without services, this template is set up to show information like the quantity, item code, price for each item, total charge for each item, sales tax, and shipping info—including the ship date, shipping method, and FOB.

§ Intuit Service Invoice. This template doesn’t bother with shipping fields because services are performed, not shipped. It includes fields for the item, description, quantity, rate, amount, tax, and purchase order number.

§ Intuit Professional Invoice. The only difference between this template and the Intuit Service Invoice is that this one doesn’t include a P.O. Number field, and the quantity (Qty) column follows the Description column.

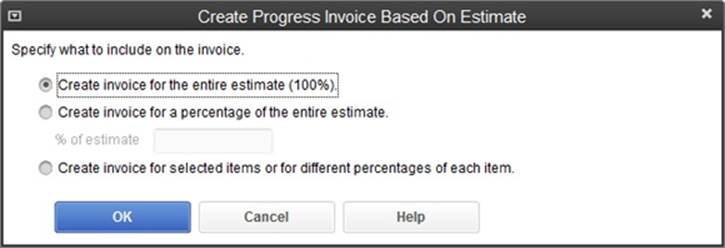

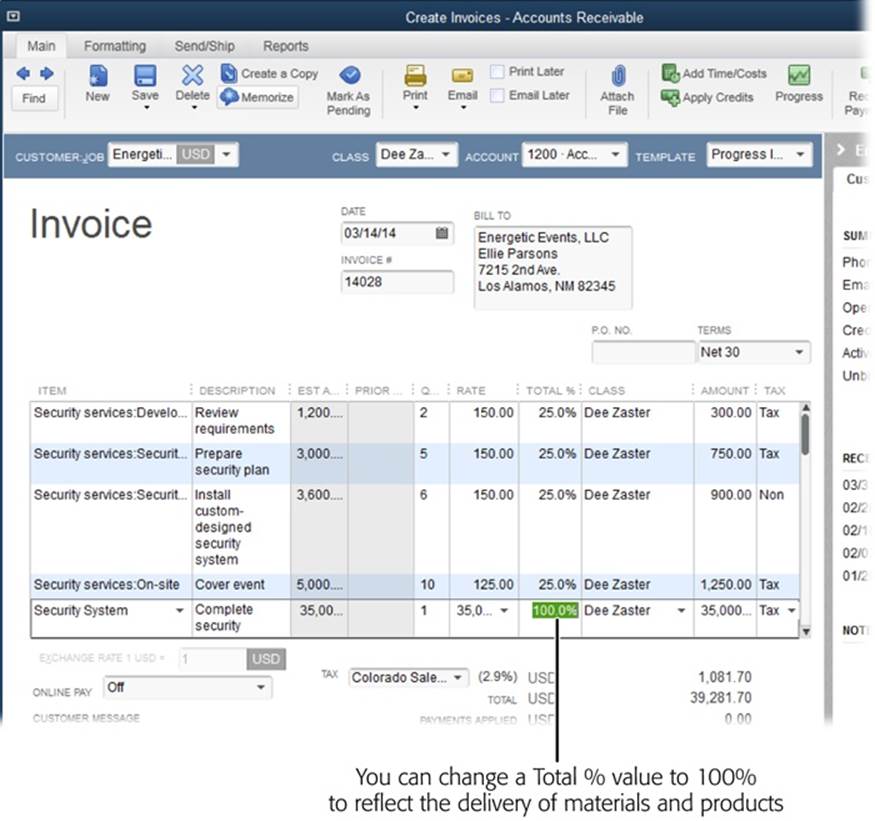

§ Progress Invoice. If you bill customers based on the progress you’ve made on their jobs, use this template, which has columns for your estimates, prior charges, and new totals. It appears in the Template drop-down list only if you turn on the preference for progress invoicing (seeMultiple Currencies).

NOTE

The Intuit Packing Slip template is included in the Template drop-down list even though it isn’t an invoice template. It’s listed because, when you ship products to customers, you can print an invoice and packing slip from the Create Invoices window (see Choosing a Print Method).

§ Fixed Fee Invoice. This template drops the quantity and rate fields, since the invoice shows only the total charge. It includes fields for the date, item, description, tax, and purchase order number.

§ Time & Expense Invoice. If you bill customers by the hour, this template is the one to use. It includes a column for hours and hourly rate, and it calculates the resulting total. (The Attorney’s Invoice template is identical to this one except in name.)

The Other Header Fields

As Figure 10-5 shows, QuickBooks can fill in most of the remaining header fields for you. Although the following fields don’t appear on every invoice template, here’s how to fill in any empty fields or change the ones that QuickBooks didn’t complete the way you want:

§ Class. If you turned on the class-tracking feature (Accounting) to categorize your income and expenses in different ways, choose a class for the invoice. If you skip this box and have the class reminder preference set, QuickBooks tells you that the box is empty when you try to save the invoice. Although you can save the invoice without a class if classes don’t apply to the transaction, it’s important to assign classes to every class-related transaction if you want your class-based reports to be accurate. For example, if you use classes to track income by partner and save an invoice without a class, the partner who delivered the services on the invoice might complain about the size of her paycheck.

Figure 10-5. After you choose a customer, if you’ve assigned a price level to that customer’s record (page 72), the name of the price level appears in brackets below the Customer:Job label. You can change the customer’s price level by editing the customer’s record (page 81), or you can choose existing price levels to change the price you charge as you add items to the invoice (see the box on page 254).

NOTE

If you work with multiple currencies and the customer is set up to use a currency other than your home one, then at the top of the Create Invoices window, the Account box appears and shows the Accounts Receivable (AR) account for the invoice’s income. QuickBooks creates an additional Accounts Receivable account (Creating an Account) for a currency, such as Account Receivable-EUR, when you assign that currency to the first new customer that uses it and then save the customer record.

§ Date. Out of the box, QuickBooks fills in the current date here, which is fine if you create invoices when you make a sale. But service businesses often send invoices on a schedule—the last day of the month is a popular choice. If you want to get a head start on your invoices, you can change your QuickBooks preferences so the program uses the same date for every subsequent invoice (until you change the date), making your end-of-month invoicing a tiny bit easier. Importing Report Templates tells you how.

§ Invoice #. When you create your first invoice, type the number that you want to start with. For example, if you’d rather not reveal that this is your first invoice, type a number such as 245. Then, each time you create a new invoice, QuickBooks increases the number in this field by one: 246, 247, and so on.

TIP

Press the plus (+) or minus (–) key to increase or decrease the invoice number by one. When you save the current invoice, QuickBooks considers its invoice number the starting point for subsequent numbers.

If your last invoice was a mistake, the best thing to do is to void it (Seeing What Customers Owe with Reports). If you delete it instead, you’ll end up with a gap in your invoice numbers. For example, when you delete invoice number 203, QuickBooks has already set the next invoice number to 204. So, if you notice the gap, in the Invoice # box, type the number you want to use to get QuickBooks back on track, and void incorrect invoices from now on.

§ Bill To. This field is essential if you mail invoices. When the customer record includes a billing address (Entering Contact Information), QuickBooks puts that address in this field. If you email invoices, a billing address isn’t necessary—the customer name in this field simply identifies the customer on the emailed form.

§ Ship To. If you sell services, you don’t need an address to ship to. But if you sell products, you need a shipping address to send the products to your customer. When you use a template like Intuit Product Invoice, QuickBooks puts the shipping address from the customer’s record in this field. If you create additional shipping addresses (for instance, for different office locations), click the down arrow to the right of the Ship To drop-down list and choose the address you want.

§ P.O. Number. If your customer issued a purchase order for the goods and services on your invoice, type that purchase order number here.

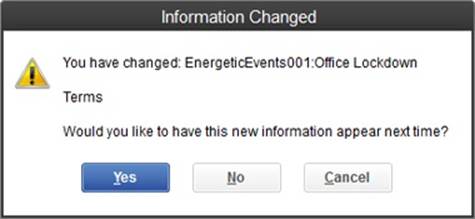

§ Terms. Typically, you set up payment terms when you create customers, and you then use those terms for every invoice. When the customer’s record includes payment terms (Entering Payment Information), QuickBooks uses them to fill in this field. However, if you decide to change the terms—perhaps due to the customer’s failing financial strength—choose a different term here, such as “Due on receipt.”

NOTE

If QuickBooks fills in fields with incorrect values, make the corrections on the invoice. When you save the invoice, QuickBooks asks if you’d like the new values to appear the next time, as shown in Figure 10-6.

