Supplier Relationship Management: How to Maximize Vendor Value and Opportunity (2014)

Chapter 5. The “Ordinaries”

Driving Behavior to Get Results

Our tour of the different clusters begins with the “Ordinaries.” We start here because this is the area where by far the vast majority of suppliers will be located.

It is also an area that is in danger of being overlooked. Doing so would be a mistake. While you need to beware of overinvesting time and attention on this cluster, don’t let the average status of these suppliers fool you. There is strength in numbers here. A keen understanding of what makes these relationships tick, and a simple set of tools for maintaining or incrementally improving their performance, can have sizeable positive results.

Characteristics of Improve Suppliers

The majority of your suppliers are likely to fit here.

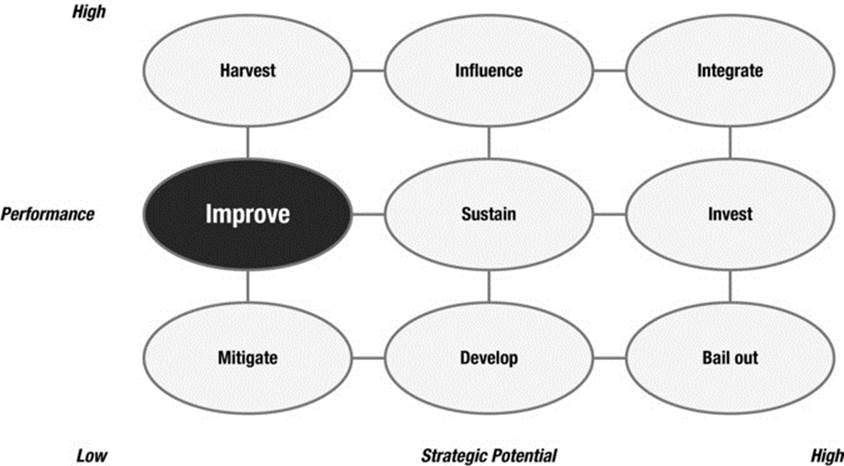

Sustain suppliers are interesting and promising from the perspective of relationship potential. Harvest suppliers are not so interesting from the perspective of relationship potential but perform well at what they do. Improve suppliers (Figure 5-1) are interesting in terms of neither. They have very limited promise and there are shortcomings in their performance.

Figure 5-1. Improve suppliers on the strategy/performance axes

Improve suppliers are typically the suppliers that many organizations have in the more basic purchasing areas. They supply commodity-style products and services that are not core to the customer’s competitive advantage. Their share of your wallet is likely to be relatively low but may not be in all cases. Your importance to them is likely to vary. Improve suppliers typically range from small and medium-sized enterprises (SMEs), who are highly dependent on a small number of customers, through to large corporations that serve many thousands of different clients.

The common theme is that their performance is broadly acceptable but not stunning. And, as with Sustain suppliers, there may be a history of missing deadlines or occasional quality issues that have left a sour taste in the mouth. The issues have not been so dramatic as to warrant the need to replace the supplier, but nor can the supplier be described as an “unsung hero” in the way that Harvest suppliers can be.

For these reasons, an Improve supplier will not make it into the innermost circle of suppliers from the perspective of the company. Should an Improve supplier fail—especially repeatedly—then you would be very likely to replace it. The Improve relationship can feel quite unstable as a result.

What Kind of Behavior to Drive

Usually, the preferred behavior is for an Improve supplier to address its shortcomings and move toward becoming a Harvest supplier. This is usually preferable to incurring the costs and dislocation of replacement. The exception to this is if the investment and resource commitment associated with the behavior change is disproportionate to the benefit the customer will receive. In that situation, replacement might become the right option. However, it still needs to be thought about carefully given that identifying alternative superstar suppliers is often challenging and not guaranteed to be successful, and will incur search costs. Companies often spend time fruitlessly looking for the holy grail of the ideal supplier. For Improve suppliers, this is rarely the right option.

![]() Note It is usually preferable to help an Improve supplier become a Harvest supplier. It is less expensive than “firing” the supplier and finding a new one, whose performance isn’t guaranteed to be an improvement.

Note It is usually preferable to help an Improve supplier become a Harvest supplier. It is less expensive than “firing” the supplier and finding a new one, whose performance isn’t guaranteed to be an improvement.

How to Work with Improve Suppliers

Similarly to Sustain suppliers, the challenge with Improve suppliers is to strike the right balance between investment and return from the relationship. The calculation is one that is more finely poised because you value the relationship potential less and are more likely to replace the supplier. You need to be very clear and straightforward in how you deal with the Improve supplier. Clearly communicate how it needs to perform more effectively. Be candid about its future potential. Otherwise, these suppliers will lack a true understanding of the situation and fail to improve, leading to the more laborious task for you of replacing them.

Governance

The effort dedicated to managing the relationship needs to be kept within clear bounds while still facilitating the sending of very clear signals. Regular review meetings with a candid exchange of dialogue will be sufficient governance to enable this. Typically, we would not expect these to be needed more than biannually.

Case Example

Consider the situation of a supplier of simple low-value parts such as fastenings. This product is not the source of a unique advantage for the customer, but the parts need to be available or else production will be interrupted. However, the supplier has a track record of missing delivery deadlines from several hours up to a day. This is not catastrophic because the manufacturer knows about this behavior and mitigates its own risk by maintaining an inventory of fastenings on hand to give it an adequate safety margin. Additionally, the value of fastenings is low. So, the working-capital implications of a few extra days inventory do not cause major alarm for the finance function. Nevertheless, this behavior is frustrating. It causes extra resources to be deployed to manage inventory, costs money in terms of inventory holding, and leads to queries being raised via enterprise-resource planning software and the operational buyers in the plant each time a deadline is missed.

Despite this major shortcoming, the correct approach is unlikely to be to replace the supplier concerned without making some attempt to correct course. If the supplier does supply fastenings that meet the quality needs to specification, there is no guarantee from a tender process that any new supplier would do this equally as well and no certainty that the delivery issues would be solved. Indeed, more risks may be introduced and there would be a significant cost of replacement. Additionally, it is even possible that there is an element of “six of one and half a dozen of the other” with respect to the problems. There may be misunderstanding over agreed lead times and delivery windows that is contributing to the problems.

The approach that is likely to be most fruitful here is to communicate very clearly to an executive at the supplier’s organization that current performance on delivery is unacceptable. At the same time, the messages need to allow for the possibility that you, the customer, may need to help the supplier do this—by, for example, adjusting its behavior and potentially agreeing on different delivery windows or clarifying precisely what its requirements are. The level of help the customer would be prepared to give would probably not have to go too far beyond these measures in order to be cost-effective. There also needs to be a clear message that if performance does not improve then the supplier is at serious risk of being replaced.

Heartland Tackles Procurement

Thomas was about to wrap up the day’s work when Laura peeked into his office. “Do you have a couple of minutes?” she asked.

Laura had learned that the easiest way to get Thomas’s attention was to walk into his office early in the morning or late in the afternoon. Given that she had been his closest associate in his path to the top at Heartland, Laura still felt that this was the right thing to do rather than formally asking for an appointment.

“Sure, Laura, but I will need to leave in 15 minutes. Both Johanna and David are performing in a play at school tonight. Pretty exciting.”

Laura put a graph in front of Thomas. “Take a look at this. I had my staff perform a quick analysis of where we have allocated our procurement resources. As I expected, most of our people are dealing with suppliers on the left-hand side of our SRM framework. With some regional variation, we actually have more than 70 percent of our people dealing with suppliers in Improve. I had expected the overall pattern, but I was surprised by how extreme this picture is. We need to do something.”

With his eyes still fixated on the graph, Thomas nodded in agreement. “What do you suggest?”

“Do you remember those initiatives that companies used to run to free people from administrative work and focus them more on strategic topics? I think we need to do something along these lines. Why should we employ hundreds of people dealing with suppliers that don’t make any difference while we hardly have anyone working with the ones that really matter?”

Now, Thomas looked up. “I know that tone in your voice,” he said with a smile. “What are you up to?”