Figure 10-6. If you click Yes here, QuickBooks changes the corresponding fields in the customer and job records. If you click No, it changes the values only on this particular invoice.

§ Rep. If you assigned a sales rep in the customer’s record (Specifying Additional Customer Information), QuickBooks fills in this field for you. If the sales rep changes from invoice to invoice (for instance, when the rep is the person who takes a phone order) and you left the Rep field blank in the customer’s record, choose the right person here. Leave the field blank if the transaction doesn’t have a sales rep.

§ Ship. QuickBooks fills in the current date here. If you plan to ship on a different date (when the products arrive from your warehouse, for example), type or choose the correct date.

§ Via. If you specified a value in the Usual Shipping Method preference (Sales & Customers), QuickBooks enters that value here. To choose a different shipping method for this invoice—for instance, when your customer needs the order right away—click this field and select the one you want. (Some templates use the label Ship Via for this field.)

§ F.O.B. This stands for “free on board” and signifies the physical point at which the customer becomes responsible for the shipment. That means that if the shipment becomes lost or damaged beyond the FOB point, it’s the customer’s problem. If you set the Usual FOB preference (Sales Tax), QuickBooks enters that location here. To choose a different FOB for this order, type the location you want.

NOTE

Unlike many of the other fields in the invoice header area, the F.O.B. box doesn’t include a drop-down list. QuickBooks doesn’t keep a list of FOB locations because most companies pick one FOB point and stick with it.

FREQUENTLY ASKED QUESTION: MYSTERIOUS PRICE CHANGES

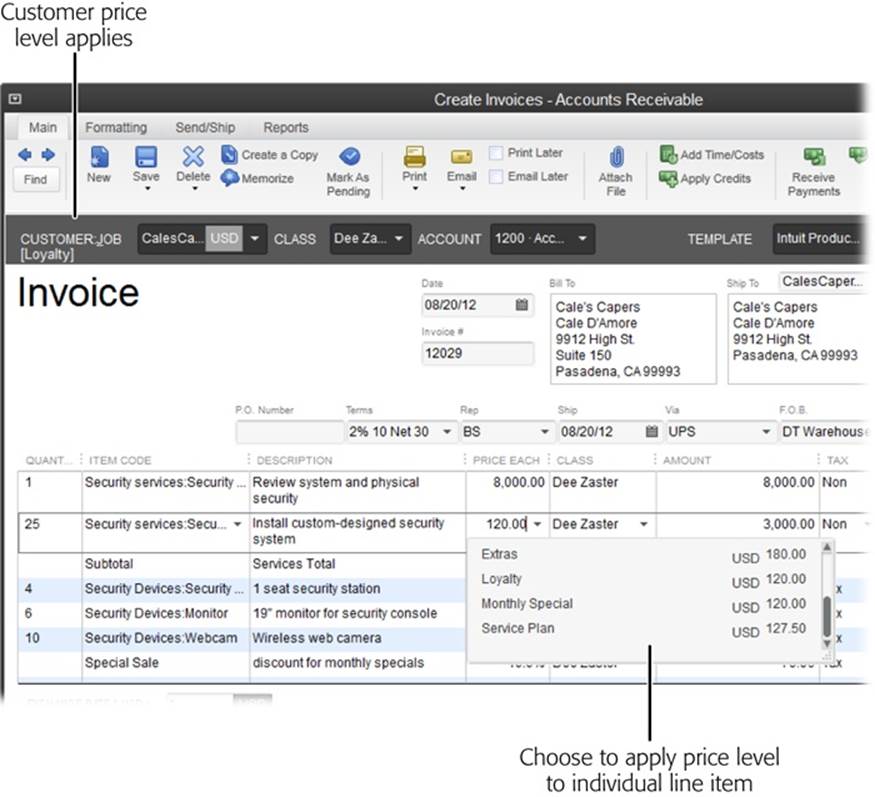

One of my Service items costs $150 per hour. But when I created a customer invoice for that item, the Price Each came up as $120. What’s going on?

Before you rush to correct that Service item’s price, look near the top of the Create Invoices window, to the right of the Customer:Job field. If you see text in square brackets, such as “[Loyalty],” you’ll know that you set up your customer with a price level (Specifying Sales Tax Information). Instead of a mistake, this price adjustment on your invoice is actually a clever and convenient feature.

Price levels are percentage increases or decreases that you can apply to the prices you charge. For example, you can set up price levels to give discounts to your high-volume customers or mark up prices for customers known for their frequent use of your customer-service line. To use price levels, you first have to turn on the Price Level preference (Sales Tax).

If you assign a price level to a customer, QuickBooks automatically applies that price-level percentage to every item you add to invoices for that customer. The only indication that QuickBooks has applied the price level is the price level’s name to the right of the Customer:Job field (and the items’ altered prices).

You can also apply price levels to individual items on an invoice. For example, suppose you offer a 20 percent discount on a different item each month. When an item is the monthly special, you can apply the Monthly Special price level to just that item, as shown in Figure 10-7.

When you use price levels, your customers don’t see that the price increases or decreases, which means they could take your discounts for granted. If you want to emphasize the discounts you apply, use a Discount item instead to visibly reduce prices on your invoices (see Applying Subtotals, Discounts, and Percentage Charges).

Entering Invoice Line Items

If you dutifully studied Chapter 5, you know about the different types of items you can add to invoices. This section describes how to fill in a line in the Create Invoices window’s line-item table to charge your customers for the things they buy. (The box on Adding Group Items to Invoicesexplains a shortcut for speeding up this process.)

The order in which you add items to an invoice is important. For example, when you add a Subtotal item, QuickBooks subtotals all the preceding items up to the previous Subtotal item (if there is one). The program does nothing to check that you add items in the correct order—you can add a Subtotal item as the first line item, even though that does nothing for your invoice. See Applying Subtotals, Discounts, and Percentage Charges for the full scoop on adding Subtotal, Discount, and Other Charge items in the right order.

NOTE

If multiple currencies are turned on and you have customers set up to use foreign currencies, when you create an invoice for one of those customers, QuickBooks automatically applies the exchange rate you entered for that currency to item prices and service rates. (See the box on Realized Gains and Losses to learn how to download exchange rates and obtain exchange rates for certain dates.) To use a specific exchange rate in an invoice, fill in the “Exchange Rate 1 [currency] =” box with the exchange rate before you add items to the invoice. (If you forgot to change the exchange rate before adding items, delete the lines in the invoice, set the exchange rate, and then add the items again.)

Figure 10-7. To apply a price level to a single item, click the Price Each (or Rate) field for the item that’s on special. When QuickBooks displays a down arrow to indicate that a drop-down list is available, click the arrow and then choose the price level you want.

The order of columns in the line-item table varies from template to template. This section lists the columns in the order they appear on the Intuit Product Invoice template (shown in Figure 10-8):

§ Quantity. For products, type a quantity. For services you sell by the hour (or other unit of time), type the number of time units. (See Selecting Billable Time and Costs to learn how to select hours from a timesheet.) If you sell services at a flat rate, you can leave this cell blank and simply fill in the Amount cell.

NOTE

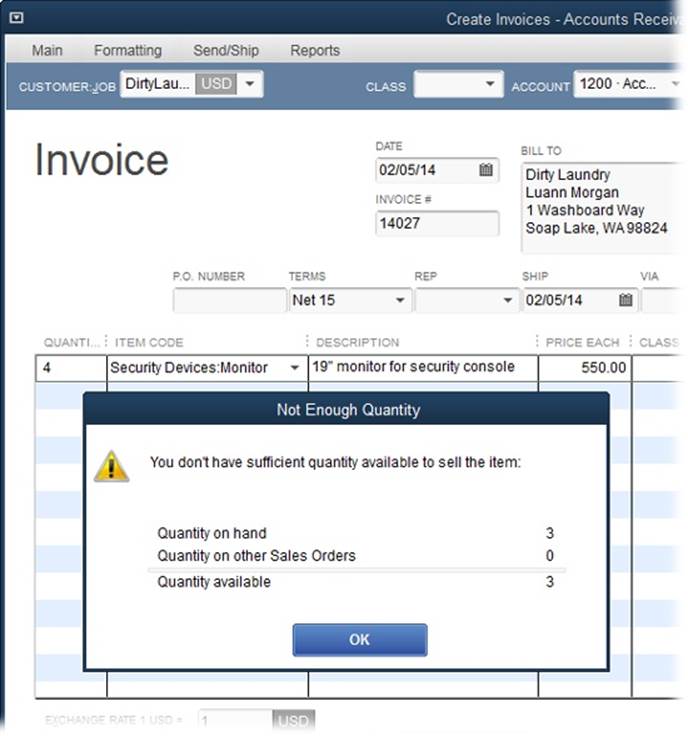

If you type a quantity for a product that exceeds how many you have on hand, QuickBooks Pro simply warns you that you don’t have enough. QuickBooks Premier displays the same warning and tells you how many you have on hand, how many are on sales orders (Checking for Unbilled Costs), and the total available.