“I want to take this opportunity to completely reshuffle and upgrade our procurement function,” Laura replied. “We will free up a lot of our staff by scaling back the interaction with Improve and other Ordinary suppliers. But just repurposing these people will not do it because most of them lack the required skill set. My proposal is the following: Over the next 12 months, we take out 40 percent of the headcount. With the available budget, I want to hire high-caliber people from consultancies, investment banks, and industry. Also, I want to start recruiting talent at the top MBA schools. According to my scenario, we will end up with an overall much reduced headcount in procurement. Of course, the new people I intend to bring in will be substantially more expensive than our current average, but we will still be below the current budget. They will have the more rounded skill sets that are needed to manage relationships internally and externally and get full value from the more strategic suppliers.”

Thomas responded dubiously. “Do you really want to do this at this point in time? You have only been in your CPO role six months.”

“Thomas, you and I know that there never is a good ‘point in time’ to do this. And you have been pretty determined to get things changed in various places. Why make an exception for procurement? I don’t expect you to make this type of decision right away, but I wanted to let you know where my head is. Can we put this on the agenda for our next Senior Leadership Team (SLT) meeting?”

It took a lot more than just one meeting of Heartland’s senior leadership team for Laura to get the ball rolling. The executives were immediately convinced by the logic of her pitch to restructure the function so as focus far more energy on managing Integrate and other Critical Cluster suppliers, but they remained concerned about the unforeseen consequences of such a deep cut in procurement. Laura was assigned a task force of corporate development and HR people to conduct a detailed analysis of roles, responsibilities, and skill sets. Internal stakeholders were interviewed about procurement’s expectations concerning Critical Cluster suppliers. After three months of intensive work, Laura reported back to the SLT with findings that just about confirmed her initial hypothesis.

Seeing the broad intent behind Laura’s plans, Thomas finally gave his approval to put the plan in action. Considering the magnitude of the task at hand, Thomas asked John McGrath, his trusted advisor, to coach Laura through the challenges of reshuffling an organization of more than 1,500 people scattered across the globe. Nine months into the program, Laura proudly reported the following status to the SLT:

· A reduction of activities devoted to managing Improve suppliers had been completed—the number of incidents or complaints: zero.

· The headcount had been freed up to manage Integrate and other Critical Cluster suppliers more effectively: out of 571 employees, 221 had been transferred to roles in other functions outside of procurement, 209 had accepted a voluntary separation package, and 141 had been transferred to other roles within procurement.

· Thirty-seven senior hires were in place to fill new strategic roles for Influence, Integrate, and Invest suppliers.

· There had been 28 recruits from top-ranking business schools.

Characteristics of Sustain Suppliers

Together with Improve, Harvest, and to a certain extent Mitigate, Sustain forms the more densely populated area of the SRM framework. For a company with 1,000 suppliers, we would expect to find dozens of Sustain suppliers.

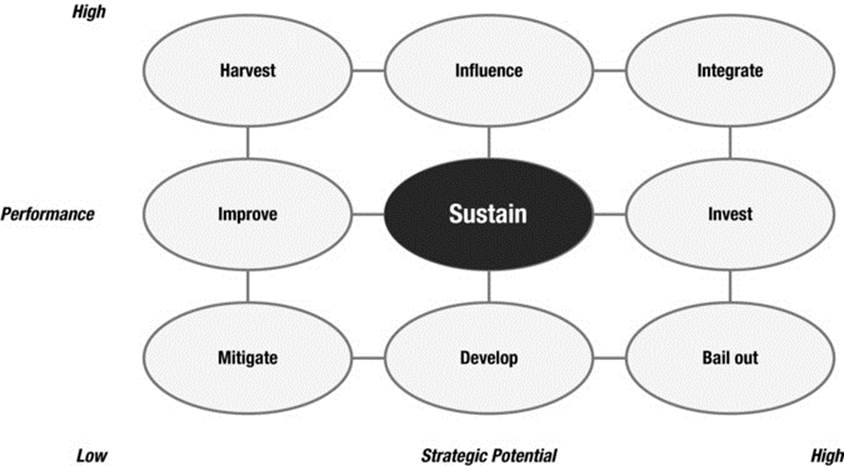

Generally speaking, suppliers in Sustain (Figure 5-2) are interesting and promising. Their strategic potential is higher than that of the vast majority of suppliers working with the company. The products and services these suppliers provide are essential for the company’s position in the market and there might even be the potential to do more with them. This places them above the majority of the company’s suppliers. It also distinguishes them from Improve suppliers—it is much more challenging to replace them. That means that you need to invest more in the relationship but without overdoing things.