Quantity doesn’t apply if the item is a discount, subtotal, or sales tax. So if you choose one of these items after entering a quantity, QuickBooks removes the value in the Quantity cell.

Figure 10-8. In the Intuit Product Invoice template, the Quantity column comes first. After you choose an item, make sure to check the value in the Amount cell. If the number looks too large or small, the quantity you entered might not match the units for the item. For example, if you charge for developing training materials by the hour but charge for teaching a training class by the day, the quantity for developing training materials has to be in hours and the quantity for teaching in days.

§ Item Code. Click this cell and then choose an item from the drop-down list (see Chapter 5 for details on items). Depending on the info you entered when you created this item (Creating Items), QuickBooks may fill in the Description and Price Each (or Rate) cells for you.

§ Description. If you set up inventory items with standard descriptions, QuickBooks automatically puts them in this cell. But you can edit a description to, for example, add details—like changing the generic description “Security service” to the more specific “Nightly rounds every two hours.”

§ Price Each (or Rate). Depending on the type of item you’re adding to the invoice, QuickBooks goes to the item’s record (see Chapter 5) and grabs the value in the Sales Price field or Rate field and puts it here. For example, an Inventory Part item’s price always comes from the Sales Price field, whereas Service items use the Rate field (unless a partner or subcontractor performs the work, in which case they use the Sales Price field).

§ Class. If you turned on the Class feature (Accounting), you can fill in this cell with the class for this item.

§ Amount. QuickBooks calculates the total in this cell by multiplying the quantity by the value in the Price Each (or Rate) field. But nothing stops you from simply typing a value in this field, which is exactly what you want for a fixed-fee contract. (For the full story on invoicing for fixed-fee contracts, see the box on Invoicing Fixed-Price Contracts.)

§ Tax. If you turned on the sales tax preference (Setting Up Sales Tax), QuickBooks displays this cell and fills it in with the taxable status you specified in the item’s record, and fills in the Tax box below the table with the Sales Tax item you set in the customer’s record. (The tax rate for the Sales Tax item you select appears to the right of the Tax box.) With the taxable status of your customers (Specifying Sales Tax Information) and the items you sell (Other Types of Items) in place, QuickBooks can automatically handle sales tax on your invoices. For example, when an item is taxable and the customer is liable for paying sales tax, the program calculates the total sales tax by adding up all the taxable items on your invoice and multiplying that number by the tax rate set in the Tax box below the table; it then displays this value below the table (see Figure 10-8).

TIP

If you notice that an item’s taxable status isn’t correct, don’t change the value in the Tax cell. You’re better off correcting the customer’s or item’s tax status so QuickBooks can calculate tax correctly in the future.

POWER USERS’ CLINIC: ADDING GROUP ITEMS TO INVOICES

If the same items frequently appear together on your invoices, you can add all those items in one step by creating a Group item (Subtotal). Any type of item is fair game for a Group item, so you can include Service items, discounts, subtotals, and other charges.

For example, customers who buy your deluxe vinyl sofa covers also tend to purchase the dirt-magnet front hall runner and the faux-marble garage floor liner. So you could create a Group item (perhaps called the Neat Freak Package) that includes the items for the sofa cover, runner, and liner, with the quantity you typically sell of each item.

To add a Group item to an invoice, in the Create Invoices window’s item drop-down list (labeled Item or Item Code depending on the invoice template you’re using), simply choose the Group item you created. QuickBooks fills in the first line by putting the name of the Group item in the item cell. Then the program adds additional lines (including quantity, description, and price) for the individual items in the group, such as the sofa cover, runner, and liner.

Modifying Line Items

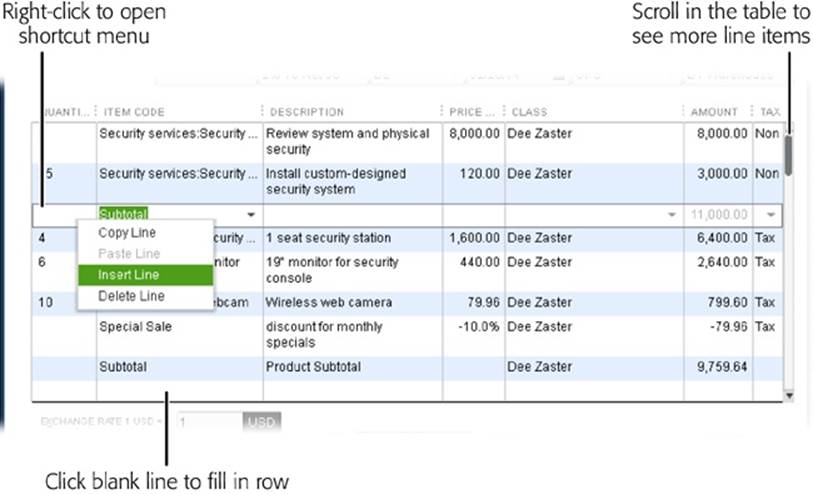

Sometimes, you forget to add line items you need. For example, say you’ve added several services and inventory items to your invoice and then realize that you need Subtotal items following the last service and last inventory items so you can apply a shipping charge to only the inventory items. Or if your customer changes her mind, you can insert or delete a line item. You can also copy and paste line items. Here’s how to modify lines in the line-item table:

§ Insert a line. Right-click the line above which you want to add a line, and then choose Insert Line from the shortcut menu, as shown in Figure 10-9. If you prefer keyboard shortcuts, press Ctrl+Insert instead.

Figure 10-9. As you add items to the table, QuickBooks adds blank lines (and new pages, if needed) to your invoice. Tab into or click a blank line to add as many lines as you need. The number of items visible depends on the size of the Create Invoices window. To view more items, click the Supermax button at the top right of the window (see page 33 for the full scoop on Supermax mode). You can also move the scroll bar up or down or resize the window by maximizing it or dragging a corner of it.

§ Delete a line. Right-click the line you want to get rid of and choose Delete Line from the shortcut menu, or press Ctrl+Delete.

§ Copy a line. Right-click the line you want to copy, and then choose Copy Line from the shortcut menu. Suppose you filled in a line for a taxable product below the Subtotal item you added for taxable items you sold. Instead of recreating the line item in the right location, it might be quicker to copy this line and paste it where it should go in the invoice table. Then be sure to delete the original line.

§ Paste a line. Right-click the line above which you want to paste the copied line and choose Paste Line from the shortcut menu.

QuickBooks adjusts the invoice’s lines accordingly.

Applying Subtotals, Discounts, and Percentage Charges

When you add Services, Inventory Parts, and Non-inventory Parts (see Chapter 5) to an invoice’s line-item table, they don’t affect their neighbors in any way. However, when you offer percentage discounts on what you sell or include Other Charge items that calculate shipping as a percentage of price, the order in which you add items becomes crucial. And if you want to apply a percentage calculation like a discount or a shipping fee to several items, you’ll need one or more Subtotal items to make the calculations work.

GEM IN THE ROUGH: INVOICING FIXED-PRICE CONTRACTS

Fixed-price contracts are risky because you have to swallow any cost overruns beyond the fixed price you charge. But if you’ve sharpened your skills on similar projects in the past and can estimate your costs with reasonable accuracy, fixed-price contracts can provide opportunities for better-than-average profit.

Once you and your customer agree on the fixed price, that amount is all that matters to the customer. Even if you track the costs of performing a job, your customer never sees those numbers. In QuickBooks, you can invoice fixed-price contracts in two different ways:

§ Group item. If you use the same sets of services and products for multiple jobs, create a Group item that includes each service and product you deliver and set up the Group item to hide the details of the underlying services and products (Subtotal). After you add the Group item to your invoice, change the price of the Group item to your fixed price.

§ Service item. If every fixed-price job is different, create a Service item (Service Items) called something like Fixed Fee and leave its Rate field set to 0.00. When you add that item to an invoice, fill in its Rate field with the full amount of the fixed-price contract. Then, when you reach a milestone that warrants a payment, create a progress invoice: In the Quantity column, type the decimal that equates to the percentage completed (such as .25 for 25 percent), and QuickBooks calculates the payment by multiplying the quantity by the fixed-price amount.

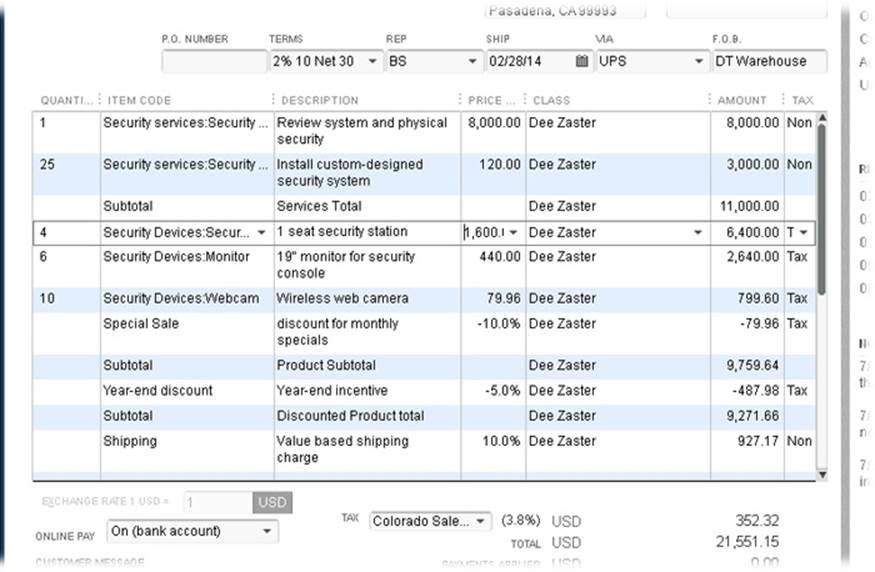

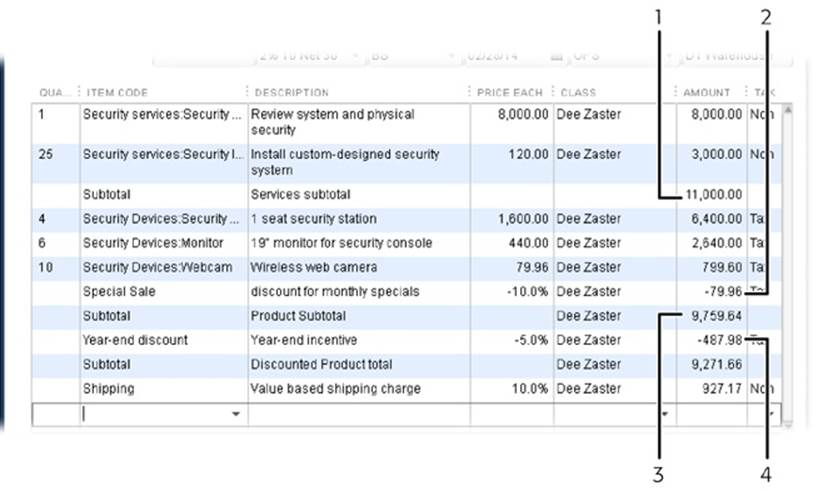

You first learned about Subtotal, Discount, and Other Charge items in Chapter 5. Figure 10-10 shows how to combine them to calculate percentage discounts and add markups to the items on your invoices. For example, the item labeled “1” is a Subtotal item that adds up the values of all the items up to the previous Subtotal item. For example, to keep the Service items out of the product subtotal, add a Subtotal item after the last Service item. As shown by the item labeled “2” in Figure 10-10, for Discount and Other Charge items created as percentages, QuickBooks multiplies the percentage by the total on the preceding line. (If the discount applies to only one item, add the Discount item immediately below the item you want to discount.) To apply a percentage discount to several items, use a Subtotal item to total their cost (such as the item labeled “3” in Figure 10-10), and then add a percentage Discount or Other Charge item on the line following that subtotal (like the item labeled “4” in Figure 10-10).

Here are the steps for arranging Subtotal, Discount, and Other Charge items to calculate percentages on invoice items:

1. If you want to discount several items on an invoice, enter all those items one after the other.

Even though the Balance Due field below the line-item table shows the total of all items, to apply a discount to all of them, you’ll need to add a Subtotal item to the line-item table.

Figure 10-10. This line-item table includes Subtotal and Discount items that apply to only some of the items on this invoice.

2. Add a Subtotal item after the last item you want to discount, like the Product Subtotal item labeled “3” in Figure 10-10.

The Subtotal item adds up all the preceding line items up to the previous Subtotal. For example, in Figure 10-10, the Services Subtotal item (labeled “1”) is a subtotal of all the Service items on the invoice. The Product Subtotal item adds up all items between the Services Subtotal and the Product Subtotal items.

3. To apply a percentage discount or charge to the subtotal, add a Discount or Other Charge item (labeled “4” in Figure 10-10) to the line immediately below the Subtotal item.

If you’ve already added other items to the invoice, right-click the line immediately below the Subtotal item and then choose Insert Line from the shortcut menu. That inserts the percentage discount or charge item on the line below the Subtotal item.

4. If you have additional items that you don’t want to include in the discount or charge, add those below the Discount or Other Charge item.

NOTE

These steps also work for Other Charge items that you set up as percentages, such as shipping, as shown at the bottom of Figure 10-10.

Adding a Message to the Customer

You can include a message to your customers on your invoices—for instance, thanking them for their business or asking for feedback. In the Customer Message drop-down list, choose the message you want to include. The messages in this drop-down list are the ones you’ve added to the Customer Message List (Customer Message List). If the message you want to use isn’t listed, then click <Add New> to open the New Customer Message dialog box.

TIP

Don’t use the Customer Message List for info that changes with every invoice, such as the purchase order number or date range for the invoice. Instead, add unique information to the cover letter or email that you send with your invoice.

Adding an Online Payment Link

The Online Pay box, which sits below the Create Invoices window’s line-item table, is your key to quick and easy payments from customers. Choose one of the online payment entries in this drop-down list, and your customer will receive an online payment link to pay you electronically from its back account or credit card via Intuit’s Online PaymentNetwork. When your customers use the links to pay you, the money gets deposited into your bank account, and you can download the payment transactions into QuickBooks by choosing Customers→Intuit PaymentNetwork→Download Payments. (There are currently no setup, cancellation, or monthly fees for this service. You currently pay a flat 50 cents for each bank payment you receive; fees for credit card payments vary. The fees for this service could change, so check with Intuit for pricing before you sign up.) This section describes how to turn on and use this feature.

NOTE

If you don’t want to use Intuit’s Online PaymentNetwork, you can turn off all online payment links in one fell swoop. Choose Edit→Preferences→Payments, and then on the Company Preferences tab, click Turn Off Online Payments. When you do so, QuickBooks turns off all online payment links on all invoices for all customers, even if links were previously turned on.

Signing Up for Intuit PaymentNetwork

Before customers can pay you through an online payment link, you have to create a PaymentNetwork account. (If your customers try to use the online payment links before you create your account, they’ll see a message that you haven’t signed up yet.) Here’s how to sign up:

1. Choose Customers→Intuit PaymentNetwork→About PaymentNetwork.

The “Get paid Online on QuickBooks invoices” screen appears in a browser window. After this screen appears, the “Quick intro: Online invoice payments” screen pops up in front of it. There you can watch a video or click Continue to get back to the “Get paid Online” screen.

2. On the “Get paid Online” screen, fill in the email address and password you want to use for the account.

You can also sign up using your Intuit account, if you have one. To do that, click the “Sign up with existing Intuit account” link.

NOTE

On the “Get paid Online” screen, QuickBooks automatically puts the email address associated with your company file in the QuickBooks Email Address field. If this field is blank or contains an incorrect email address, be sure to type in the correct one. PaymentNetwork communicates with you through this email address and, more importantly, uses it to direct customer payments to your bank account.

3. To add your bank account info, click the “Add bank now so you’re all set” radio button. Then, fill in the info for the bank account you want deposits sent to.

You need to provide the type of account, bank name, routing number, account number, account holder’s name, company name, and phone number.

4. When you finish filling in the fields, click Complete Set Up.

A message box shows that your info is being processed.