Figure 5-2. Sustain suppliers on the strategy/performance axes

Despite this above-average strategic potential though, this supplier still has not made it into the innermost circle of suppliers from the perspective of the company. Unlike with Critical Cluster suppliers, you are not leveraging major competitive advantage from the relationship. However, the positioning of the supplier within the category of Strategic Potential suggests that you could. The reason you are not doing so is that performance is just average. You may even have tried to give the supplier opportunities to do more and provide more value to your business. But the supplier has not been able to perform when given those opportunities. In hindsight, those attempts were certainly not disasters but they left a bit of a sour taste behind. The supplier may have slipped deadlines, there may have been some quality issues that were contained, or the resulting service or product may not have fully met customer expectations. You are now wary of offering further opportunities to the supplier along the same lines.

Based on this average performance, the supplier is now used for average tasks. It would be awarded with contracts for mainstream products and services that are not as exciting as the really-hot-and-new stuff the company stands for. That position may even give the supplier a fairly large chunk of the available business. So, superficially things will look good from a supplier perspective, and only a closer look at profit margins would reveal the untapped opportunities.

What Kind of Behavior to Drive

The desired behavior to use with the Sustain supplier needs to be determined by the overall context. Provided that there are alternative suppliers that perform at a higher level and are positioned in Influence, there might not be the need to change a lot of things. In that case, the supplier would be encouraged to work on its performance with the company’s minimal involvement. After all, there are no major fixes needed and the company has learned to live with the few shortcomings the supplier has. Both parties may be content with this status quo.

However, that may not be the case. You may feel that you really need more active innovation in the product areas that the supplier provides. This is more likely to occur if you have no Influence supplier in these areas. In this case, you would want to give the supplier far-more active encouragement to increase performance to world-class levels. If there already is an Influence supplier in these product areas, then you would not expend this effort. It would not be worth your while. You might even decide to encourage the Influence supplier to expand its scope. That would be a potential threat for the Sustain supplier.

How to Work with Sustain Suppliers

The challenge of working with Sustain suppliers is to strike the right balance between investment and return. When these suppliers recognize what you value about working with them, they will be less likely to become complacent and allow their performance to slip or to present less desirable commercial terms to you. Always treat the Sustain supplier fairly while not tying up disproportionate resources. The relationship is likely to be relatively arm’s-length, with the supplier needing to compete for additional business. However, take care in this respect. Market and performance changes can cause shifts in the relationship. Remaining sufficiently close to the supplier will help you understand this dynamic and act accordingly.

![]() Note Achieving the right balance between investment in a Sustain supplier and the return on that investment is a moving target. As the market and the supplier’s performance change, you will need to adjust the dial frequently to get the best results. That requires staying close to the supplier to make the right moves.

Note Achieving the right balance between investment in a Sustain supplier and the return on that investment is a moving target. As the market and the supplier’s performance change, you will need to adjust the dial frequently to get the best results. That requires staying close to the supplier to make the right moves.

Governance

Since there are probably dozens of suppliers in Sustain for an average company, the effort dedicated to managing the relationship for each needs to be kept at bay. For the majority of suppliers, the key platform for alignment will be quarterly reviews. In these reviews, the company will give the supplier feedback on its performance against a set of predetermined criteria. The supplier will then provide an update of key initiatives and progress against plan.

For Sustain suppliers that lack competitors in the Influence box, quarterly reviews still might be the right forum, but there should be a different emphasis in the message that is delivered to them. The company should outline very clear and specific expectations regarding what it takes to reach world-class performance.

Here, it is important to consider what improvements the company can realistically trigger in a Sustain supplier. Most likely, the Sustain supplier will provide a product or a service that is deemed essential for a certain industry. Therefore, this supplier will have working relationships with many customers in that industry and your company will not have an overwhelming importance for it. Considering this, the company will not be able to provide more than a nudge to move in the direction of world-class performance. The main initiative and momentum needs to be created by the supplier on its own.