5. When the “Tell us about your business” screen appears, fill in the fields like your company name and federal tax ID, and then click Apply.

That’s all there is to it!

Setting Online Payment Link Preferences

QuickBooks gives you several ways to control when online payment links appear:

§ All invoices for all customers. To include online payment links on every invoice you create, turn on the Invoice Payments preference. Choose Edit→Preferences→Payments, and then click the Company Preferences tab. Turn on the “Include online payment link on invoices” checkbox. If you don’t have the multi-currency preference turned on in your company file, in the “Allow invoice to be paid online with” drop-down list, choose the payment methods you want to accept: “bank account” or “bank account or credit card.” If you do have the multi-currency preference turned on, all you’ll see is the text “Allow invoice to be paid online with bank account,” because that’s the only method available for multi-currency files. To include links on printed invoices, too, turn on the “Also include on printed invoices” checkbox.

§ All invoices for a customer. You can specify whether to include online payment links on all the invoices for a particular customer by editing the customer’s record; Specifying Sales Tax Information tells you how. The Add Online Payment Link To Invoices setting is on the Payment Settings tab of the Create Customer or Edit Customer window.

NOTE

If you choose a setting for a specific customer, it overrides the setting you chose for all invoices in the Preferences dialog box. For example, if you tell QuickBooks to include online payment links on all invoices and then edit a customer’s record to not show such links, online payment links won’t show up on future invoices for that customer, but they’ll still appear on the rest of the invoices you create.

§ Individual invoice. When the invoice is visible in the Create Invoices window, choose the setting you want for that invoice in the Online Pay box below the line-item table.

Choosing How to Send the Invoice

On the Create Invoices window’s Main tab (if it’s not selected, click it in the window’s upper-left corner), you’ll find two checkboxes that simplify sending invoices to customers: Print Later and Email Later. But these checkboxes don’t tell the whole story—you actually have five options for sending invoices:

§ Print now. If you create only the occasional invoice and send it as soon as it’s complete, turn off both checkboxes. Then, on the Create Invoices window’s Main tab, click Print and follow the instructions on Printing One Form.

§ Print later. If you want to add the invoice to a queue to print later, turn on the Print Later checkbox. That way you can print all the invoices in the queue, as described on Printing One Form.

§ Email now. In the Create Invoices window’s Main tab, click the Email button (it looks like an envelope) and follow the instructions for emailing invoices on Emailing One Form.

§ Email later. If you want to add the invoice to a queue to email later, turn on the Email Later checkbox. You can then send all the invoices in the queue, as described on Emailing in Batches.

TIP

See Setting Your Send Preferences if you want to set a preference that automatically turns on the Email Later checkbox if the customer’s Preferred Delivery Method is email. And Search explains how QuickBooks works with email programs.

§ Print and email later. Turn on both checkboxes if you want to email invoices to get the ball rolling and then follow up with paper copies.

If you’re sending an invoice for products you’ve sold, you also have to ship those products to your customer. See the box on Shipping Products to learn a convenient and money-saving way to ship products.

UP TO SPEED: SHIPPING PRODUCTS

If you sell products, making regular runs to the FedEx or UPS office gets old quickly. But sitting quietly within QuickBooks is a free service that could change the way you ship packages.

The program’s Shipping Manager feature lets you sign up for shipping services and start sending out packages right away. You can print FedEx, UPS, and U.S. Postal Service shipping labels; schedule pickups; and even track package progress right in QuickBooks. Shipping Manager fills in shipping labels with customer addresses from your QuickBooks invoices, sales receipts, or customer records. All you pay are the FedEx, UPS, or postal service charges on your shipment.

Here’s where you can find Shipping Manager:

§ If you’re creating an invoice for products you plan to ship, in the Create Invoices window, click the Send/Ship tab, and then click the button for the shipping method you want to use. In the drop-down menu that appears, choose what you want to do, such as ship a package, schedule a pickup, or track a package that’s already on its way.

§ The Sales Receipt window also includes a Send/Ship tab, which works in the same way as the one in the Create Invoices window.

§ Choose File→Shipping, and then choose Ship FedEx Package, Ship UPS Package, or Ship USPS Package.

The first time you choose a shipping action, such as Ship FedEx Package, a setup wizard steps you through creating an account for that shipping company.

Adding a Memo to Yourself

The Create Invoices window includes a Memo box, which works just like Memo boxes throughout QuickBooks. You can use it to remind yourself about something special on the invoice or to summarize the transaction. For example, if the invoice is the first one for a new customer, you can note that in the Memo box. The memo won’t print on the invoices you send to your customers. However, it does appear on your sales reports and customer statements, so be careful what you type here.

NOTE

The Open Invoices report (Reports→Customers & Receivables→Open Invoices) is handy when you want to see all the invoices for which you haven’t yet received payment. It lists all the invoices for each customer and job, when they’re due, and their open balances. If the invoices are overdue, the Aging column shows just how late they are. Income Tracker (Receivables Aging) is another way to check up on upcoming or overdue income.

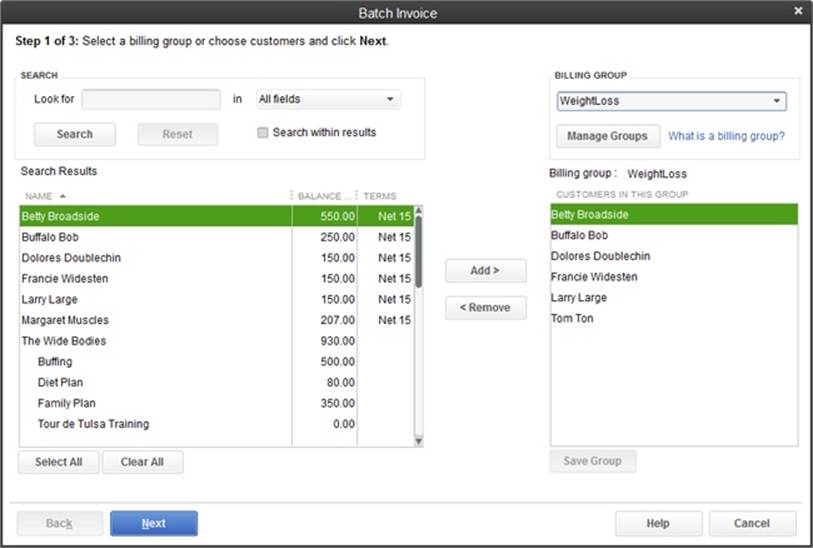

Creating Batch Invoices

If you send invoices with the same items and the same quantities to many of your customers, QuickBooks offers a great invoicing timesaver. Instead of creating individual invoices for each customer, you can set up a single batch invoice and send it to as many customers as you want. And you can speed things up even more by creating a billing group that includes all the customers that receive the invoice, so you don’t have to re-select them each time you send a batch invoice.

NOTE

You can’t use the batch invoice feature if you have multiple currencies turned on (Multiple Currencies). That’s why when that preference is turned on, the Create Batch Invoices entry doesn’t appear on the Customers menu.

Before You Create Your First Batch Invoice

Batch invoices use the payment terms, sales tax rates, and send methods you specify for each customer, so be sure to fill in these fields in customers’ records before you create your first batch invoice. These fields are on the Payment Settings, Sales Tax Settings, and Additional Info tabs (Entering Payment Information, Specifying Sales Tax Information, and Specifying Sales Tax Information, respectively) of the Create Customer and Edit Customer windows. You can use the Add/Edit Multiple List Entries window (Adding and Editing Multiple Records) to find and fill in any missing values.

Setting Up a Batch Invoice

Here’s how to create a batch invoice for several customers:

1. Choose Customers→Create Batch Invoices.

The Batch Invoice window opens (Figure 10-11).

NOTE

If this is your first time using Create Batch Invoices, the “Is your customer info set up correctly?” message box appears, reminding you that you need to fill in terms, sales tax, and send method settings for your batch invoice customers. Click OK to close it and open the Batch Invoice window. If you need to fill in more information for your customers, close the Batch Invoice window and choose Lists→Add/Edit Multiple List Entries to open the Add/Edit Multiple List Entries window to complete your customers’ records.

Figure 10-11. You can rename or delete the billing groups you create by clicking Manage Groups. To select a different billing group, choose it from the Billing Group drop-down list. If you modify the customers in the list, click Save Group to update the billing group with the current set of customer names.

2. In the Batch Invoice window, either select individual customers in the Search Results list and then click Add to add them to the Customers In This Group box on the window’s right side, or choose an existing group from the Billing Group drop-down list.

If you select individual customers, you can select adjacent names by clicking the first customer’s name and then Shift-clicking the last customer’s name. You can also Ctrl-click each customer name you want to select.

If you choose a billing group, the name of the group appears above the Customers In This Group box, and the individual names appear in the box, as shown in Figure 10-11. (The box on Creating a Billing Group explains how to create billing groups.)

NOTE

If you add individual customers and a billing group to the Customers In This Group list, when you click away from the list, a Batch Invoice message box asks if you want to save the changes to the billing group. Click Yes to add the individual customers to this billing group and use the full list for the batch invoice. Click No to use the list of customers for this batch invoice while leaving the saved billing group as it is. Or click Cancel to return to the Batch Invoice window to make additional changes.

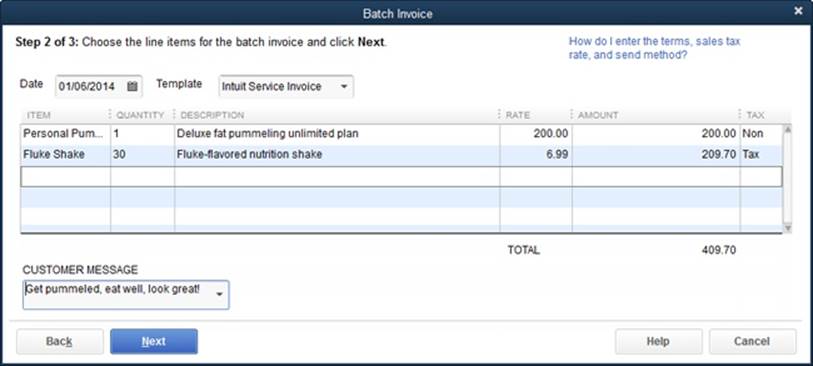

3. After you add the appropriate customers to the Customers In This Group list, click Next.

On the “Step 2 of 3” screen that appears, QuickBooks automatically puts today’s date in the Date box and displays a table for the next step in the process: adding items to the invoice.

4. To use a different date, choose it in the Date box.

You can also choose a different invoice template from the Template drop-down list.

5. In the line-item table (Figure 10-12), fill in the items you want to add to the invoice just as you do for a regular invoice (Entering Invoice Line Items).

You can add any item from your Item List to a batch invoice.

6. After you fill in the items for the invoice, click Next.

The “Step 3 of 3” screen lists the customers who will receive the invoice, including their terms, send methods, tax info, and other information. If you notice any errors or omissions, click Back to correct them.

7. When everything looks good, click Create Invoices.

QuickBooks creates the invoices for the selected customers. The Batch Invoice Summary dialog box appears and shows how many invoices are set up to print and how many to email, based on the customers’ preferred delivery methods. (The dialog box mentions the customer’s Preferred Send Method, but the field in the customer record is actually labeled “Preferred Delivery Method.”) If the Preferred Delivery Method for any of the customers is set to None, the dialog box’s “unmarked” entry shows how many invoices aren’t marked to be mailed or emailed; you can send them later by choosing File→Send Forms or File→Print Forms (Printing One Form).

Figure 10-12. Fill in the items for the batch invoice as you do the line items in the Create Invoices window. (The fields you see in the table depend on the invoice template you’re using.)

TIP

You can view or change each customer’s delivery method selection in the Customer Center. Simply right-click the customer’s name and choose Edit. Then click the Payment Settings tab to see your selections.

8. Click Print to print the invoices marked to print; click Email to send the invoices marked to be emailed.

If you want to print or email the invoices later, click Close. Then you can print or email them by choosing File→Print Forms→Invoices or File→Send Forms.

UP TO SPEED: CREATING A BILLING GROUP

Billing groups make it easy to select all the customers who receive the same batch invoice. Once you set up a billing group, you can select it in the Batch Invoice window, and QuickBooks automatically adds all the customers in it to the Customers In This Group box in one fell swoop.

Here’s how to create a billing group:

1. In the Batch Invoice window (Customers→Create Batch Invoices), before you select customer names, in the Billing Group drop-down list, choose <Add New>.

2. In the Group Name dialog box, type a name of the group, like WeightLoss for all the customers on your monthly diet plan, for example. Then click Save.

3. In the Batch Invoice window’s Search Results list, Ctrl-click all the customers you want to add to the group, and then click Add to copy the names to the Customers In This Group box.

4. Click the Save Group button below the Customers In This Group box.

QuickBooks saves your new billing group so you can use it again simply by selecting it in the Batch Invoice window.

Deposits, Down Payments, and Retainers

Deposits, down payments, and retainers are all prepayments: money that customers give you that you haven’t actually earned yet. For example, a customer might give you a down payment to reserve a spot in your busy schedule. Until you perform services or deliver products to earn that money, the down payment is more like a loan from the customer than income.

Receiving money for something you didn’t do feels good, but don’t make the mistake of considering that money yours. Prepayments belong to your customers until you earn them, and they require a bit more care than payments you receive for completed work and delivered products. This section explains how to manage all the intricacies of customer prepayments.

Setting Up QuickBooks for Prepayments

If you accept prepayments of any kind, you’ll need an account in your chart of accounts to keep that money separate from your income. You’ll also need an item that you can add to your invoices to deduct prepayments from what your customers owe:

§ Prepayment account. If your customer gives you money and you never do anything to earn it, the customer is almost certain to ask for it back. Because unearned money from a customer is like a loan, create an Other Current Liability account in your chart of accounts (see Creating an Account) to hold prepayments. Call it something like Customer Prepayments.

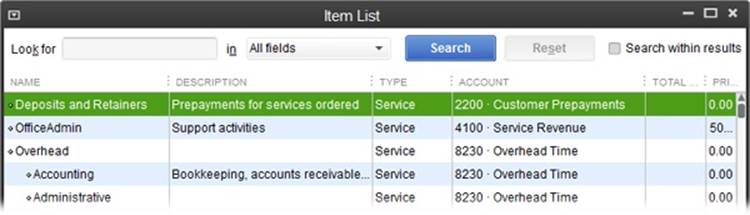

§ Prepayment item. Create a prepayment item in your Item List, as shown in Figure 10-13.

Figure 10-13. Whether you accept deposits or retainers for services or product deposits, create a Service item for these prepayments. When you create this item, assign it to the prepayment account (a current liability account) you created.

Recording Prepayments

When a customer hands you a check for a deposit or down payment, the first thing you should do is wait until she’s out of earshot to yell, “Yippee!” The second thing is to record the prepayment in QuickBooks. You haven’t done any work yet, so there’s no invoice to apply the payment to. Fortunately, a sales receipt not only records a prepayment in QuickBooks, but when you print it, it also acts as a receipt for your customer. Here’s how to create one:

1. Make sure the Sales Receipts preference is turned on.

If you don’t see a Create Sales Receipts icon in the QuickBooks Home page’s Customers panel or an Enter Sales Receipts entry on the Customers menu, choose Edit→Preferences→Desktop View, and then click the Company Preferences tab. Turn on the Sales Receipts checkbox, and then click OK.

2. On the Home page, click the Create Sales Receipts icon (or choose Customers→Enter Sales Receipts).

QuickBooks opens the Enter Sales Receipts window to a blank receipt.

3. In the Customer:Job box, choose the customer or job from which you received a deposit or down payment.

QuickBooks fills in some of the fields, such as the customer’s address in the Sold To box, with information from the customer’s record.

4. Fill in the other header boxes as you would for a regular sales receipt or invoice (Filling in Invoice Header Fields).

If you use classes, in the Class box, choose a class to track the prepayment. If you have a customized template just for prepayments (Customizing Forms), in the Template drop-down list, select that template. In the Date box, choose the date that you received the prepayment. In the Payment Method box, pick the method the customer used to pay you. If the customer paid by check, in the Check No. box, type the check number for reference.

5. In the table, click the first Item cell and use its drop-down list to choose the prepayment item you want to use (for example, a Service item called something like “Deposits and Retainers,” as described on Deposits, Down Payments, and Retainers).

This step is the key to recording a prepayment to the correct account. Because your prepayment items are tied to an Other Current Liability account, QuickBooks doesn’t post the payment as income, but rather as money owed to your customer.