Case Example

Anyone driving through Riverside County up to Palm Springs, California, cannot help but be impressed by the large array of turbines in the San Gorgonio Pass Wind Farm. This gateway into the Coachella Valley is one of the windiest regions in Southern California. This wind farm contains more than 4,000 separate turbines and, with a capacity of 360 megawatts, provides enough electricity to power Palm Springs and the entire Coachella Valley.

San Gorgonio is by far not the largest wind farm in the world. California alone has two wind farms that are larger. The world record for onshore wind farms is currently held by the Gansu Wind Farm in China, with a capacity of 5,000 MW. The biggest offshore wind farm is the London Array with 630 MW. For comparison, the largest nuclear reactor in the world is currently being built in Olkiluoto, Finland. Once fully operational, its capacity will be 1,600 MW.

With many large wind farms under construction, let’s take a look at the relationship between the typical developer of a wind farm and the typical turbine maker. All starts with the developer identifying a suitable piece of land. The developer will begin by collecting detailed wind patterns by specific location, height, and day. The most desired outcome of these analyses is steady wind throughout the year, not varying over day and night.

Based on the confirmed wind patterns, engineering consulting firms will then configure the wind park. By specific location, they will plan the most optimal turbine. Some locations within the wind park will be more suitable for tall and big turbines; others will be more suitable for smaller turbines on shorter towers.

On average, a wind turbine extracts 44 percent of the kinetic energy of the wind flowing through the turbine. The science is well understood and there is not much room for differentiation between the makers of turbines. With that, the typical turbine supplier would have average strategic potential and therefore fall into the middle column of the SRM framework.

In terms of performance, the overwhelming majority of turbine suppliers will fall into the average category. Given the volatile nature of the wind industry, it is challenging for suppliers to perform flawlessly. Wind farm projects are notoriously late. Normally, it takes the developer more time than expected to get all the required approvals and financing put in place. The turbine supplier can only wait and hope for the best. Usually, the order confirmation finally comes in when internal capacities are already booked for other contracts. This up and down makes it difficult to achieve process stability. In addition, local legislation often requires substantial modifications to the structural, electrical, and hydraulic components of the turbine.

The usual headaches for wind farm developers when dealing with turbine suppliers are delivery delays, cost creeps, and quality problems. None of these usually get too serious and eventually every wind farm gets up and running.

The relationship between the developer and the turbine supplier usually does not become very close. From the developer’s point of view, identifying the right piece of land, matching turbine types with wind patterns, getting the approvals, and securing the financing are the core activities, and the turbine supplier comes in after all of those steps are taken care of. So when the turbine supplier is ramping up, the developer is already ramping down. Of course, operational personnel from the developer will monitor the supplier to ensure that it is delivering to specification.

In summary, the relationship between the wind farm developer and the turbine supplier fits into the Sustain supplier interaction model squarely. The supplier is essential to the developer, but at least from today’s technological point of view, there is no way to fundamentally differentiate and to create a winning ecosystem. With the volatile environment in the business, chances are that the developer will hardly ever be enthusiastic about the performance of the supplier but will regard it as necessary.

Heartland Begins to Deploy TrueSRM

As the restructuring of procurement was coming toward a close, Laura started to turn her attention more to how the TrueSRM framework would be deployed. As part of the restructuring, Laura had created a very small central function in procurement that had responsibility for tools and processes. This was now led by Blair Worden, reporting directly to Laura in her role as procurement COO. Blair had joined procurement from Heartland’s finance function, where he had previously been the commercial finance head for the European business. He was charged with implementing the framework. Given the importance of TrueSRM to the business, however, Laura maintained a very strong interest in the detail. Blair brought a perspective beyond procurement. Although he was a career finance professional, he had also held previous roles in marketing and IT, and he was on Heartland’s fast-track development path.

Blair inherited the initial rough supplier segmentation that had been carried out to support the original activity analysis that had prompted the decision to restructure. Laura and Blair decided to take a strong, top-down approach to reviewing the segmentation rather than the very bottom-up, category-by-category approach that often leads to each category vying to name suppliers in the Critical Cluster. While this may make sense for the individual category, it rarely works from a corporate perspective and can lead to the perverse result of facilities suppliers, for example, being classified as Integrate. Laura and Blair decided to work through each interaction model one by one, both to validate the suppliers that were classified in it and to drive the right interventions that would need to be executed by the category leaders responsible for it.