6. In the Amount cell, type the amount of the deposit or down payment.

You don’t need to bother with entering values in the Qty and Rate cells—the sales receipt simply records the total that the customer gave you. You’ll add the details for services and products later when you create invoices.

7. Complete the sales receipt as you would any other payment form.

For example, add a message to the customer, if you like. At the top of the Enter Sales Receipt window, click Email or Print to provide the customer with a receipt. If you turned off the preference to use the Undeposited Funds account (Payroll & Employees), you’ll see the Deposit To box to the right of the Class box. In the Deposit To box, choose Undeposited Funds if you plan to hold the payment and deposit it with others. If you’re going to race to the bank as soon as your computer shuts down, choose your bank account instead. (If you turn on the preference to use the Undeposited Funds account, QuickBooks automatically deposits payments to the Undeposited Funds account, so the Deposit To box doesn’t appear in the Sales Receipt window.)

8. Click Save & Close.

QuickBooks posts the payment to your prepayment account and closes the Enter Sales Receipts window.

Applying a Deposit, Down Payment, or Retainer

When you finally start to deliver stuff to customers who’ve paid up front, you invoice them as usual. But the invoice you create needs one additional line item that deducts the customer’s prepayment from the invoice balance.

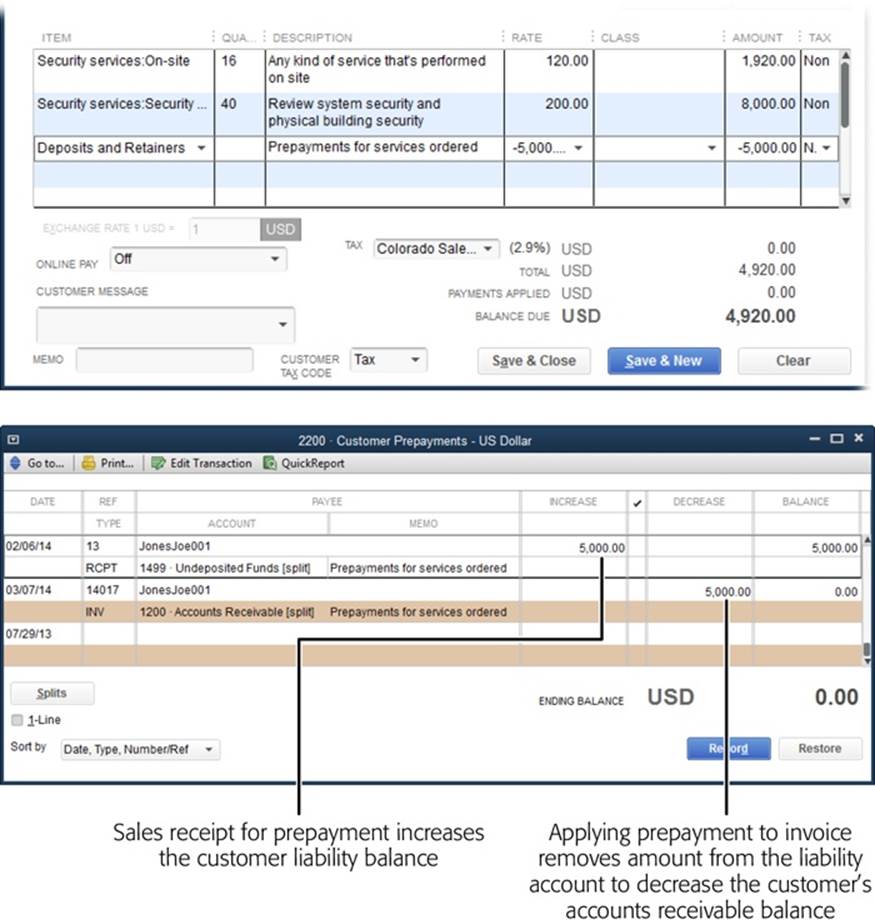

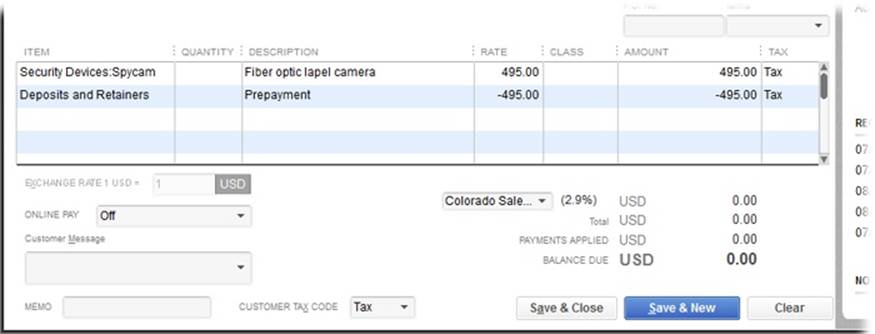

Create the invoice as you normally would with items for the services, products, charges, and discounts (Entering Invoice Line Items). After you’ve added all those items, add the item for the prepayment and fill in the Amount cell with a negative number to deduct the prepayment from the invoice amount, as shown in Figure 10-14 (top).

Figure 10-14. Top: When you create an invoice for the customer, the prepayment offsets the customer’s balance. To deduct the prepayment from the invoice balance, in the Amount cell, enter the prepayment as a negative number, as shown here. Bottom: Initially, when you create a sales receipt for a deposit or down payment, QuickBooks adds the money to your prepayment Other Current Liability account. When you apply the deposit to an invoice, QuickBooks transfers the money from that account to reduce the customer’s Accounts Receivable balance.

NOTE

If the charges on the invoice are less than the amount of the customer’s deposit, deduct only as much of the deposit as you need; you can apply the rest of it to the next invoice.

Refunding Prepayments

Deposits and down payments don’t guarantee that your customers will follow through with their projects or orders. For example, a customer might make a deposit on decor for his bachelor pad. But when he meets his future wife at the monster truck rally, his plan for the bachelor pad is crushed as flat as the cars under the trucks’ wheels. Of course, your customer wants his money back, which means you share some of his disappointment.

Your first step is to determine how much money the customer gets back. For example, if a customer cancels an order before you’ve purchased the products, you might refund the entire deposit. However, if the leopard-print wallpaper has already arrived, you might keep part of the deposit as a restocking fee.

After you decide how much of the deposit you’re going to keep, you have to do two things: move the portion of the deposit that you’re keeping from the prepayment account to an income account, and then refund the rest of the deposit. Here’s how to do both:

1. Create an invoice for the customer or job by choosing Customers→Create Invoices, and then, in the Customer:Job box, choosing the customer.

You create an invoice to turn the deposit you’re keeping into income.

2. In the first Item cell, choose an item related to the canceled job or order.

For example, if you’re keeping a deposit for products you ordered, choose the item for those products. If the deposit was for services you planned to perform, choose the appropriate Service item instead.

3. In the item’s Amount cell, type the amount of the deposit that you’re keeping.

Because items are connected to income accounts (see Chapter 5), this first line in the invoice is where you assign the amount of the deposit that you’re keeping to the correct income account for the products or services you sold.

4. In the table’s second line, add the prepayment item and fill in the amount of the deposit you’re keeping as a negative amount, as shown in Figure 10-15.

This item removes the amount of the deposit you’re keeping from your liability account so you no longer owe the customer that money.

5. Click Save & Close.

QuickBooks removes the deposit you’re keeping from the prepayment liability account and posts that money to the income account associated with the item you selected in step 2. If you’re keeping the whole deposit, you’re done. But if you aren’t keeping the entire amount, you have to refund the rest to the customer, so continue on to the next step.

Figure 10-15. In the first row’s Amount cell, enter the amount of the deposit you’re keeping as a positive number. Then, in the Amount cell for the prepayment (the second row), type a negative number, which makes the invoice’s balance zero. The prepayment item also deducts the deposit from the prepayment liability account, so you no longer “owe” the customer that money.

6. To refund the rest of the deposit, create a credit memo for the remainder (Creating Credit Memos).

In the Create Credit Memos/Refunds window’s table, add the prepayment item you used in the invoice. In the Amount cell, type the amount that you’re refunding.

7. Click Save & Close.

QuickBooks removes the remaining deposit amount from your prepayment liability account. Because the credit memo has a credit balance, QuickBooks opens the Available Credit dialog box.

8. In the Available Credit dialog box, choose the “Give a refund” option and then click OK.

QuickBooks opens the Issue a Refund dialog box and fills in the customer or job, the account from which the refund is issued, and the refund amount. If you want to refund the deposit from a different account, choose a different refund payment method or account.