They chose to start in the Ordinaries cluster. Laura felt that Thomas did not need to be involved in any significant way here, although other functional leaders would clearly be very much part of the implementation.

After the Improve suppliers, Sustain was the most populous model. Laura and Blair convened in Laura’s office to discuss what to do. Addressing the groups was actually surprisingly tricky.

Laura laid out her perspective: “We really don’t want to put too much effort into these guys,” she said, referring to the Sustain suppliers. “But they do have more value to us than the Improve suppliers. I mean some of our major IT vendors sit here.”

“I agree,” said Blair. “I am sure some of them could contribute far more to our business than they do currently. We need to encourage and support them to do this but not at the expense of disproportionate effort our side.”

“We need to nudge them,” added Laura.

“I think that mandating some very clear scorecards that show our view of them, with a clear message, would work here,” Blair suggested.

“We need to keep it simple, though,” said Laura. “I do not want to create a paper chase with people pursuing metrics, reconciling numbers, and debating statistics. That would defeat what we are trying to achieve.”

Blair thought for a moment or two. He then added: “Maybe we just make it very transparent to them how we see their position. We communicate that there are issues that have prevented us from awarding them more business and that they need to up their game if they are to continue with us.”

“Yes, a simple score card that records our view of them is probably enough. We can combine that with a quarterly review session that the suppliers lead and a business representative attends. The review session will also give the opportunity for a two-way dialogue, and for the supplier to explain its perspective.”

“OK.” said Blair. “I will start to contact the category leaders to make that happen. We might also want to think about providing some training so as to help the category leaders treat the reviews as genuine two-way dialogues rather than pure information-giving sessions.”

“Good idea. Let’s capture that,” agreed Laura. “I am sure we will also have additional training needs as we go through the other models. Harvest is next . . . .”

Characteristics of Harvest Suppliers

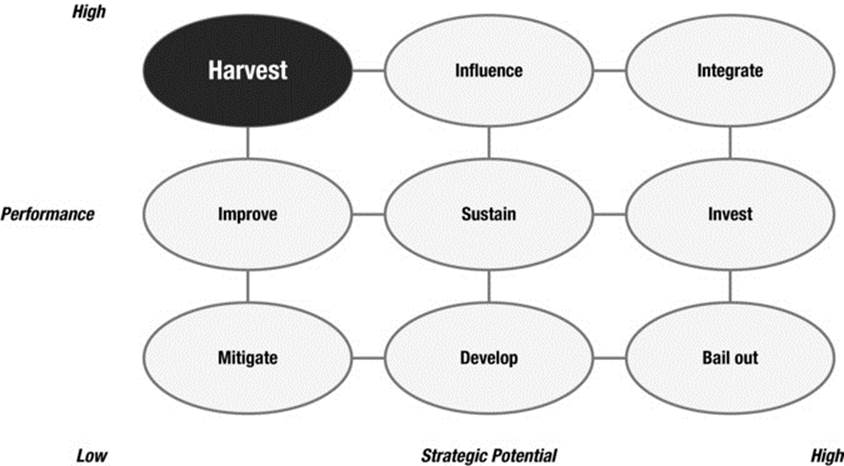

Harvest suppliers are typically thinner on the ground than the other Ordinaries. For a company with 1,000 suppliers, we would not expect to find more than a couple of dozen of them in this interaction model.

Suppliers in Harvest (Figure 5-3) can be seen as “unsung heroes.” Their performance is excellent but the actual potential relationship value is low. They supply goods or services that the company needs to have but that are not highly critical to its commercial success. The most basic cross-industry example of a Harvest supplier might be the distributor of stationery to the company’s offices; it always happens on time, the cost performance is fine, and if it stopped everyone would notice. But, there is not some great yearning need for the customer to tap greater value from the relationship through innovation. Indeed, if the supplier did innovate significantly, we may not even notice or might struggle to see the value.

Figure 5-3. Harvest suppliers on the strategy/performance axes

So, despite its strong performance, this supplier has not made it into the innermost circle of suppliers from the perspective of the company. Nor can it ever hope to. Mature and sensible Harvest suppliers realize that this is the reality and manage accordingly. They are used to their status as unsung heroes and focus on performance as the only way to retain and win additional contracts. Their share of wallet with any individual customer can vary significantly. The common feature is that Harvest suppliers operate in category areas that are usually not strategic for the business, such as telecommunications, facilities management, and utilities. These are all areas that for most businesses are essential services that are noticed if they fail but for which there is no real need to drive exclusive innovation. Accordingly, the Harvest suppliers focus on serving a very large number of customers to build scale and to hedge their bets in case any particular customer chooses to stop working with them. They will value their relationship with you but will typically not overinvest in it.

What Kind of Behavior to Drive

The desired behavior of the Harvest suppliers needs to be determined in the overall context. Assuming you have correctly determined that the potential relationship value is low, then the desired behavior is to “carry on as is.” There is no need to change anything nor to rock the boat.

This means that you need the Harvest supplier to maintain its current strong performance and not to falter. You need it to value the relationship with you sufficiently enough that it is incentivized to continue to perform.

How to Work with Harvest Suppliers

Whereas the trick to working with Sustain suppliers is to invest enough effort in the relationship to maintain the performance level while not inadvertently sending a signal that you want to “partner,” most Harvest suppliers are sufficiently mature that they will continue to perform with very limited encouragement from the customer. They are used to doing this for a large number of other customers too and will happily do the same for you if you let them. Harvest suppliers are also used to having to justify their continued presence through competitive tender; the possible threat of which (if not overdone) can provide a continued goad to best-in-class performance on quality, service, and economic dimensions.

Things tend to go wrong when individual buyers in companies overfocus on the relationship and miscommunicate the true position. This sometimes happens when customers apply supplier segmentation at a category level and do not force an organization-wide calibration. We have seen situations where well-performing suppliers of mundane items get wrongly labeled as partners. This is often as a result of overenthusiastic category managers in nonstrategic categories wanting to apply partnership approaches inappropriately. Such behavior inevitably leads eventually to frustration and misalignment on both sides. In particular, the Harvest supplier may misinterpret such signals as an indication that it can charge a premium price beyond that which is justified by its strong performance and competitive advantage in its category. Ultimately, this would be self-defeating.

Harvest suppliers illustrate in the most extreme case the broad injunction associated with the Ordinaries cluster, “Leave well enough alone.”

![]() Tip Value your Harvest suppliers and praise them when appropriate as the unsung heroes they are. But do not encourage them to think of themselves as partners. In most cases, the products they offer are not important, strategic inputs to your key initiatives.

Tip Value your Harvest suppliers and praise them when appropriate as the unsung heroes they are. But do not encourage them to think of themselves as partners. In most cases, the products they offer are not important, strategic inputs to your key initiatives.

Governance

Typically, biannual reviews will be sufficient platforms for governance. In these reviews, the company will give the supplier feedback on its performance against a set of predetermined criteria. It will also give encouragement that continued strong performance will be rewarded and that reduced performance can be dealt with through competition.

We would not expect the governance discussions to go beyond these points. There is neither a significant need for you to discuss initiatives that will build the relationship nor to involve senior leadership other than specific functional experts such as the head of facilities. Depending on its actual scale of business with you, the Harvest supplier may involve senior executives from its side, but you need not be tempted to match this in most normal situations.

The real challenge with managing the governance meetings is to stay focused on the themes that matter for this interaction model. Overenthusiasm needs to be reined in on both sides. This will avoid frustration and inappropriate behavior. Typically, candor that the supplier is in the Harvest state will be helpful as part of these forums. An intelligent Harvest supplier will not push back on this but will welcome the clarity that you are providing.

Case Example

Let’s consider a mundane example of a service that every business requires: facilities management. This is an essential service that involves ensuring facilities are cleaned, guarded, and maintained properly. It also often includes energy management. Usually, this is something that senior executives do not want to spend time thinking about. A number of different organizations offer “service”-based solutions. Typically, these suppliers each have a large number of customers whose share of wallet will vary based on the characteristics of the business. The category is also highly competitive and the service level is critical. Poor performance can lead to contract cancellation—although usually customers seek to avoid this if they can, given the costs of dislocation that would be incurred.