9. Click OK to create the refund.

All that’s left for you to do is mail the refund check.

Invoicing for Billable Time and Costs

When you work on a time-and-materials contract, you charge the customer for labor costs plus job expenses. Cost-plus contracts are similar except that you charge a fee on top of the job costs. Contracts like these are both low risk and low reward—in effect, you’re earning an hourly wage for the time you work. For these types of contracts, it’s critical that you capture all the expenses associated with the job or you’ll lose some of the profit that the contract offers.

QuickBooks helps you get those billable items into your invoices. You have to tell the program about every hour worked and every expense you incur for a customer or job. But once you do that, it’s easy to build an invoice that captures these billable items. You can add billable time and costs to an invoice when it’s open in the Create Invoices window. And, when you open the Create Invoices window in QuickBooks Pro or Premier and choose a customer or job, the program reminds you about outstanding billable time and costs. QuickBooks Premier also has a separate feature specifically for creating invoices for billable time and costs. The following sections tell you how to perform all these tasks.

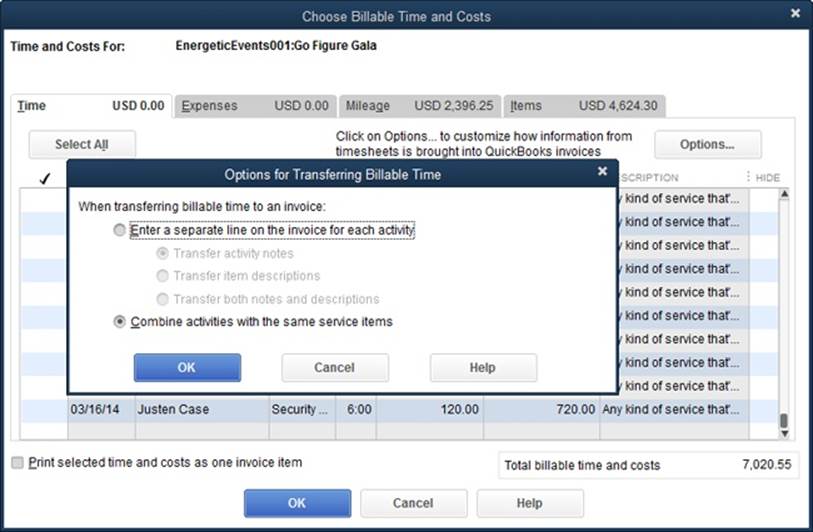

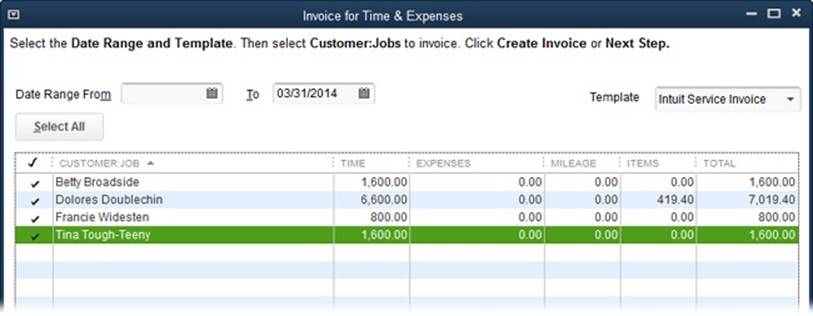

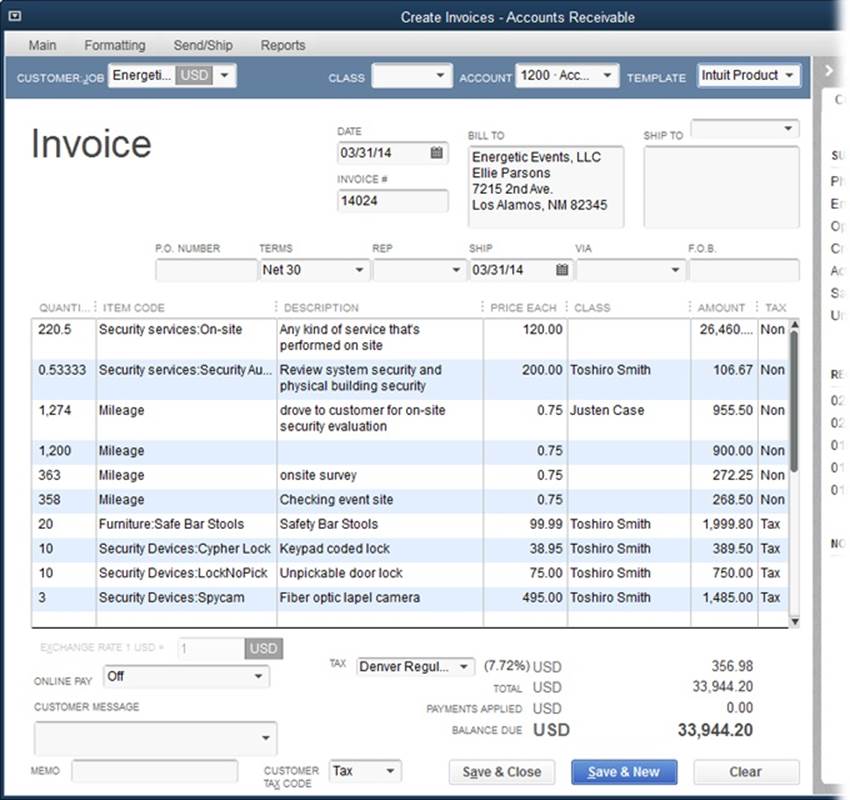

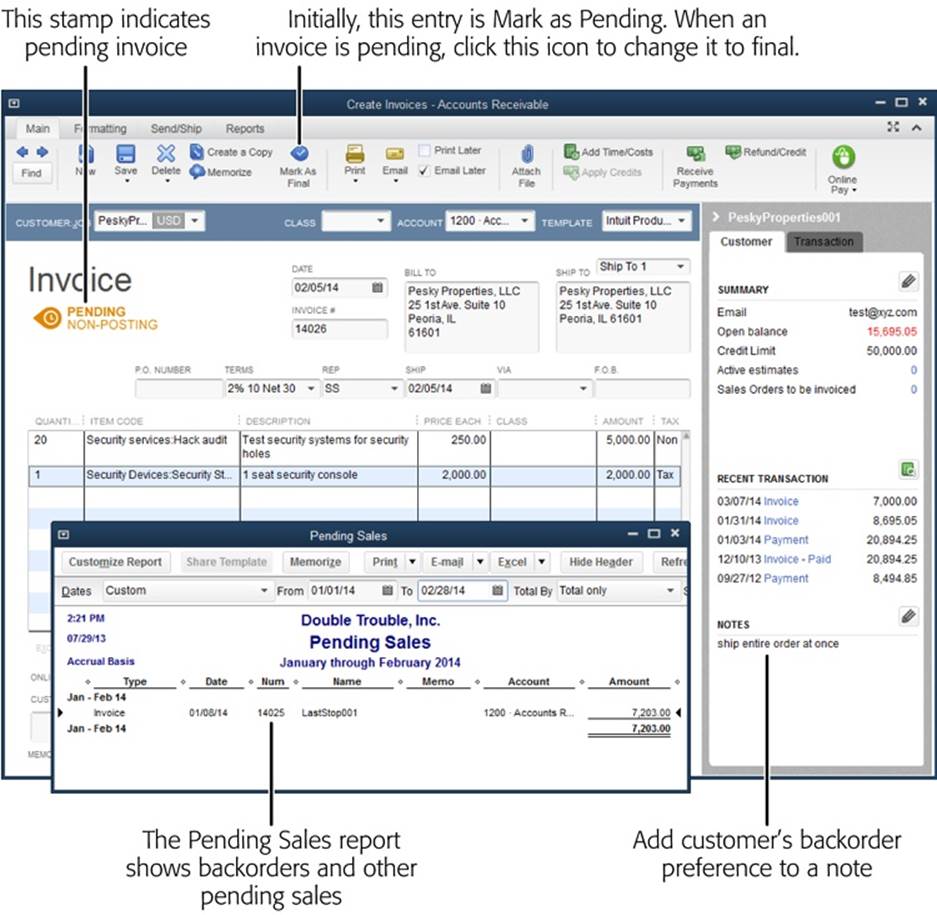

Setting Up Invoicing for Time and Costs