If one looks at the sales messages of the suppliers concerned, the whole pitch is associated with outsourcing a headache so that you as a customer do not have to worry about it. These suppliers understand their core business model. They give messages associated with “quiet efficiency,” “supporting businesses,” and “one-stop shopping”—focusing on how to make life easy for their customers.

Innovation from these suppliers is focused on taking these service-related concepts still further to enable you as a customer to worry even less about the category in the future. They drive the innovation themselves for all of their customers and it does not need your help or input to create, although you may need to take some action in order to tap into it. An example of this would be a top-performing facilities supplier that brings to you as a customer a smart metering solution that enables energy consumption to be controlled. This would ideally be combined with bidirectional control and data analytics to ensure that energy-usage policies can be optimized, set, and consistently implemented across your estate. Such solutions can lead to double-digit percentage savings in energy consumption. Valuable as these savings are, they do not lead to a game-changing improvement in the competitiveness of the end product for the vast majority of companies. Furthermore, the supplier has no incentive in any event to offer an individual customer some form of exclusivity or unique advantage even if you do value its service. In its market, it needs to serve everyone equally well and must “play the field” in order to create scale and profit.

The supplier doing this work will be high performing but is still in the Harvest category in terms of relationship potential; it performs strongly in its function and its failure would be rapidly noticed, but there is no real opportunity for the customer to broaden the relationship as a way to obtain significant competitive advantage in the marketplace.

Heartland Scales Back Overinvestment of Time

Laura and Blair were now considering the Harvest suppliers. One of the suppliers included on the top-down segmentation was Facilities R Us, the office-facilities supplier that organized cleaning and washroom services for Heartland. Laura fixed her gaze on the supplier: “It makes sense that we classified it as Harvest,” she said. “I know that it performs very well and we never seem to have any issues.”

“The category team talks about it as a ‘strategic partner’ though,” commented Blair. “The team and the corporate-services function see Facilities R Us as contributing huge amounts of value-added input. I know that they have lots of meetings with the supplier. There was even an Innovation Day last year.”

“Yes,” said Laura. “This is one of the cases where there is overinvestment in and too much effort being spent on this supplier. It is supplying something pretty basic very well, but it does not contribute to how we grow the top line.”

“Do you think it is our fault, or theirs, that there is all this effort?” Blair asked her.

“Probably six of one and a half dozen of the other. I always believe that you get the supplier behavior that you deserve. I suspect that Facilities R Us is responding to the steering we have given it as a customer. We are a large account for them. The company’s sales manager will no doubt be very happy to attend any meeting we want to set up and quite frankly indulge our whims. The point is that we need to be more focused and disciplined as a business here. Facilities R Us delivers well but we create process around it that is excessive and probably distracting more than anything else. ”

“Yes,” agreed Blair. “I am sure we will find the same thing with other Harvest suppliers.”

“We need to scale back the meetings here, recognize the mundaneness of what the supplier is doing, and allow it to do its job. I also suspect the company is incurring excess cost to support this account, and its chances of winning real incremental business are low. I mean it is a facilities business, and it has our core contract. There is not really anything else to give them.”

“I will work with the category team to get this in shape,” Blair resolved. “We need to communicate to the supplier how we really see the company. Then they can get on with the job we really want done.”

Blair then thought for a second and added: “Say, if the company can cut down on the effort it has to devote to managing us, then perhaps we ought to be asking for better commercial terms to reflect that, too?”

Laura laughed. “Maybe we should,” she said, “but not straightaway, I think!”

Rethink Relations with Ordinaries

In this chapter, we have described the three interaction models that characterize the Ordinaries. As we have seen, these will constitute the vast majority of suppliers to your business. The trick for managing these suppliers is to balance the level of investment you put into the relationship with the potential returns.

We started with the Ordinaries precisely because we do not want to ignore them. It is all too easy to do that when one turns to the other clusters that distinguish themselves more readily. This distinction is a positive one for the Critical Cluster because of the high potential value you can achieve from working with them. It is negative in the case of the Problematics, where serious fixes are needed.

We will turn our attention in Chapter 6 to the challenging Problematic Suppliers. We will then address the grassy uplands of the Critical Cluster in Chapter 7.